please answer 4,5,6

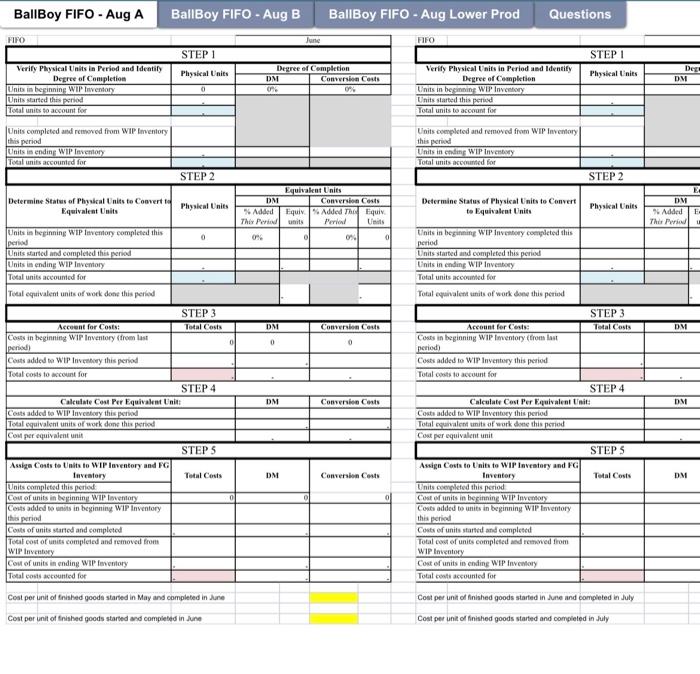

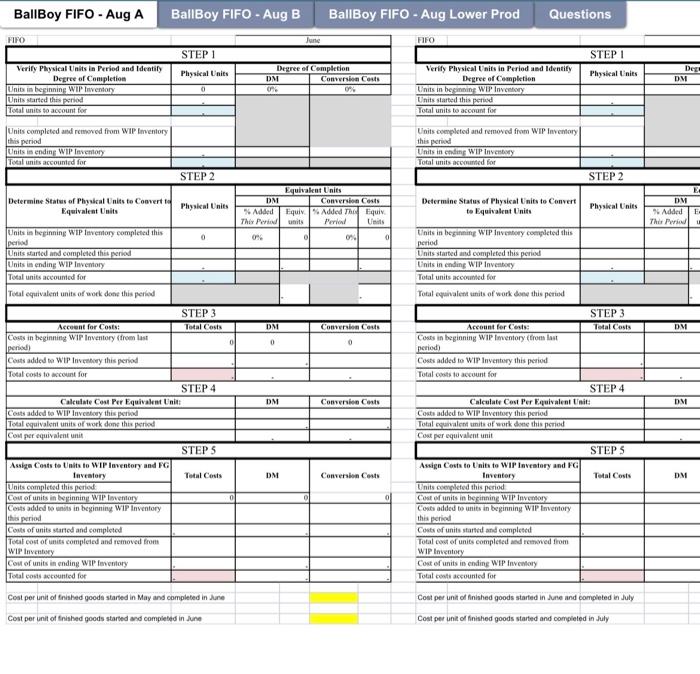

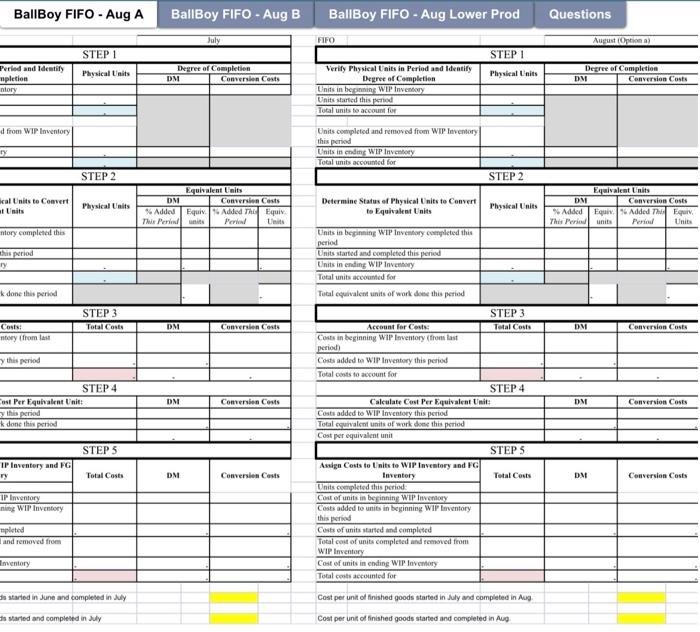

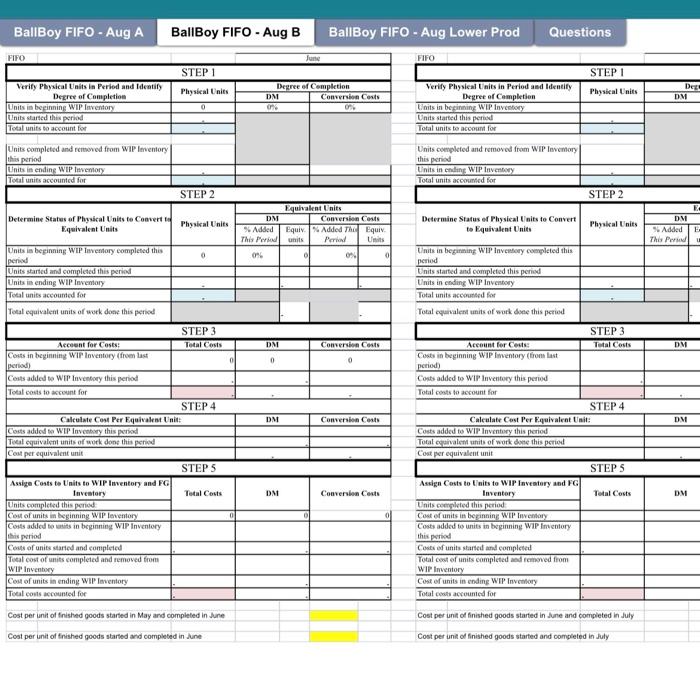

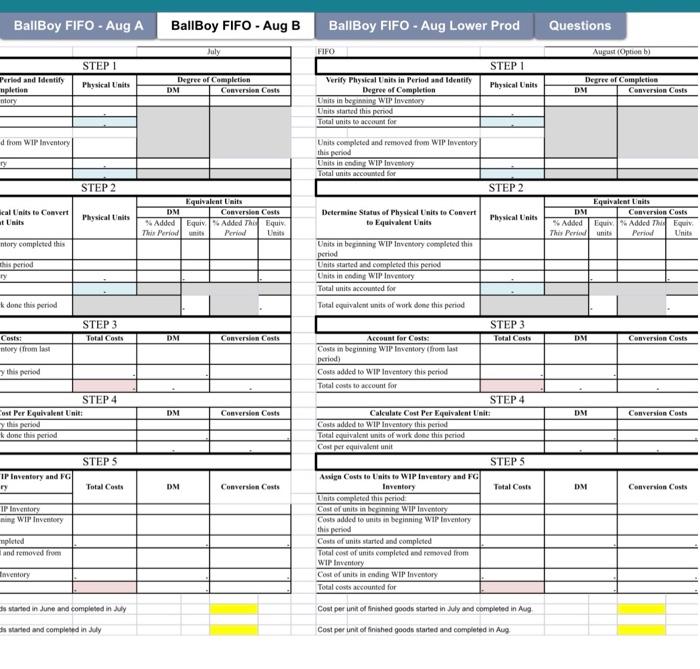

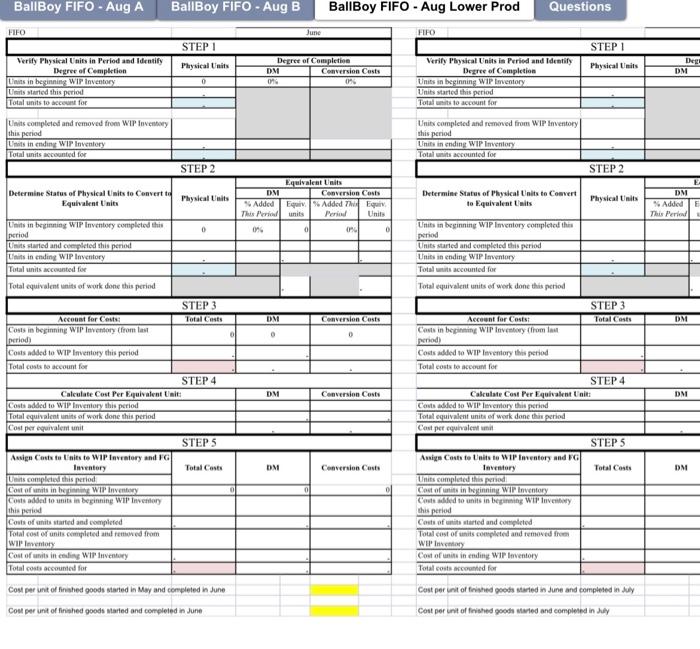

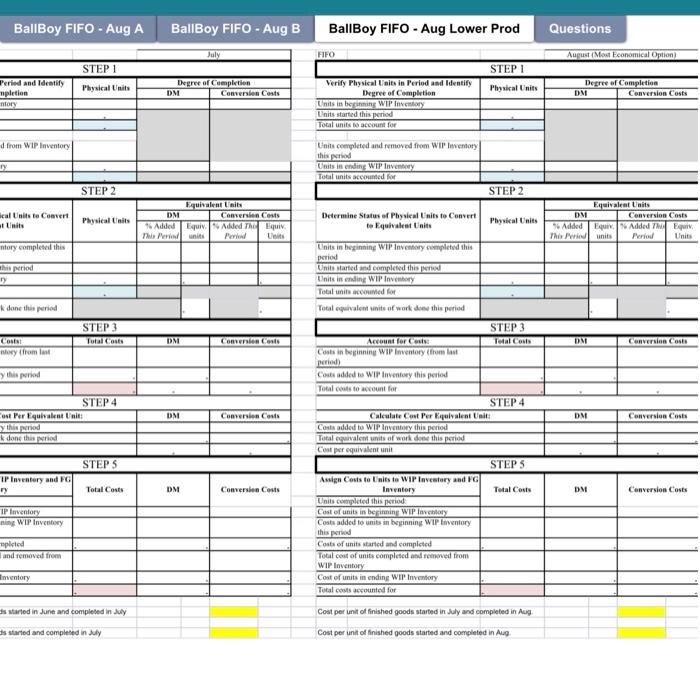

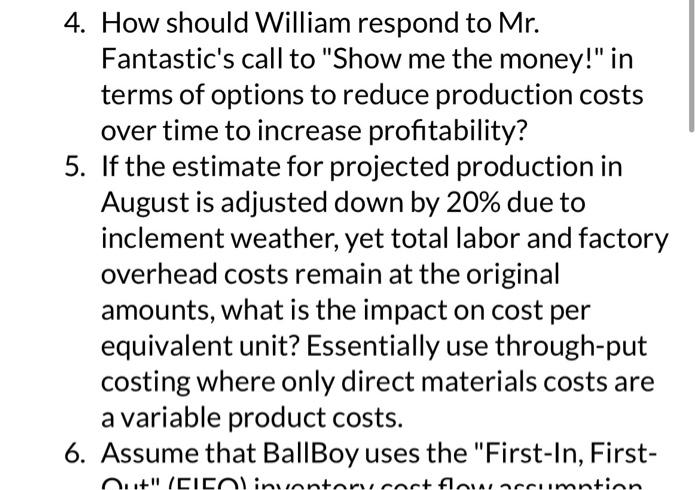

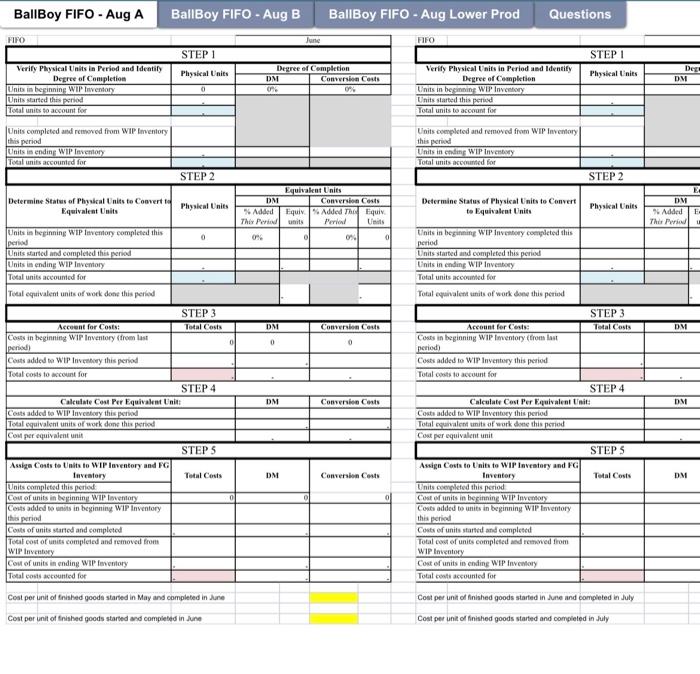

BallBoy FIFO - Aug A BallBoy FIFO - Aug B BallBoy FIFO - Aug Lower Prod Questions \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline FirO & & & & & Jung & & FIFO & & & \\ \hline & & STEP 1 & & & & & & STEP I & & \\ \hline Ver & Physical taits in Peried and teatify & Plusical Enits & & Degree ef & fCempletion & & Verify Physical thits in Period and Identify & Phesical Lnits & & Dez \\ \hline & Decree of Completion & Physical Unifs & DM & & Convrriben & Cents & Degree of Campletion & Physical Cnits & DM & \\ \hline & beginning WIP Inventory & 0 & 0 & & on & & Enits in beginining WTP Inveneory & & & \\ \hline Units & ried this period & & & & & & Units started this perios & & & \\ \hline Total u & fs bo account for & & & & & & Total units to account for & & & \\ \hline \begin{tabular}{l} Units \\ this pa \\ \end{tabular} & \begin{tabular}{l} mpleted and removed from WIP leventory \\ od \end{tabular} & & & & & & \begin{tabular}{l} Units coenpleted and removed from WIP