Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all 1. (6 pts.) You have sold a stock held for one year at $52.40, which you purchased at $45.00. You also received

please answer all

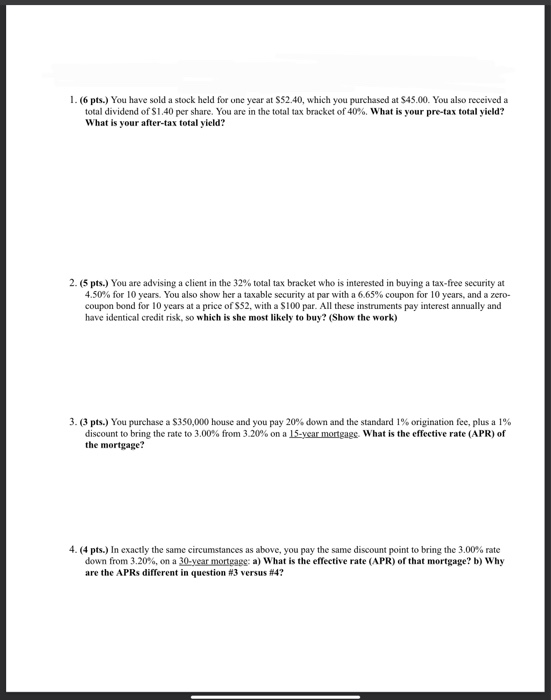

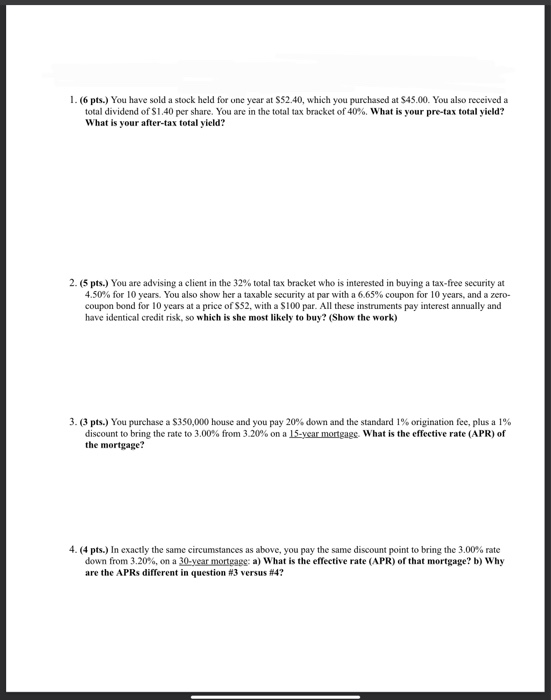

1. (6 pts.) You have sold a stock held for one year at $52.40, which you purchased at $45.00. You also received a total dividend of S1.40 per share. You are in the total tax bracket of 40%. What is your pre-tax total yield? What is your after-tax total yield? 2. (5 pts.) You are advising a client in the 32% total tax bracket who is interested in buying a tax-free security at 4.50% for 10 years. You also show her a taxable security at par with a 6,65% coupon for 10 years, and a zero- coupon bond for 10 years at a price of 52, with a $100 par. All these instruments pay interest annually and have identical credit risk, so which is she most likely to buy? (Show the work) 3.3pts.) You purchase a $350,000 house and you pay 20% down and the standard 1% origination fee, plus a 1% discount to bring the rate to 3.00% from 3.20% on a 15-year mortgage. What is the effective rate (APR) of the mortgage? 4. (4 pts.) In exactly the same circumstances as above, you pay the same discount point to bring the 3.00% rate down from 3.20%, on a 30-year mortgage: a) What is the effective rate (APR) of that mortgage? b) Why are the APRs different in question #3 versus #4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started