Answered step by step

Verified Expert Solution

Question

1 Approved Answer

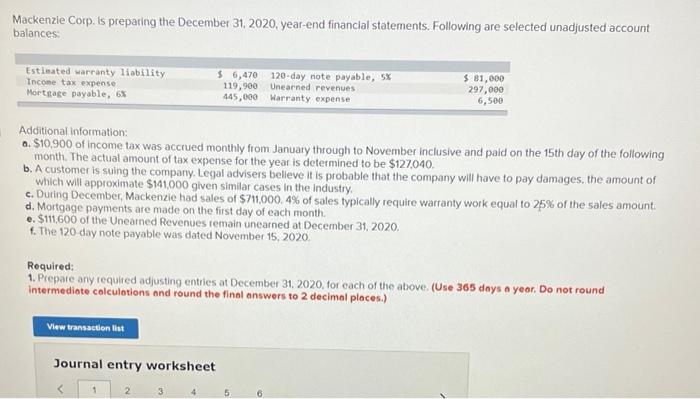

Please answer 8 min left only !! Mackenzie Corp. Is preparing the December 31, 2020, year-end financlal statements. Following are selected unadjusted account balances: Additional

Please answer 8 min left only !!

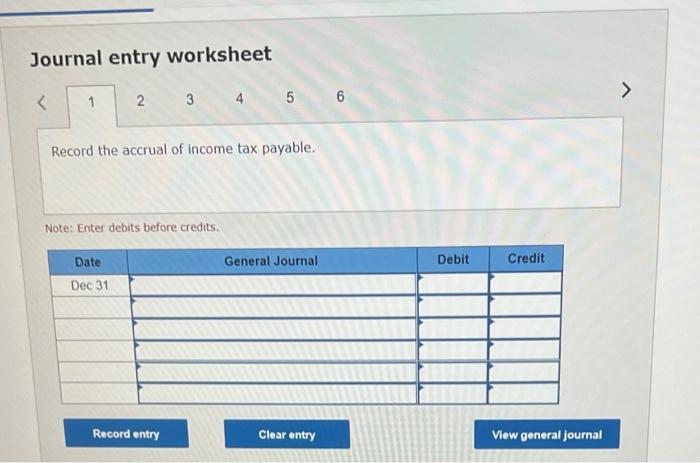

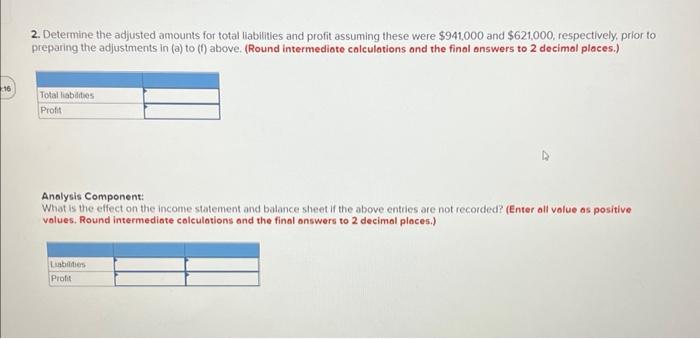

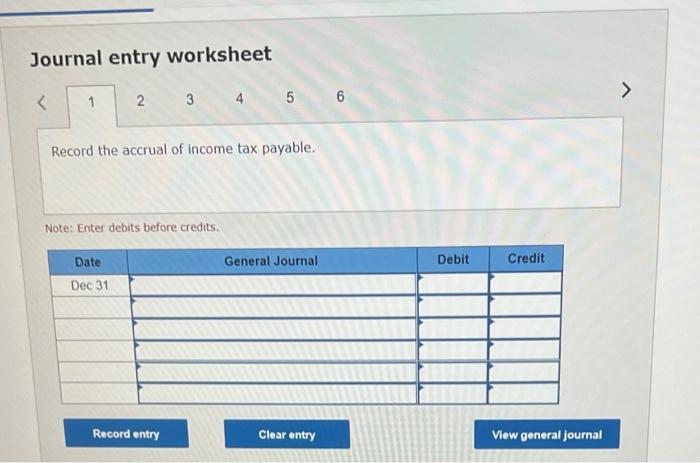

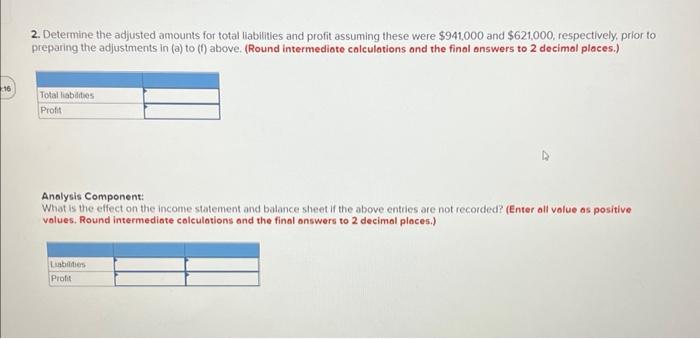

Mackenzie Corp. Is preparing the December 31, 2020, year-end financlal statements. Following are selected unadjusted account balances: Additional information: 0. $10,900 of income tax was accrued monthly from January through to November inclusive and paid on the 15 th day of the following month. The actual amount of tax expense for the year is determined to be $127,040. b. A customer is suing the company. Legal advisers belleve it is probable that the company will have to pay damages, the amount of which will approximate $141,000 given similar cases in the industry. c. Duting December, Mackenzie had sales of $711,000.4% of sales typically require warranty work equal to 25% of the sales amount. d. Mortgage payments are made on the first day of each month. e. $111,600 of the Uneamed Revenues remain unearned at December 31,2020 . f. The 120 day note payable was dated November 15,2020 . Required: 1. Prepare any required adjusting entries at December 31, 2020, for each of the above. (Use 365 days a year. Do not round intermediate calculotions and round the final answers to 2 decimal places.) Journal entry worksheet Journal entry worksheet 2 3 5 Note: Enter debits before credits. 2. Determine the adjusted amounts for total liabilities and profit assuming these were $941,000 and $621,000, respectively, prior to preparing the adjustments in (a) to (f) above. (Round intermediote calculations and the final answers to 2 decimal places.) Anolysis Component: What is the effect on the income statement and balance sheet if the above entries are not recorded? (Enter all volue as positive volues. Round intermediate calculations and the final onswers to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started