Invemory \\ this period \end{tabular} & & & \\ \hline Units & ending WIP lavemory & & & & & & Enits in ending WIP Inverioory & & & \\ \hline Total y & ts accounted for & & & & & & Total units accounted for & & & \\ \hline & & STEP 2 & & & & & & STEP 2 & & \\ \hline & & & & Equha! & alent Units & & & & & E \\ \hline Deter & ine States of Physical Units to Coovert th & Phovisalenits & DM & & Comzersion & Cests & Determine Status ef Physical Iits to Convert & Plovekal Inits & DM & \\ \hline & Equivalent Units & Physisal t nits & \begin{tabular}{l} SAdSed \\ This Preriod \end{tabular} & \begin{tabular}{l} \begin{tabular}{c} Equiv. \\ units \end{tabular} \\ \end{tabular} & \begin{tabular}{c} \% Added thin \\ Period \end{tabular} & \begin{tabular}{l} Equiv. \\ Uninits \end{tabular} & to Equivalent Units & Phyokal t nits & & \\ \hline \begin{tabular}{l} Units \\ period \\ \end{tabular} & beginning WIP levemiry completed this & 0 & & o & & 0 & \begin{tabular}{l} Wints in begining WIJ' lavenory completed this \\ period \end{tabular} & & & \\ \hline Units : & iried and completed this period & & & & & & Units starfed and complefed this period & & & \\ \hline Units i & ending WIP Invemtary & & & . & & . & Units in ending WI' Inventory & . & & \\ \hline Tocal u & is accounded for & & & & & & Total units acconuted fos & & & \\ \hline Tetal c & aivalent units of work done this