Answered step by step

Verified Expert Solution

Question

1 Approved Answer

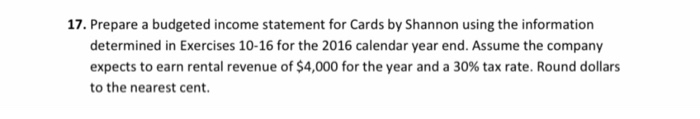

Please answer #17. I provided the answers for 10-16. Number 15 is Calculations of cost of good sold 17. Prepare a budgeted income statement for

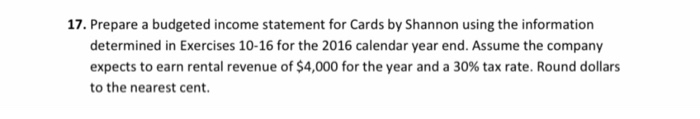

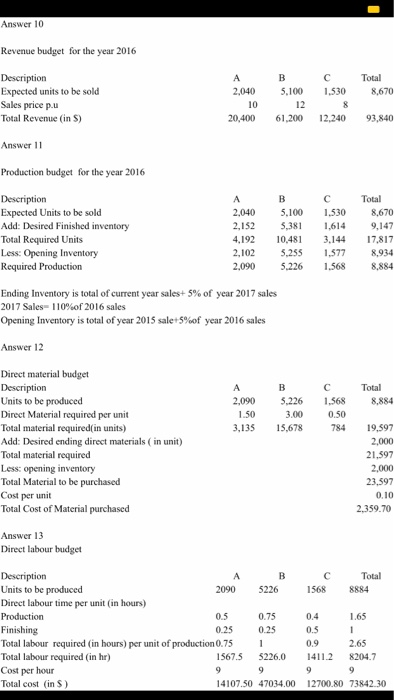

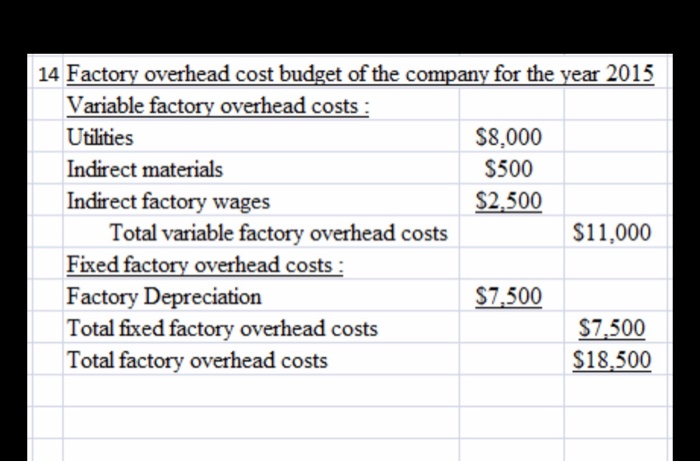

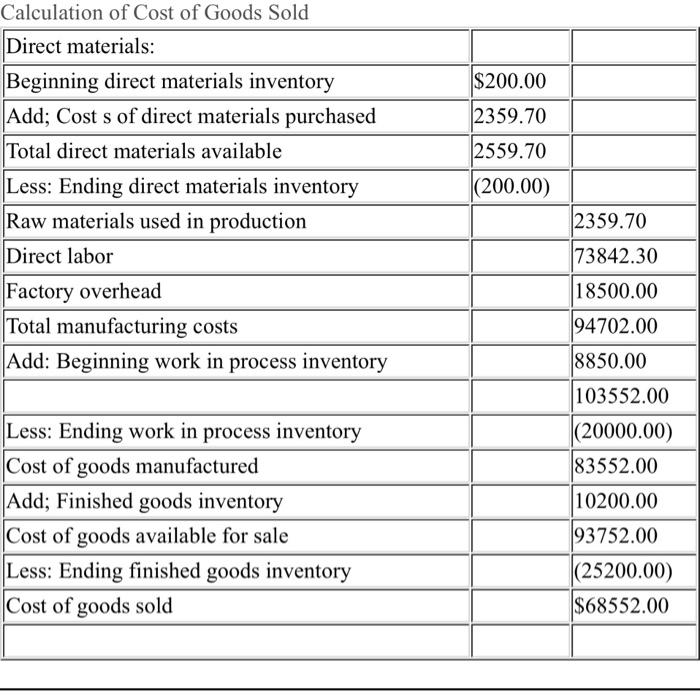

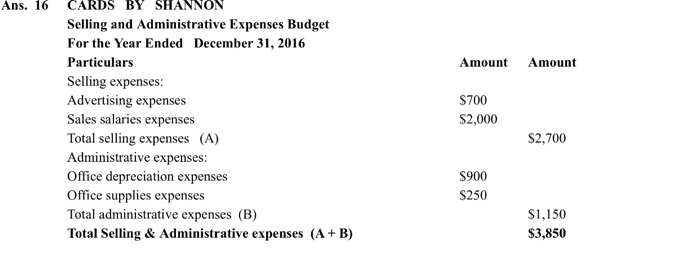

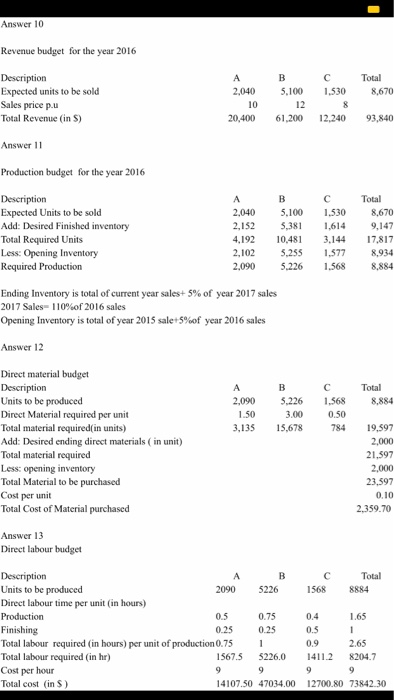

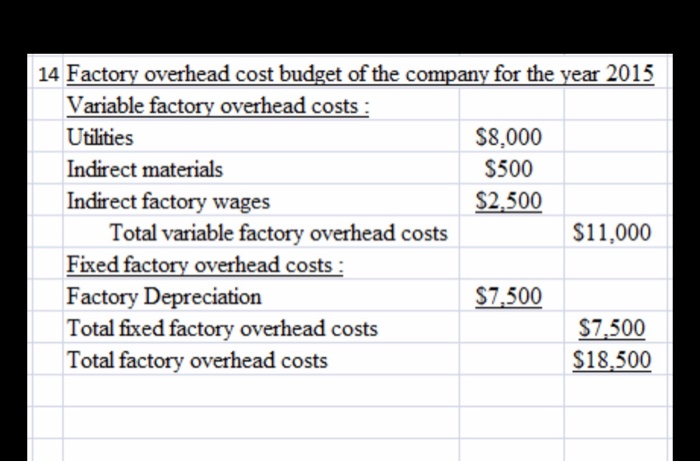

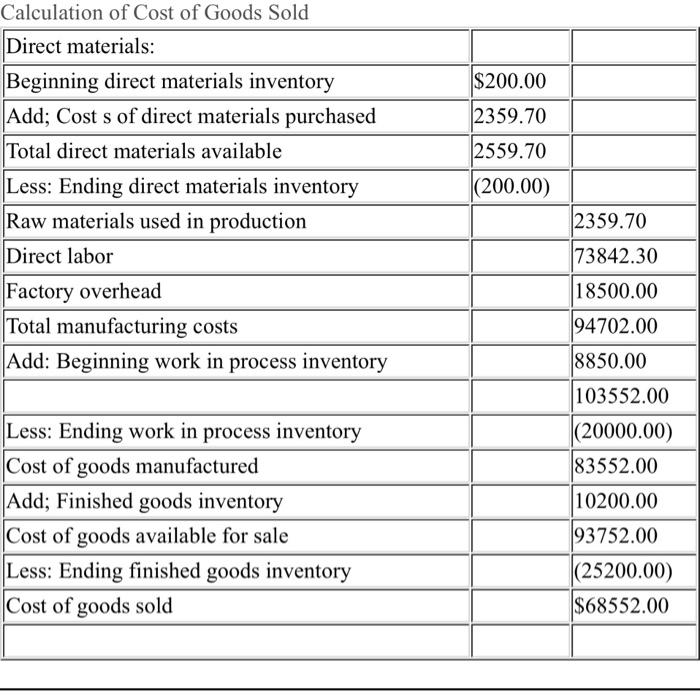

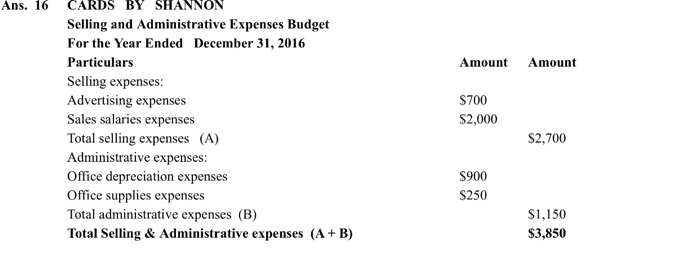

Please answer #17. I provided the answers for 10-16. Number 15 is "Calculations of cost of good sold" 17. Prepare a budgeted income statement for Cards by Shannon using the information determined in Exercises 10-16 for the 2016 calendar year end. Assume the company expects to earn rental revenue of $4,000 for the year and a 30% tax rate. Round dollars to the nearest cent. Answer 10 Revenue budget for the year 2016 ABC Total 2,040 5.100 1.530 8.670 Description Expected units to be sold Sales pricepu Total Revenue (in S) 10 20,400 61,200 12.240 93,840 Answer 11 Production budget for the year 2016 Description Expected Units to be sold Add: Desired