Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer a question 3,5 and 6 Evergreen Company was formed in 2013 as a company specialized in producing baby skin-care products. Their dermatologist-developed skin-care

please answer a question 3,5 and 6

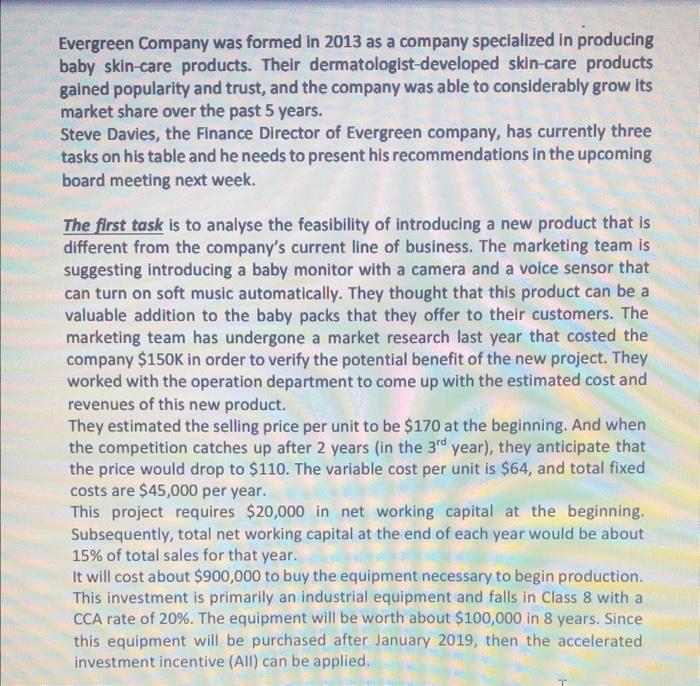

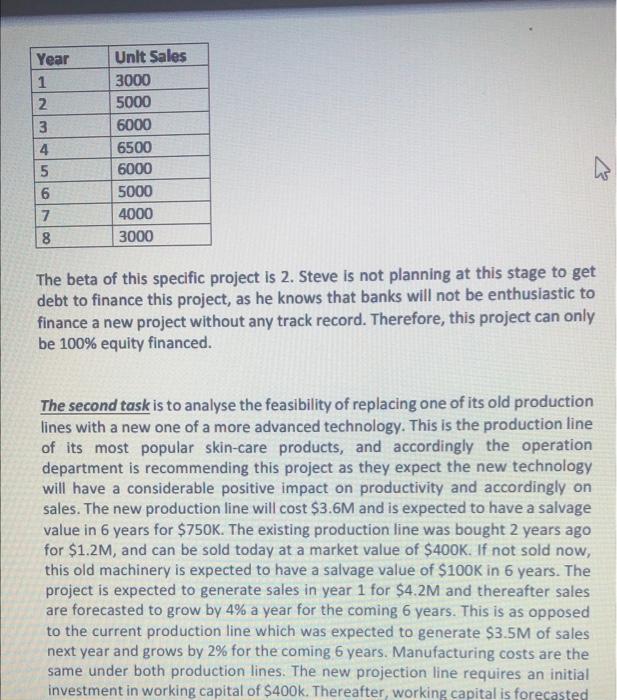

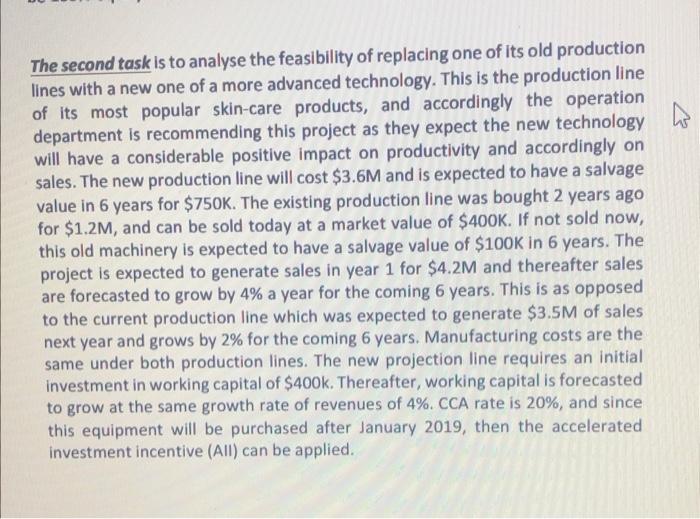

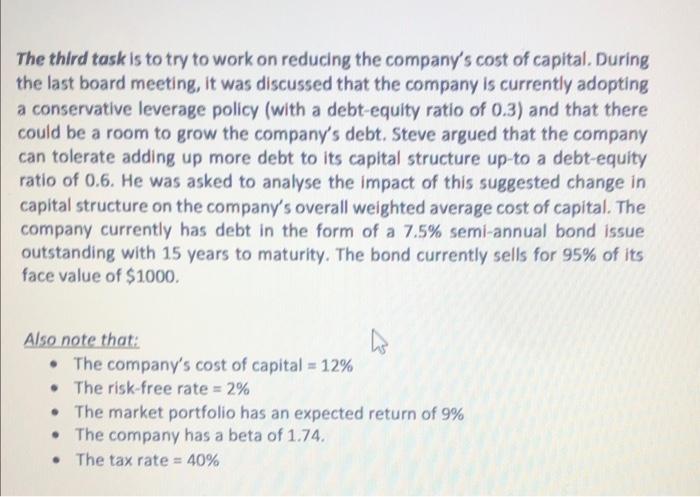

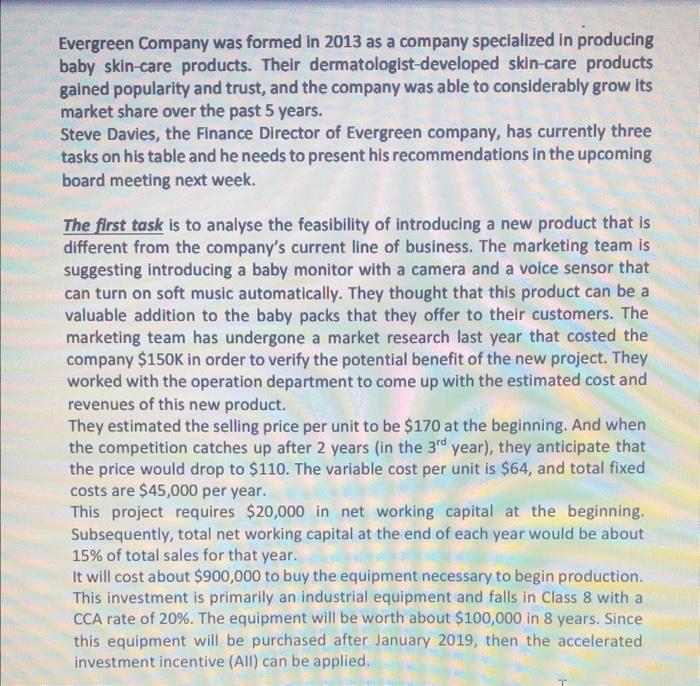

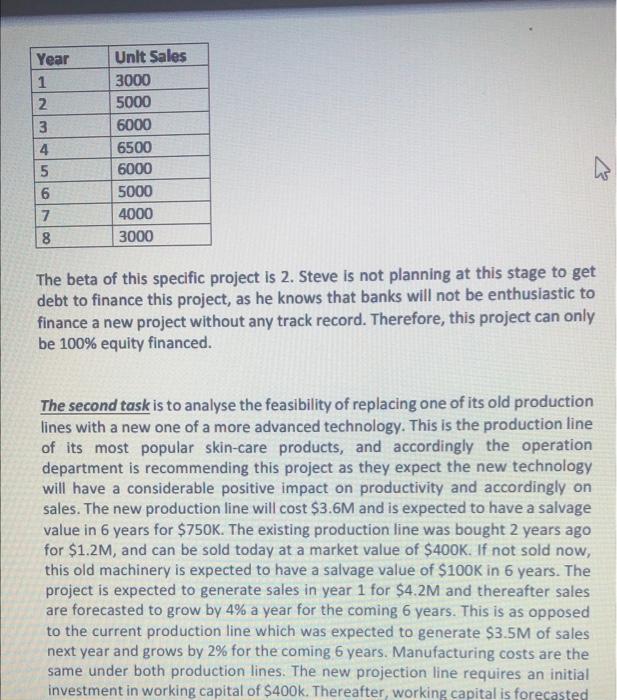

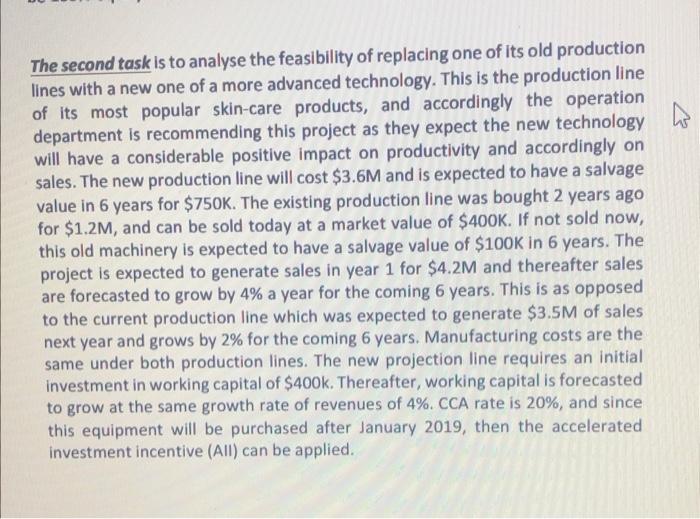

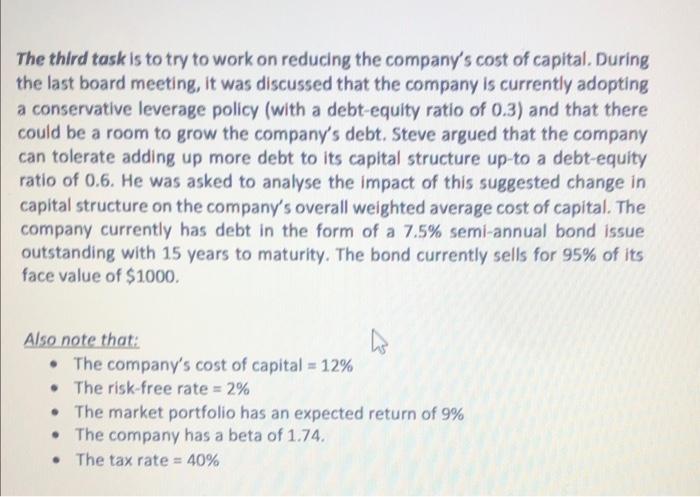

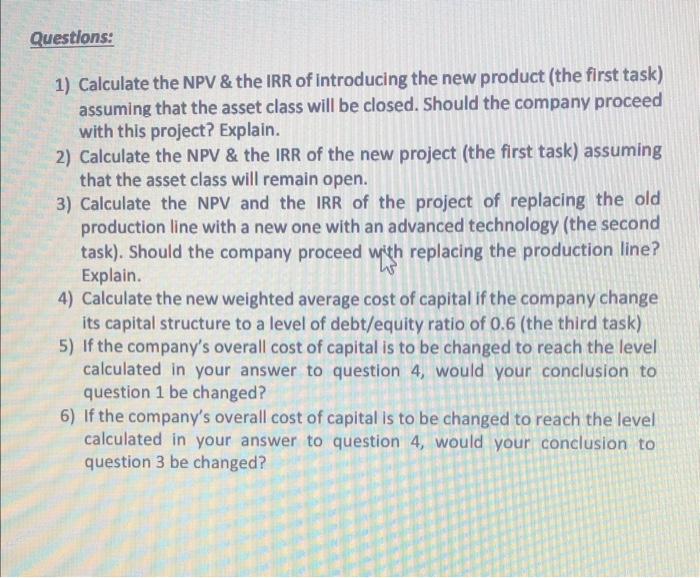

Evergreen Company was formed in 2013 as a company specialized in producing baby skin-care products. Their dermatologist-developed skin-care products gained popularity and trust, and the company was able to considerably grow Its market share over the past 5 years. Steve Davies, the Finance Director of Evergreen company, has currently three tasks on his table and he needs to present his recommendations in the upcoming board meeting next week. The first task is to analyse the feasibility of introducing a new product that is different from the company's current line of business. The marketing team is suggesting introducing a baby monitor with a camera and a voice sensor that can turn on soft music automatically. They thought that this product can be a valuable addition to the baby packs that they offer to their customers. The marketing team has undergone a market research last year that costed the company $150K in order to verify the potential benefit of the new project. They worked with the operation department to come up with the estimated cost and revenues of this new product. They estimated the selling price per unit to be $170 at the beginning. And when the competition catches up after 2 years (in