Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all for like questions 1. questions 2. To add to his growing chain of grocery stores, on January 1, 2016. Danny Marks bought

please answer all for like

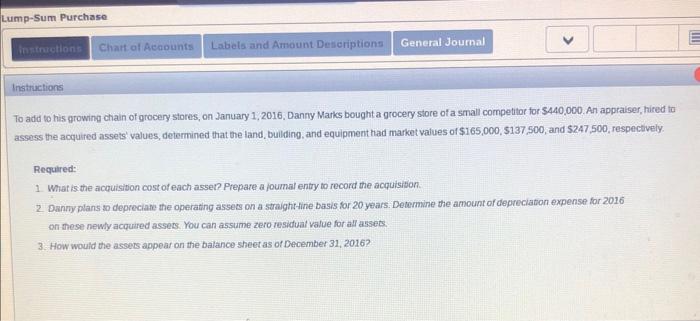

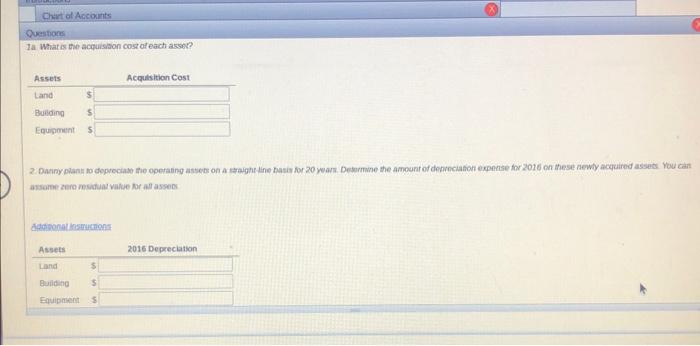

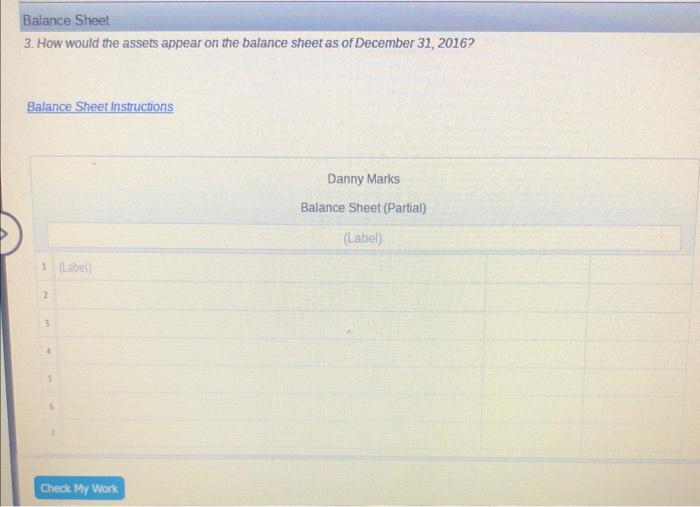

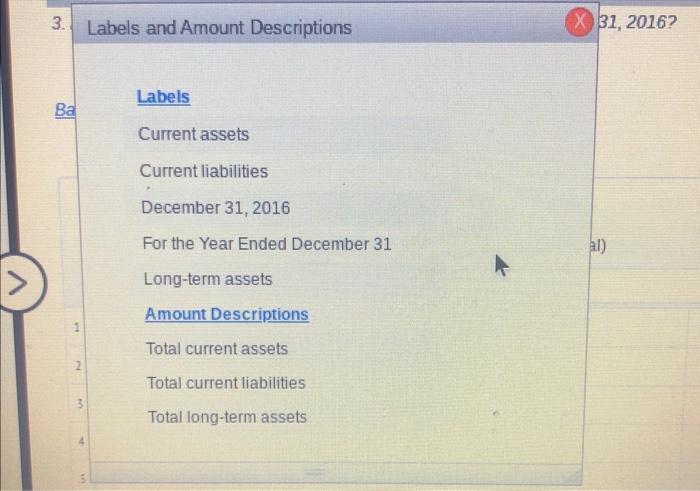

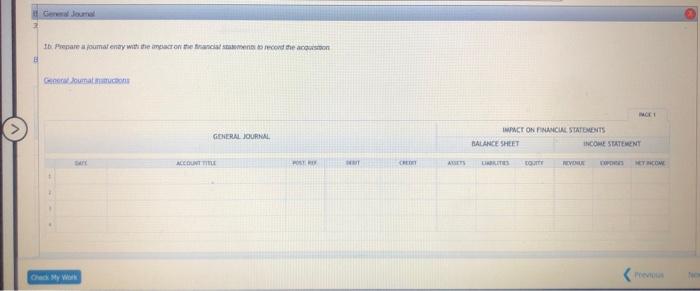

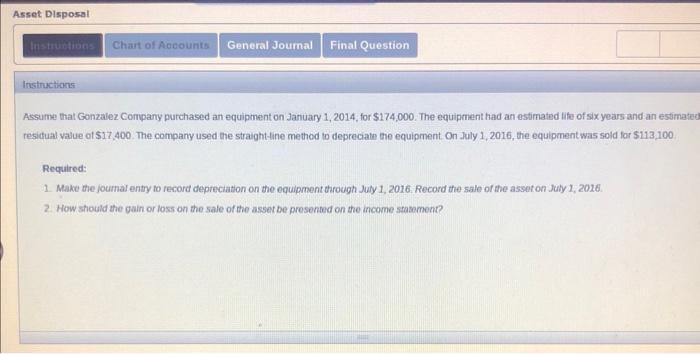

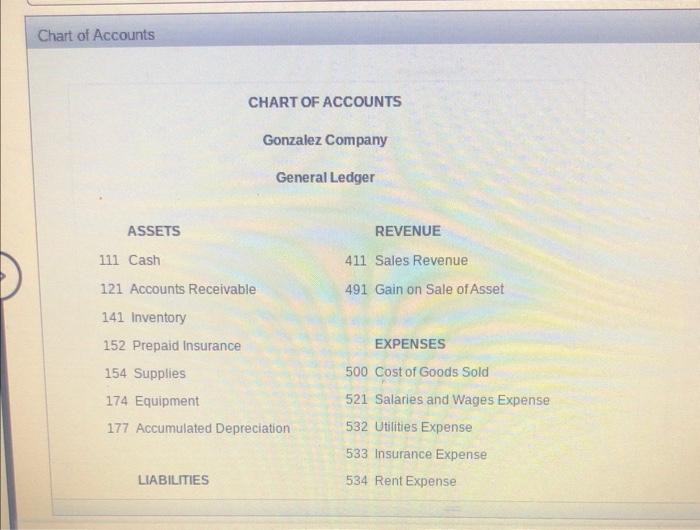

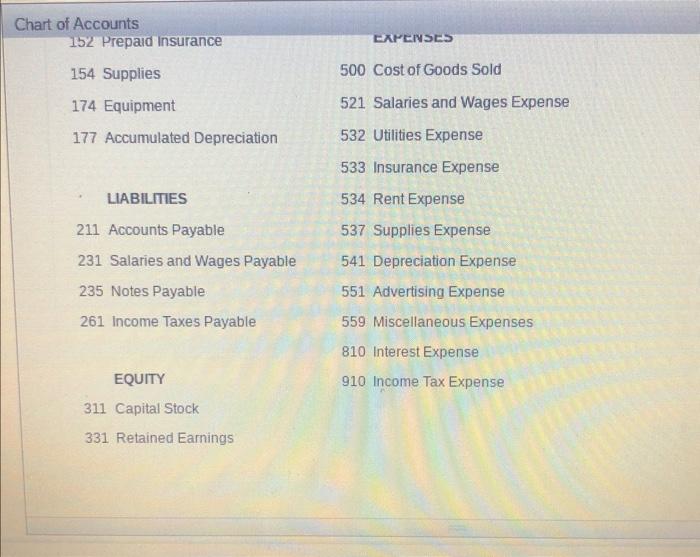

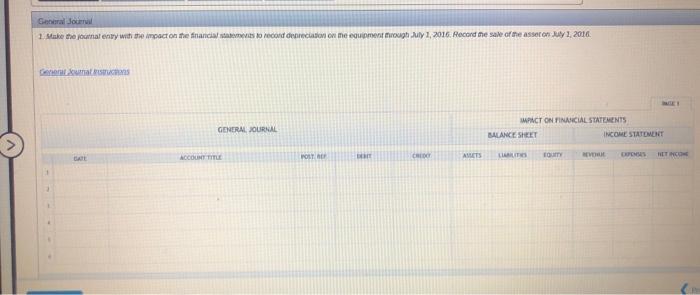

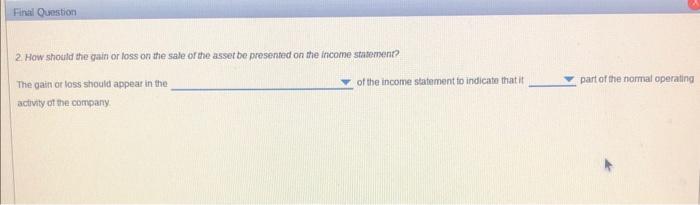

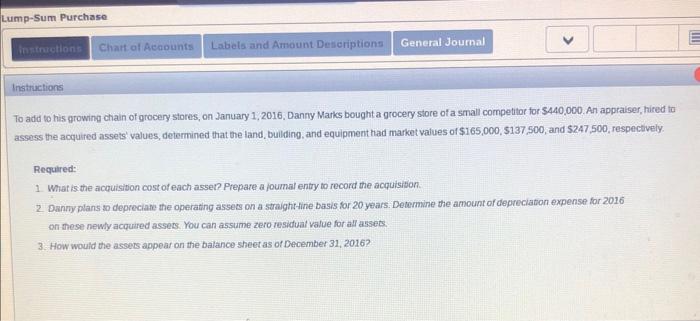

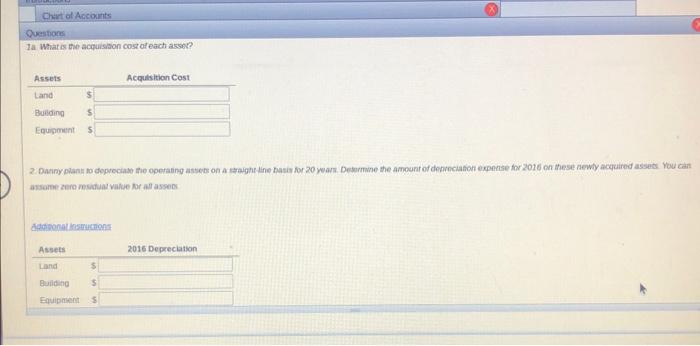

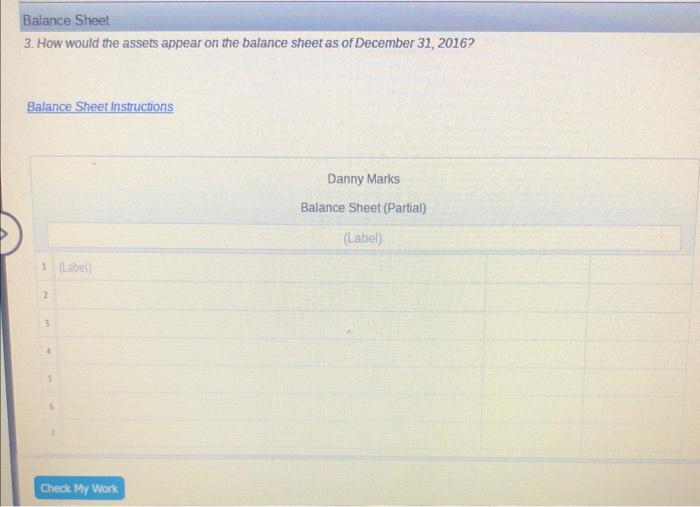