Finished inventory Total Required Units Less: Opening Inventory Required Production 2,040 2,152 4,192 2,102 2.090 5.100 5.381 10.481 5.255 5.226 1.530 1.614 3.144 1,577 Total 8,670 9,147 17.817 8,934 8.884 Ending Inventory is total of current year sales+5% of year 2017 sales 2017 Sales - 110%of 2016 sales Opening Inventory is total of year 2015 sale+5%of year 2016 sales Answer 12 A 2.090 1.50 3,135 B 5.226 3.00 15,678 C 1.568 0.50 Total 8.884 Direct material budget Description Units to be produced Direct Material required per unit Total material required in units) Add: Desired ending direct materials in unit) Total material required Less: opening inventory Total Material to be purchased Cost per unit Total Cost of Material purchased 19.597 2,000 21.597 2.000 23,597 0.10 2.359.70 Answer 13 Direct labour budget Description AB C Total Units to be produced 20905226 Direct labour time per unit (in hours) Production 0.5 0.75 0.4 1.65 Finishing 0.25 Total labour required (in hours) per unit of production 0.75 1 Total labour required in hr) 1567.5 5226. 0 14112 8204.7 Cost per hour Total cost in S) 14107.50 47034.00 12700.80 73842.30 2.65 14 Factory overhead cost budget of the company for the year 2015 Variable factory overhead costs : Utilities $8.000 Indirect materials $500 Indirect