Please answer 1-6 this is the entire document, there is no additional info.

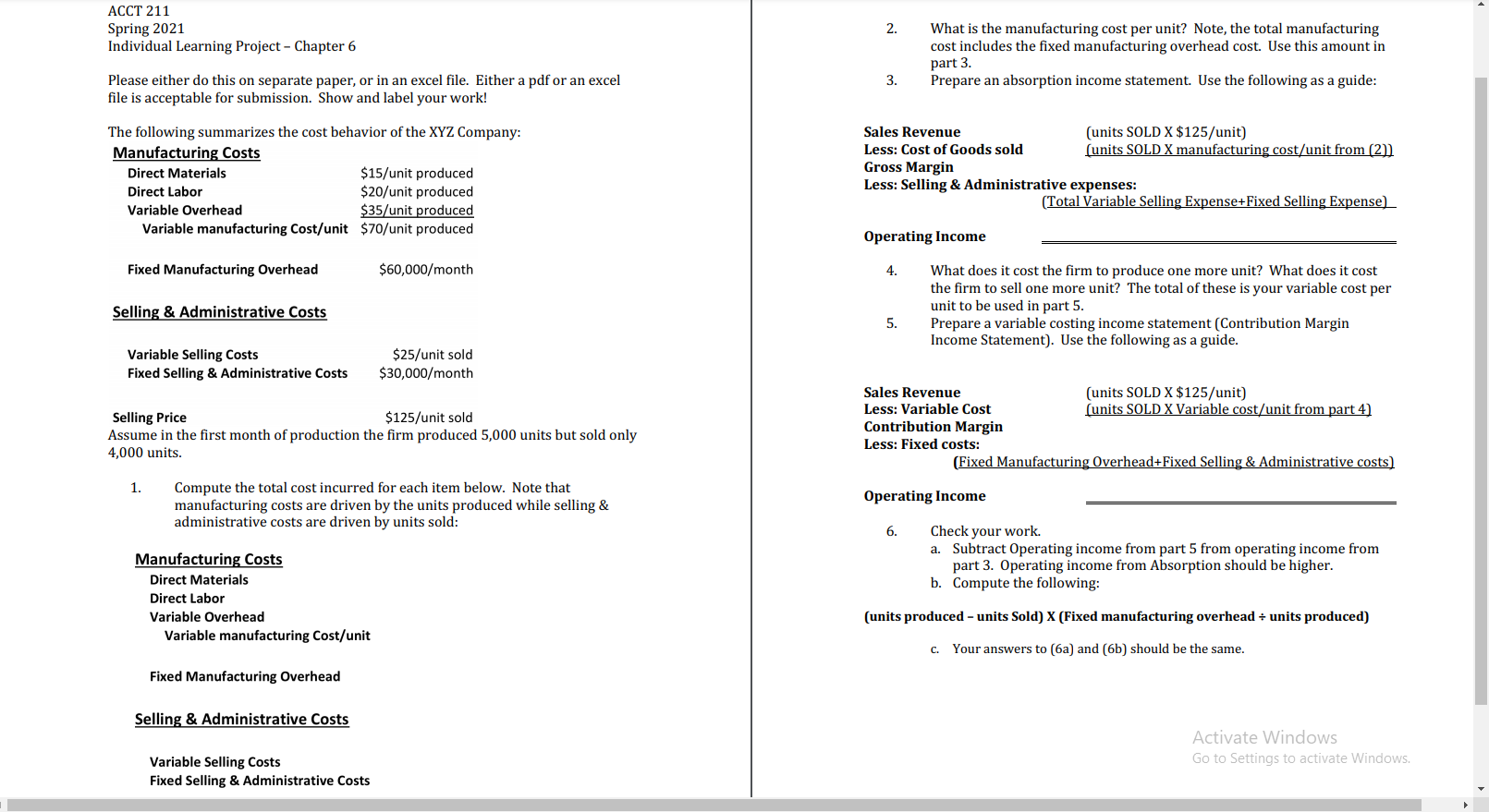

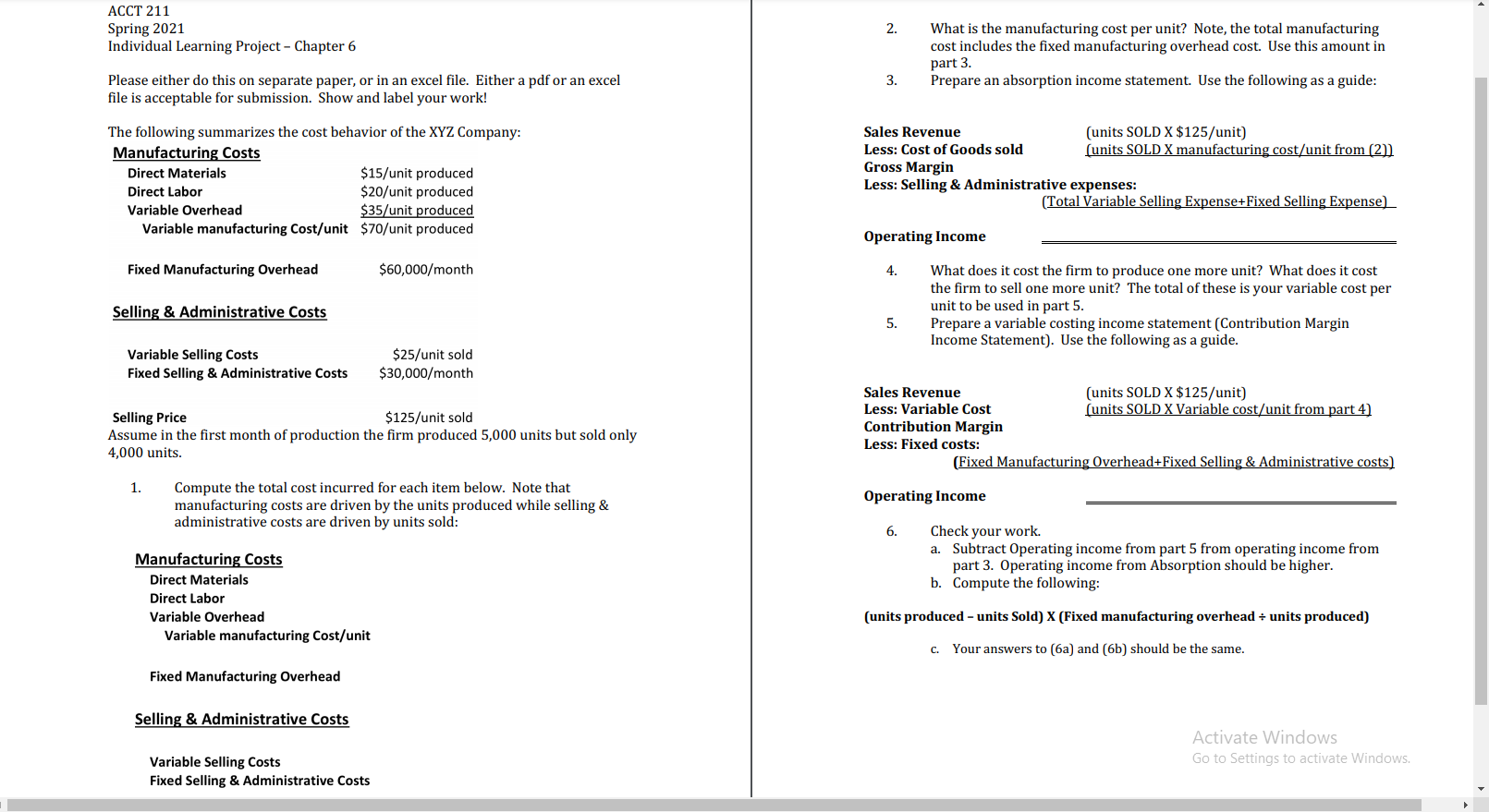

ACCT 211 Spring 2021 Individual Learning Project - Chapter 6 2. What is the manufacturing cost per unit? Note, the total manufacturing cost includes the fixed manufacturing overhead cost. Use this amount in part 3 3. Please either do this on separate paper, or in an excel file. Either a pdf or an excel file is acceptable for submission. Show and label your work! Prepare an absorption income statement. Use the following as a guide: The following summarizes the cost behavior of the XYZ Company: Manufacturing Costs Direct Materials $15/unit produced Direct Labor $20/unit produced Variable Overhead $35/unit produced Variable manufacturing Cost/unit $70/unit produced Sales Revenue (units SOLD X $125/unit) Less: Cost of Goods sold (units SOLD X manufacturing cost/unit from (2) Gross Margin Less: Selling & Administrative expenses: (Total Variable Selling Expense+Fixed Selling Expense) Operating Income Fixed Manufacturing Overhead $60,000/month 4. Selling & Administrative Costs What does it cost the firm to produce one more unit? What does it cost the firm to sell one more unit? The total of these is your variable cost per unit to be used in part 5. Prepare a variable costing income statement Contribution Margin Income Statement). Use the following as a guide. 5. Variable Selling Costs Fixed Selling & Administrative Costs $25/unit sold $30,000/month Selling Price $125/unit sold Assume in the first month of production the firm produced 5,000 units but sold only 4,000 units. Sales Revenue (units SOLD X $125/unit) Less: Variable Cost (units SOLD X Variable cost/unit from part 4) Contribution Margin Less: Fixed costs: (Fixed Manufacturing Overhead+Fixed Selling & Administrative costs) 1. Operating Income Compute the total cost incurred for each item below. Note that manufacturing costs are driven by the units produced while selling & administrative costs are driven by units sold: 6. Check your work. a. Subtract Operating income from part 5 from operating income from part 3. Operating income from Absorption should be higher. b. Compute the following: Manufacturing Costs Direct Materials Direct Labor Variable Overhead Variable manufacturing Cost/unit (units produced - units Sold) x (Fixed manufacturing overhead = units produced) c. Your answers to 6a) and (6b) should be the same. Fixed Manufacturing Overhead Selling & Administrative Costs Activate Windows Go to Settings to activate Windows. Variable Selling Costs Fixed Selling & Administrative Costs