Please answer all, as soon as possible. urgent. Thanks so much.

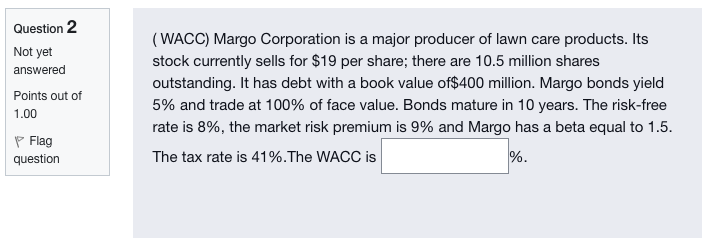

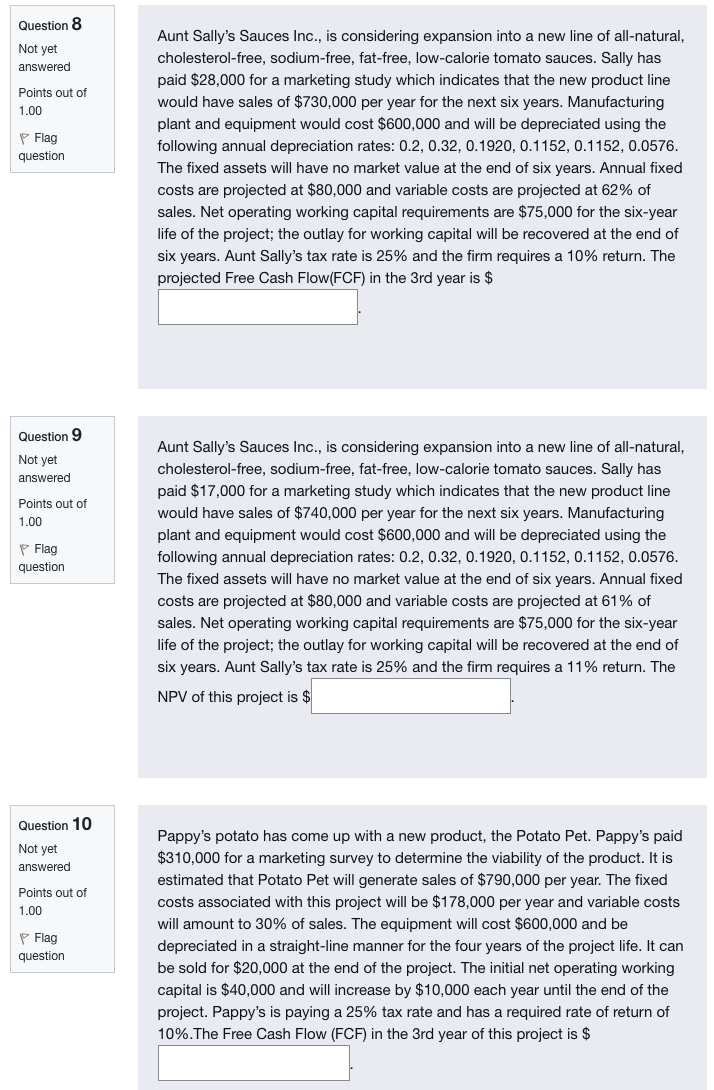

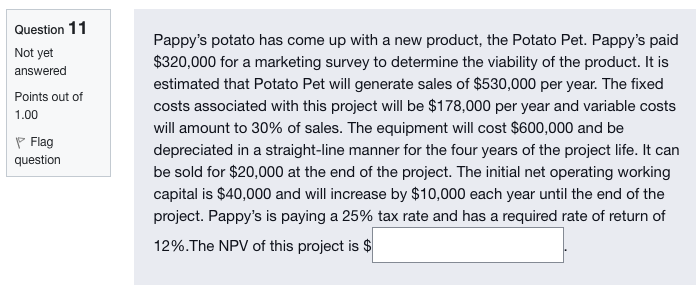

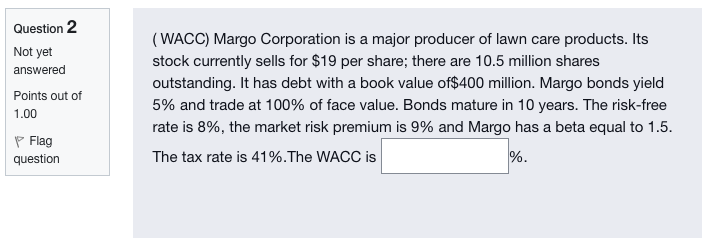

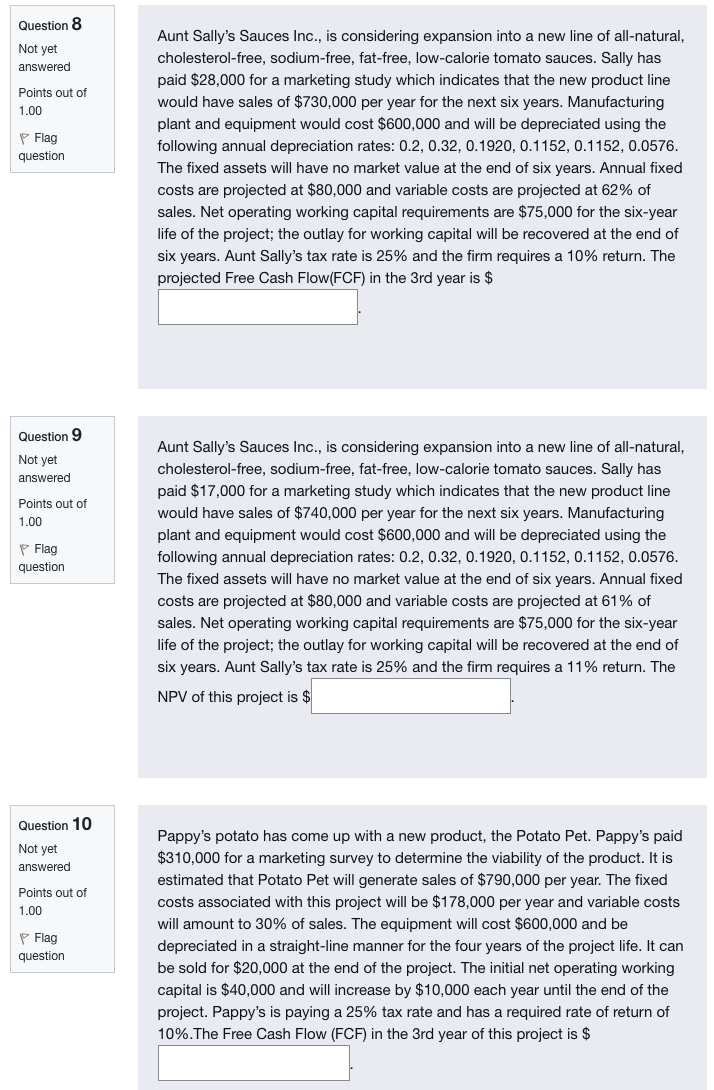

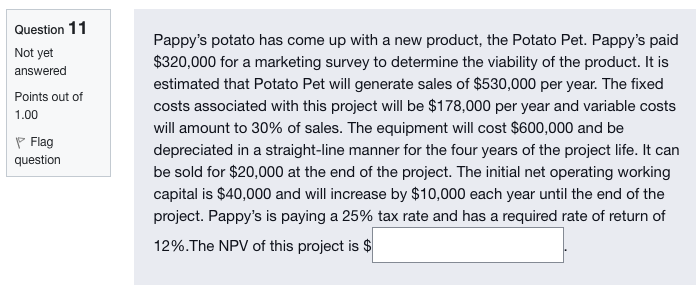

Question 2 Not yet answered Points out of 1.00 P Flag question (WACC) Margo Corporation is a major producer of lawn care products. Its stock currently sells for $19 per share; there are 10.5 million shares outstanding. It has debt with a book value of$400 million. Margo bonds yield 5% and trade at 100% of face value. Bonds mature in 10 years. The risk-free rate is 8%, the market risk premium is 9% and Margo has a beta equal to 1.5. The tax rate is 41%. The WACC is % Question 8 Not yet answered Points out of 1.00 P Flag question Aunt Sally's Sauces Inc., is considering expansion into a new line of all-natural, cholesterol-free, sodium-free, fat-free, low-calorie tomato sauces. Sally has paid $28,000 for a marketing study which indicates that the new product line would have sales of $730,000 per year for the next six years. Manufacturing plant and equipment would cost $600,000 and will be depreciated using the following annual depreciation rates: 0.2, 0.32, 0.1920, 0.1152, 0.1152, 0.0576. The fixed assets will have no market value at the end of six years. Annual fixed costs are projected at $80,000 and variable costs are projected at 62% of sales. Net operating working capital requirements are $75,000 for the six-year life of the project; the outlay for working capital will be recovered at the end of six years. Aunt Sally's tax rate is 25% and the firm requires a 10% return. The projected Free Cash Flow(FCF) in the 3rd year is $ Question 9 Not yet answered Points out of 1.00 P Flag question Aunt Sally's Sauces Inc., is considering expansion into a new line of all-natural, cholesterol-free, sodium-free, fat-free, low-calorie tomato sauces. Sally has paid $17,000 for a marketing study which indicates that the new product line would have sales of $740,000 per year for the next six years. Manufacturing plant and equipment would cost $600,000 