Please answer all and I will give thumbs up

Please answer all and I will give thumbs up

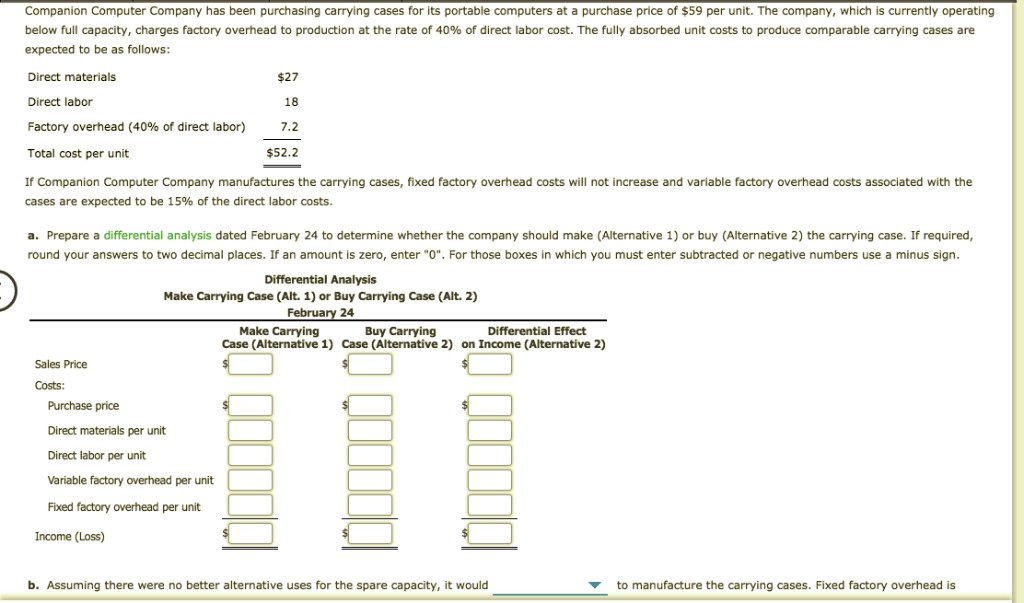

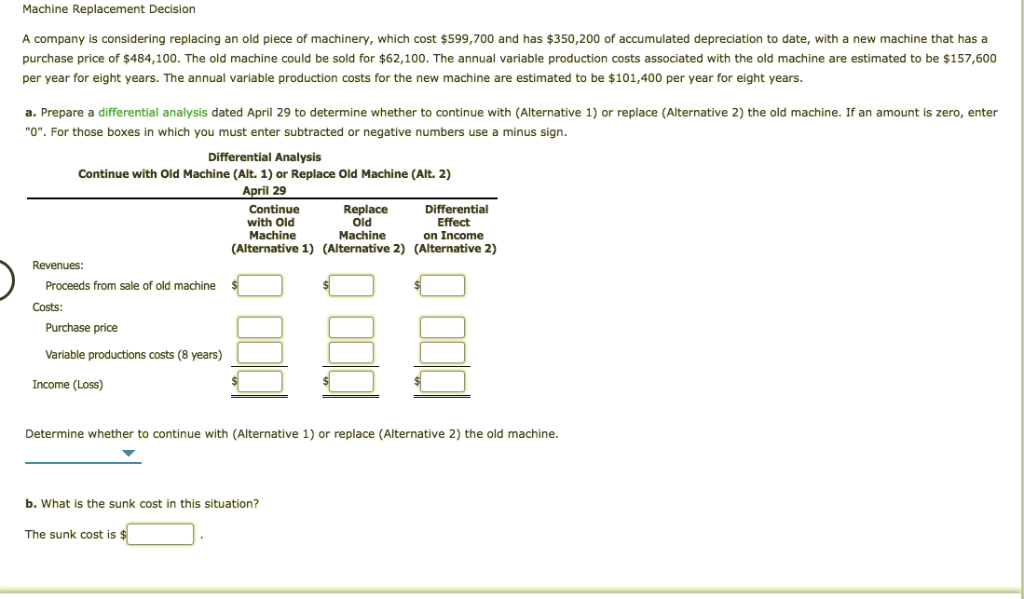

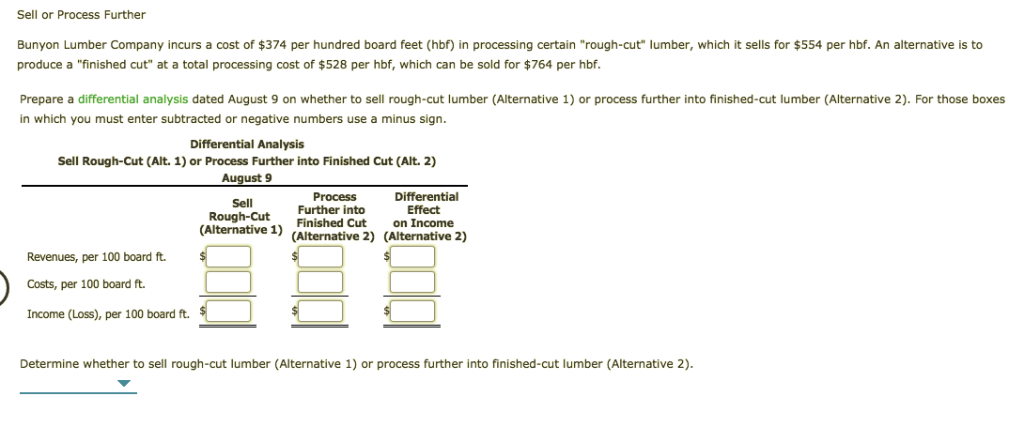

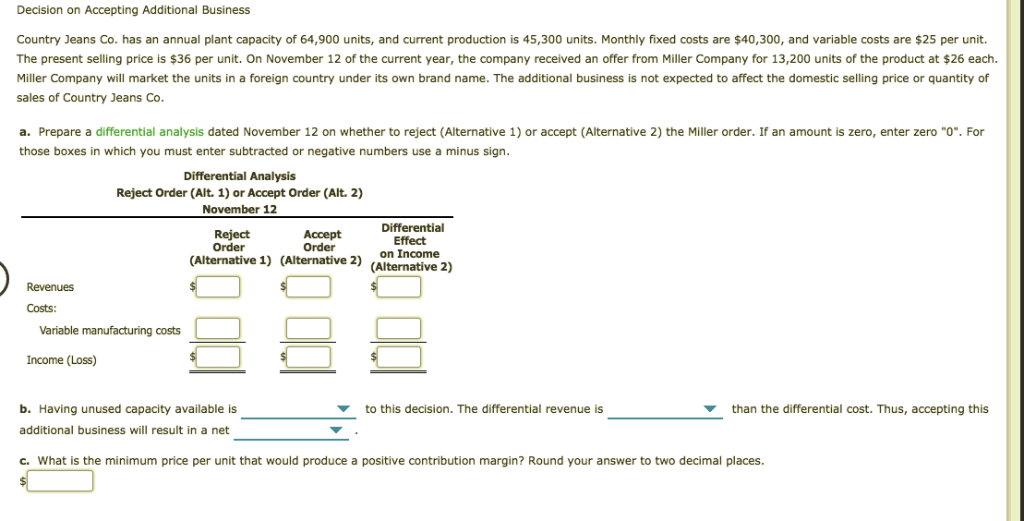

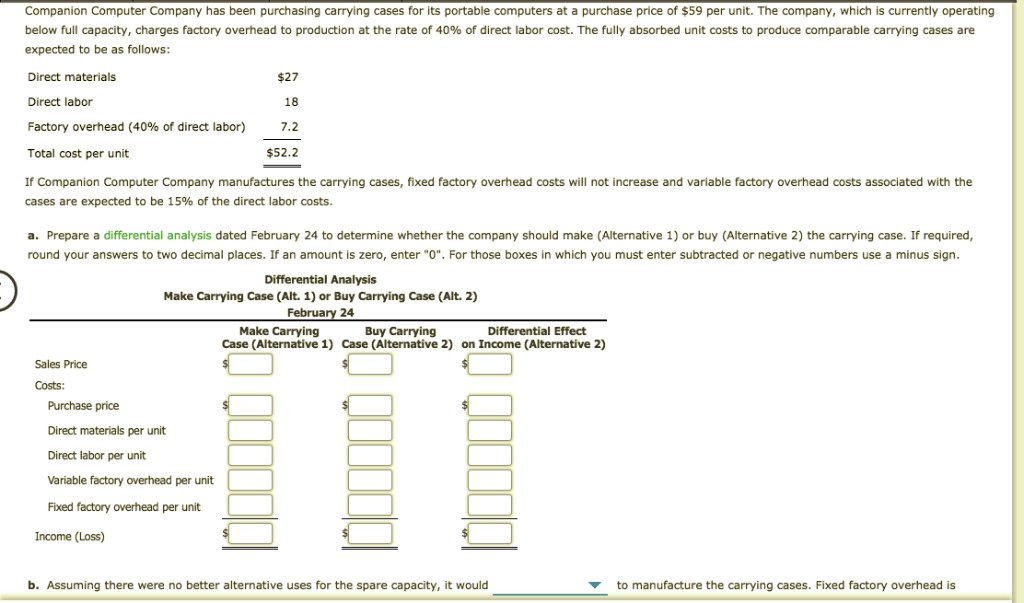

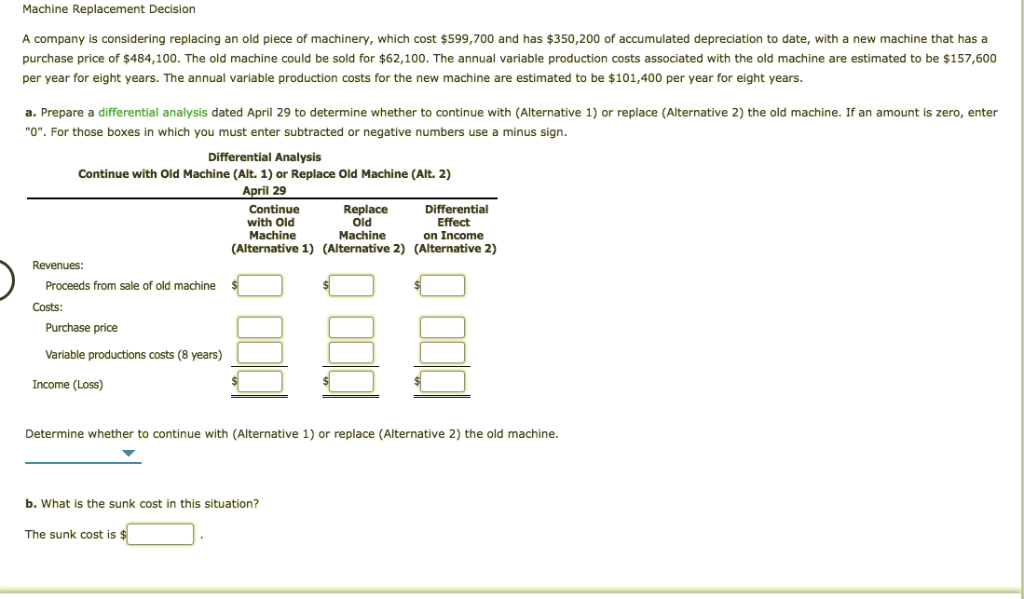

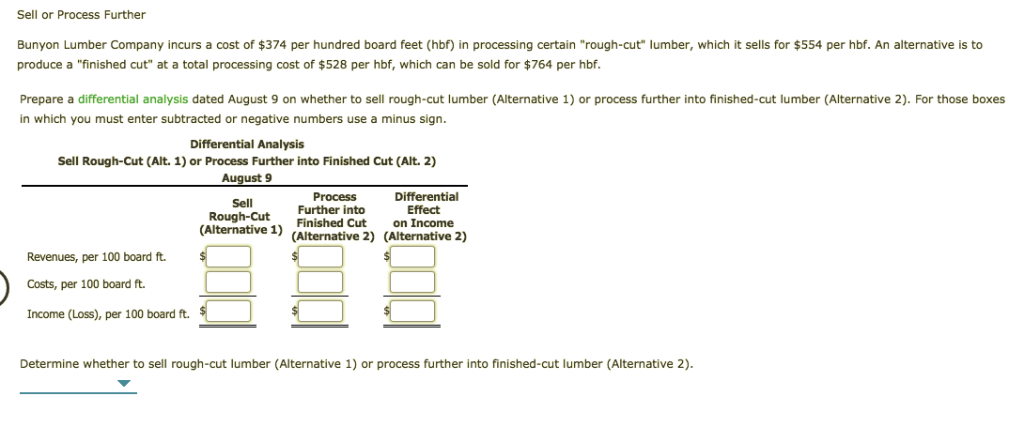

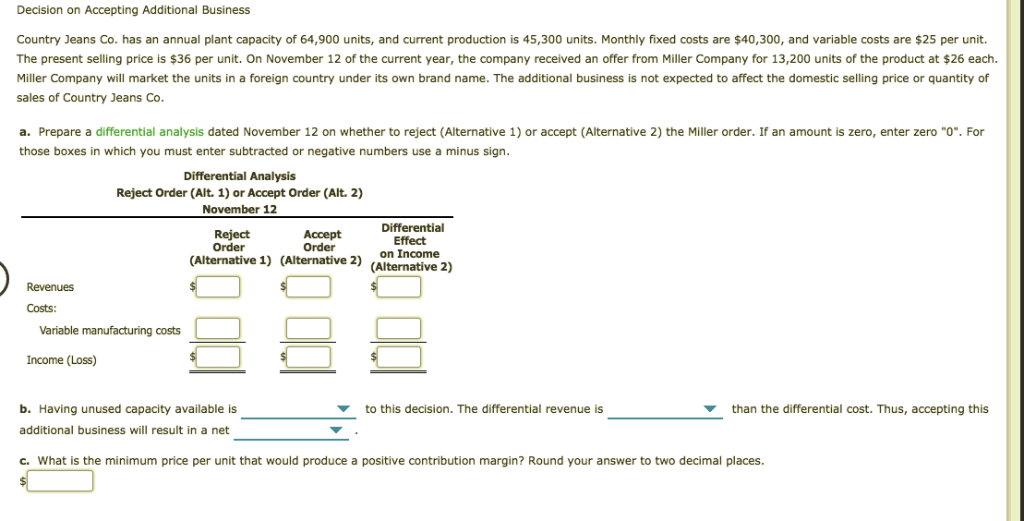

Companion Computer Company has been purchasing carrying cases for its portable computers at a purchase price of $59 per unit. The company, which is currently operating below full capacity, charges factory overhead to production at the rate of 40% of direct labor cost. The fully absorbed unit costs to produce comparable carrying cases are expected to be as follows: Direct materials $27 Direct labor 18 Factory overhead (40% of direct labor) 7.2 $52.2 Total cost per unit If Companion Computer Company manufactures the carrying cases, fixed factory overhead costs will not increase and variable factory overhead costs associated with the cases are expected to be 15% of the direct labor