please answer all exercises listed in the picutres. The last 2 pictures go together for one question.

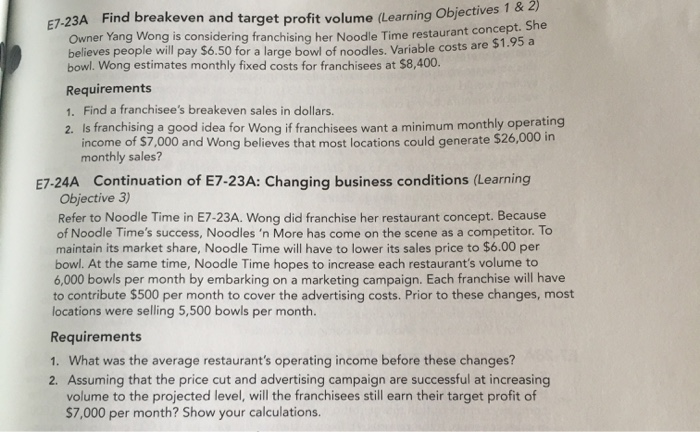

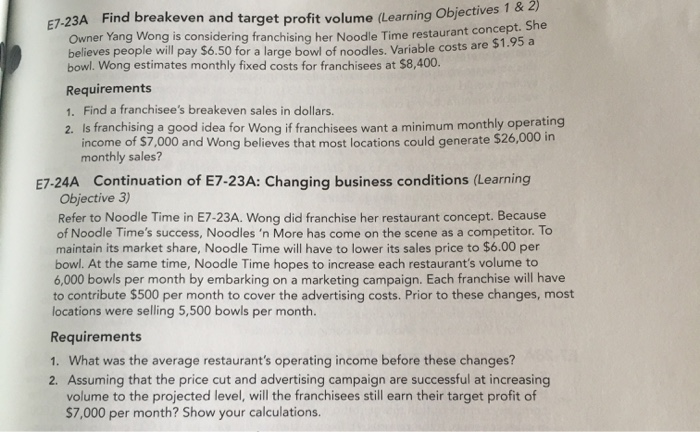

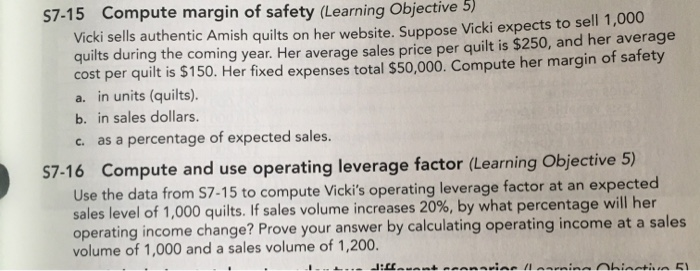

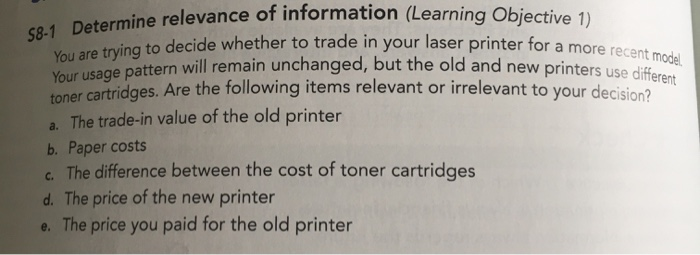

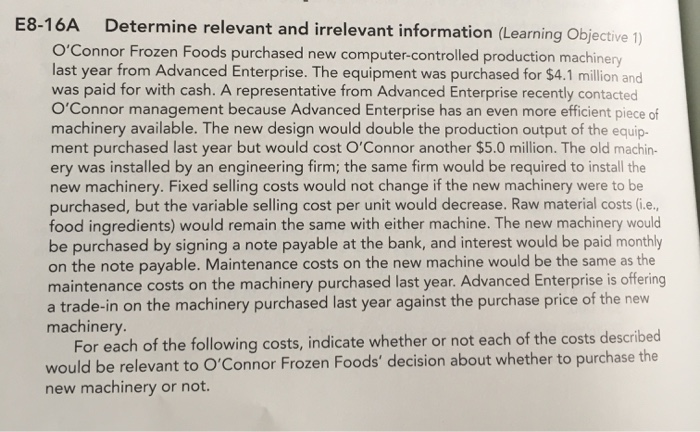

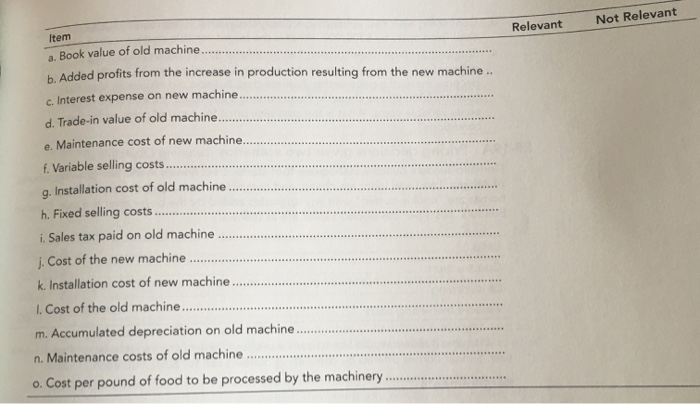

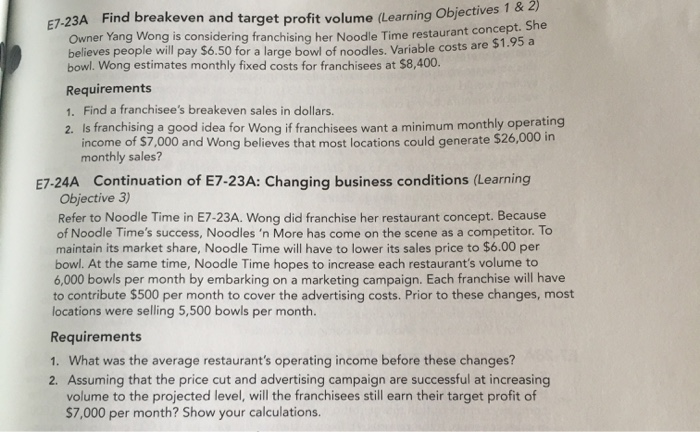

e (Learning Objectives 1 & 2) 57-23A Find breakeven and target profit volume (Learning Object Owner Yang Wong is considering franchising her Noodle Time restaurant concept. She believes people will pay $6.50 for a large bowl of noodles. Variable costs are > bowl. Wong estimates monthly fixed costs for franchisees at $8,400. Requirements 1. Find a franchisee's breakeven sales in dollars. 2. Is franchising a good idea for Wong if franchisees want a minimum monthly operating income of $7,000 and Wong believes that most locations could generate $26,000 in monthly sales? E7-24A Continuation of E7-23A: Changing business conditions (Learning Objective 3) Refer to Noodle Time in E7-23A. Wong did franchise her restaurant concept. Because of Noodle Time's success, Noodles 'n More has come on the scene as a competitor lo maintain its market share, Noodle Time will have to lower its sales price to $6.00 per bowl. At the same time, Noodle Time hopes to increase each restaurant's volume to 6,000 bowls per month by embarking on a marketing campaign. Each franchise will have to contribute $500 per month to cover the advertising costs. Prior to these changes, most locations were selling 5,500 bowls per month. Requirements 1. What was the average restaurant's operating income before these changes? 2. Assuming that the price cut and advertising campaign are successful at increasing volume to the projected level, will the franchisees still earn their target profit of $7,000 per month? Show your calculations. S7-15 Compute margin of safety (Learning Objective 5) Vicki sells authentic Amish quilts on her website. Suppose Vicki expects to sell , quilts during the coming year. Her average sales price per quilt is $250, and her average cost per quilt is $150. Her fixed expenses total $50,000. Compute her margin of safety a. in units (quilts). b. in sales dollars. c. as a percentage of expected sales. 