Answered step by step

Verified Expert Solution

Question

1 Approved Answer

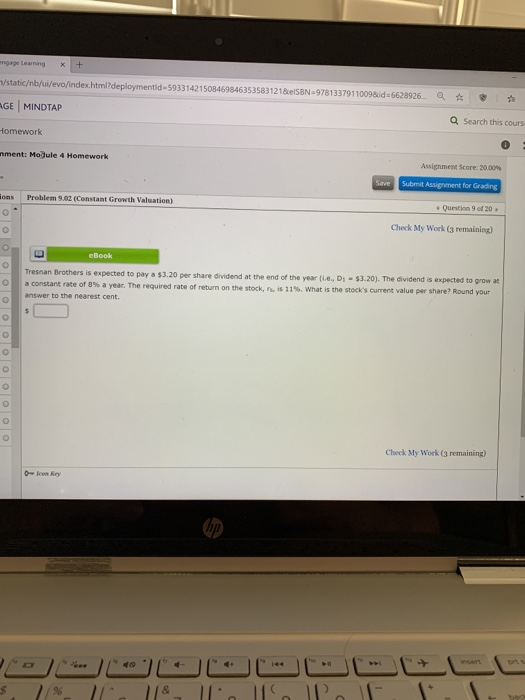

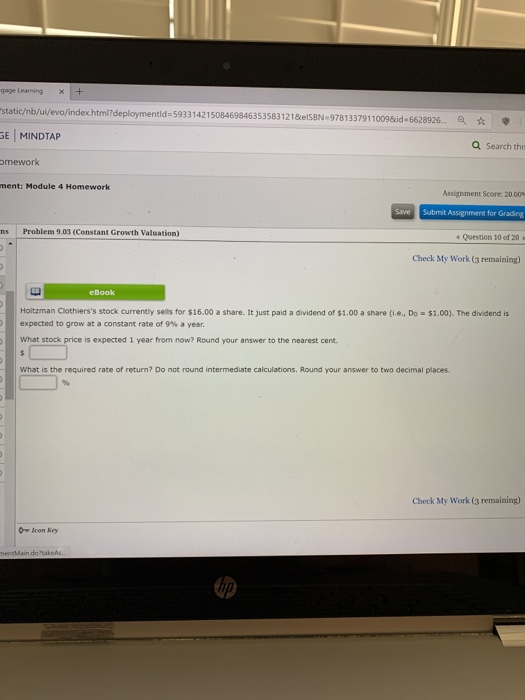

please answer all 3 questions -Cengage learning x + com/staticb/ui/evo/index.html?deploymentid=59331421508469846353583121858N=9781337911009&id-6628926 GAGE MINDTAP Q Search this ca 4 Homework ignment: Module 4 Homework Assignment Score: 20.00%

