Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all and be correct/right! Requirement: Pick only one correct answer 1 1.- A trial balance: a. Proves that debits and credits are equal

please answer all and be correct/right!

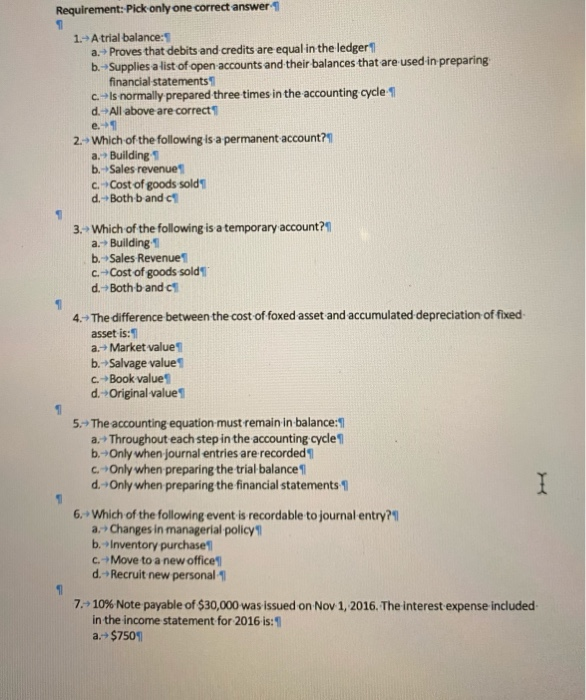

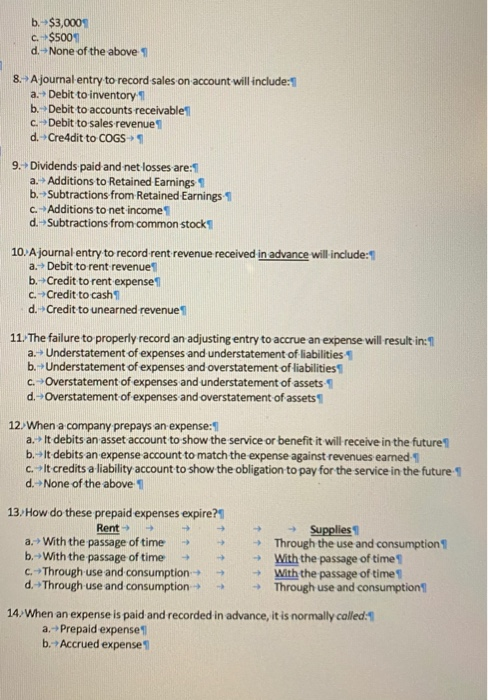

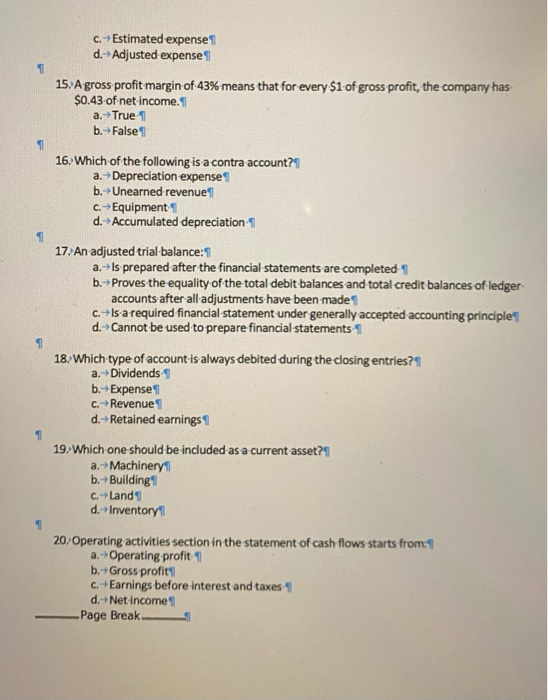

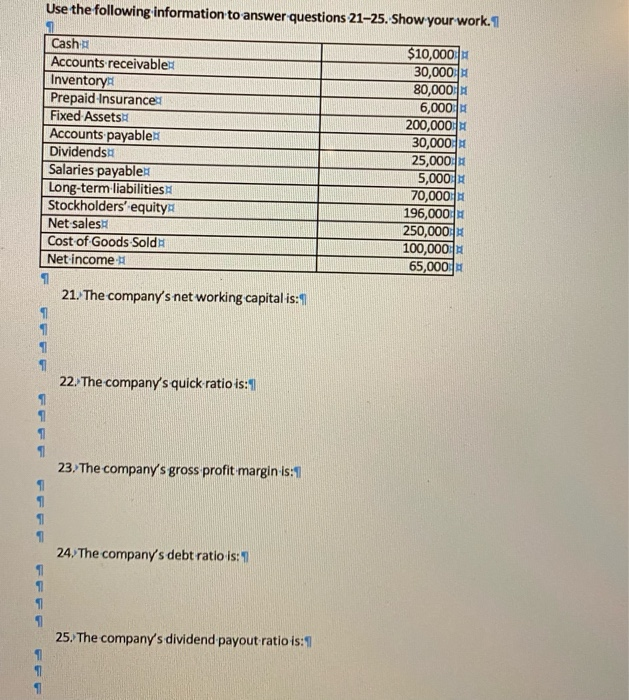

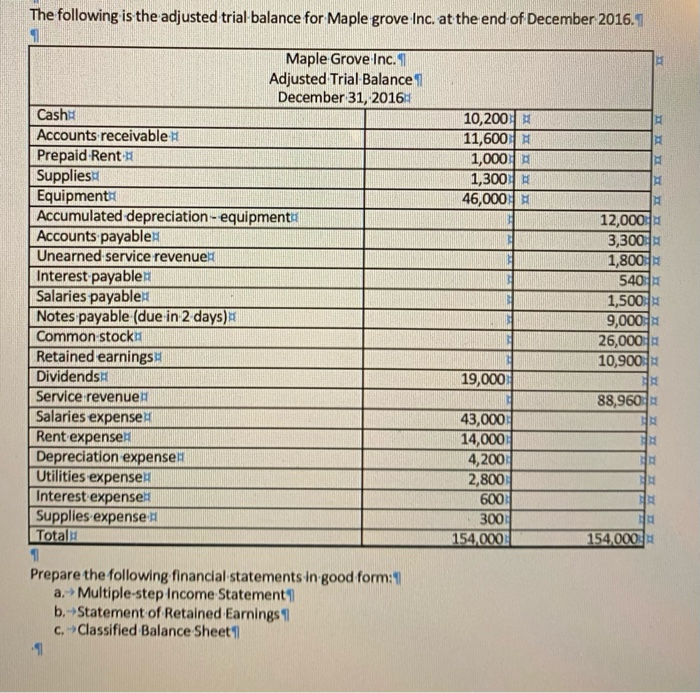

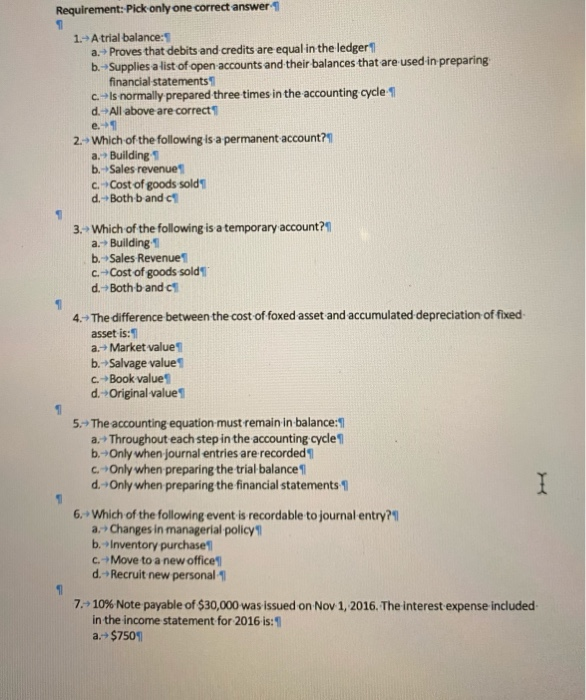

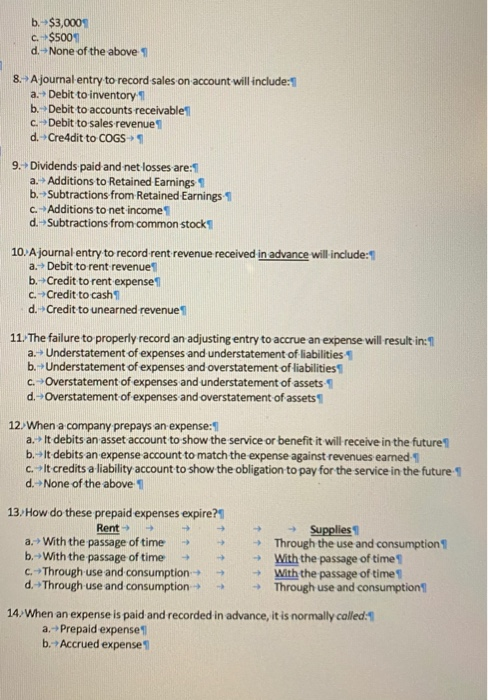

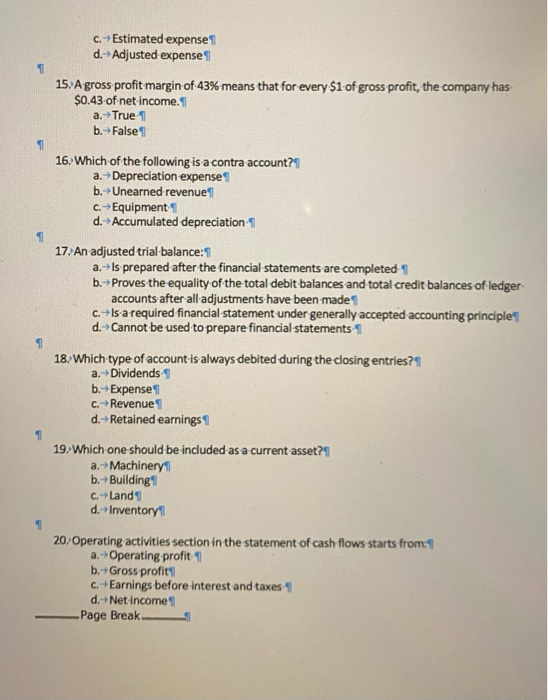

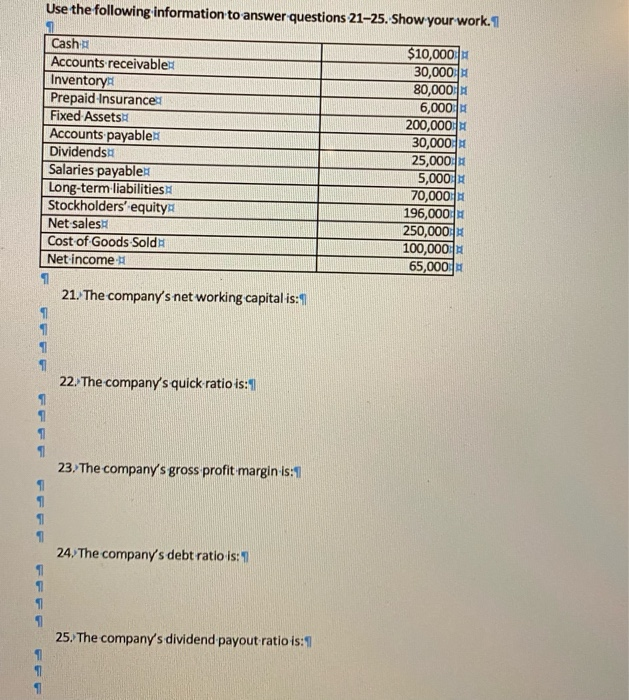

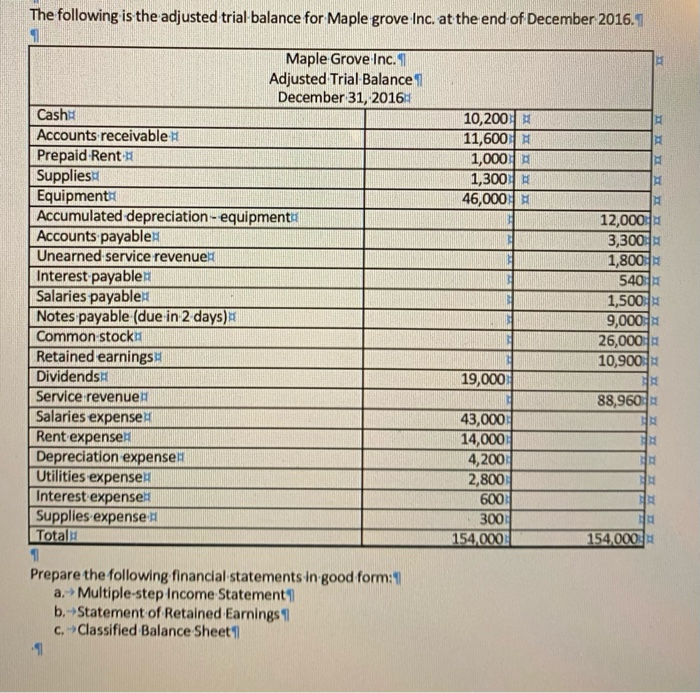

Requirement: Pick only one correct answer 1 1.- A trial balance: a. Proves that debits and credits are equal in the ledger b.- Supplies a list of open accounts and their balances that are used in preparing: financial statements c.- Is normally prepared three times in the accounting cycle 1 d. All above are correct e. 2.- Which of the following is a permanent account?1 a. Building b. Sales revenue" c. Cost of goods sold d. Both band 9 3. Which of the following is a temporary account? a. Building 1 b. Sales Revenues C.-Cost of goods sold1 d. Both band 4.- The difference between the cost of foxed asset and accumulated depreciation of fixed asset is: 1 a.- Market value b. Salvage values c.-Book values d.--Original values 5.