please answer 1-5

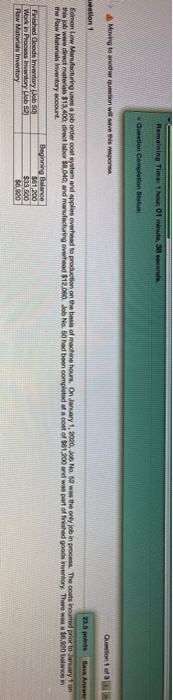

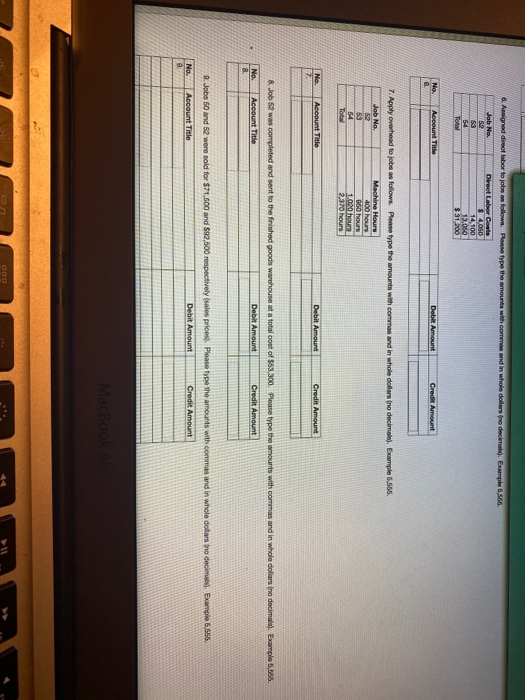

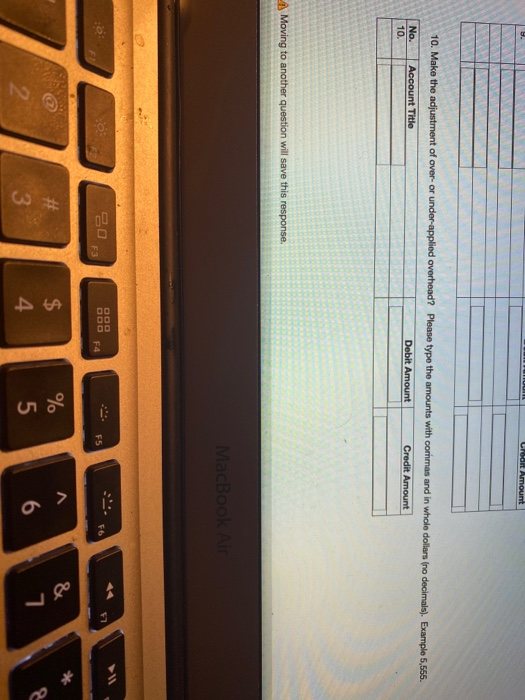

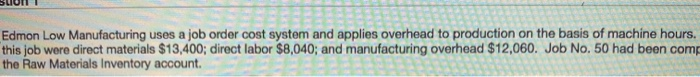

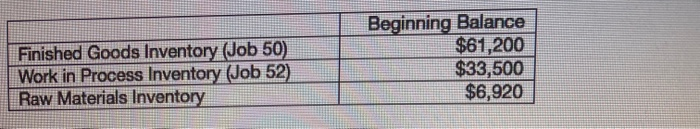

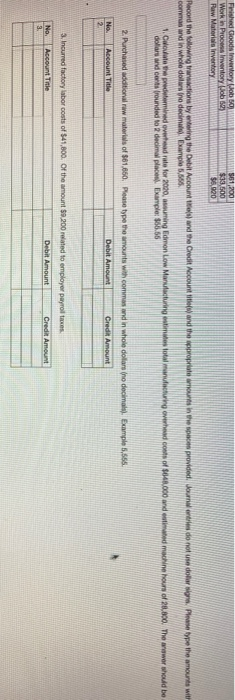

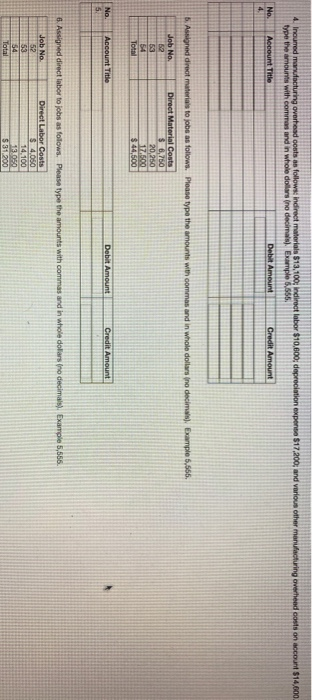

Remaining Timel 1 hou, 01 minute, 30 seconde Question completion Status: Moving to another won will save impone Question of eation 1 235 points fave Anwe Edmon Low Manufacturing utos a job order cost system and applies overhead to production on the basis of machine hours. On January 1, 2000, Job No. 2 was the only job in process. The coas roured prior to January 1 on this job were direct materiale $13,400, direct labor 0,010, and manufacturing overhead $12.060. Job No. 50 had been completed at a cost of $61,200 and was part of the goods invertory There was a $6,900 bin the Raw Material inventory count. Beginning Balance Finished Goods invertoryb 50 $61,200 Work in Process wory Lb 52) $33,500 Raw Materials inventory S6920 & Agned direct labor to jobs as follows. Please type the amount with Come and in whole dollara no decimal). Example 6.856. Jab No. Direct Labor Coats 52 $ 4050 53 14,100 R 13.00 To $31200 und Title No 6. Debit Amount Credit Amount 7. Apply overhead to jobs as follows. Please type the amounts with command in whole dollars no decimals). Example 5,566. Job No. 52 53 54 Machine Hours 400 hours 900 hours 1020 hours 2370 hours To Account Title No 7 Debit Amount Credit Amount 8. Job 52 was completed and sent to the finished goods warehouse at a total cost of $53,300. Please type the amounts with commas and in whole dollars Ino decimals). Example 5,655. No. Account Title Debit Amount Credit Amount 8. 8. Jobs 50 and 52 were sold for $71,500 and $92,500 respectively sales prices. Please type the amounts with commes and in whole dollars (no decimal) Example 5,556 Account Title Debit Amount Credit Amount No. 9 MacBook 44 Credit Amount 10. Make the adjustment of over- or under-applied overhead? Please type the amounts with cornmas and in whole dollars (no decimals). Example 5,556. No. 10. Account Title Debit Amount Credit Amount A Moving to another question will save this response. MacBook AS