Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all for thumbs up Ang Enterprises has a levered beta of 1, its capital structure consists of 40% debt and 60% equity, and

please answer all for thumbs up

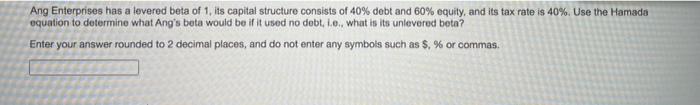

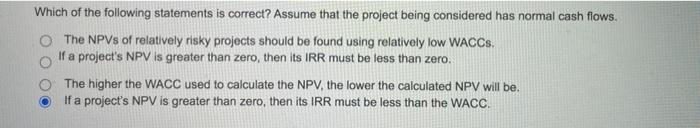

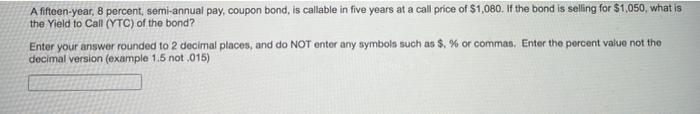

Ang Enterprises has a levered beta of 1, its capital structure consists of 40% debt and 60% equity, and its tax rate is 40%. Use the Hamada equation to determine what Ang's beta would be if it used no dobt, L.o.what is its unlevered bota? Enter your answer rounded to 2 decimal places, and do not enter any symbols such as $, % or commas. Which of the following statements is correct? Assume that the project being considered has normal cash flows. The NPVs of relatively risky projects should be found using relatively low WACCS. If a project's NPV is greater than zero, then its IRR must be less than zero. The higher the WACC used to calculate the NPV, the lower the calculated NPV will be If a project's NPV is greater than zero, then its IRR must be less than the WACC A fifteen year, 8 percent, semi-annual pay, coupon bond, is callable in five years at a call price of $1,080. If the bond is selling for $1,050, what is the Yield to Call (YTC) of the bond? Enter your answer rounded to 2 decimal places, and do NOT enter any symbols such as $, % or comman, Enter the percent value not the decimal version (example 1.5 not.015) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started