Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all 1. John Corbitt takes a fully amortizing mortgage for $80,000 at 10 percent interest for 30 years, monthly payments What will be

please answer all

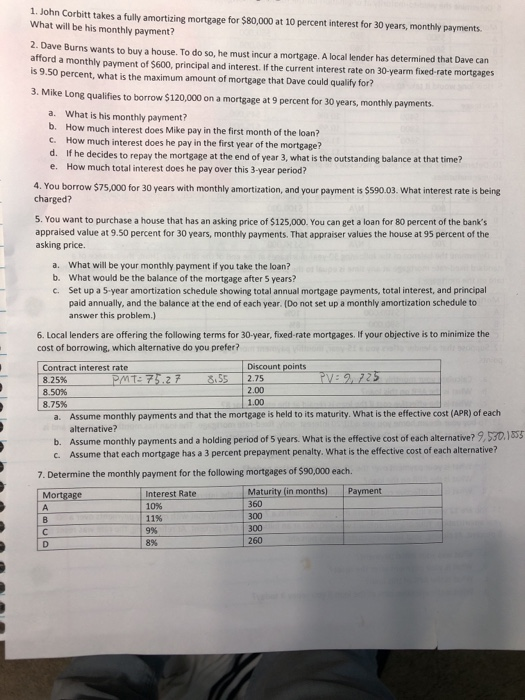

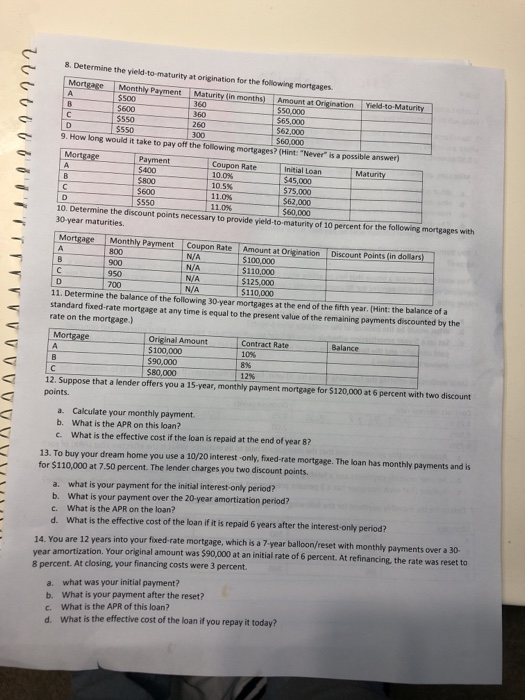

1. John Corbitt takes a fully amortizing mortgage for $80,000 at 10 percent interest for 30 years, monthly payments What will be his monthly payment? 2. Dave Burns wants to buy a house. To do so, he must incur a mortgage. A local lender has determined that Dave can afford a monthly payment of $600, principal and interest. If the current interest rate on 30-yearm fixed-rate mortgages is 9.50 percent, what is the maximum amount of mortgage that Dave could qualify for? 3. Mike Long qualifies to borrow $120,000 on a mortgage at 9 percent for 30 years, monthly payments a. What is his monthly payment? b. How much interest does Mike pay in the first month of the loan? c. How much interest does he pay in the first year of the mortgage? d. If he decides to repay the mortgage at the end of year 3, what is the outstanding balance at that time? e. How much total interest does he pay over this 3-year period? 4. You borrow $75,000 for 30 years with monthly amortization, and your payment is $590.03. What interest rate is being charged? 5. You want to purchase a house that has an asking price of $125,000. You can get a loan for 80 percent of the bank's appraised value at 9.50 percent for 30 years, monthly payments. That appraiser values the house at 95 percent of the asking price. What will be your monthly payment if you take the loan? a. b. What would be the balance of the mortgage after 5 years? c. Set up a 5 year amortization schedule showing total annual mortgage payments, total interest, and principal paid annually, and the balance at the end of each year. (Do not set up a monthly amortization schedule to answer this problem.) 6. Local lenders are offering the following terms for 30-year, fixed-rate mortgages. If your objective is to minimize the cost of borrowing, which alternative do you prefer? Discount points Contract interest rate MTe 73.27 3552.75 8.25% 2.00 8.50% 1.00 8.75% Assume monthly payments and that the mortgage is held to its maturity. What is the effective cost (APR) of each a. alternative? b. Assume monthly payments and a holding period of 5 years. What is the effective cost of each alternative? 9,530.153 c. Assume that each mortgage has a 3 percent prepayment penalty. What is the effective cost of each alternative? 7. Determine the monthly payment for the following mortgages of $90,000 each. oreage Maturity (in months) Payment Interest Rate 360 300 300 10% 11% 9% 260 8% 8. Determine the yield-to-maturity at origination for the following mortgages Mortgage Monthly Payment Maturity (in months) Amount at Origination $500 $600 5550 360 $65,000 562,000 260 $550 300 9. How long would it take to pay off the following mortgages? (Hint:"Never" is a possible answer) $60,000 Payment Coupon Rate Matunity $45,000 575,000 10.5% $600 5550 11.0% $62,000 Determine the dscount points necesayto provide yeld to maturityodf 10 percent for the folowing monteages with 11.0% 560,000 30 year maturities. Mortgage Monthly Payment Coupon Rate Amount at Origination Discount Points (in dollars) N/A N/A 100,000 900 $110,000 950 N/A $125,000 700 N/A 110,000 11. Determine the balance of the following 30-year mortgages at the end of the fifth year. (Hint:the balance of a standard fixed-rate mortgage at any time is equal to the present value of the remaining payments discounted by the rate on the mortgage.) Ioriginal Amount 100,000 90,000 $80,000 Balance Mortgage Contract Rate - 10% 12% 12. Suppose that a lender offers you a 15-year, monthly payment mortgage for $120,000 at 6 percent with two discount points Calculate your monthly payment. What is the APR on this loan? What is the effective cost if the loan is repaid at the end of year 8? a. b. c. 13. To buy your dream home you use a 10/20 interest only, fixed-rate mortgage. The loan has monthly payments and is for $110,000 at 7.50 percent. The lender charges you two discount points. what is your payment for the initial interest-only period? b. a. t is your payment over the 20-year amortization period? What is the APR on the loan? What is the effective cost of the loan if it is repaid 6 years after the interest-only period? Wha c. d. re 12 years into your fixed-rate mortgage, which is a 7-year balloon/reset with monthly payments over a 30- rtization. Your original amount was $90,000 at an initial rate of 6 percent. At refinancing, the rate was reset to 14. You a year amortization. 8 percent. At closing, your financing costs were 3 percent. what was your initial payment? a. b. What is your payment after the reset? c. What is the APR of this loan? d. What is the effective cost of the loan if you repay it today

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started