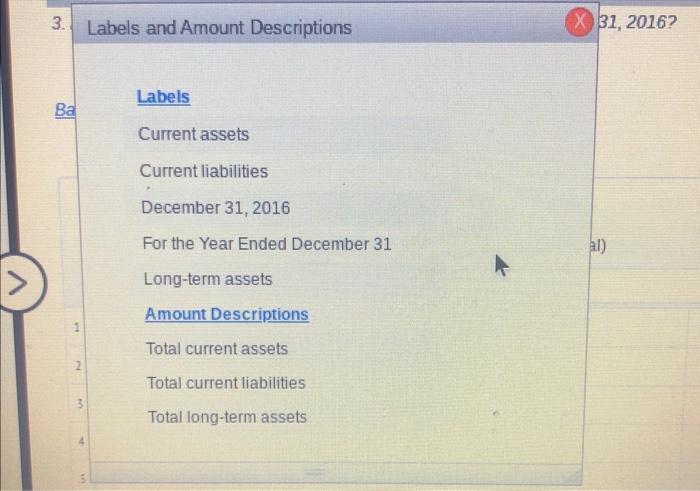

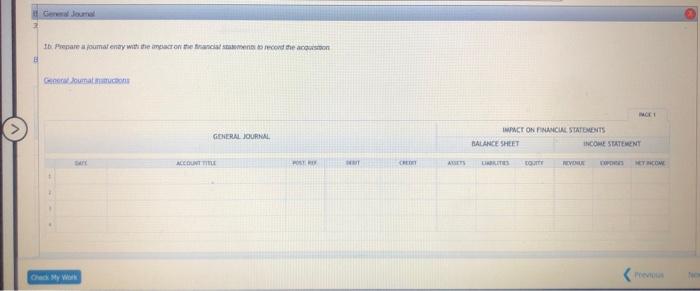

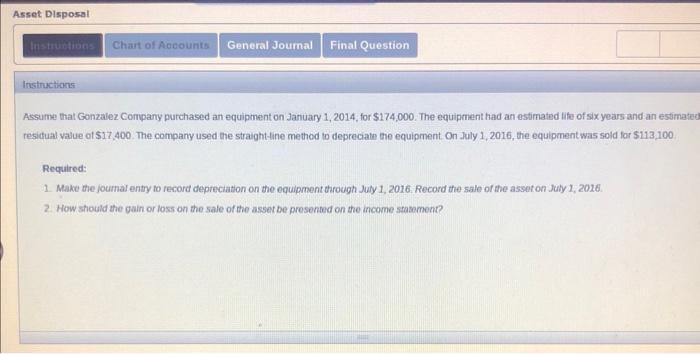

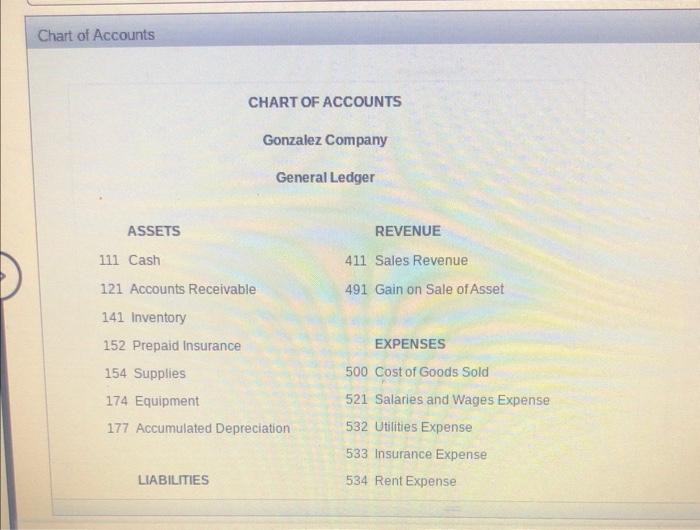

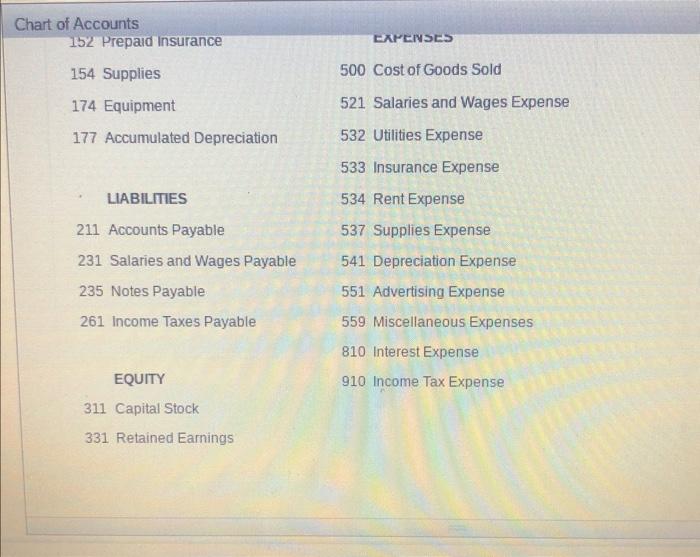

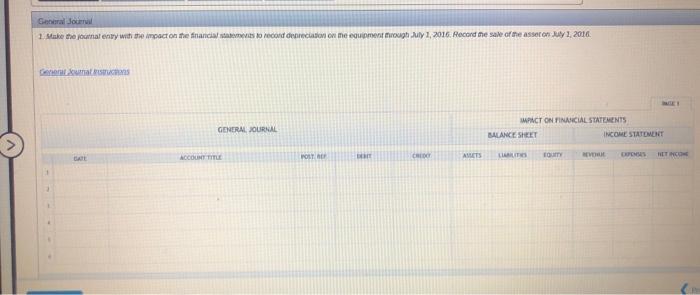

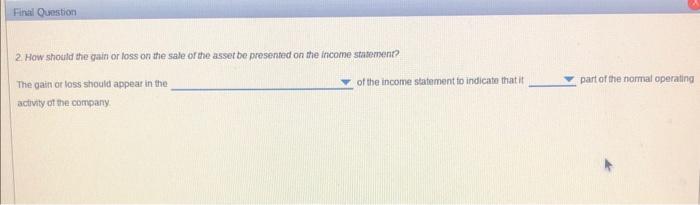

To add to his growing chain of grocery stores, on January 1, 2016. Danny Marks bought a grocery store of a small competitor for $440,000. An appraiser, hired to assess the acquired assets' values, determined that the land, building, and equipment had market values of $165,000,$137,500, and $247,500, respectively. Required: 1. What is the accuisition cost of each asset? Prepare a joumal entry to record the acquisision. 