Please answer all 5mcq , pls dont ans one only pls , thank u so much ty

Please answer all 5mcq , pls dont ans one only pls , thank u so much ty

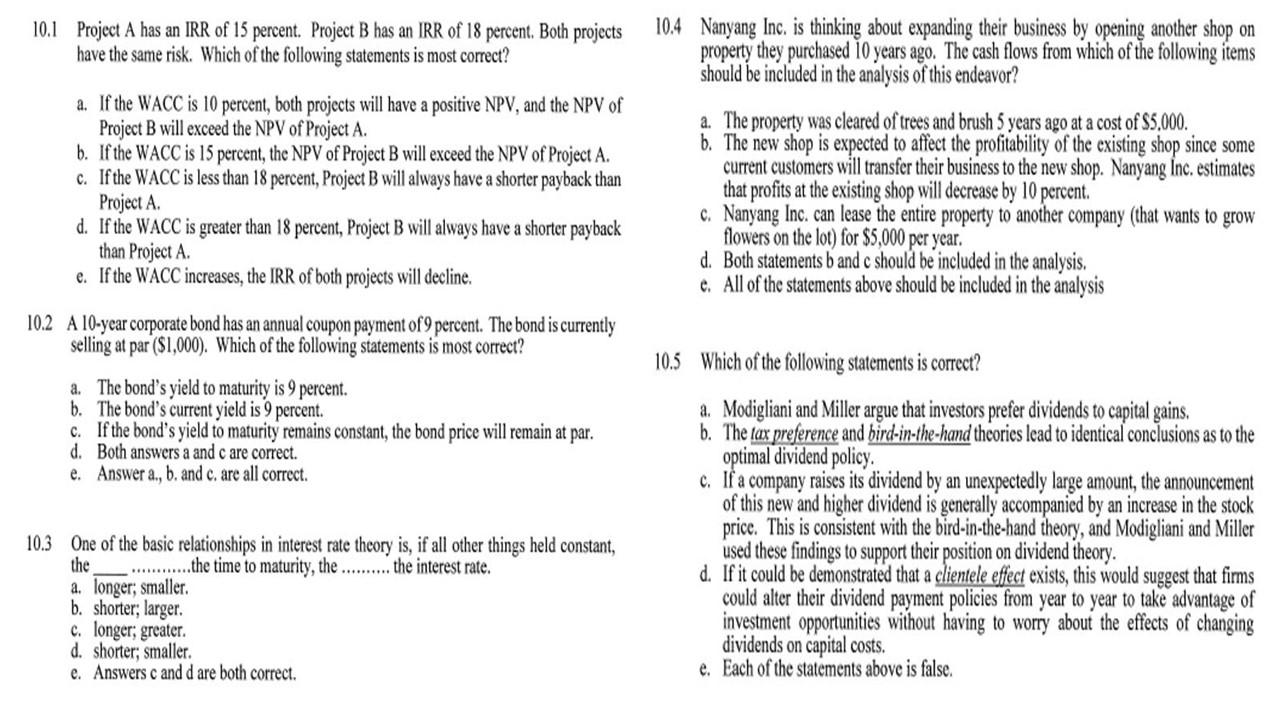

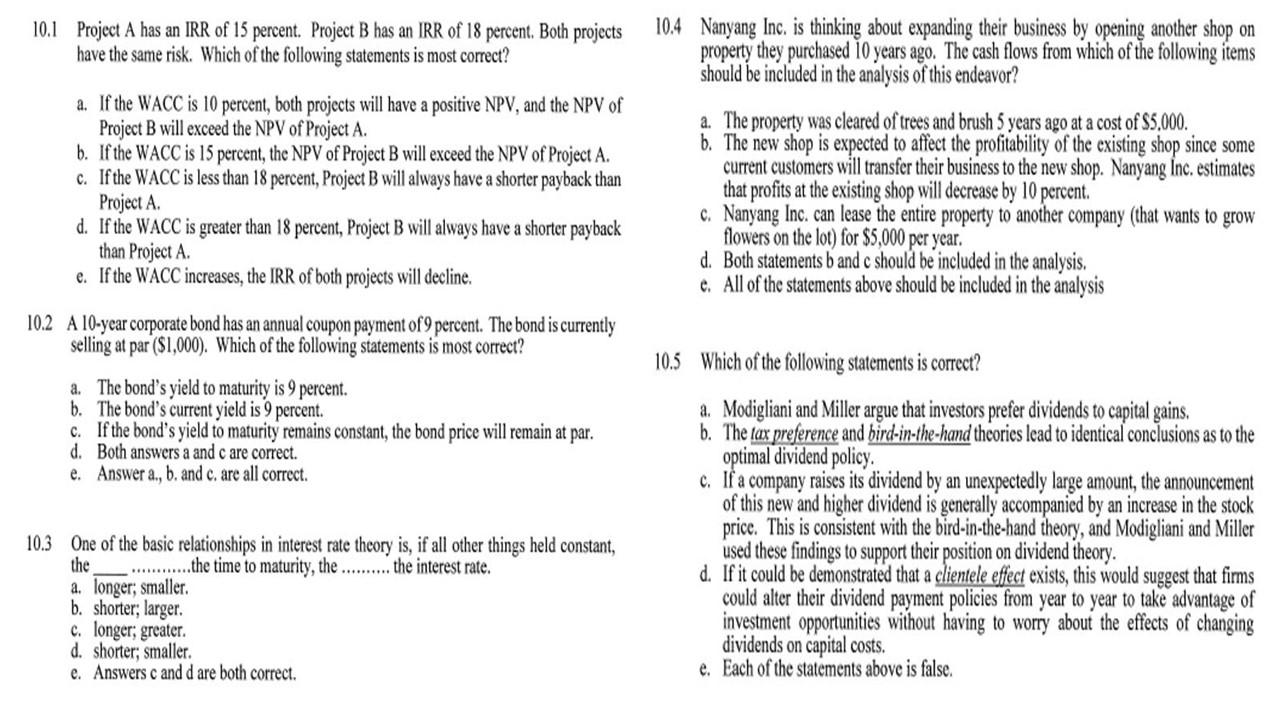

10.1 Project A has an IRR of 15 percent. Project B has an IRR of 18 percent. Both projects have the same risk. Which of the following statements is most correct? a. If the WACC is 10 percent, both projects will have a positive NPV, and the NPV of Project B will exceed the NPV of Project A. b. If the WACC is 15 percent, the NPV of Project B will exceed the NPV of Project A. c. If the WACC is less than 18 percent, Project B will always have a shorter payback than Project A. d. If the WACC is greater than 18 percent, Project B will always have a shorter payback than Project A. e. If the WACC increases, the IRR of both projects will decline. 10.4 Nanyang Inc. is thinking about expanding their business by opening another shop on property they purchased 10 years ago. The cash flows from which of the following items should be included in the analysis of this endeavor? a. The property was cleared of trees and brush 5 years ago at a cost of $5.000. b. The new shop is expected to affect the profitability of the existing shop since some current customers will transfer their business to the new shop. Nanyang Inc. estimates that profits at the existing shop will decrease by 10 percent. c. Nanyang Inc. can lease the entire property to another company (that wants to grow flowers on the lot) for $5,000 per year. d. Both statements b and c should be included in the analysis. e. All of the statements above should be included in the analysis 10.2 A 10-year corporate bond has an annual coupon payment of 9 percent. The bond is currently selling at par ($1,000). Which of the following statements is most correct? 