and will be depreciated using the following annual depreciation rates: 0.2, 0.32, 0.1920, 0.1152, 0.1152, 0.0576. The fixed assets will have no market value at the end of six years. Annual fixed costs are projected at $80,000 and variable costs are projected at 61% of sales. Net operating working capital requirements are $75,000 for the six-year life of the project; the outlay for working capital will be recovered at the end of six years. Aunt Sally's tax rate is 25% and the firm requires a 11% return. The NPV of this project is $ Question 10 Not yet answered Points out of 1.00 P Flag question Pappy's potato has come up with a new product, the Potato Pet. Pappy's paid $310,000 for a marketing survey to determine the viability of the product. It is estimated that Potato Pet will generate sales of $790,000 per year. The fixed costs associated with this project will be $178,000 per year and variable costs will amount to 30% of sales. The equipment will cost $600,000 and be depreciated in a straight-line manner for the four years of the project life. It can be sold for $20,000 at the end of the project. The initial net operating working capital is $40,000 and will increase by $10,000 each year until the end of the project. Pappy's is paying a 25% tax rate and has a required rate of return of 10%.The Free Cash Flow (FCF) in the 3rd year of this project is $ Question 11 Not yet answered Points out of 1.00 P Flag question Pappy's potato has come up with a new product, the Potato Pet. Pappy's paid $320,000 for a marketing survey to determine the viability of the product. It is estimated that Potato Pet will generate sales of $530,000 per year. The fixed costs associated with this project will be $178,000 per year and variable costs will amount to 30% of sales. The equipment will cost $600,000 and be depreciated in a straight-line manner for the four years of the project life. It can be sold for $20,000 at the end of the project. The initial net operating working capital is $40,000 and will increase by $10,000 each year until the end of the project. Pappy's is paying a 25% tax rate and has a required rate of return of 12%. The NPV of this project is $