please answer all 3 questions

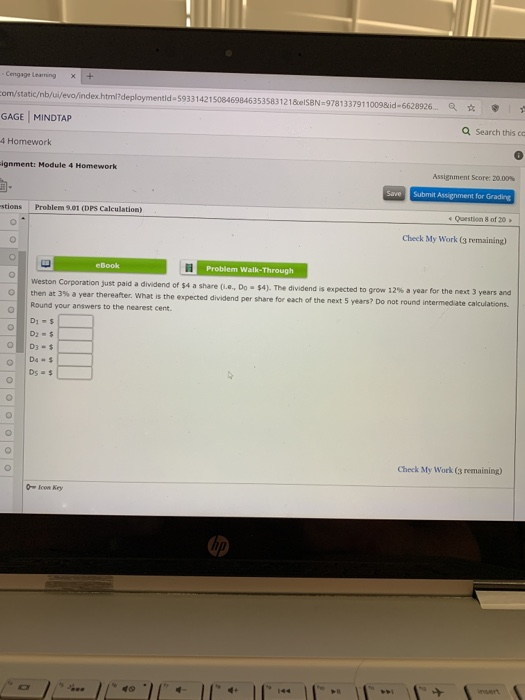

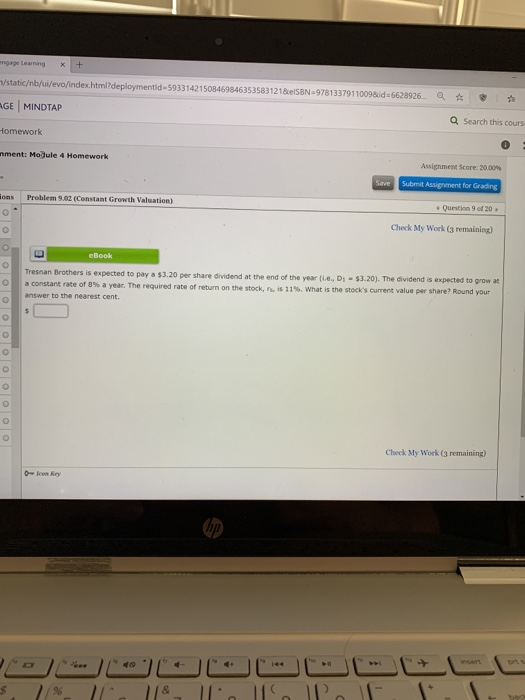

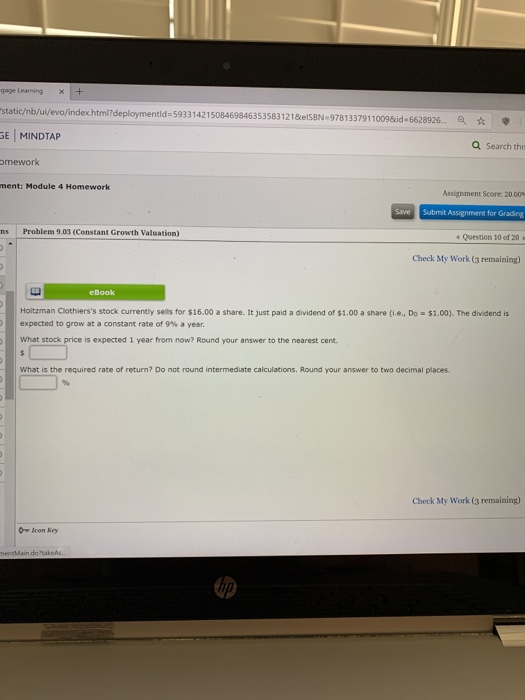

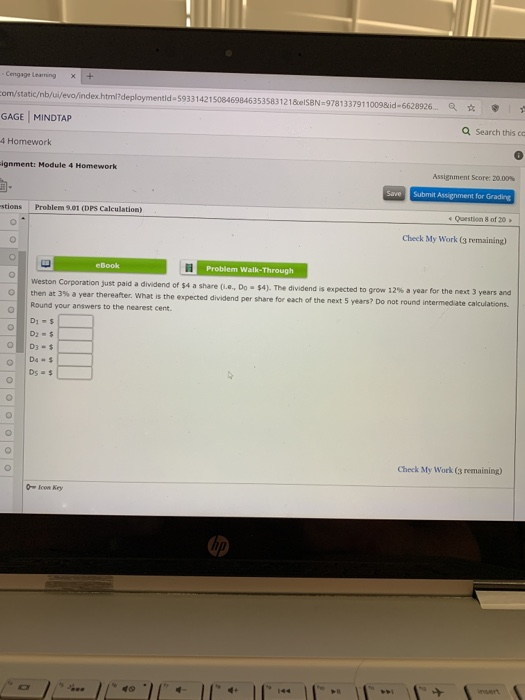

-Cengage learning x + com/staticb/ui/evo/index.html?deploymentid=59331421508469846353583121858N=9781337911009&id-6628926 GAGE MINDTAP Q Search this ca 4 Homework ignment: Module 4 Homework Assignment Score: 20.00% Submit Assignment for Grading Save estions Problem 9.01 (DPS Calculation) Question of 20 Check My Work (3 remaining) Book Problem Walk-Through Weston Corporation just paid a dividend of $4 a share (.., Do = $4). The dividend is expected to grow 12% a year for the next 3 years and then at 3% a year thereafter. What is the expected dividend per share for each of the next 5 years? Do not round intermediate calculations. Round your answers to the nearest cent. D1 - $ OOOOOOOOO Check My Work (3 remaining) *. * - - - + Smart engage learning x + staticb/ui/evo/index.html?deploymentid-59331421508469846353583121&SBN 9781337911009&id=5628926_ AGE MINDTAP a Q Search this cours Homework nment: Module 4 Homework Assignment Score: 20.00% Submit Assignment for Grading Save ons Problem 9.02 (Constant Growth Valuation) Question 9 20 Check My Work (3 remaining) Tresnan Brothers is expected to pay a $3.20 per share dividend at the end of the year (ie, D; - $3.20). The dividend is expected to grow at a constant rate of 5% a year. The required rate of return on the stocks is 115. What is the stock's current value per share? Round your answer to the nearest cent. OOOOOOOOOOOO Check My Work (3 remaining) " $7/% 118 1 1P gage Learning x + "staticb/ui/evo/indexhtml?deploymentid=593314215084698463535831218eISBN 9781337911009&id=6628926 GE MINDTAP @ Search this amework ment: Module 4 Homework Assignment Score: 20.00% Save Submit Assignment for Grading ns Problem 9.03 (Constant Growth Valuation) Question 10 of 20 Check My Work (3 remaining) eBook Holtzman Clothiers's stock currently sells for $16.00 a share. It just paid a dividend of $1.00 a share (.e., Do = $1.00). The dividend is expected to grow at a constant rate of 9% a year. What stock price is expected 1 year from now? Round your answer to the nearest cent. What is the required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. Check