Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 9-30 PART IV Reporting Results 9-28. The Hospital for Ending Long-term Problems (HELP) had the following financial events during the year: 1. HELP

please answer 9-30

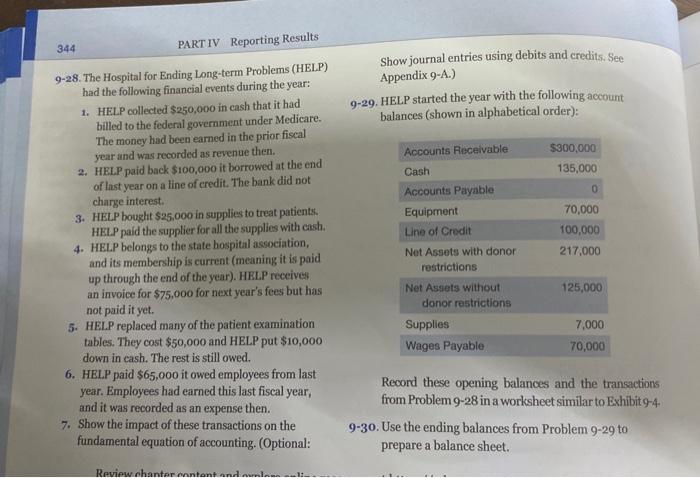

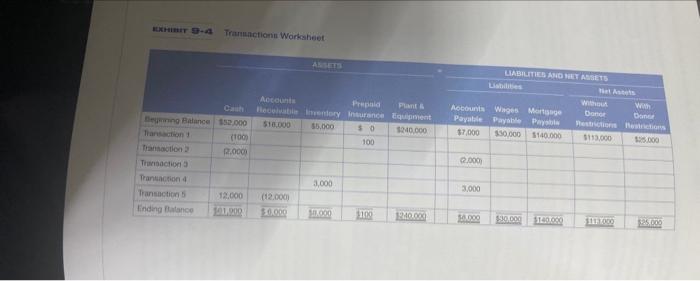

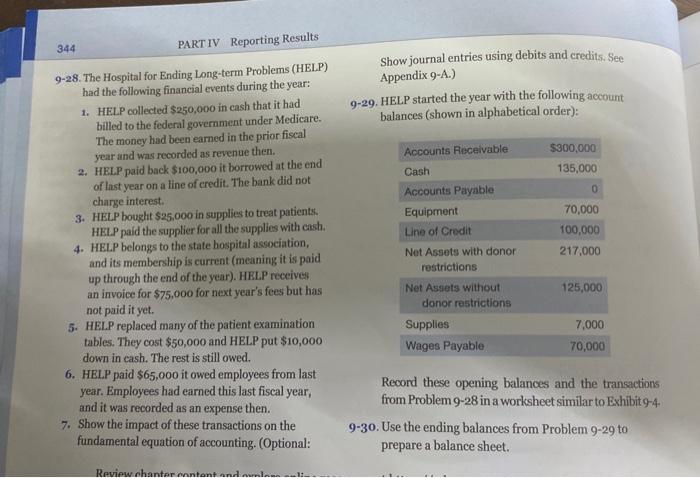

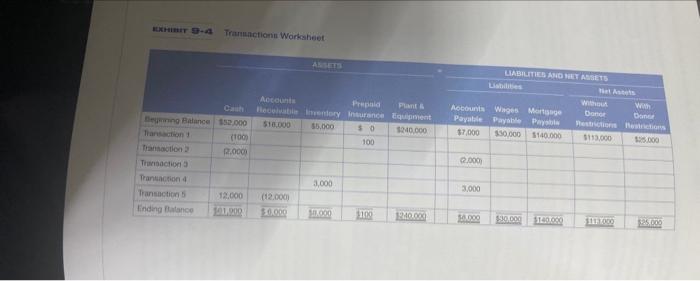

PART IV Reporting Results 9-28. The Hospital for Ending Long-term Problems (HELP) had the following financial events during the year: 1. HELP collected $250,000 in cash that it had billed to the federal government under Medicare. The money had been earned in the prior fiscal year and was recorded as revenue then. 2. HELP paid back $100,000 it borrowed at the end of last year on a line of credit. The bank did not charge interest. 3. HELP bought $25,000 in supplies to treat patients. HELP paid the supplier for all the supplies with cash. 4. HELP belongs to the state hospital association, and its membership is current (meaning it is paid up through the end of the year). HELP receives an invoice for $75,000 for next year's fees but has not paid it yet. 344 5. HELP replaced many of the patient examination tables. They cost $50,000 and HELP put $10,000 down in cash. The rest is still owed. 6. HELP paid $65,000 it owed employees from last year. Employees had earned this last fiscal year, and it was recorded as an expense then. 7. Show the impact of these transactions on the fundamental equation of accounting. (Optional: Review chanter content and ownlao. 12 Show journal entries using debits and credits. See Appendix 9-A.) 9-29. HELP started the year with the following account balances (shown in alphabetical order): Accounts Receivable Cash Accounts Payable Equipment Line of Credit Net Assets with donor restrictions Net Assets without donor restrictions Supplies Wages Payable $300,000 135,000 0 70,000 100,000 217,000 125,000 7,000 70,000 Record these opening balances and the transactions from Problem 9-28 in a worksheet similar to Exhibit 9-4. 9-30. Use the ending balances from Problem 9-29 to prepare a balance sheet. EXHIBIT 9-4 Transactions Worksheet Begining Balance $52,000 Transaction 11 (100) Transaction 2 (2.000) Transaction 3 Transaction 4 Transaction 5 Ending Balance 12,000 101,900 ANSETS Accounts Prepaid Plant & Receivable Inventory Insurance Equipment $18.000 $5,000 $240,000 $0 100 (12.000) 1.0.000 3,000 10.000 $100 12:40.000 (2.000) Accounts Wages Mortgage Payable Payable Paysbla $7,000 $30,000 $140.000 3.000 LIABILITIES AND NET ASSETS $5,000 Lisbilities $30,000 Without With Donor Doner Restrictions Restrictions $113,000 $25.000 $1133.000 $25,000 PART IV Reporting Results 9-28. The Hospital for Ending Long-term Problems (HELP) had the following financial events during the year: 1. HELP collected $250,000 in cash that it had billed to the federal government under Medicare. The money had been earned in the prior fiscal year and was recorded as revenue then. 2. HELP paid back $100,000 it borrowed at the end of last year on a line of credit. The bank did not charge interest. 3. HELP bought $25,000 in supplies to treat patients. HELP paid the supplier for all the supplies with cash. 4. HELP belongs to the state hospital association, and its membership is current (meaning it is paid up through the end of the year). HELP receives an invoice for $75,000 for next year's fees but has not paid it yet. 344 5. HELP replaced many of the patient examination tables. They cost $50,000 and HELP put $10,000 down in cash. The rest is still owed. 6. HELP paid $65,000 it owed employees from last year. Employees had earned this last fiscal year, and it was recorded as an expense then. 7. Show the impact of these transactions on the fundamental equation of accounting. (Optional: Review chanter content and ownlao. 12 Show journal entries using debits and credits. See Appendix 9-A.) 9-29. HELP started the year with the following account balances (shown in alphabetical order): Accounts Receivable Cash Accounts Payable Equipment Line of Credit Net Assets with donor restrictions Net Assets without donor restrictions Supplies Wages Payable $300,000 135,000 0 70,000 100,000 217,000 125,000 7,000 70,000 Record these opening balances and the transactions from Problem 9-28 in a worksheet similar to Exhibit 9-4. 9-30. Use the ending balances from Problem 9-29 to prepare a balance sheet. EXHIBIT 9-4 Transactions Worksheet Begining Balance $52,000 Transaction 11 (100) Transaction 2 (2.000) Transaction 3 Transaction 4 Transaction 5 Ending Balance 12,000 101,900 ANSETS Accounts Prepaid Plant & Receivable Inventory Insurance Equipment $18.000 $5,000 $240,000 $0 100 (12.000) 1.0.000 3,000 10.000 $100 12:40.000 (2.000) Accounts Wages Mortgage Payable Payable Paysbla $7,000 $30,000 $140.000 3.000 LIABILITIES AND NET ASSETS $5,000 Lisbilities $30,000 Without With Donor Doner Restrictions Restrictions $113,000 $25.000 $1133.000 $25,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started