Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer a, b, and c 10. This excerpt, which discusses dual currency bonds, is taken from the International Capital Market, published in 1989 by

Please answer a, b, and c

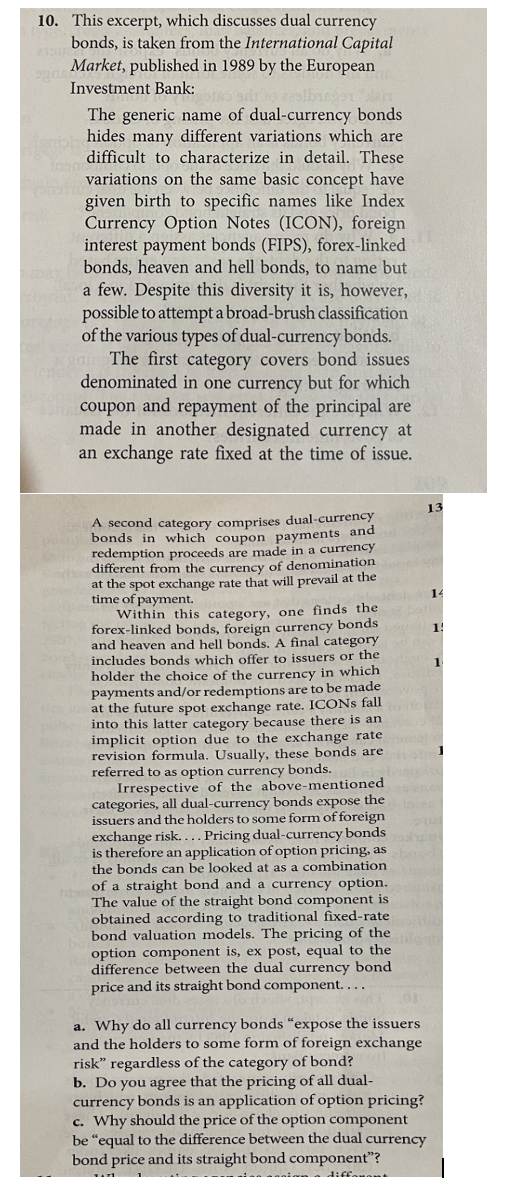

10. This excerpt, which discusses dual currency bonds, is taken from the International Capital Market, published in 1989 by the European Investment Bank: The generic name of dual-currency bonds hides many different variations which are difficult to characterize in detail. These variations on the same basic concept have given birth to specific names like Index Currency Option Notes (ICON), foreign interest payment bonds (FIPS), forex-linked bonds, heaven and hell bonds, to name but a few. Despite this diversity it is, however, possible to attempt a broad-brush classification of the various types of dual-currency bonds. The first category covers bond issues denominated in one currency but for which coupon and repayment of the principal are made in another designated currency at an exchange rate fixed at the time of issue. 13 14 1! 1 in A second category comprises dual-currency bonds in which coupon payments and redemption proceeds are made in a currency different from the currency of denomination at the spot exchange rate that will prevail at the time of payment. Within this category, one finds the forex-linked bonds, foreign currency bonds and heaven and hell bonds. A final category 1 includes bonds which offer to issuers or the holder the choice of the which of the currency payments and/or redemptions are to be made at the future spot exchange rate. ICONs fall into this latter category because there is an implicit option due to the exchange rate revision formula. Usually, these bonds are rred to as option currency bonds. all dual -currency bonds the issuers and the holders to some form of foreign exchange risk. ... .... Pricing dual-currency bonds is therefore an application of option pricing, as the bonds can be looked at as a combination of a straight bond and a currency option. The value of the straight bond component is obtained according to traditional fixed-rate bond valuation models. The pricing of the option component is, ex post, equal to the difference between the dual currency bond price and its straight bond component.... referred categon pective of the above-mentioned expose a. Why do all currency bonds "expose the issuers and the holders to some form of foreign exchange risk" regardless of the category of bond? b. Do you agree that the pricing of all dual- currency bonds is an application of option pricing? c. Why should the price of the option component be "equal to the difference between the dual currency bond price and its straight bond component"? ----...aniadauStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started