- The accounting equation must remain in balance: a. Throughout each step in the accounting cycle b. Only when journal entries are recorded c. Only when preparing the trial balance d. Only when preparing the financial statements I 6. Which of the following event is recordable to journal entry?1 a. Changes in managerial policy b. Inventory purchase c. Move to a new office d.-Recruit new personal 1 7.-10% Note payable of $30,000 was issued on Nov 1, 2016. The interest expense included in the income statement for 2016 is: 1 a. $7509 1 b. $3,000 C. $500 d. None of the above 8.- A journal entry to record sales on account will include:1 a. Debit to inventory b. Debit to accounts receivable c. - Debit to sales revenue d.-Credit to COGS | 9. Dividends paid and net losses are: 1 a.- Additions to Retained Earnings b. Subtractions from Retained Earnings 1 c. - Additions to net income d.- Subtractions from common stock 10. A journal entry to record rent revenue received in advance will include:1 a.- Debit to rent revenue b. Credit to rent expense c. Credit to cash d.-Credit to unearned revenue 11. The failure to properly record an adjusting entry to accrue an expense will result in: 1 a.- Understatement of expenses and understatement of liabilities b. Understatement of expenses and overstatement of liabilities c. Overstatement of expenses and understatement of assets d.- Overstatement of expenses and overstatement of assets 1 12. When a company prepays an expense:1 a. It debits an asset account to show the service or benefit it will receive in the future b.-It debits an expense account to match the expense against revenues earned-1 c.