Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all and show work f Department G entry would be recorded by the process cost accounting system uses $53,000 of direct labor and

please answer all and show work

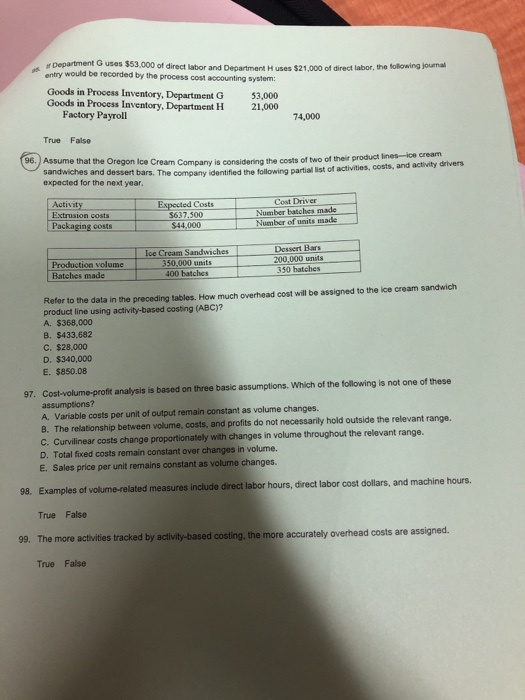

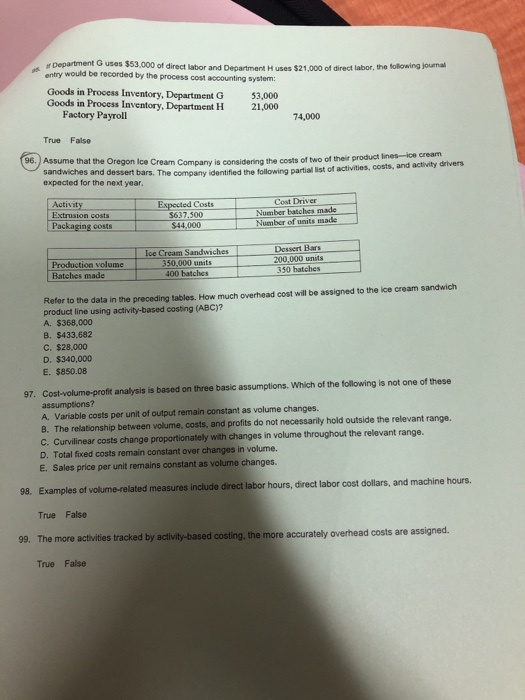

f Department G entry would be recorded by the process cost accounting system uses $53,000 of direct labor and Department H uses $21,000 of direct labor, the following journal Goods in Process Inventory, Department G Goods in Process Inventory, Department H 53,000 21,000 Factory Payroll 74,000 True False 96.) Assume that the Oregon Ice Cream Company is considering the costs of two of their sandwiches and dessert bars. The company identified the following partial l expected for the next year ist of activities, costs, and activity drivers Cost Driver Activity Extrusion costs Packaging costs Costs Number batches made Number of units made $637.500 Dessert Bars 200,000 units 350 batches loe Cream Sandwiches Production volume350,000 units Batehes made400 batches Refer to the data in the preceding tables. How much overhead cost will be assigned to the ice cream sandwich product line using activity-based costing (ABC)? A. $368,000 B. $433,682 C. $28,000 D. $340,000 E. $850.08 97. Cost-volume-profit analysis is based on three basic assumptions. Which of the following is not one of these A. Variable costs per unit of output remain constant as volume changes B. The relationship between volume, costs, and profits do not necessarily hold outside the relevant range. C. Curvilinear costs change proportionately with changes in volume throughout the relevant r D. Total fixed costs remain constant over changes in volume. E. Sales price per unit remains constant as volume changes. of volume-related measures include direct labor hours, direct labor cost dollars, and machine hours. True False The more activities tracked by activity-based costing, the more accura True False ned. 99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started