please answer 27-39

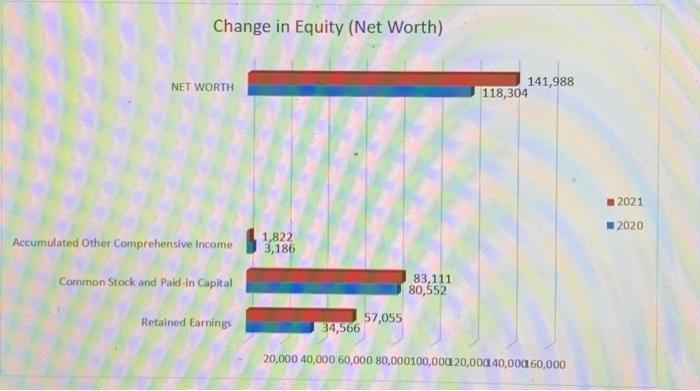

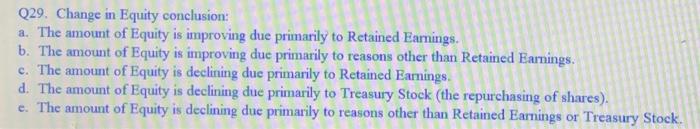

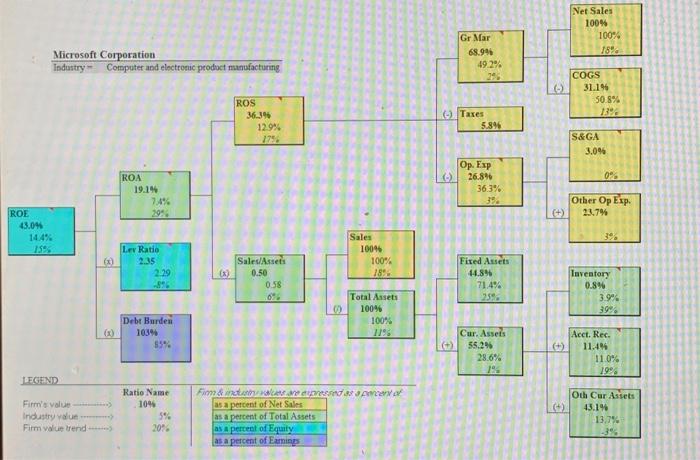

Times Interest Earned (TIE) 30.00 27.03 27.03 25.00 18.13 20.00 15.00 10.00 6.58 5.00 0.00 2020 2021 Plan Industry Q27. Times Interest Earned and Safe Leverage conclusion: a. The firm has a sufficient level of interest coverage safety, and the level of safety is improving or unchanged. b. The firm has a sufficient level of interest coverage safety, but the level of safety is declining. c. The firm does not have a sufficient level of interest coverage safety, but level of safety is improving. d. The firm does not have a sufficient level of interest coverage safety, and the level of safety is declining. e. The firm has no interest expense, so interest coverage is not a problem. Q28. Times Interest Earned and Safe Leverage conclusion, trend: a. The level of safety is improving due primarily to the improvement in Earnings (EBIT). b. The level of safety is improving due primarily to the reduction in Interest Expense. c. The level of safety is declining due primarily to the decline in Earnings (EBIT). d. The level of safety is declining due primarily to the increase in Interest Expense. e. Not applicable (The firm has no interest expense, or there is no change in leverage). Change in Equity (Net Worth) NET WORTH 141,988 118,304 2021 2020 Accumulated Other Comprehensive Income 1,822 3,186 Common Stock and Paid in Capital 83,111 80,552 57,055 34,566 Retained Earnings 20,000 40,000 60,000 80,000100,000 20,000.40,00060,000 Q29. Change in Equity conclusion: a. The amount of Equity is improving due primarily to Retained Earnings. b. The amount of Equity is improving due primarily to reasons other than Retained Earnings. c. The amount of Equity is declining due primarily to Retained Earnings d. The amount of Equity is declining due primarily to Treasury Stock (the repurchasing of shares). e. The amount of Equity is declining due primarily to reasons other than Retained Earnings or Treasury Stock Rick Fred Rate ficrosoft Corporation conomic Profit Creation Diagnosis RED) Cost or Equity 13 Operating Profit Avg Total Ascote 13 Firma Economic Profit 1,054 27.545 XEquity Proportion 40122 Ordinary Profit 4235 * More Premium Required Cost of Capital MOR 5.14 Lab Proportion Profit Analysis 57246 Firm's Cost of Debt $100,000 Cost of Debt $50,000 255 X Income Tax Rate Abow changes $0 Economic Profit Ordinary Profit Operation Profi Required arket Value Creation Diagnosis Mr Owl Current mig Volos of Conte Operation 2003 Cook of Capital Exped Archives 15146 Hoe of the Firm ROA 000 Earring: Growth 1911 156577 Volue of Growth Opportunitie Cost of Capit SIN Value Analysis Cost of Capital (1.c) 5401 Tine Length of Comp. Adv. (Y) 55.000 Net Sales 100% 100% 18 Microsoft Corporation Industry Computer and electronic product manufacturing Gr Mar 68.94 49.2% 2% COGS 31.1% 50 8% 13% ROS 36.3% 12.9% 279 Taxes 5.896 S&GA 3.0% 0 ROA 19.14 7.444 299. Op. Exp . 26.8% 36.3% 39. Other Op Exp 23.7% (+) ROE 43.04 14.4% 1396 Le Ratio 2.35 229 Sales 100% 100% 18 Sales Assets 0.50 0.58 09 (X) Fixed Assets 44.8% 71.4% Inventory 0.8% 3.94 39% Total Assets 100% 100% (1) Debt Burden 10393 559. Cur. Assets 55.2% 28.6% 19 Acct. Rec. 11.4% 11.0% 19 TEGEND Fimm's value--> Industry value> Firm value trend Ratio Name 1046 59 20% Fimm & diretorty walane tead 86 SAYO as a percent of Net Sales as a percent of Total Assets as a percent of Equity as a percent of Earnings Oth Cur Assets 43.196 13,7%