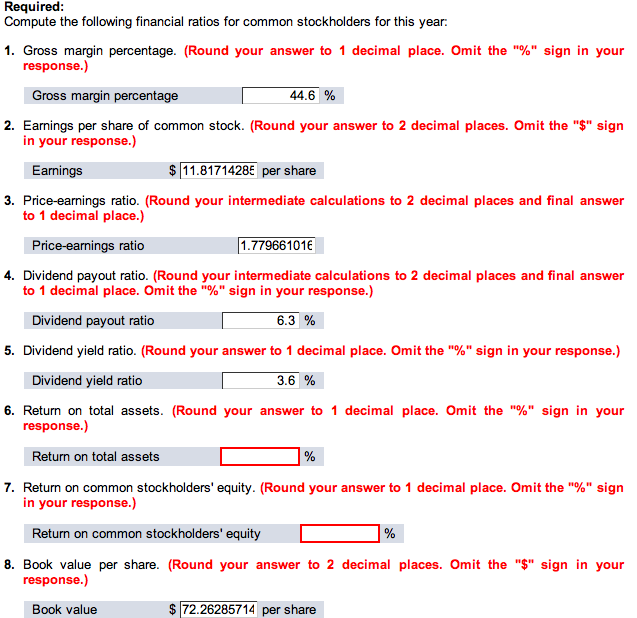

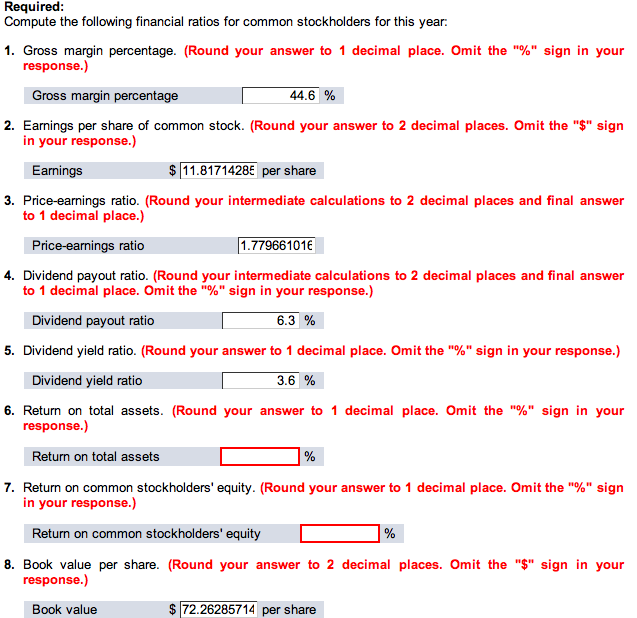

Please answer 6 & 7.

