Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER A AND B. *STUCK AFTER MULTIPLE ATTEMPTS* On August 20, Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs.

PLEASE ANSWER A AND B. *STUCK AFTER MULTIPLE ATTEMPTS*

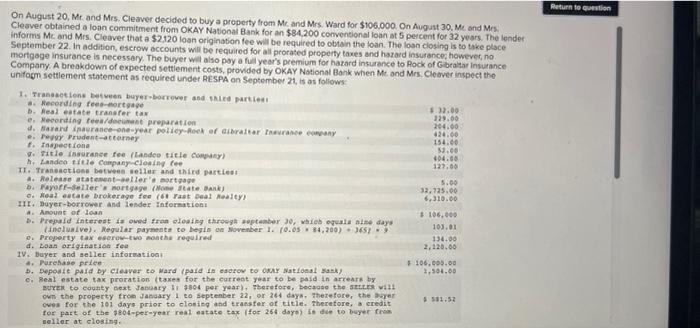

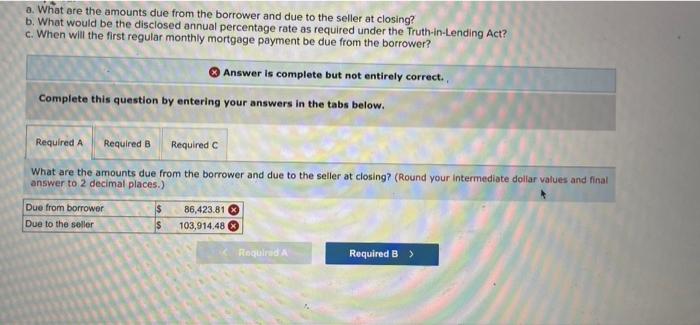

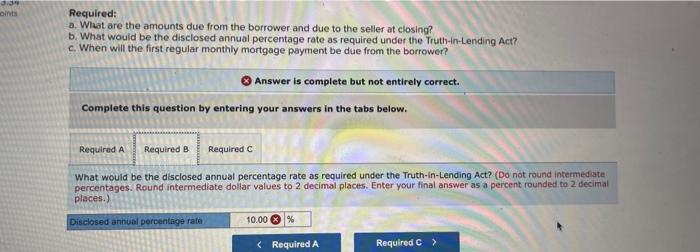

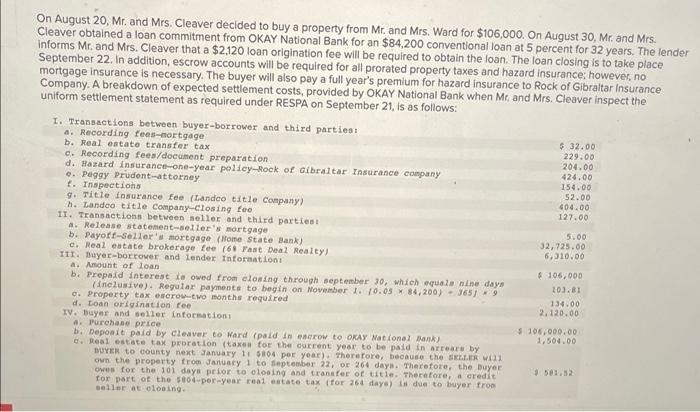

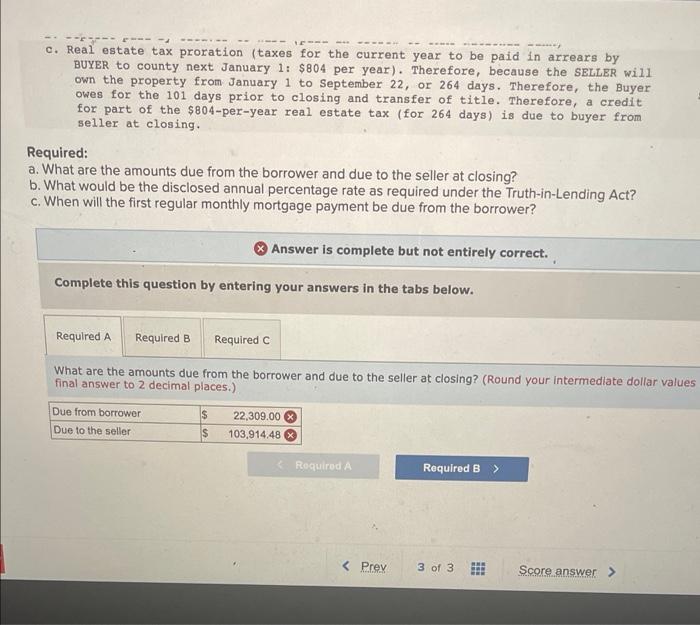

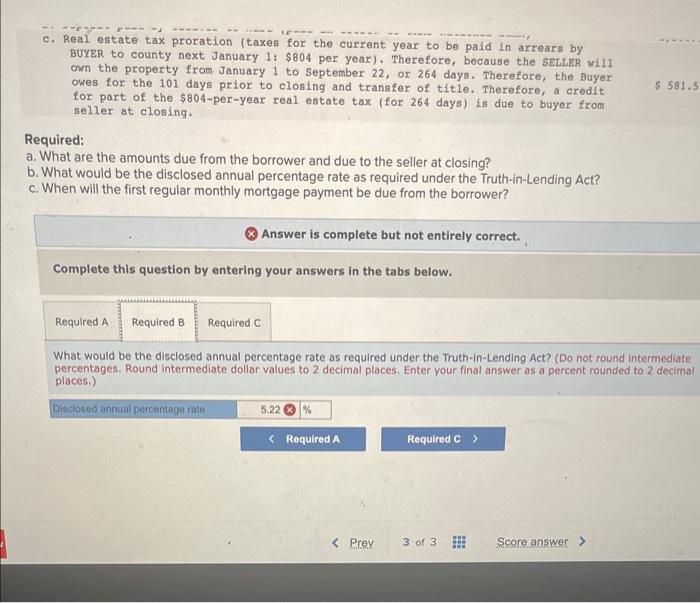

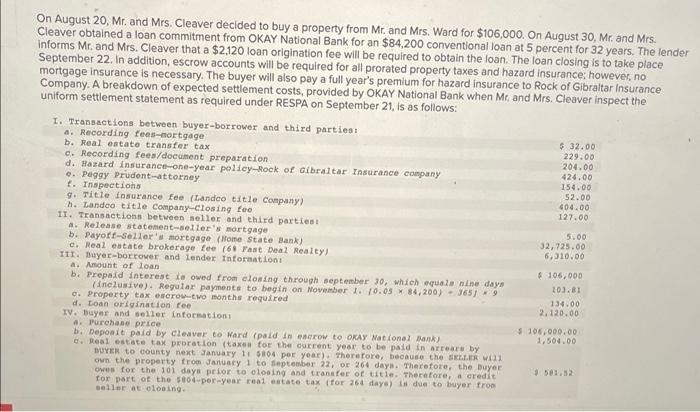

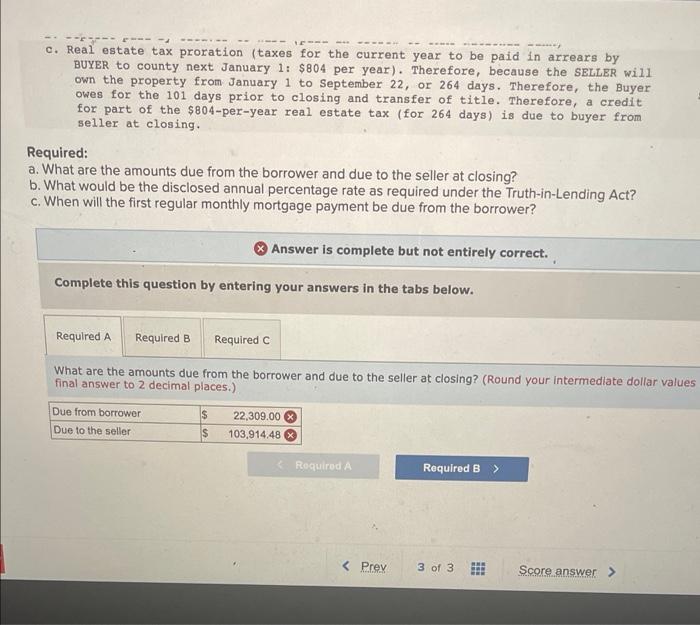

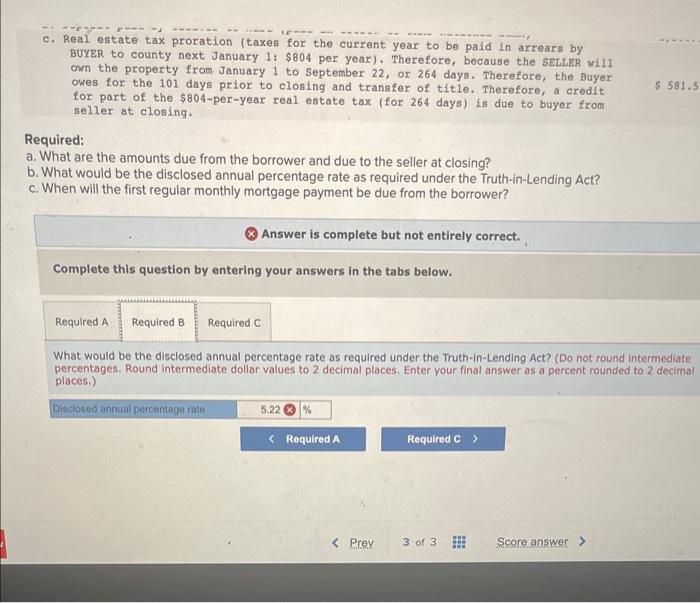

On August 20, Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs. Ward for $106000. On Augaut 30, Me and Mral Cleaver obtained a foan commitment from OKAY National Bank for an $84.200 comventional foan at 5 percent for 32 years. The lendee informs Me. and Mrs. Cleaver that a 32.120 loan origination fee will be required to otstan the toan. The loan elosing is to take place September 22. In addition, escrow bccounts will be required for all prorased preperfy taxes and harard insurances however, ho mortgage insurance is necescary. The biyer wal also poy a fullyear's premium for harard insurance to Rock of Gaca4ar insurance Company. A breakdown of expected settlement costs, provided by OKAY National Bank when M. and Mrs. Cleaver inspect the unifosm settlement wtatement as required under RESPA on September 21, is as foliows? a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? Q Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What are the amounts due from the borrower and due to the seller at closing? (Round your intermediate doliar values and final answer to 2 decimal places.) Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? (3) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? (Do not round intermed ate percentages. Round intermediate dollar values to 2 decimal places. Enter your final answer as a percent rounded to 2 decimal On August 20, Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs. Ward