-It credits a liability account to show the obligation to pay for the service in the future 1 d. None of the above 1 13. How do these prepaid expenses expire? Rent Supplies a. With the passage of time Through the use and consumption b. With the passage of time With the passage of time c. Through use and consumption With the passage of time d. Through use and consumption Through use and consumption 14. When an expense is paid and recorded in advance, it is normally called:1 a. Prepaid expense" b. Accrued expense - - - - - c. Estimated expense d.-Adjusted expense 15. A gross profit margin of 43% means that for every $1 of gross profit, the company has $0.43 of net income. a. True 1 b. False 16. Which of the following is a contra account? a.- Depreciation expenses b. Unearned revenue C.-Equipment d. Accumulated depreciation 1 17. An adjusted trial balance: 1 a.- Is prepared after the financial statements are completed 1 b. Proves the equality of the total debit balances and total credit balances of ledger accounts after all adjustments have been made c. Is a required financial statement under generally accepted accounting principle d.- Cannot be used to prepare financial statements 1 18. Which type of account is always debited during the closing entries? a.- Dividends 1 b. Expense c. Revenue d.- Retained earnings 1 19. Which one should be included as a current asset?1 a.- Machinery1 b.- Building C. Land d. Inventory 20. Operating activities section in the statement of cash flows starts from:1 a.