10.5 Which of the following statements is correct? a. The bond's yield to maturity is 9 percent. b. The bond's current yield is 9 percent. c. If the bond's yield to maturity remains constant, the bond price will remain at par. d. Both answers a and care correct. e. Answer a., b. and c. are all correct. 10.3 One of the basic relationships in interest rate theory is, if all other things held constant, the .............the time to maturity, the .......... the interest rate. a. longer; smaller b. shorter; larger. c. longer; greater d. shorter; smaller. e. Answers c and d are both correct. a. Modigliani and Miller argue that investors prefer dividends to capital gains, b. The tax preference and bird-in-the-hand theories lead to identical conclusions as to the optimal dividend policy. c. If a company raises its dividend by an unexpectedly large amount, the announcement of this new and higher dividend is generally accompanied by an increase in the stock price. This is consistent with the bird-in-the-hand theory , and Modigliani and Miller used these findings to support their position on dividend theory. d. If it could be demonstrated that a clientele effect exists, this would suggest that firms could alter their dividend payment policies from year to year to take advantage of investment opportunities without having to worry about the effects of changing dividends on capital costs. e. Each of the statements above is false

Please answer all 5mcq , pls dont ans one only pls , thank u so much ty

Please answer all 5mcq , pls dont ans one only pls , thank u so much ty