My Work (3 remaining) 0 Icon Key -Cengage learning x + com/staticb/ui/evo/index.html?deploymentid=59331421508469846353583121858N=9781337911009&id-6628926 GAGE MINDTAP Q Search this ca 4 Homework ignment: Module 4 Homework Assignment Score: 20.00% Submit Assignment for Grading Save estions Problem 9.01 (DPS Calculation) Question of 20 Check My Work (3 remaining) Book Problem Walk-Through Weston Corporation just paid a dividend of $4 a share (.., Do = $4). The dividend is expected to grow 12% a year for the next 3 years and then at 3% a year thereafter. What is the expected dividend per share for each of the next 5 years? Do not round intermediate calculations. Round your answers to the nearest cent. D1 - $ OOOOOOOOO Check My Work (3 remaining) *. * - - - + Smart engage learning x + staticb/ui/evo/index.html?deploymentid-59331421508469846353583121&SBN 9781337911009&id=5628926_ AGE MINDTAP a Q Search this cours Homework nment: Module 4 Homework Assignment Score: 20.00% Submit Assignment for Grading Save ons Problem 9.02 (Constant Growth Valuation) Question 9 20 Check My Work (3 remaining) Tresnan Brothers is expected to pay a $3.20 per share dividend at the end of the year (ie, D; - $3.20). The dividend is expected to grow at a constant rate of 5% a year. The required rate of return on the stocks is 115. What is the stock's current value per share? Round your answer to the nearest cent. OOOOOOOOOOOO Check My Work (3 remaining) " $7/% 118 1 1P gage Learning x + "staticb/ui/evo/indexhtml?deploymentid=593314215084698463535831218eISBN 9781337911009&id=6628926 GE MINDTAP @ Search this amework ment: Module 4 Homework Assignment Score: 20.00% Save Submit Assignment for Grading ns Problem 9.03 (Constant Growth Valuation) Question 10 of 20 Check My Work (3 remaining) eBook Holtzman Clothiers's stock currently sells for $16.00 a share. It just paid a dividend of $1.00 a share (.e., Do = $1.00). The dividend is expected to grow at a constant rate of 9% a year. What stock price is expected 1 year from now? Round your answer to the nearest cent. What is the required rate of return? Do not round intermediate calculations. Round your answer to two decimal places. Check My Work (3 remaining) 0 Icon Key

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started