PLEASE ANSWER ALL 4 Questions!

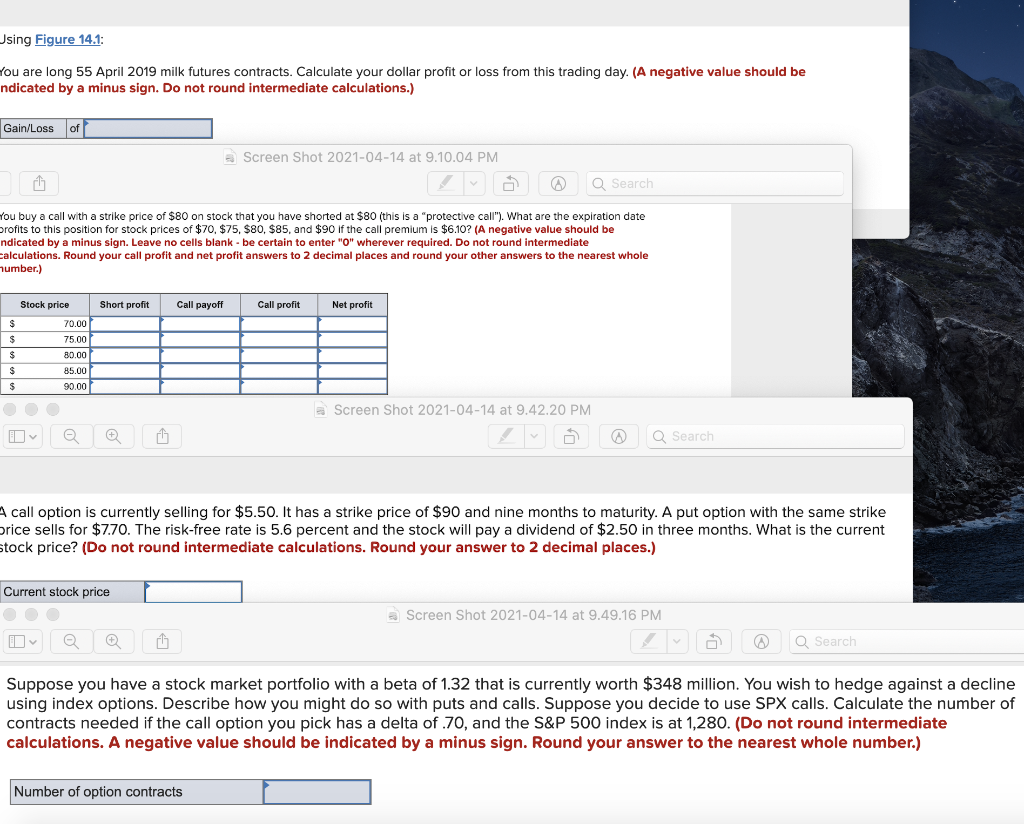

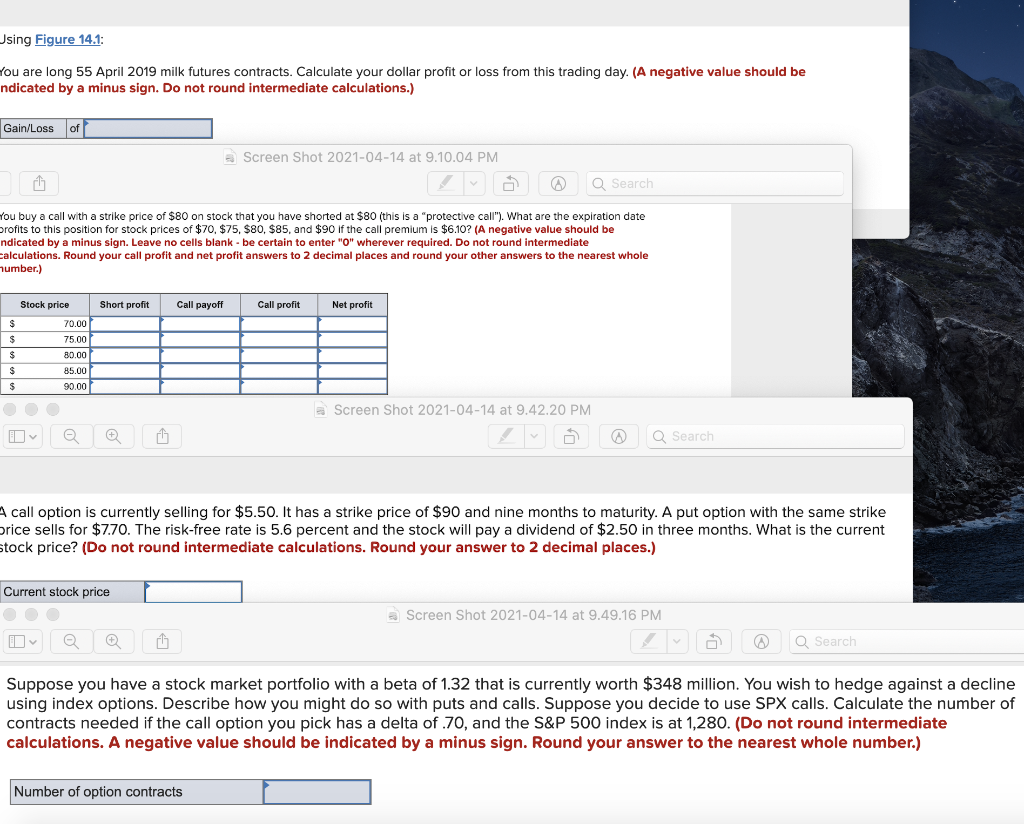

Using Figure 14.1: You are long 55 April 2019 milk futures contracts. Calculate your dollar profit or loss from this trading day. (A negative value should be ndicated by a minus sign. Do not round intermediate calculations.) Gain/Loss of Screen Shot 2021-04-14 at 9.10.04 PM Q Search You buy a call with a strike price of $80 on stock that you have shorted at $80 (this is a "protective call"). What are the expiration date profits to this position for stock prices of $70, $75, $80, $85, and $90 if the call premium is $6.10? (A negative value should be ndicated by a minus sign. Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Round your call profit and net profit answers to 2 decimal places and round your other answers to the nearest whole number.) Short profit Call payoff Call profit Net profit $ $ $ s Stock price 70.00 75.00 80.00 85.00 90.00 Screen Shot 2021-04-14 at 9.42.20 PM 6 Q Search A call option is currently selling for $5.50. It has a strike price of $90 and nine months to maturity. A put option with the same strike orice sells for $7.70. The risk-free rate is 5.6 percent and the stock will pay a dividend of $2.50 in three months. What is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current stock price Screen Shot 2021-04-14 at 9.49.16 PM Q Search Suppose you have a stock market portfolio with a beta of 1.32 that is currently worth $348 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of 70, and the S&P 500 index is at 1,280. (Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the nearest whole number.) Number of option contracts Using Figure 14.1: You are long 55 April 2019 milk futures contracts. Calculate