57-16 Compute and use operating leverage factor (Learning Objective 5) Use the data from S7-15 to compute Vicki's operating leverage factor at an expected sales level of 1,000 quilts. If sales volume increases 20%, by what percentage will her operating income change? Prove your answer by calculating operating income at a sales volume of 1,000 and a sales volume of 1,200. IL 58-1 Determine relevance of info ine relevance of information (Learning Objective 1) You are trying to decide whether to trade in your laser printer for a more our laser printer for a more recent model new printers use different Your usage pattern will remain unchanged dges. Are the following items relevant or irrelevant to your decision? a. The trade-in value of the old printer b. Paper costs c. The difference between the cost of toner cartridges d. The price of the new printer e. The price you paid for the old printer E8-16A Determine relevant and irrelevant information (Learning Objective 1) O'Connor Frozen Foods purchased new computer-controlled production machinery last year from Advanced Enterprise. The equipment was purchased for $4.1 million and was paid for with cash. A representative from Advanced Enterprise recently contacted O'Connor management because Advanced Enterprise has an even more efficient piece of machinery available. The new design would double the production output of the equip- ment purchased last year but would cost O'Connor another $5.0 million. The old machin- ery was installed by an engineering firm; the same firm would be required to install the new machinery. Fixed selling costs would not change if the new machinery were to be purchased, but the variable selling cost per unit would decrease. Raw material costs (.e. food ingredients) would remain the same with either machine. The new machinery would be purchased by signing a note payable at the bank, and interest would be paid monthly on the note payable. Maintenance costs on the new machine would be the same as the maintenance costs on the machinery purchased last year. Advanced Enterprise is offering a trade-in on the machinery purchased last year against the purchase price of the new machinery. For each of the following costs, indicate whether or not each of the costs described would be relevant to O'Connor Frozen Foods' decision about whether to purchase the new machinery or not. Relevant Not Relevant Item a. Book value of old machine...... b. Added profits from the increase in production resulting from the new machine.. c. Interest expense on new machine. d. Trade-in value of old machine... ......... ... ........... e. Maintenance cost of new machine.......... f. Variable selling costs.......... g. Installation cost of old machine........... h. Fixed selling costs i. Sales tax paid on old machine ..... j. Cost of the new machine ....... k. Installation cost of new machine ..... 1. Cost of the old machine....... m. Accumulated depreciation on old machine ..... n. Maintenance costs of old machine .............. o. Cost per pound of food to be processed by the machinery