Please answer 38-40. Do not answer 37.

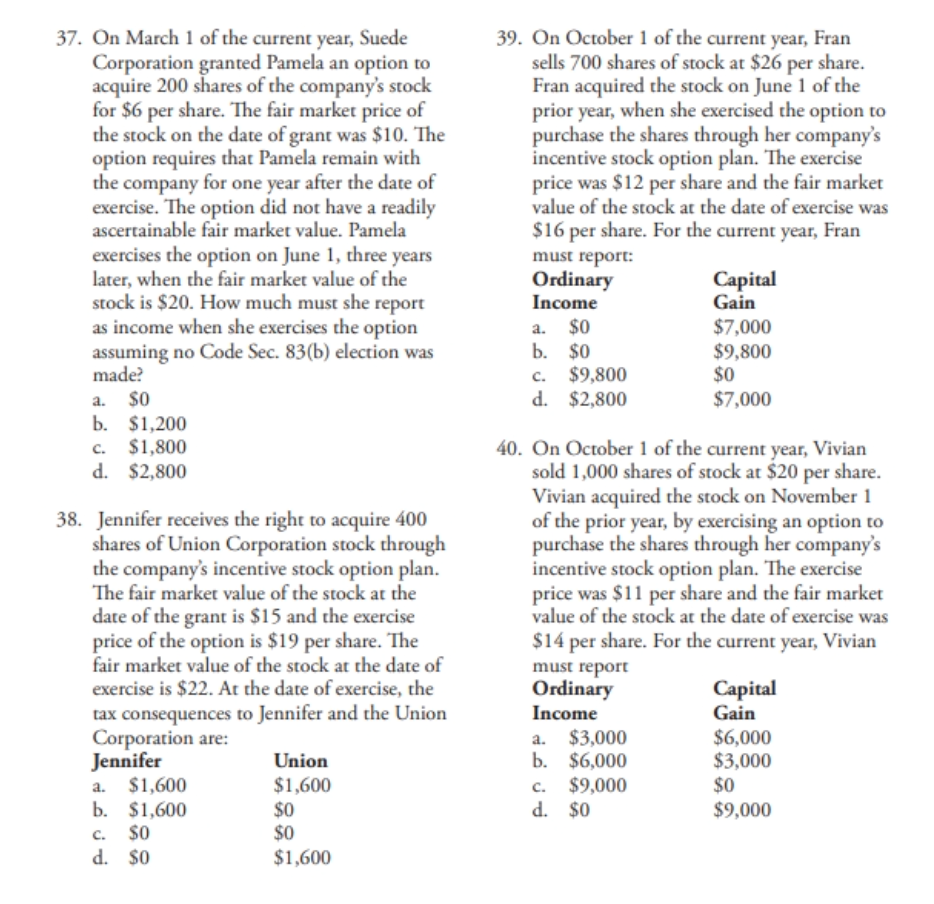

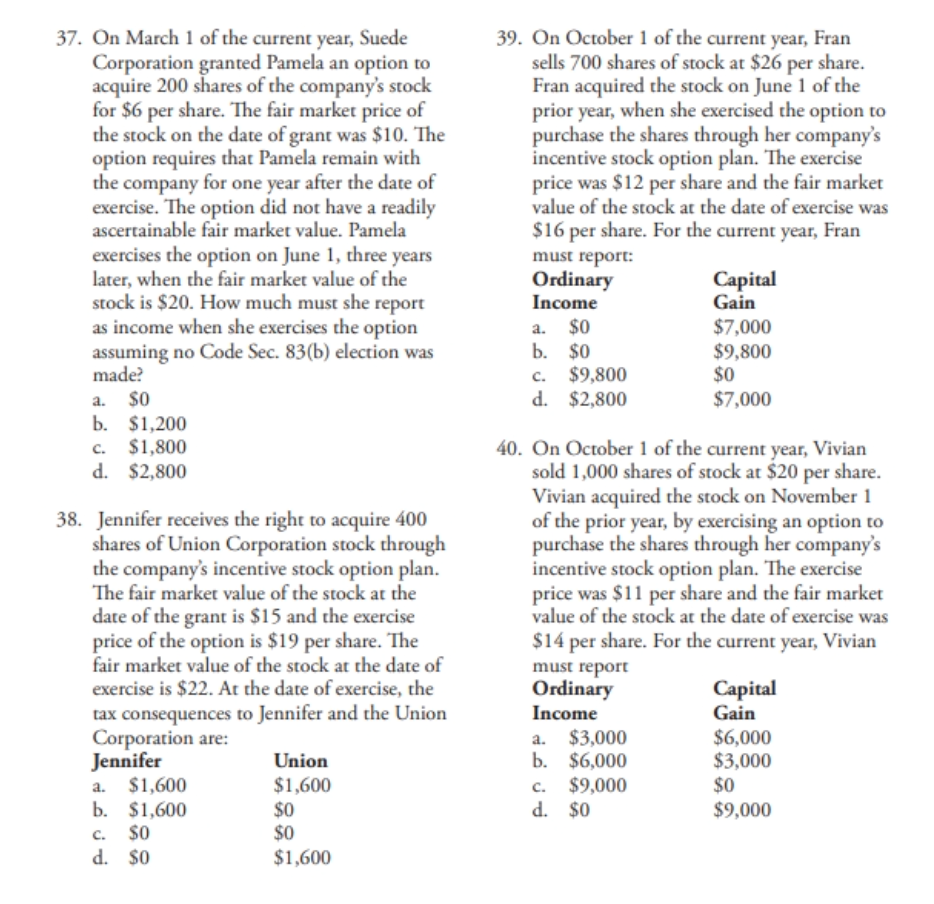

37. On March 1 of the current year, Suede Corporation granted Pamela an option to acquire 200 shares of the company's stock for $6 per share. The fair market price of the stock on the date of grant was $10. The option requires that Pamela remain with the company for one year after the date of exercise. The option did not have a readily ascertainable fair market value. Pamela exercises the option on June 1, three years later, when the fair market value of the stock is $20. How much must she report as income when she exercises the option assuming no Code Sec. 83(b) election was made? a. $0 b. $1,200 c. $1,800 d. $2,800 39. On October 1 of the current year, Fran sells 700 shares of stock at $26 per share. Fran acquired the stock on June 1 of the prior year, when she exercised the option to purchase the shares through her company's incentive stock option plan. The exercise price was $12 per share and the fair market value of the stock at the date of exercise was $16 per share. For the current year, Fran must report: Ordinary Capital Income Gain a. $0 $7,000 b. $0 $9,800 c. $9,800 $0 d. $2,800 $7,000 38. Jennifer receives the right to acquire 400 shares of Union Corporation stock through the company's incentive stock option plan. The fair market value of the stock at the date of the grant is $15 and the exercise price of the option is $19 per share. The fair market value of the stock at the date of exercise is $22. At the date of exercise, the tax consequences to Jennifer and the Union Corporation are: Jennifer Union a $1,600 $1,600 b. $1,600 $0 c. $0 d. $0 $1,600 40. On October 1 of the current year, Vivian sold 1,000 shares of stock at $20 per share. Vivian acquired the stock on November 1 of the prior year, by exercising an option to purchase the shares through her company's incentive stock option plan. The exercise price was $11 per share and the fair market value of the stock at the date of exercise was $14 per share. For the current year, Vivian must report Ordinary Capital Income Gain