Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 8-9, i need it in 1 hour thank youuuu 8. Michael Company leased equipment to Hay Corporation on July 1, 2012 2 points

please answer 8-9, i need it in 1 hour thank youuuu

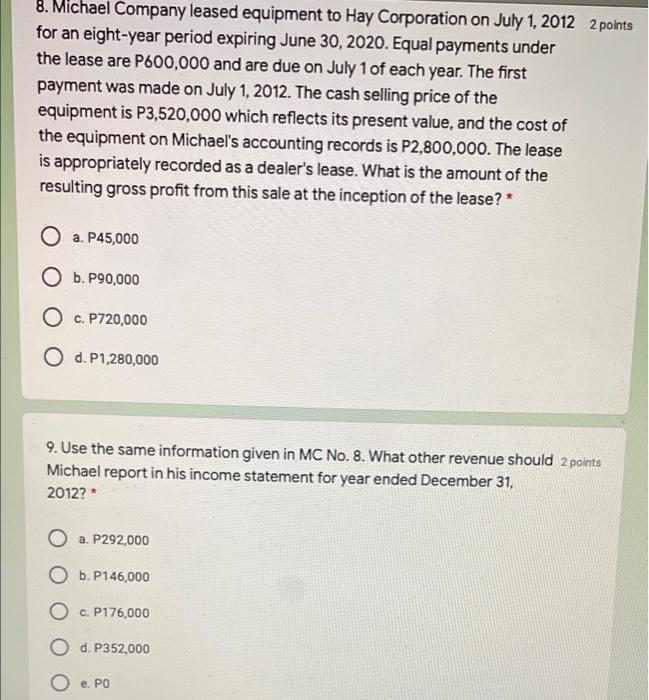

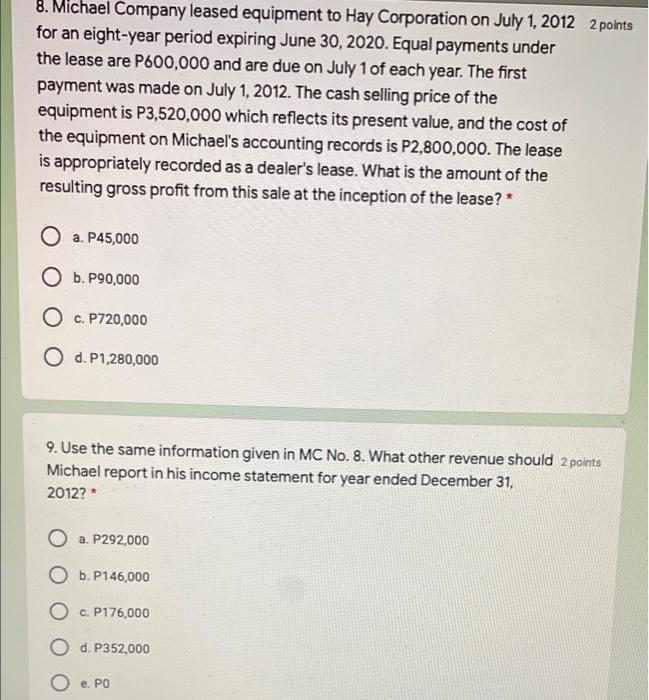

8. Michael Company leased equipment to Hay Corporation on July 1, 2012 2 points for an eight-year period expiring June 30, 2020. Equal payments under the lease are P600,000 and are due on July 1 of each year. The first payment was made on July 1, 2012. The cash selling price of the equipment is P3,520,000 which reflects its present value, and the cost of the equipment on Michael's accounting records is P2,800,000. The lease is appropriately recorded as a dealer's lease. What is the amount of the resulting gross profit from this sale at the inception of the lease?* O a. P45,000 O b. P90,000 O c. P720,000 O d. P1,280,000 9. Use the same information given in MC No. 8. What other revenue should 2 points Michael report in his income statement for year ended December 31, 2012? O a. P292,000 O b. P146,000 O c. P176,000 O d. P352,000 e. Po

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started