- Operating profit 1 b. Gross profits c. Earnings before interest and taxes 1 d. Net Income -Page Break Use the following information to answer questions 21-25. Show your work. 1 Cash- Accounts receivable Inventory Prepaid Insurance Fixed Assets Accounts payables Dividends Salaries payable Long-term liabilities Stockholders' equity Net sales Cost of Goods Sold Net income $10,000 30,000 80,000 6,000 200,000 30,000 25,000 5,000 70,000 196,000 250,000 100,000 65,000 21. The company's net working capital is: 1 1 22. The company's quick ratio is: 1 1 1 23. The company's gross profit margin is: 1 1 1 1 1 24. The company's debt ratio is: 1 1 1 11 1 25. The company's dividend payout ratio is: 1 1 1 1 The following is the adjusted trial balance for Maple grove Inc. at the end of December 2016.1 1 Maple Grove Inc. 1 Adjusted Trial Balance December 31, 2016 Cash 10,200 Accounts receivable 11,600 Prepaid Rent- 1,000 Supplies 1,300 Equipment 46,000 Accumulated depreciation - equipment 12,000 Accounts payable 3,300 Unearned service revenue 1,800 Interest payable: 540A Salaries payable: 1,500 Notes payable (due in 2 days) 9,000 Common stock 26,000 Retained earnings 10,900 Dividends 19,000 Service revenue 88,960 Salaries expense 43,000 Rent expenses 14,000 Depreciation expensell 4,200 Utilities expense 2,800 Interest expense 600 Supplies expense 300 Total 154,000 154,000 Prepare the following financial statements in good form:41 a. Multiple-step Income Statement b. Statement of Retained Earnings C. Classified Balance Sheet1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started