period & & & - & & . & Total equinalent units of work deee this peried & & & \\ \hline & & STEP3 & & & & & & S'EP 3 & & \\ \hline & Acceent for Costs: & Tetal Costs & DM & & Conversibn & Cests & Acseunt for Cests: & Tetal Costs & DM & \\ \hline \begin{tabular}{l} Coits \\ period \end{tabular} & beginning WTr lnventory (froen last & 0 & 0 & & 0 & & \begin{tabular}{l} Costs in beginning WIP Imentory (from last \\ pcriod) \end{tabular} & & & \\ \hline Cents & ded to WIP Inventory this period & & & & & & Conts added to WIP Inventory this period & & & \\ \hline Total s & sts to account for & & + & & + & & Total costs to account for & & . & \\ \hline & & STEP 4 & & & & & & STEP 4 & & \\ \hline & Calculate Cost Per Equivalent Un & & DM & & Conversion & Cests & Caleulate Cest Per Equiralent U & & DM & \\ \hline Costs & ded fo WTP Invenbiry this period & & & & & & Costs added to WIP Inventory this period & & & \\ \hline Toeal c & aivalent units of work dons this peried & & & & & & Total equivalent units of work doete this poried & & & \\ \hline Cosp & equivalent unit & & & & & & Cost per equivalent unit & & & \\ \hline & & STEP 5 & & & & & & STEP 5 & & \\ \hline Assing & \begin{tabular}{l} Costs to Units to WIP Imventory and FG \\ Investery \end{tabular} & Tetal Costs & DM & & Coaversion & Cests & \begin{tabular}{l} Assign Cests to Iits to WIP Investary and FG \\ Imventory \end{tabular} & Tetal Costs & DM & \\ \hline Units: & mpleted this penod & & & & & & Dnits coenglated this period: & & & \\ \hline Cout ol & units in beginning WIP leventory & 0 & & 8 & & 0 & Cost of units in berinning WIP lincenory & & & \\ \hline \begin{tabular}{l} Costs \\ this po: \\ \end{tabular} & \begin{tabular}{l} Jed to atits in beginning WIP Inventory \\ od \end{tabular} & & & & & & \begin{tabular}{l} Costs added to units in beginning WIP Imentory \\ this poriod \end{tabular} & & & \\ \hline Cents & units staried and completed & & & & & & Costs of units staried and eompleted & & & \\ \hline \begin{tabular}{l} Tocal c \\ Wir' in \end{tabular} & \begin{tabular}{l} st of units compleced and removed from \\ cntory \end{tabular} & & & & & & \begin{tabular}{l} Total ceot of units completed and femoned from \\ WiP inventory \end{tabular} & & & \\ \hline Cost of & units in ending WIP Imentory & & & & & & Cost of units in ending WIP Invethory & & & \\ \hline Toeal s & vis accounted for & & & & & & Total ceots acrounied for & & & \\ \hline Cost p & init of finished goods started in May and co & mpleted in sune & & & & & Cost per unit of finished goods started in June and & ompleted in July & & \\ \hline & & & & & & & & & & \\ \hline Cost p & r unit of frished goods started and completed & Iin June & & & & & Cost per unit of finished goods started and complet & din July & & \\ \hline \end{tabular} BallBoy FIFO - Aug A BallBoy FIFO - Aug B BallBoy FIFO - Aug Lower Prod Questions BallBoy FIFO - Aug A BallBoy FIFO - Aug B BallBoy FIFO - Aug Lower Prod Questions 4. How should William respond to Mr. Fantastic's call to "Show me the money!" in terms of options to reduce production costs over time to increase profitability? 5. If the estimate for projected production in August is adjusted down by 20% due to inclement weather, yet total labor and factory overhead costs remain at the original amounts, what is the impact on cost per equivalent unit? Essentially use through-put costing where only direct materials costs are a variable product costs. 6. Assume that BallBoy uses the "First-In, First- equivalent unit? Essentially use through-put costing where only direct materials costs are a variable product costs. 6. Assume that BallBoy uses the "First-In, FirstOut" (FIFO) inventory cost flow assumption for all of its inventory calculations and that BallBoy sold 30,000 units in June. At the selling price of US $97.00 per unit, what is the gross profit for July if the packaging department adds US $0.04 to the cost of each unit and the company sells 35,000 units in July? Assuming BallBoy uses the FIFO inventory cost flow assumption for financial accounting, would gross profit in July have been higher or lower if BallBoy sold 25,000