Answered step by step

Verified Expert Solution

Question

1 Approved Answer

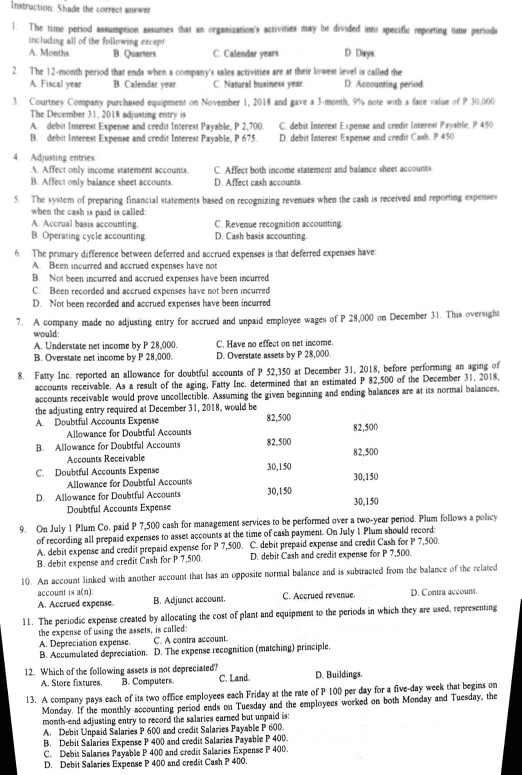

please answer 5 to 13 A Mothe r s Calendar year D Days 2 The 12 month period that when t h e A Fiscal

please answer 5 to 13

A Mothe r s Calendar year D Days 2 The 12 month period that when t h e A Fiscal yet B Calendar year Natural buyer DA Courtney Compa ched November 1, 2018 ad avea The December 11, 2018 A debit interest Expense and credit interest Payable. 2.700C debut interest Expense and credit ne w 450 B ebineres Expense and credit Interest Payable 675 D. debitere Expenser 4 Adjusting entries Affect only income utement CAffect both income statement and balance sheet B Affect only balance sheet account D. Affect cash accounts The system of preparing financial statements based on recognizing revenues when the cash is received and reporting when the cash is paid is called A Accrual basis accounting C Revenue recognition accounting Operating cycle accounting D Cash his counting 6 The primary difference between deferred and accrued expenses is that deferred expenses have A Been incurred and accrued expenses have not B Not been incurred and accrued expenses have been incurred C Been recorded and accrued expenses have not been incurred D. Not been recorded and accrued expenses have been incurred A company made no adjusting entry for accrued and unpaid employee wages of P 28,000 on December 31 This oversight would A Understate net income by P 28.000 C. Have no effect on net income B. Overstate net income by P 28,000. D. Overstate assets by P 28,000 Fatty Inc reported an allowance for doubtful accounts of P 52,350 at December 31, 2018, before performing an aging of accounts receivable. As a result of the aging, Fatty Inc, determined that an estimated P 82.500 of the December 31, 2018 accounts receivable would prove uncollectible. Assuming the given beginning and ending balances are at its normal balances, the adjusting entry required at December 31, 2018, would be A Doubtful Accounts Expense 82,500 Allowance for Doubtful Accounts 82,500 B. Allowance for Doubtful Accounts 82.500 Accounts Receivable 82,500 C Doubtful Accounts Expense 30,150 Allowance for Doubtful Accounts 30,150 D. Allowance for Doubtful Accounts 30,150 Doubtful Accounts Expense 30,150 9. On July 1 Plum Co, paid P 7,500 cash for management services to be performed over a two-year period. Plum follows a policy of recording all prepaid expenses to asset accounts at the time of cash payment. On July 1 Plum should record A. debit expense and credit prepaid expense for P 7,500. C. debit prepaid expense and credit Cash for P 7,500 B. debit expense and credit Cash for P 7.500. D. debit Cash and credit expense for P 7.500 10. An account linked with another account that has an opposite normal balance and is subtracted from the balance of the related account is an) A. Accrued expense B. Adjunct account C. Accrued revenue D. Contra account 11. The periodic expense created by allocating the cost of plant and equipment to the periods in which they are used, representing the expense of using the assets, is called: A. Depreciation expense C. A contra account B. Accumulated depreciation. D. The expense recognition (matching principle. 12. Which of the following assets is not depreciated! A. Store fixtures. B. Computers C. Land D. Buildings 13. A company pays cach of its two office employees each Friday at the rate of P 100 per day for a five-day week that begins on Monday. If the monthly accounting period ends on Tuesday and the employees worked on both Monday and Tuesday, the month-end adjusting entry to record the salaries camed but unpaid is A. Debit Unpaid Salaries P 600 and credit Salaries Payable P 600. B. Debit Salaries Expense P400 and credit Salaries Payable P 400. C. Debit Salaries Payable P 400 and credit Salaries Expense P 400. D. Debit Salaries Expense P 400 and credit Cash P 400Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started