Answered step by step

Verified Expert Solution

Question

1 Approved Answer

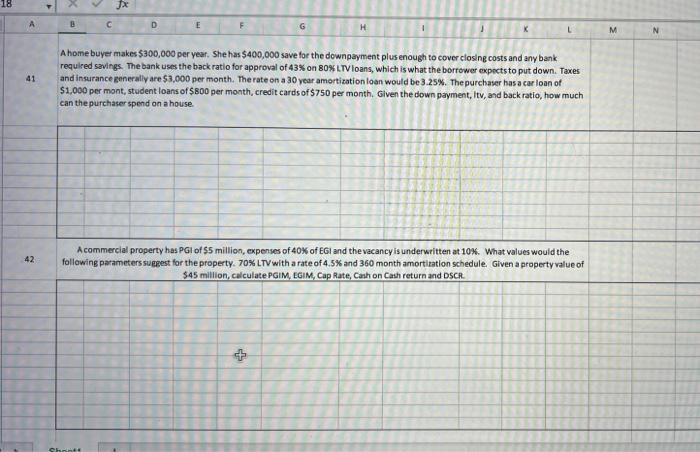

PLEASE ANSWER 2 questions asap plssss B C D E G H M 41 Ahome buyer makes $300,000 per year. She has $400,000 save for

PLEASE ANSWER 2 questions asap plssss

B C D E G H M 41 Ahome buyer makes $300,000 per year. She has $400,000 save for the downpayment plus enough to cover closing costs and any bank required savings. The bank uses the back ratio for approval of 43% on 80% LTV loans, which is what the borrower expects to put down. Taxes and insurance generally are $3,000 per month. The rate on a 30 year amortization loan would be 3.25%. The purchaser has a car loan of $1,000 per mont, student loans of $800 per month, credit cards of $750 per month. Given the down payment, Itv, and back ratio, how much can the purchaser spend on a house 42 Acommercial property has PGI of $5 million, expenses of 40% of EGI and the vacancy is underwritten at 10%. What values would the following parameters suggest for the property. 70% LTV with a rate of 4.5% and 360 month amortization schedule. Given a property value of $45 million, calculate PGIM. EGIM. Cap Rate, Cash on Cash return and DSCR + B C D E G H M 41 Ahome buyer makes $300,000 per year. She has $400,000 save for the downpayment plus enough to cover closing costs and any bank required savings. The bank uses the back ratio for approval of 43% on 80% LTV loans, which is what the borrower expects to put down. Taxes and insurance generally are $3,000 per month. The rate on a 30 year amortization loan would be 3.25%. The purchaser has a car loan of $1,000 per mont, student loans of $800 per month, credit cards of $750 per month. Given the down payment, Itv, and back ratio, how much can the purchaser spend on a house 42 Acommercial property has PGI of $5 million, expenses of 40% of EGI and the vacancy is underwritten at 10%. What values would the following parameters suggest for the property. 70% LTV with a rate of 4.5% and 360 month amortization schedule. Given a property value of $45 million, calculate PGIM. EGIM. Cap Rate, Cash on Cash return and DSCR +

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started