Answered step by step

Verified Expert Solution

Question

1 Approved Answer

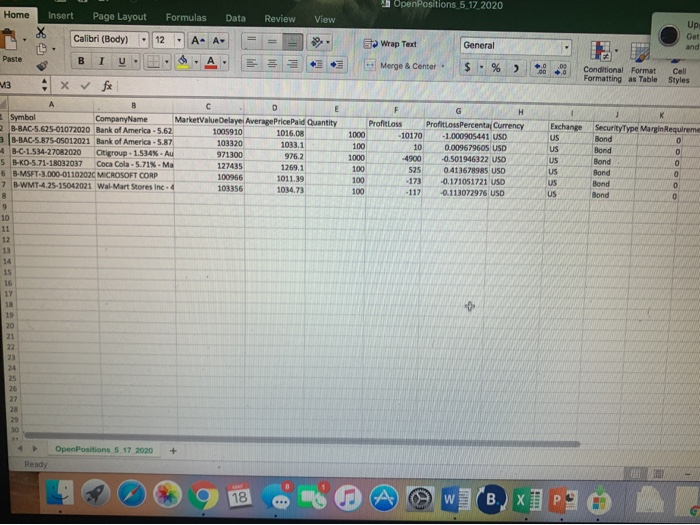

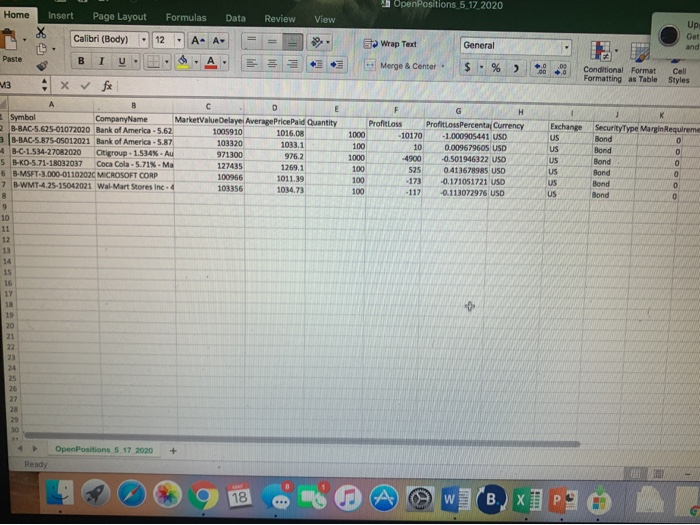

PLEASE ANSWER ALL ASAP! THE QUESTIONS TO THE SPREADSHEET IS ALSO ATTACHED! the picture is very clear please try to zoom into it. i need

PLEASE ANSWER ALL ASAP! THE QUESTIONS TO THE SPREADSHEET IS ALSO ATTACHED!