for $106,000. On August 30 , Mr. and Mrs. Cleaver obtained a loan commitment from OKAY National Bank for an $84,200 conventional loan at 5 percent for 32 years. The lender informs Mr. and Mrs. Cleaver that a $2,120 loan origination fee will be required to obtain the loan. The loan closing is to take place September 22. In addition, escrow accounts will be required for all prorated property taxes and hazard insurance; however, no mortgage insurance is necessary. The buyer will also pay a full year's premium for hazard insurance to Rock of Gibraltar Insurance Company. A breakdown of expected settlement costs, provided by OKAY National Bank when Mr, and Mrs. Cleaver inspect the uniform settlement statement as required under RESPA on September 21 , Is as follows: c. Real estate tax proration (taxes for the current year to be paid in arrears by BUYER to county next January 1: \$804 per year). Therefore, because the SELLBR will own the property from January 1 to September 22, or 264 days. Therefore, the Buyer owes for the 101 days prior to closing and transfer of title. Therefore, a credit for part of the $804-per-year real estate tax (for 264 days) is due to buyer from seller at closing. Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What are the amounts due from the borrower and due to the seller at closing? (Round your intermediate dollar values final answer to 2 decimal places.) c. Real estate tax proration (taxes for the current year to be paid in arrears by BUYER to county next January 1: \$804 per year). Therefore, because the SELLER will own the property from January 1 to September 22, or 264 days. Therefore, the Buyer owes for the 101 days prior to closing and transfer of title. Therefore, a credit: for part of the $804-per-year real estate tax (for 264 days) is due to buyer from seller at closing. Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? () Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? (Do not round intermediate percentages. Round intermediate dollar values to 2 decimal places. Enter your final answer as a percent rounded to 2 decima places.) On August 20, Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs. Ward for $106000. On Augaut 30, Me and Mral Cleaver obtained a foan commitment from OKAY National Bank for an $84.200 comventional foan at 5 percent for 32 years. The lendee informs Me. and Mrs. Cleaver that a 32.120 loan origination fee will be required to otstan the toan. The loan elosing is to take place September 22. In addition, escrow bccounts will be required for all prorased preperfy taxes and harard insurances however, ho mortgage insurance is necescary. The biyer wal also poy a fullyear's premium for harard insurance to Rock of Gaca4ar insurance Company. A breakdown of expected settlement costs, provided by OKAY National Bank when M. and Mrs. Cleaver inspect the unifosm settlement wtatement as required under RESPA on September 21, is as foliows? a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? Q Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What are the amounts due from the borrower and due to the seller at closing? (Round your intermediate doliar values and final answer to 2 decimal places.) Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? (3) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? (Do not round intermed ate percentages. Round intermediate dollar values to 2 decimal places. Enter your final answer as a percent rounded to 2 decimal On August 20, Mr. and Mrs. Cleaver decided to buy a property from Mr. and Mrs. Ward for $106,000. On August 30 , Mr. and Mrs. Cleaver obtained a loan commitment from OKAY National Bank for an $84,200 conventional loan at 5 percent for 32 years. The lender informs Mr. and Mrs. Cleaver that a $2,120 loan origination fee will be required to obtain the loan. The loan closing is to take place September 22. In addition, escrow accounts will be required for all prorated property taxes and hazard insurance; however, no mortgage insurance is necessary. The