Answered step by step

Verified Expert Solution

Question

1 Approved Answer

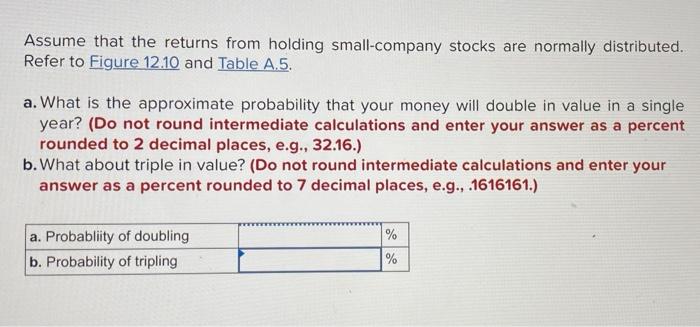

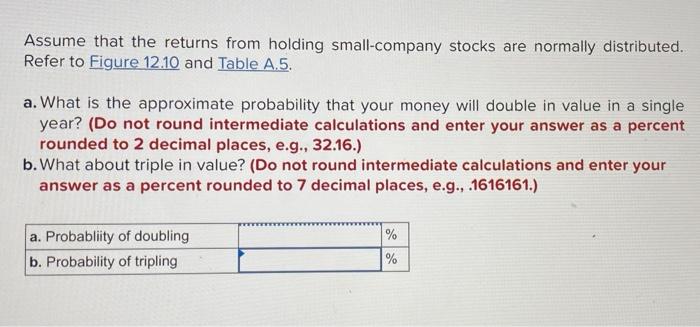

Please answer a and b using the given information. Thank you! Assume that the returns from holding small-company stocks are normally distributed. Refer to Figure

Please answer a and b using the given information. Thank you!