the 3rd year), they anticipate that the price would drop to $110. The variable cost per unit is $64, and total fixed costs are $45,000 per year. This project requires $20,000 in net working capital at the beginning. Subsequently, total net working capital at the end of each year would be about 15% of total sales for that year. It will cost about $900,000 to buy the equipment necessary to begin production. This investment is primarily an industrial equipment and falls in Class 8 with a CCA rate of 20%. The equipment will be worth about $100,000 in 8 years. Since this equipment will be purchased after January 2019, then the accelerated investment incentive (All) can be applied. Year 1 2 3 4 5 6 7 8 Unit Sales 3000 5000 6000 6500 6000 5000 4000 3000 LA 8 The beta of this specific project is 2. Steve is not planning at this stage to get debt to finance this project, as he knows that banks will not be enthusiastic to finance a new project without any track record. Therefore, this project can only be 100% equity financed. The second task is to analyse the feasibility of replacing one of its old production lines with a new one of a more advanced technology. This is the production line of its most popular skin-care products, and accordingly the operation department is recommending this project as they expect the new technology will have a considerable positive impact on productivity and accordingly on sales. The new production line will cost $3.6M and is expected to have a salvage value in 6 years for $750K. The existing production line was bought 2 years ago for $1.2M, and can be sold today at a market value of $400K. If not sold now, this old machinery is expected to have a salvage value of $100K in 6 years. The project is expected to generate sales in year 1 for $4.2M and thereafter sales are forecasted to grow by 4% a year for