factory wages $2.500 Total variable factory overhead costs $11,000 Fixed factory overhead costs : Factory Depreciation $7,500 Total fixed factory overhead costs $7,500 Total factory overhead costs $18,500 Calculation of Cost of Goods Sold Direct materials: Beginning direct materials inventory Add; Costs of direct materials purchased Total direct materials available Less: Ending direct materials inventory Raw materials used in production Direct labor Factory overhead Total manufacturing costs Add: Beginning work in process inventory $200.00 2359.70 2559.70 |(200.00) 2359.70 73842.30 18500.00 94702.00 8850.00 103552.00 (20000.00) 83552.00 10200.00 93752.00 |(25200.00) $68552.00 Less: Ending work in process inventory Cost of goods manufactured Add; Finished goods inventory Cost of goods available for sale Less: Ending finished goods inventory Cost of goods sold Ans. 16 Amount Amount CARDS BY SHANNON Selling and Administrative Expenses Budget For the Year Ended December 31, 2016 Particulars Selling expenses: Advertising expenses Sales salaries expenses Total selling expenses (A) Administrative expenses: Office depreciation expenses Office supplies expenses Total administrative expenses (B) Total Selling & Administrative expenses (A + B) $700 $2,000 $2.700 $900 $250 $1,150 $3,850

