PLEASE ANSWER A-E!!!

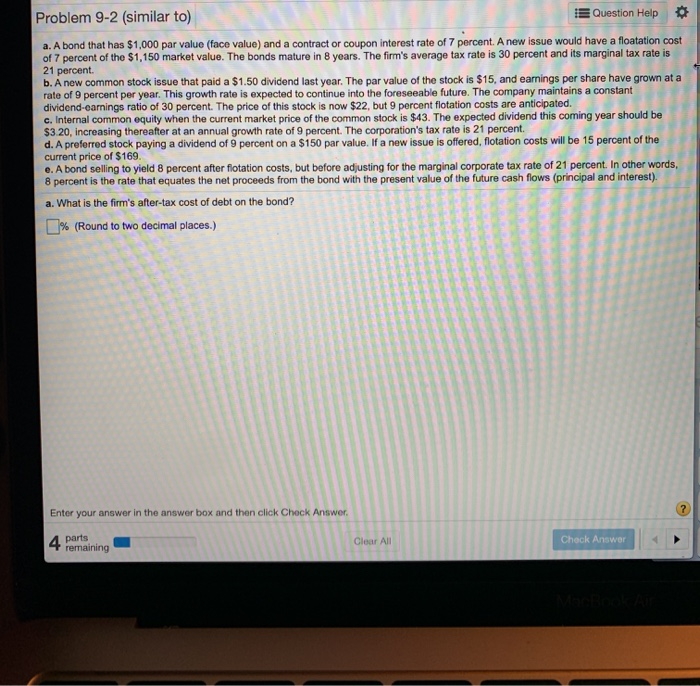

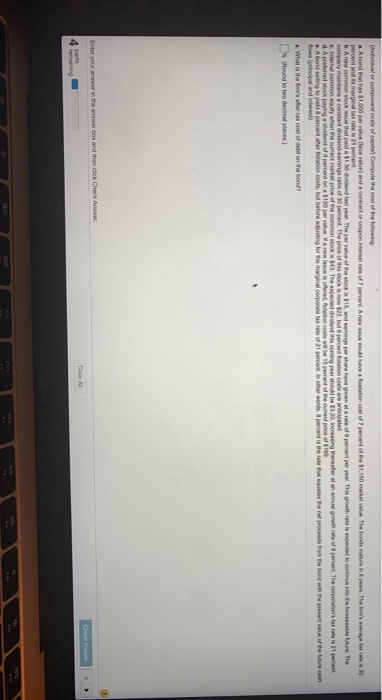

and more A new con la The 15 and persone e per year company ma n dags of percent The pro p erert Bon d and o nywhere the comment . The e vents coming year the server d. Aprendang a nd of percena 100 Harw o o will be 15 percent of 10 Alondego 8 percenter f o ut before informal corporate 21 percent inter words penis the s of the grow ofercent. The corporate is 1 percent proceeds from the bond with p u rch S Score of it 7 of 98.completely HW Score 66.67%, 6 of 9 pts X Problem 9-20 (similar to) Ouition Hapo manufacturing division, and the other came from the firm's distribution company. Both proposals promise a return on invested capital is approximately 15 percent. In the past, Newcastle has a single -wide cost of capital to evaluate new investments However, managers have long recognized that the manufacturing division is signanty more than the distribution division. In fact, comparable firms in the manufacturing division have quity bets of about 1.7, whereas distribution companies typically have quitybets of only 13. Given the sire of the proposals Newcastle's managements can undertake only one wants to be reacts wing on the more promising investment Given the importance of getting the cost of Capital estimas dos correct sposobe m's chefrancacer has asked you to prepare cow of capital malestreach of the two on the regul ation needed to accomplish your task follows: The cost of debt financing is a percent before a marginal rate of 22 percent. You may assume cost of bis atter any son con firm might incur. Thes e rate of interest on long-term US Treasury bonds is current iz percent and onds is Ourrenty 72 percent and the markers premium as averaged 45 percent over the past several years man p renta The color of the The firm has suficient internally generated funds such that now lock wilave to be sold totale equity financing a. Estimate the divisional costs of capital for the manufacturing and distribution divisions . Which of the two projects should the firm undertake assuming cannot do both due to labor and other financial restraints? Discuss What is the divisional cost of capital for the manufacturing division? L Round to two decimal places) Enter your awer in the answer box and Tonic Check 2 Penta Clear All MacBook Air Problem 9-2 (similar to) or component of Compute growth of percent. The corporation a t er proceeds from the band w he t her company maintains a constant dividend caring o p The 122 percentation contre alcomongity when the current market price of the common sok 143. These dividend this coming year should be 320 g o d. A preferred to paying dividend of percent on a $150 perv a r d, toon i te 15 percent of the currence of 10 A bonding to y el percent a tion , but before using for the magna corporate taxe of 21 percent. In other words per the w fous proposer .. What is the firm's wher- cost of debt on the band? EN Round to lwe decimal paces) MacBook Air command option option command Problem 9-2 (similar to) Question Help a. A bond that has $1,000 par value (face value) and a contract or coupon interest rate of 7 percent. A new issue would have a floatation cost of 7 percent of the $1,150 market value. The bonds mature in 8 years. The firm's average tax rate is 30 percent and its marginal tax rate is 21 percent. b. A new common stock issue that paid a $1.50 dividend last year. The par value of the stock is $15, and earnings per share have grown at a rate of 9 percent per year. This growth rate is expected to continue into the foreseeable future. The company maintains a constant dividend-earnings ratio of 30 percent. The price of this stock is now $22, but 9 percent flotation costs are anticipated. c. Internal common equity when the current market price of the common stock is $43. The expected dividend this coming year should be $3.20, increasing thereafter at an annual growth rate of 9 percent. The corporation's tax rate is 21 percent. d. A preferred stock paying a dividend of 9 percent on a $150 par value. If a new issue is offered, flotation costs will be 15 percent of the current price of $169. e. A bond selling to yield 8 percent after flotation costs, but before adjusting for the marginal corporate tax rate of 21 percent. In other words, 8 percent is the rate that equates the net proceeds from the bond with the present value of the future cash flows (principal and interest). a. What is the firm's after-tax cost of debt on the bond? % (Round to two decimal places.) Enter your answer in the