the coming 6 years. This is as opposed to the current production line which was expected to generate $3.5M of sales next year and grows by 2% for the coming 6 years. Manufacturing costs are the same under both production lines. The new projection line requires an initial investment in working capital of $400k. Thereafter working capital is forecasted The second task is to analyse the feasibility of replacing one of its old production lines with a new one of a more advanced technology. This is the production line of its most popular skin-care products, and accordingly the operation department is recommending this project as they expect the new technology will have a considerable positive impact on productivity and accordingly on sales. The new production line will cost $3.6M and is expected to have a salvage value in 6 years for $750K. The existing production line was bought 2 years ago for $1.2M, and can be sold today at a market value of $400K. If not sold now, this old machinery is expected to have a salvage value of $100K in 6 years. The project is expected to generate sales in year 1 for $4.2M and thereafter sales are forecasted to grow by 4% a year for the coming 6 years. This is as opposed to the current production line which was expected to generate $3.5M of sales next year and grows by 2% for the coming 6 years. Manufacturing costs are the same under both production lines. The new projection line requires an initial investment in working capital of $400k. Thereafter, working capital is forecasted to grow at the same growth rate of revenues of 4%. CCA rate is 20%, and since this equipment will be purchased after January 2019, then the accelerated investment incentive (All) can be applied. The third task is to try to work on reducing the company's cost of capital. During the last board meeting, it was discussed