2. Danny flans to depreciate the operating asserg on a straght-fine basis for 20 years. Detimine the amount of depreciation expense for 2016 on these newty acquired assets. You can assume zero residual vatue for all assets. 3. How would the assers appear on the balance sheet as of December 31, 2016? 1a. What is the aceuisation cost of each assor? assarn zere msidual value for an assed difdional insmutnons 3. How would the assets appear on the balance sheet as of December 31,2016? Labels and Amount Descriptions Cenerat doumat in mucopnt Assume that Gonzalez Company purchased ant equipinent on January 1,2014 , for $174,000. The equipment had an estimated life of six years and an esdimated residual value of $17,400. The company used the straight-line method to depreciatn the equipment. On July 1,2016 , the equipment was sold for 5113,100 . Requiredt 1. Make the journal entry to record depreciation on the equipment through July 1, 2016. Record the sale of the asset on July 1, 2016. 2. How should the guin or loss on the sale of the asset be presented on the inceme stasement? Chart of Accounts CHART OF ACCOUNTS Gonzalez Company General Ledger ASSETS REVENUE 111 Cash 411 Sales Revenue 121 Accounts Receivable 491 Gain on Sale of Asset 141 Inventory 152 Prepaid Insurance EXPENSES 154 Supplies 500 Cost of Goods Sold 174 Equipment 521 Salaries and Wages Expense 177 Accumulated Depreciation 532 Utilities Expense 533 Insurance Expense LIABILTIES 534 Rent Expense Chart of Accounts 152 Prepald insurance 154 Supplies 500 Cost of Goods Sold 174 Equipment 521 Salaries and Wages Expense 177 Accumulated Depreciation 532 Utilities Expense 533 Insurance Expense - LIABILITES 534 Rent Expense 211 Accounts Payable 537 Supplies Expense 231 Salaries and Wages Payable 541 Depreciation Expense 235 Notes Payable 551 Advertising Expense 261 Income Taxes Payable 559 Miscellaneous Expenses 810 Interest Expense EQUITY 910 Income Tax Expense 311 Capital Stock 331 Retained Earnings Eiverat kumiat ersmivitings 2. How should the gain or loss on the sale of the asset be presented on the income statment? The gain or loss should appear in the activity of the company questions 1.

questions 2.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started