buyer will also pay a full year's premium for hazard insurance to Rock of Gibraltar Insurance Company. A breakdown of expected settlement costs, provided by OKAY National Bank when Mr, and Mrs. Cleaver inspect the uniform settlement statement as required under RESPA on September 21 , Is as follows: c. Real estate tax proration (taxes for the current year to be paid in arrears by BUYER to county next January 1: \$804 per year). Therefore, because the SELLBR will own the property from January 1 to September 22, or 264 days. Therefore, the Buyer owes for the 101 days prior to closing and transfer of title. Therefore, a credit for part of the $804-per-year real estate tax (for 264 days) is due to buyer from seller at closing. Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? X Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What are the amounts due from the borrower and due to the seller at closing? (Round your intermediate dollar values final answer to 2 decimal places.) c. Real estate tax proration (taxes for the current year to be paid in arrears by BUYER to county next January 1: \$804 per year). Therefore, because the SELLER will own the property from January 1 to September 22, or 264 days. Therefore, the Buyer owes for the 101 days prior to closing and transfer of title. Therefore, a credit: for part of the $804-per-year real estate tax (for 264 days) is due to buyer from seller at closing. Required: a. What are the amounts due from the borrower and due to the seller at closing? b. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? c. When will the first regular monthly mortgage payment be due from the borrower? () Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What would be the disclosed annual percentage rate as required under the Truth-in-Lending Act? (Do not round intermediate percentages. Round intermediate dollar values to 2 decimal places. Enter your final answer as a percent rounded to 2 decima places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started