Answered step by step

Verified Expert Solution

Question

1 Approved Answer

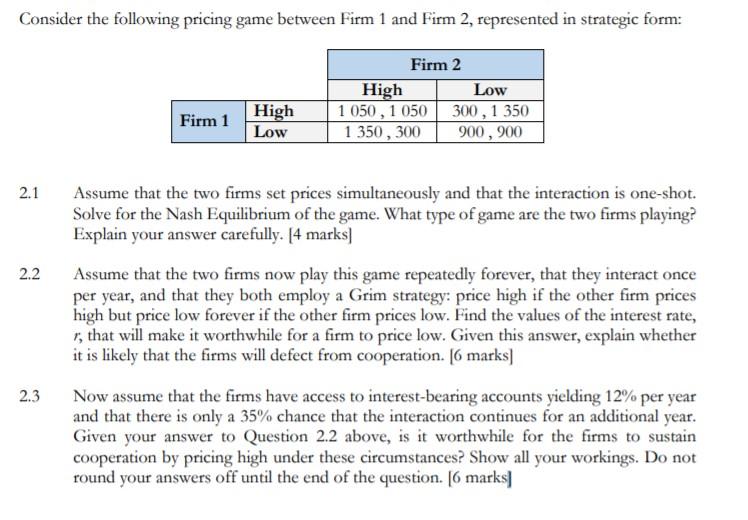

Please answer 2.2 and 2.3 only Consider the following pricing game between Firm 1 and Firm 2, represented in strategic form: Firm 2 High Low

Please answer 2.2 and 2.3 only

Consider the following pricing game between Firm 1 and Firm 2, represented in strategic form: Firm 2 High Low 1 050, 1 050 300, 1 350 1 350, 300 900, 900 Firm 1 High Low 2.1 2.2 Assume that the two firms set prices simultaneously and that the interaction is one-shot. Solve for the Nash Equilibrium of the game. What type of game are the two firms playing? Explain your answer carefully. [4 marks Assume that the two firms now play this game repeatedly forever, that they interact once per year, and that they both employ a Grim strategy: price high if the other firm prices high but price low forever if the other firm prices low. Find the values of the interest rate, r, that will make it worthwhile for a firm to price low. Given this answer, explain whether it is likely that the firms will defect from cooperation. 16 marks) Now assume that the firms have access to interest-bearing accounts yielding 12% per year and that there is only a 35% chance that the interaction continues for an additional year. Given your answer to Question 2.2 above, is it worthwhile for the firms to sustain cooperation by pricing high under these circumstances? Show all your workings. Do not round your answers off until the end of the question. 16 marks 2.3 Consider the following pricing game between Firm 1 and Firm 2, represented in strategic form: Firm 2 High Low 1 050, 1 050 300, 1 350 1 350, 300 900, 900 Firm 1 High Low 2.1 2.2 Assume that the two firms set prices simultaneously and that the interaction is one-shot. Solve for the Nash Equilibrium of the game. What type of game are the two firms playing? Explain your answer carefully. [4 marks Assume that the two firms now play this game repeatedly forever, that they interact once per year, and that they both employ a Grim strategy: price high if the other firm prices high but price low forever if the other firm prices low. Find the values of the interest rate, r, that will make it worthwhile for a firm to price low. Given this answer, explain whether it is likely that the firms will defect from cooperation. 16 marks) Now assume that the firms have access to interest-bearing accounts yielding 12% per year and that there is only a 35% chance that the interaction continues for an additional year. Given your answer to Question 2.2 above, is it worthwhile for the firms to sustain cooperation by pricing high under these circumstances? Show all your workings. Do not round your answers off until the end of the question. 16 marks 2.3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started