Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer ALL four questions thx Question The current price of one share of RJC stock is 97.70. A call option on RJC stock with

please answer ALL four questions thx

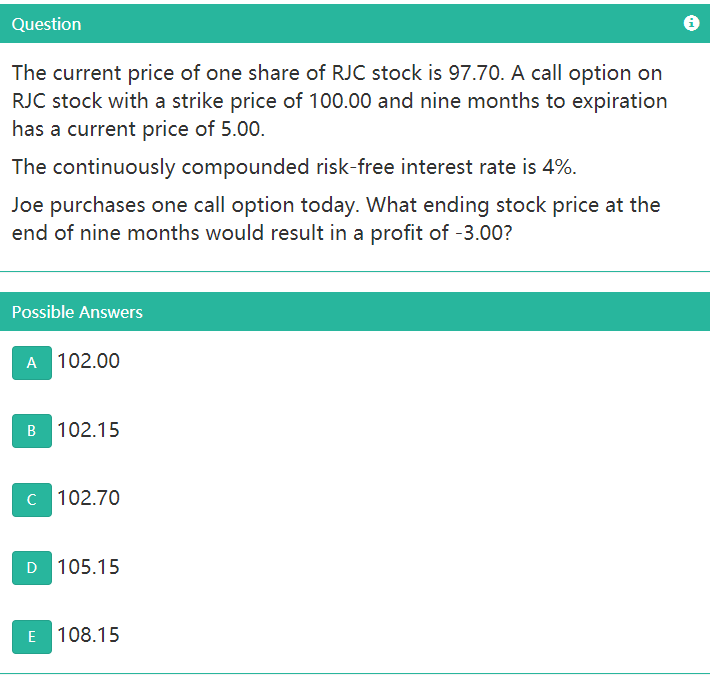

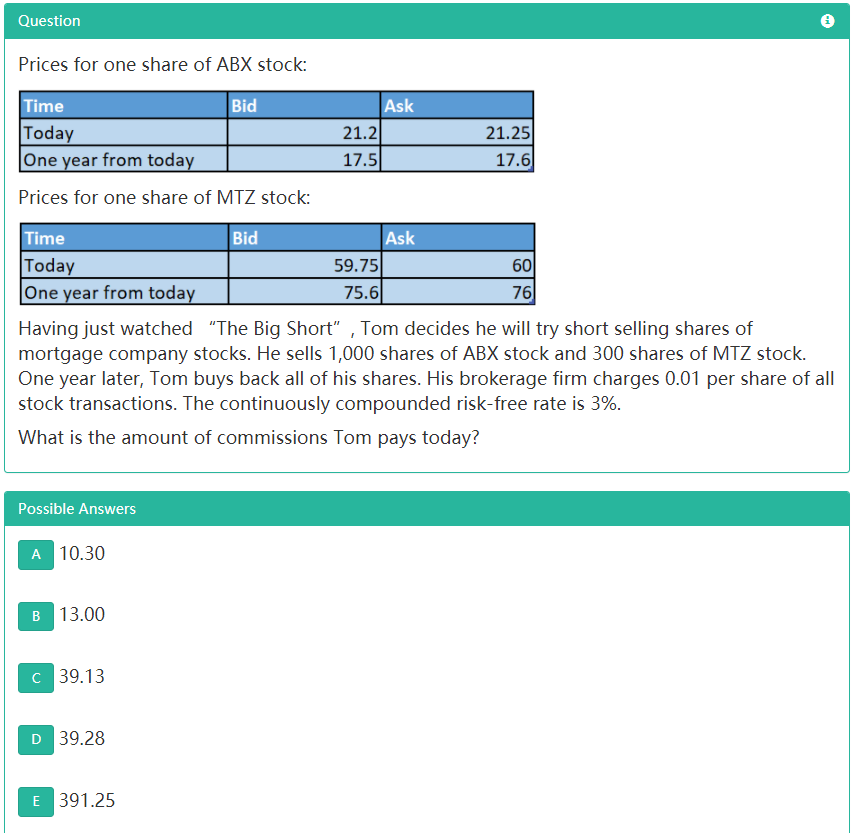

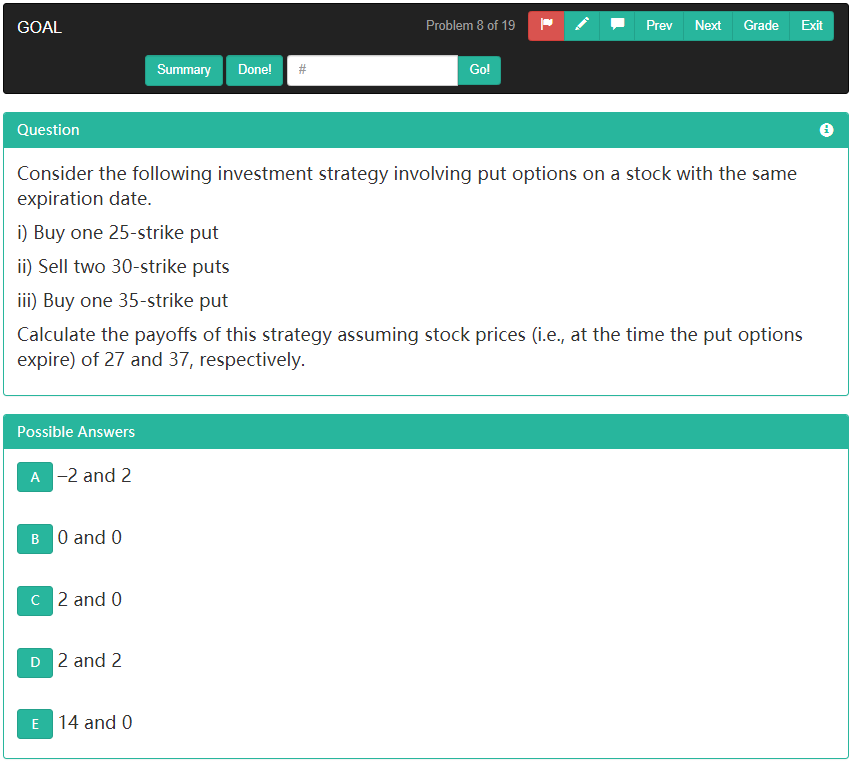

Question The current price of one share of RJC stock is 97.70. A call option on RJC stock with a strike price of 100.00 and nine months to expiration has a current price of 5.00. The continuously compounded risk-free interest rate is 4%. Joe purchases one call option today. What ending stock price at the end of nine months would result in a profit of -3.00? Possible Answers A 102.00 B 102.15 C 102.70 D 105.15 E 108.15 Question Prices for one share of ABX stock: Time Bid Today One year from today Prices for one share of MTZ stock: Ask 21.21 17.5 21.251 17.6 Time Bid Ask Today 59.75 60 One year from today 75.6 76 Having just watched The Big Short" , Tom decides he will try short selling shares of mortgage company stocks. He sells 1,000 shares of ABX stock and 300 shares of MTZ stock. One year later, Tom buys back all of his shares. His brokerage firm charges 0.01 per share of all stock transactions. The continuously compounded risk-free rate is 3%. What is the amount of commissions Tom pays today? Possible Answers A 10.30 B 13.00 C 39.13 D 39.28 E 391.25 Question Suppose that stock X is currently priced at 30 per share and the company has announced that it is going to pay a dividend of 0.3 per share after 1 month. You short-sell 50 shares of stock X. After 3 months, you cover the short position when the stock price is 33.3. Calculate the 3-month profit, assuming a continuously compounded risk-free rate of 5%. Possible Answers A 180 B 161 C -180 D-161 E-129 GOAL Problem 8 of 19 Prev Next Grade Exit Summary Done! Go! Question Consider the following investment strategy involving put options on a stock with the same expiration date. i) Buy one 25-strike put ii) Sell two 30-strike puts iii) Buy one 35-strike put Calculate the payoffs of this strategy assuming stock prices (i.e., at the time the put options expire) of 27 and 37, respectively. Possible Answers A-2 and 2 B 0 and 0 c2 and 0 D 2 and 2 E 14 and 0Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started