that the company is currently adopting a conservative leverage policy (with a debt equity ratio of 0.3) and that there could be a room to grow the company's debt. Steve argued that the company can tolerate adding up more debt to its capital structure up-to a debt-equity ratio of 0.6. He was asked to analyse the impact of this suggested change in capital structure on the company's overall weighted average cost of capital. The company currently has debt in the form of a 7.5% semi-annual bond issue outstanding with 15 years to maturity. The bond currently sells for 95% of its face value of $1000, Also note that: The company's cost of capital = 12% The risk-free rate = 2% The market portfolio has an expected return of 9% The company has a beta of 1.74. The tax rate = 40% Questions: 1) Calculate the NPV & the IRR of Introducing the new product (the first task) assuming that the asset class will be closed. Should the company proceed with this project? Explain. 2) Calculate the NPV & the IRR of the new project (the first task) assuming that the asset class will remain open. 3) Calculate the NPV and the IRR of the project of replacing the old production line with a new one with an advanced technology (the second task). Should the company proceed with replacing the production line? Explain. 4) Calculate the new weighted average cost of capital if the company change its capital structure to a level of debt/equity ratio of 0.6 (the third task) 5) If the company's overall cost of capital is to be changed to reach the level calculated in your answer to question 4, would your conclusion to question 1 be changed? 6) If the company's overall cost of capital is to be changed to reach the level calculated in your answer to question 4, would your conclusion to question 3 be changed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started