DOO 20 GOD F4 76 F5 F3 # $ 4 % 5 6 7 2 3 Edmon Low Manufacturing uses a job order cost system and applies overhead to production on the basis of machine hours. this job were direct materials $13,400; direct labor $8,040; and manufacturing overhead $12,060. Job No. 50 had been comp the Raw Materials Inventory account. On January 1, 2020, Job No. 52 was the only job in process. The costs incurred prior to January 1 on pleted at a cost of $61,200 and was part of finished goods inventory. There was a $6,920 balance in Finished Goods Inventory (Job 50) Work in Process Inventory (Job 52) Raw Materials Inventory Beginning Balance $61,200 $33,500 $6,920 Fished Goods twentory wob Work in Process Inventory Raw Materials invertory 551,200 $33,600 $5.920 Record the following tractions by bring the Debit Account and the Credit Acount and the proprio nors in the space provided our do not usedlo Plype the amounts with Comas and in whole dollars no decimal Example 5.855. Completed overtrend rate for 2000, uning men Low Maruti sto ang had come of 48.000 de mine hour of 21.000 The wwer whold be dollars and controunded to decimal place Example: $56.66 2. Purchased additional raw materials of $61.660. Please type the mounts with command in whole dollars no decimal. Example 5,565 No. Account Title Debit Amount Credit Amount 15 3. Incurred factory labor costs of $41,800. Of the amount $9.200 related to employer payroll taxes. Account Title Debit Amount No. 3. Credit Amount 4. Incurred manufacturing overhead costs as follows indirect materials $13,100. Indirect labor $10,600; depreciation exper$17,200, and various other manufacturing owerhead costs on account $14,000 type the amounts with command in whole dollars no decimals). Example 555 Account Title Debit Amount Credit Amount No 4 6. Assigned direct materials to jobs as follows. Please type the amounts with commes and in whole dollars no decima). Example 5,566. Job No. Direct Material Costs 6,750 20,250 54 17.500 Total $ 44,500 No 5. Account Title Debit Amount Credit Amount 6. Assigned direct labor to jobs as follows. Please type the amounts with commas and in whole dolars (no decimals). Example 5,566. Job No 52 53 54 Total Direct Labor Costs $ 4050 14.100 13.050 $ 31.200