the picture is very clear please try to zoom into it. i need the answers asap

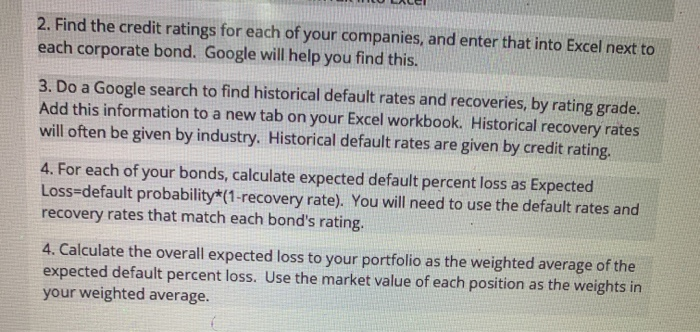

OpenPositions 5 17_2020 Home Insert Page Layout Formulas Data Review View Calibri (Bodyl 12 Up Get and 5. Wrap Text General Paste B U- 9 Merge & Center $ - % ) 0 00 Conditional Format Cell Formatting as Table Styles F x x B D Symbol Company Name MarketValueDelaye AveragePricePald Quantity 2B-HAC-5.625-01072020 Bank of America - 5.62 1005910 1016.08 3 B-BAC-5.875-05012021 Bank of America - 5.87 103320 1033.1 4 B-C-1.534-27082020 Citigroup. 1.534% - Au 971300 976.2 5 E KO TIET 2017 Coca Cola - 5.71% - Ma 127435 12691 6 B- MSFT-3.000-0110202C MICROSOFT CORP 100966 1011.39 7 B-WMT-4.25-15042021 Wal-Mart Stores inc. 4 103356 1034.73 1000 100 1000 100 100 100 ProfitLoss -10170 10 -4900 525 -173 -117 G H ProfitossPercental Currency -1.000905441 USD 0.009679605 USD -0.501946322 USO 0.413678985 USD -0.171051721 USD -0.113072976 USD Exchange US US US US US US Security Type Margin Requireme Bond 0 Bond O Bond 0 Bond 0 Bond 0 Bond 0 9 10 11 12 13 15 16 17 0 19 20 21 22 23 24 25 25 28 30 Open Positions 5 17 2020 + Ready 18 A 0 W B. x] Pa o 2. Find the credit ratings for each of your companies, and enter that into Excel next to each corporate bond. Google will help you find this. 3. Do a Google search to find historical default rates and recoveries, by rating grade. Add this information to a new tab on your Excel workbook. Historical recovery rates will often be given by industry. Historical default rates are given by credit rating. 4. For each of your bonds, calculate expected default percent loss as Expected Loss=default probability*(1-recovery rate). You will need to use the default rates and recovery rates that match each bond's rating, 4. Calculate the overall expected loss to your portfolio as the weighted average of the expected default percent loss. Use the market value of each position as the weights in your weighted average. OpenPositions 5 17_2020 Home Insert Page Layout Formulas Data Review View Calibri (Bodyl 12 Up Get and 5. Wrap Text General Paste B U- 9 Merge & Center $ - % ) 0 00 Conditional Format Cell Formatting as Table Styles F x x B D Symbol Company Name MarketValueDelaye AveragePricePald Quantity 2B-HAC-5.625-01072020 Bank of America - 5.62 1005910 1016.08 3 B-BAC-5.875-05012021 Bank of America - 5.87 103320 1033.1 4 B-C-1.534-27082020 Citigroup. 1.534% - Au 971300 976.2 5 E KO TIET 2017 Coca Cola - 5.71% - Ma 127435 12691 6 B- MSFT-3.000-0110202C MICROSOFT CORP 100966 1011.39 7 B-WMT-4.25-15042021 Wal-Mart Stores inc. 4 103356 1034.73 1000 100 1000 100 100 100 ProfitLoss -10170 10 -4900 525 -173 -117 G H ProfitossPercental Currency -1.000905441 USD 0.009679605 USD -0.501946322 USO 0.413678985 USD -0.171051721 USD -0.113072976 USD Exchange US US US US US US Security Type Margin Requireme Bond 0 Bond O Bond 0 Bond 0 Bond 0 Bond 0 9 10 11 12 13 15 16 17 0 19 20 21 22 23 24 25 25 28 30 Open Positions 5 17 2020 + Ready 18 A 0 W B. x] Pa o 2. Find the credit ratings for each of your companies, and enter that into Excel next to each corporate bond. Google will help you find this. 3. Do a Google search to find historical default rates and recoveries, by rating grade. Add this information to a new tab on your Excel workbook. Historical recovery rates will often be given by industry. Historical default rates are given by credit rating. 4. For each of your bonds, calculate expected default percent loss as Expected Loss=default probability*(1-recovery rate). You will need to use the default rates and recovery rates that match each bond's rating, 4. Calculate the overall expected loss to your portfolio as the weighted average of the expected default percent loss. Use the market value of each position as the weights in your weighted average Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started