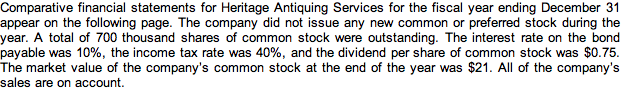

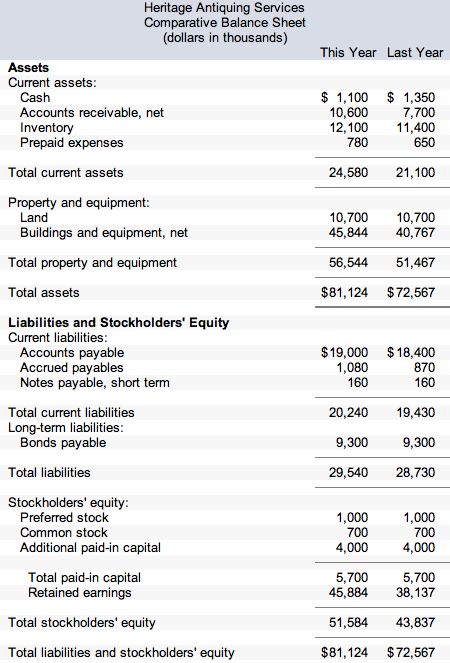

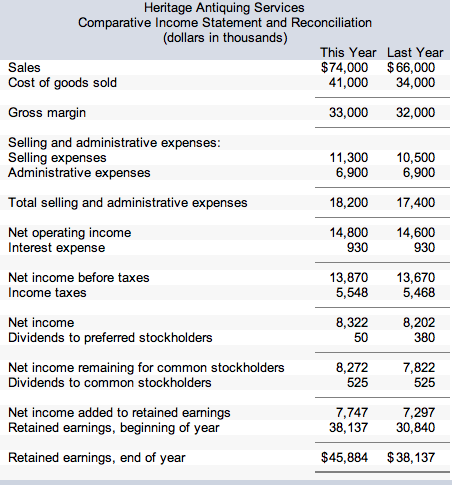

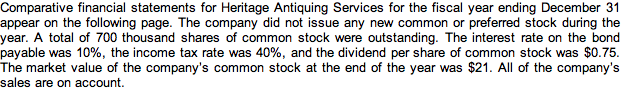

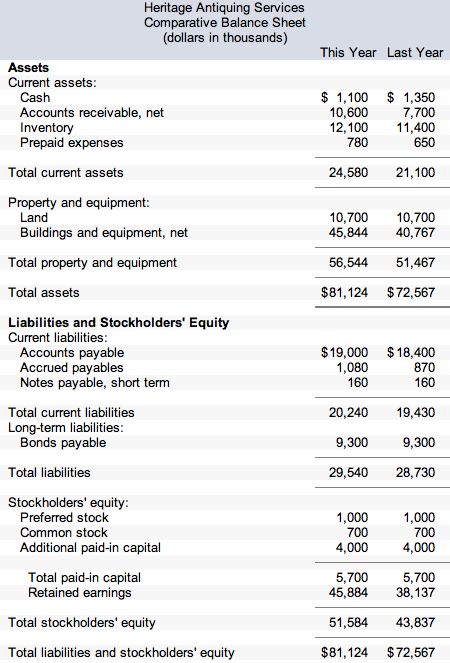

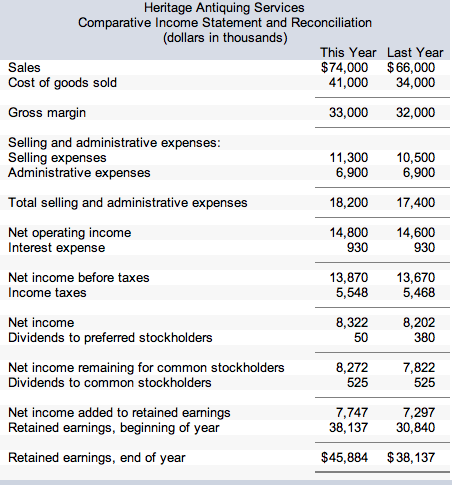

Comparative financial statements for Heritage Antiquing Services for the fiscal year ending December 31 appear on the following page. The company did not issue any new common or preferred stock during the year. A total of 700 thousand shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75. The market value of the company's common stock at the end of the year was $21. All of the company's sales are on account. Required: Compute the following financial ratios for common stockholders for this year. Gross margin percentage. (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Gross margin percentage Earnings per share of common stock. (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Earnings per share Price-eamings ratio. (Round your intermediate calculations to 2 decimal places and final answer to 1 decimal place.) Price-eamings ratio Dividend payout ratio. (Round your intermediate calculations to 2 decimal places and final answer to 1 decimal place. Omit the "%" sign in your response.) Dividend payout ratio Dividend yield ratio. (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Dividend yield ratio Return on total assets. (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Return on total assets Return on common stockholders' equity. (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Return on common stockholders' equity Book value per share. (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Book value per share. Comparative financial statements for Heritage Antiquing Services for the fiscal year ending December 31 appear on the following page. The company did not issue any new common or preferred stock during the year. A total of 700 thousand shares of common stock were outstanding. The interest rate on the bond payable was 10%, the income tax rate was 40%, and the dividend per share of common stock was $0.75. The market value of the company's common stock at the end of the year was $21. All of the company's sales are on account. Required: Compute the following financial ratios for common stockholders for this year. Gross margin percentage. (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Gross margin percentage Earnings per share of common stock. (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Earnings per share Price-eamings ratio. (Round your intermediate calculations to 2 decimal places and final answer to 1 decimal place.) Price-eamings ratio Dividend payout ratio. (Round your intermediate calculations to 2 decimal places and final answer to 1 decimal place. Omit the "%" sign in your response.) Dividend payout ratio Dividend yield ratio. (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Dividend yield ratio Return on total assets. (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Return on total assets Return on common stockholders' equity. (Round your answer to 1 decimal place. Omit the "%" sign in your response.) Return on common stockholders' equity Book value per share. (Round your answer to 2 decimal places. Omit the "$" sign in your response.) Book value per share