costs. a. Prepare a differential analysis dated February 24 to determine whether the company shou ld make (Alternative 1) or buy (Alternative 2) the carrying case. If required, o two decimal places. round your answers an amount is zero, enter "O". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Make Carrying Case (Alt. 1) or Buy Carrying Case (Alt. 2) February 24 Differential Effect Buy Carrying Case (Alternative 1) Case (Alternative 2) on Income (Alternative 2) Make Carrying Sales Price Costs: Purchase price Direct materials per unit Direct labor per unit Variable factory overhead per unit Fixed factory overhead per unit Income (Loss) to manufacture the carrying cases. Fixed factory overhead is b. Assuming there were no better alternative uses for the spare capacity, it would Machine Replacement Decision A company is considering replacing an old piece of machinery, which cost $599,700 and has $350,200 of accumulated depreciation to date, with new machine that has a purchase price of $484,100. The old machine could be sold for $62,100. The annual variable production costs associated with the old machine are estimated to be $157,600 per year for eight years. The annual variable production costs for the new machine are estimated to be $101,400 per year for eight years. a. Prepare a differential analysis dated April 29 to determine whether to continue with (Alternative 1) or replace (Alternative 2) the old machine. If an amount is zero, enter minus sign. "0". For those boxes in which you must enter subtracted or negative numbers use Differential Analysis Continue with Old Machine (Alt. 1) or Replace Old Machine (Alt. 2) April 29 Continue with Old Differential Replace Old Effect Machine Machine on Income (Alternative 1) (Alternative 2) (Alternative 2) Revenues: $ Proceeds from sale f old machine Costs: Purchase price Variable productions costs (8 years) Income (Loss) Determine whether to continue with (Alternative 1) or replace (Alternative 2) the old machine. b. What is the sunk cost in this situation? The sunk cost is $ Mom Sell or Process Further Bunyon Lumber Company incurs a cost of $374 per hundred board feet (hbf) in processing certain "rough-cut" lumber, which it sells for $554 per