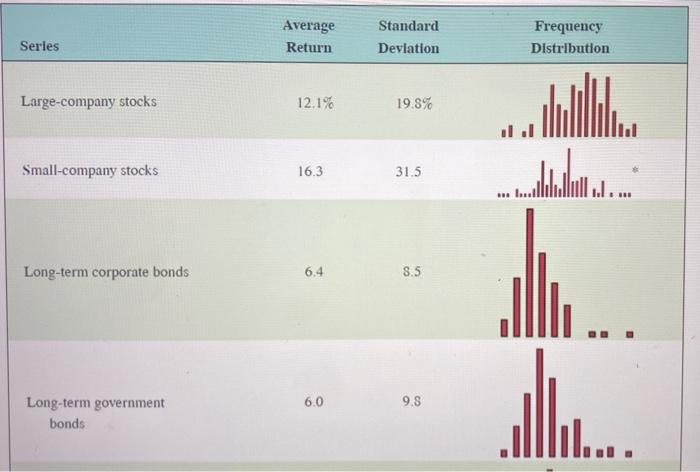

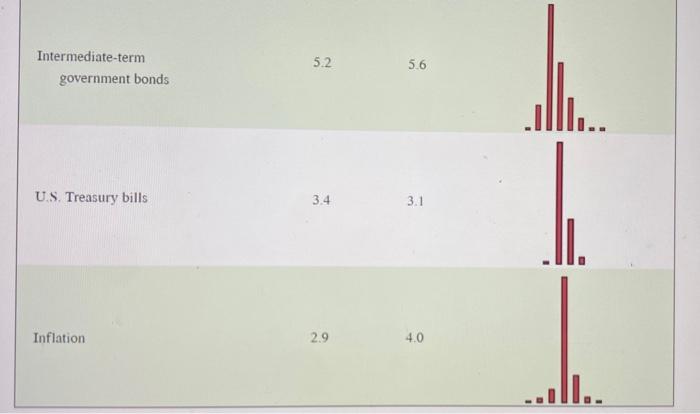

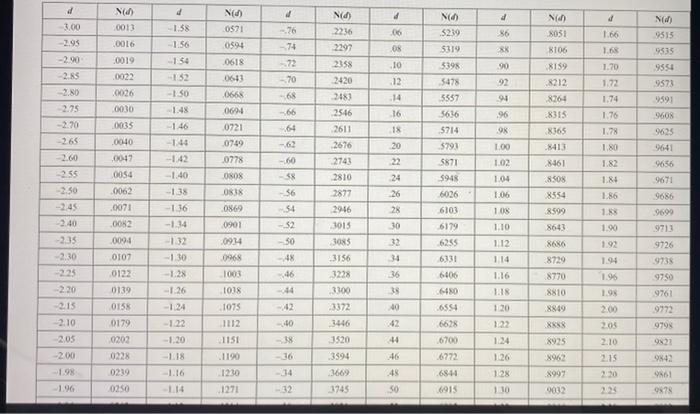

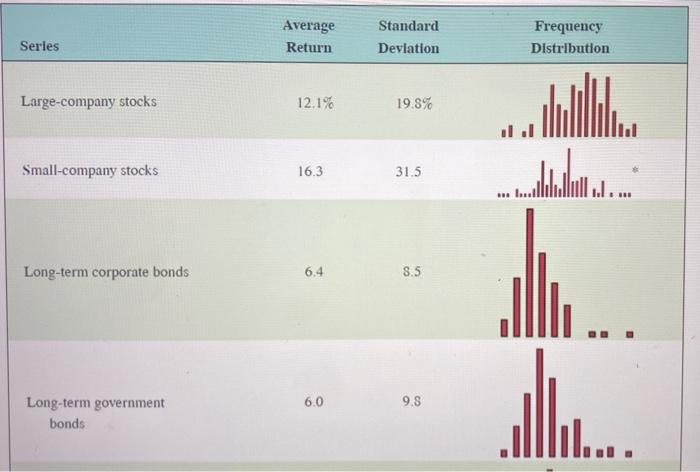

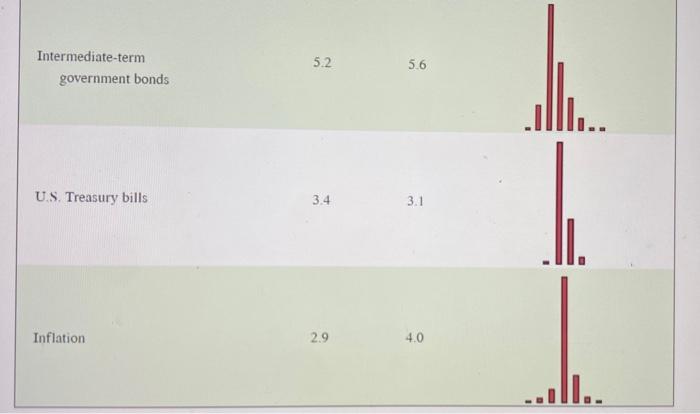

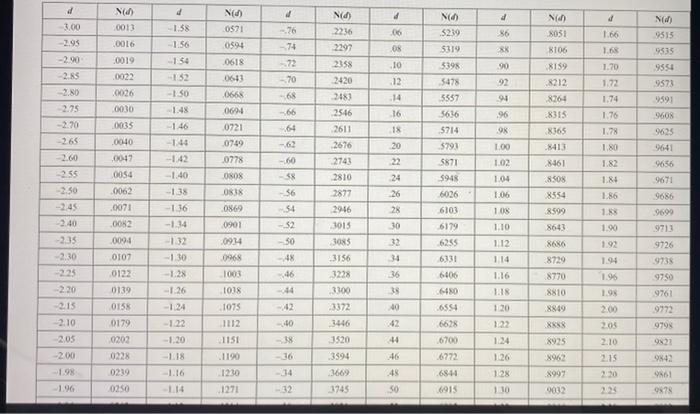

Assume that the returns from holding small-company stocks are normally distributed. Refer to Figure 12.10 and Table A.5. a. What is the approximate probability that your money will double in value in a single year? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) b. What about triple in value? (Do not round intermediate calculations and enter your answer as a percent rounded to 7 decimal places, e.g., .1616161.) a. Probabliity of doubling b. Probability of tripling % % Series Large-company stocks Small-company stocks Long-term corporate bonds Long-term government bonds Average Return 12.1% 16.3 6.4 6.0 Standard Deviation 19.8% 31.5 8.5 9.8 *** Frequency Distribution LLL 188 III.... Intermediate-term government bonds U.S. Treasury bills. Inflation 5.2 3.4 2.9 5.6 3.1 4.0 JJ... d -3.00 -2.95 -2.90 -2.85 -2.75 -2.70 -2.65 -2.60 -2.55 -2.50 -2.45 -2.40 -2.35 -2.30 -2.25 -2.20 -2.15 -2.10 -2.05 -2.00 -1.98 -1.96 N(d) 20013 0016 0019 0022 0026 0030 0035 .0040 0047 0054 0062 .0071 0082 0094 0107 0122 0139 0158 0179 0202 0228 0239 0250 d -1.58 -1.56 -1.54 -1.52 -1.50 -1.48 -1.46 -1.44 -1.42 -1.40 -1.38 -1.36 -1.34 -1.32 -1.30 -1.28 -1.26 -1.24 -1.20 -1.18 -1.16 -1.14 N() 0571 0594 0618 0643 0668 0694 0721 0749 0778 0808 0838 0869 0901 0934 0968 1003 1038 1075 1112 1151 1190 1230 1271 d -.76 -74 -72 -70 -68 -66 64 -62 -60 -58 -56 -54 -52 -50 -48 46 -44 -42 -40 -38 -36 -34 -32 N(d) 2236 2297 2358 2420 2483 2546 2611 2676 2743 2810 2877 2946 3015 3085 3156 3228 3300 3372 3520 3594 3669 3745 4 06 .08 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 M N(4) 5239 5319 5398 5478 5557 5636 5714 5793 5871 5948 6026 6103 6179 6255 6406 6554 6628 6700 6772 .6844 6915 d 86 88 90 92 94 96 98 1.00 1.02 1.04 1.06 1.08 1.10 1.12 1.14 1.16 1.18 120 1:22 1.24 1.26 1:28 1:30 N(d) 8051 8106 8159 8212 8264 .8315 8365 8413 8461 8508 8554) 8599 8643 8686 8729 8770 8810 8849 8888 8925 8962 8997 9032 d 1.66 1.68 1.70 1.72 1.74 1.76 1.78 1.80 1.82 1.84 1.86 1.90 1.92 1.94 1.96 1.98 2.00 2.05 2.10 2.15 2:20 2.25 Pew N(d) 9515 9535 9554 9573 9591 9608 9625 9641 9671 9686 9699 9713 9726 9738 97.50 9761 9772 9798 9821 9842 9861 9878

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started