Please answer #17. I provided the answers for 10-16. Number 15 is "Calculations of cost of good sold" 17. Prepare a budgeted income statement for Cards by Shannon using the information determined in Exercises 10-16 for the 2016 calendar year end. Assume the company expects to earn rental revenue of $4,000 for the year and a 30% tax rate. Round dollars to the nearest cent. Answer 10 Revenue budget for the year 2016 ABC Total 2,040 5.100 1.530 8.670 Description Expected units to be sold Sales pricepu Total Revenue (in S) 10 20,400 61,200 12.240 93,840 Answer 11 Production budget for the year 2016 Description Expected Units to be sold Add: Desired Finished inventory Total Required Units Less: Opening Inventory Required Production 2,040 2,152 4,192 2,102 2.090 5.100 5.381 10.481 5.255 5.226 1.530 1.614 3.144 1,577 Total 8,670 9,147 17.817 8,934 8.884 Ending Inventory is total of current year sales+5% of year 2017 sales 2017 Sales - 110%of 2016 sales Opening Inventory is total of year 2015 sale+5%of year 2016 sales Answer 12 A 2.090 1.50 3,135 B 5.226 3.00 15,678 C 1.568 0.50 Total 8.884 Direct material budget Description Units to be produced Direct Material required per unit Total material required in units) Add: Desired ending direct materials in unit) Total material required Less: opening inventory Total Material to be purchased Cost per unit Total Cost of Material purchased 19.597 2,000 21.597 2.000 23,597 0.10 2.359.70 Answer 13 Direct labour budget Description AB C Total Units to be produced 20905226 Direct labour time per unit (in hours) Production 0.5 0.75 0.4 1.65 Finishing 0.25 Total labour required (in hours) per unit of production 0.75 1 Total labour required in hr) 1567.5 5226. 0 14112 8204.7 Cost per hour Total cost in S) 14107.50 47034.00 12700.80 73842.30 2.65 14 Factory overhead cost budget of the company for the year 2015 Variable factory overhead costs : Utilities $8.000 Indirect materials $500 Indirect factory wages $2.500 Total variable factory overhead costs $11,000 Fixed factory overhead costs : Factory Depreciation $7,500 Total fixed factory overhead costs $7,500 Total factory overhead costs $18,500 Calculation of Cost of Goods Sold Direct materials: Beginning direct materials inventory Add; Costs of direct materials purchased Total direct materials available Less: Ending direct materials inventory Raw materials used in production Direct labor Factory overhead Total manufacturing costs Add: Beginning work in process inventory $200.00 2359.70 2559.70 |(200.00) 2359.70 73842.30 18500.00 94702.00 8850.00 103552.00 (20000.00) 83552.00 10200.00 93752.00 |(25200.00) $68552.00 Less: Ending work in process inventory Cost of goods manufactured Add; Finished goods inventory Cost of goods available for sale Less: Ending finished goods inventory Cost of goods sold Ans. 16 Amount Amount CARDS BY SHANNON Selling and Administrative Expenses Budget For the Year Ended December 31, 2016 Particulars Selling expenses: Advertising expenses Sales salaries expenses Total selling expenses (A) Administrative expenses: Office depreciation expenses Office supplies expenses Total administrative expenses (B) Total Selling & Administrative expenses (A + B) $700 $2,000 $2.700 $900 $250 $1,150 $3,850

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started