a. $3,000 $6,000 b. $6,000 $3,000 $9,000 $0 d. $0 $9,000 c. $0 37. On March 1 of the current year, Suede Corporation granted Pamela an option to acquire 200 shares of the company's stock for $6 per share. The fair market price of the stock on the date of grant was $10. The option requires that Pamela remain with the company for one year after the date of exercise. The option did not have a readily ascertainable fair market value. Pamela exercises the option on June 1, three years later, when the fair market value of the stock is $20. How much must she report as income when she exercises the option assuming no Code Sec. 83(b) election was made? a. $0 b. $1,200 c. $1,800 d. $2,800 39. On October 1 of the current year, Fran sells 700 shares of stock at $26 per share. Fran acquired the stock on June 1 of the prior year, when she exercised the option to purchase the shares through her company's incentive stock option plan. The exercise price was $12 per share and the fair market value of the stock at the date of exercise was $16 per share. For the current year, Fran must report: Ordinary Capital Income Gain a. $0 $7,000 b. $0 $9,800 c. $9,800 $0 d. $2,800 $7,000 38. Jennifer receives the right to acquire 400 shares of Union Corporation stock through the company's incentive stock option plan. The fair market value of the stock at the date of the grant is $15 and the exercise price of the option is $19 per share. The fair market value of the stock at the date of exercise is $22. At the date of exercise, the tax consequences to Jennifer and the Union Corporation are: Jennifer Union a $1,600 $1,600 b. $1,600 $0 c. $0 d. $0 $1,600 40. On October 1 of the current year, Vivian sold 1,000 shares of stock at $20 per share. Vivian acquired the stock on November 1 of the prior year, by exercising an option to purchase the shares through her company's incentive stock option plan. The exercise price was $11 per share and the fair market value of the stock at the date of exercise was $14 per share. For the current year, Vivian must report Ordinary Capital Income Gain a. $3,000 $6,000 b. $6,000 $3,000 $9,000 $0 d. $0 $9,000 c. $0