your dollar profit or loss from this trading day. (A negative value should be ndicated by a minus sign. Do not round intermediate calculations.) Gain/Loss of Screen Shot 2021-04-14 at 9.10.04 PM Q Search You buy a call with a strike price of $80 on stock that you have shorted at $80 (this is a "protective call"). What are the expiration date profits to this position for stock prices of $70, $75, $80, $85, and $90 if the call premium is $6.10? (A negative value should be ndicated by a minus sign. Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Round your call profit and net profit answers to 2 decimal places and round your other answers to the nearest whole number.) Short profit Call payoff Call profit Net profit $ $ $ s Stock price 70.00 75.00 80.00 85.00 90.00 Screen Shot 2021-04-14 at 9.42.20 PM 6 Q Search A call option is currently selling for $5.50. It has a strike price of $90 and nine months to maturity. A put option with the same strike orice sells for $7.70. The risk-free rate is 5.6 percent and the stock will pay a dividend of $2.50 in three months. What is the current stock price? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Current stock price Screen Shot 2021-04-14 at 9.49.16 PM Q Search Suppose you have a stock market portfolio with a beta of 1.32 that is currently worth $348 million. You wish to hedge against a decline using index options. Describe how you might do so with puts and calls. Suppose you decide to use SPX calls. Calculate the number of contracts needed if the call option you pick has a delta of 70, and the S&P 500 index is at 1,280. (Do not round intermediate calculations. A negative value should be indicated by a minus sign. Round your answer to the nearest whole number.) Number of option contracts