answer box and then click A 4 parts remaining Check Answer and more A new con la The 15 and persone e per year company ma n dags of percent The pro p erert Bon d and o nywhere the comment . The e vents coming year the server d. Aprendang a nd of percena 100 Harw o o will be 15 percent of 10 Alondego 8 percenter f o ut before informal corporate 21 percent inter words penis the s of the grow ofercent. The corporate is 1 percent proceeds from the bond with p u rch S Score of it 7 of 98.completely HW Score 66.67%, 6 of 9 pts X Problem 9-20 (similar to) Ouition Hapo manufacturing division, and the other came from the firm's distribution company. Both proposals promise a return on invested capital is approximately 15 percent. In the past, Newcastle has a single -wide cost of capital to evaluate new investments However, managers have long recognized that the manufacturing division is signanty more than the distribution division. In fact, comparable firms in the manufacturing division have quity bets of about 1.7, whereas distribution companies typically have quitybets of only 13. Given the sire of the proposals Newcastle's managements can undertake only one wants to be reacts wing on the more promising investment Given the importance of getting the cost of Capital estimas dos correct sposobe m's chefrancacer has asked you to prepare cow of capital malestreach of the two on the regul ation needed to accomplish your task follows: The cost of debt financing is a percent before a marginal rate of 22 percent. You may assume cost of bis atter any son con firm might incur. Thes e rate of interest on long-term US Treasury bonds is current iz percent and onds is Ourrenty 72 percent and the markers premium as averaged 45 percent over the past several years man p renta The color of the The firm has suficient internally generated funds such that now lock wilave to be sold totale equity financing a. Estimate the divisional costs of capital for the manufacturing and distribution divisions . Which of the two projects should the firm undertake assuming cannot do both due to labor and other financial restraints? Discuss What is the divisional cost of capital for the manufacturing division? L Round to two decimal places) Enter your awer in the answer box and Tonic Check 2 Penta Clear All MacBook Air Problem 9-2 (similar to) or component of Compute growth of percent. The corporation a t er proceeds from the band w he t her company maintains a constant dividend caring o p The 122 percentation contre alcomongity when the current market price of the common sok 143. These dividend this coming year should be 320 g o d. A preferred to paying dividend of percent on a $150 perv a r d, toon i te 15 percent of the currence of 10 A bonding to y el percent a tion , but before using for the magna corporate taxe of 21 percent. In other words per the w fous proposer .. What is the firm's wher- cost of debt on the band? EN Round to lwe decimal paces) MacBook Air command option option command Problem 9-2 (similar to) Question Help a. A bond that has $1,000 par value (face value) and a contract or coupon interest rate of 7 percent. A new issue would have a floatation cost of 7 percent of the $1,150 market value. The bonds mature in 8 years. The firm's average tax rate is 30 percent and its marginal tax rate is 21 percent. b. A new common stock issue that paid a $1.50 dividend last year. The par value of the stock is $15, and earnings per share have grown at a rate of 9 percent per year. This growth rate is expected to continue into the foreseeable future. The company maintains a constant dividend-earnings ratio of 30 percent. The price of this stock is now $22, but 9 percent flotation costs are anticipated. c. Internal common equity when the current market price of the common stock is $43. The expected dividend this coming year should be $3.20, increasing thereafter at an annual growth rate of 9 percent. The corporation's tax rate is 21 percent. d. A preferred stock paying a dividend of 9 percent on a $150 par value. If a new issue is offered, flotation costs will be 15 percent of the current price of $169. e. A bond selling to yield 8 percent after flotation costs, but before adjusting for the marginal corporate tax rate of 21 percent. In other words, 8 percent is the rate that equates the net proceeds from the bond with the present value of the future cash flows (principal and interest). a. What is the firm's after-tax cost of debt on the bond? % (Round to two decimal places.) Enter your answer in the answer box and then click A 4 parts remaining Check