hbf. An alternative is to produce a "finished cut" at a total processing cost of $528 per hbf, which can be sold for $764 per hbf. Prepare a differential analysis dated August 9 on whether to sell rough-cut lumber (Alternative 1) or process further into finished-cut lumber (Alternative 2). For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis into Finished Cut (Alt. 2) Sell Rough-Cut (Alt. 1) or Process Furtl August 9 Process Differential Sell Finished Cut (Alternative 1) (Alternative 2) (Alternative 2) Rough-Cut on Income Revenues, per 100 board ft. Costs, per 100 board ft. Income (Loss), per 100 board ft. Determine whether to sell rough-cut lumber (Alternative 1) or process further into finished-cut lumber (Alternative 2). Decision on Accepting Additional Business Country Jeans Co. has an annual plant capacity 64,900 units, and current production is 45,300 units. Monthly fixed costs are $40,300, and variable costs are $25 per unit. The present selling price is $36 per unit. On November 12 of the current year, the company received an offer from Miller Company for 13,200 units of the product at $26 each. Miller Company will market the units in a foreign country under its own brand name. The additional business is not expected to affect the domestic selling price or quantity of Countor sales of Country Jeans Co. a. Prepare a differential analysis dated November 12 on whether to reject (Alternative 1) or accept (Alternative 2) the Miller order. If an amount is zero, enter zero "0". For those boxes in which you must enter subtracted or negative numbers use a minus sign. Differential Analysis Reject Order (Alt. 1) or Accept Order (Alt. 2) November 12 Differential Reject Order Accept Order (Alternative 1) (Alternative 2) (Alternative 2) on Income Revenues Costs: Variable manufacturing costs Income (Loss) than the differential cost. Thus, accepting this b. Having unused capacity available is to this decision. The differential revenue is additional business will result in a net c. What is the minimum price per unit that would produce positive contribution margin? Round your answer to two decimal places

Please answer all and I will give thumbs up

Please answer all and I will give thumbs up