Please answer all

Please answer all

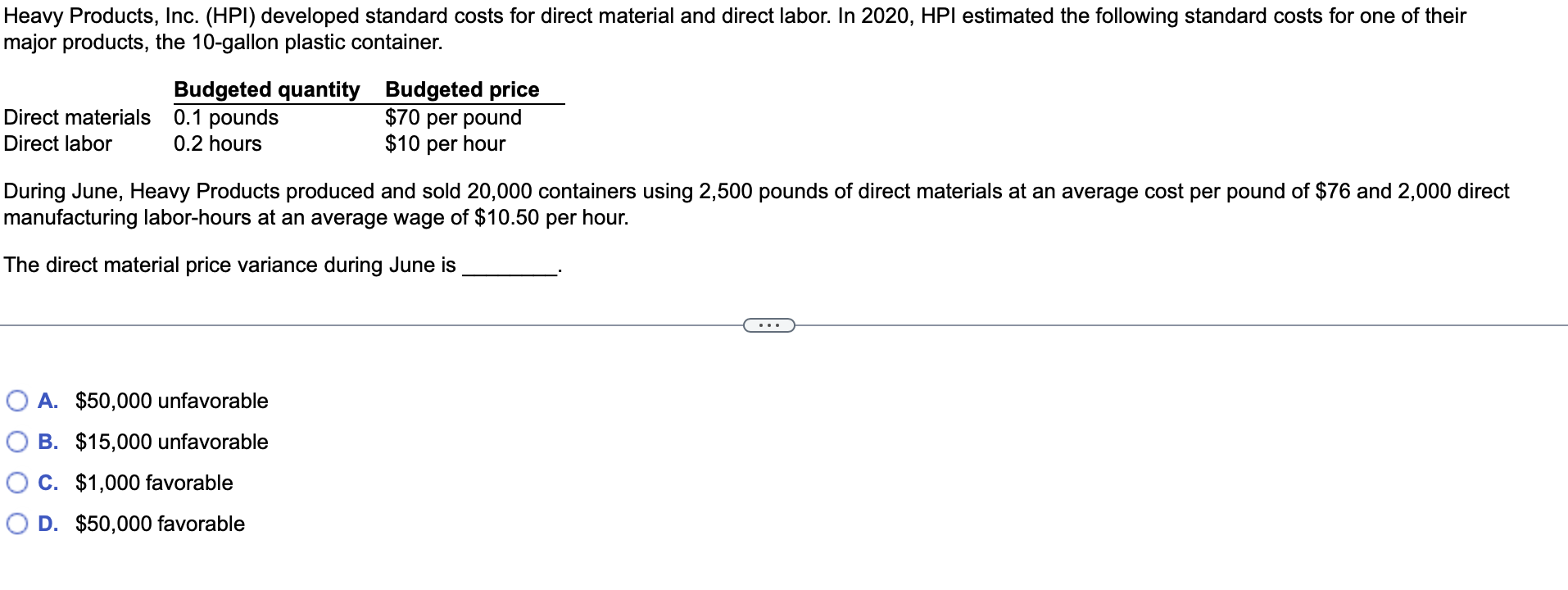

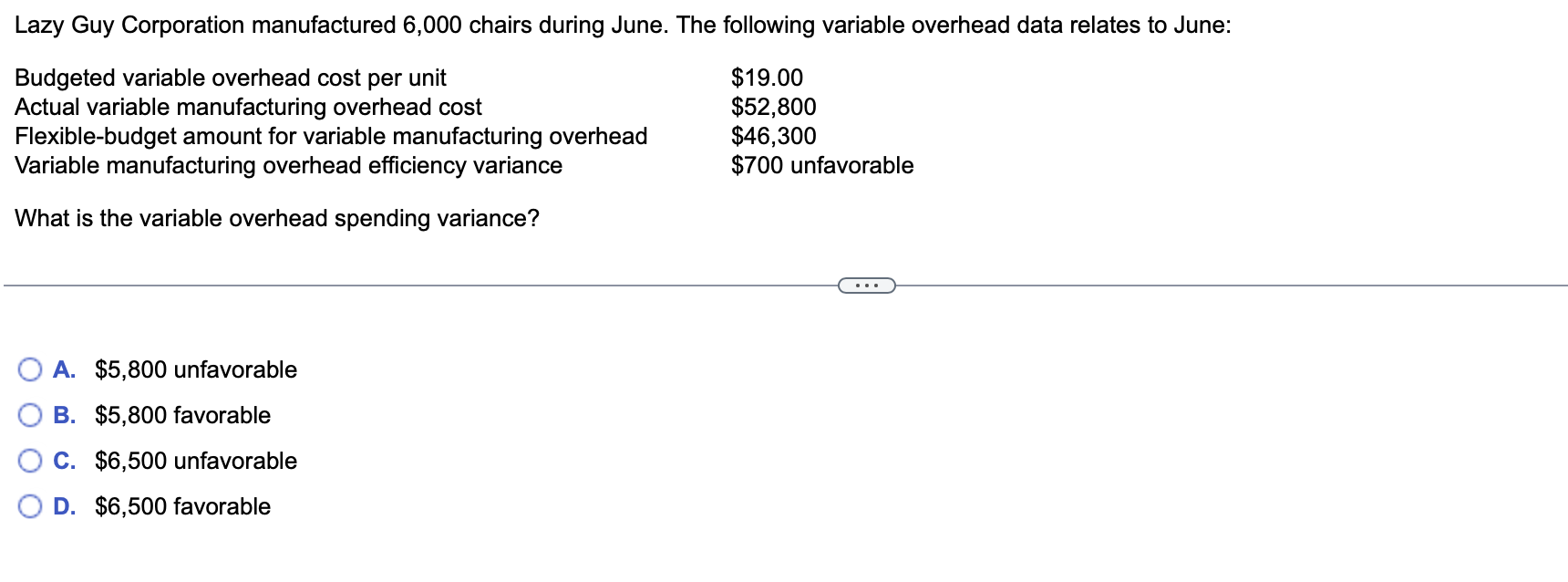

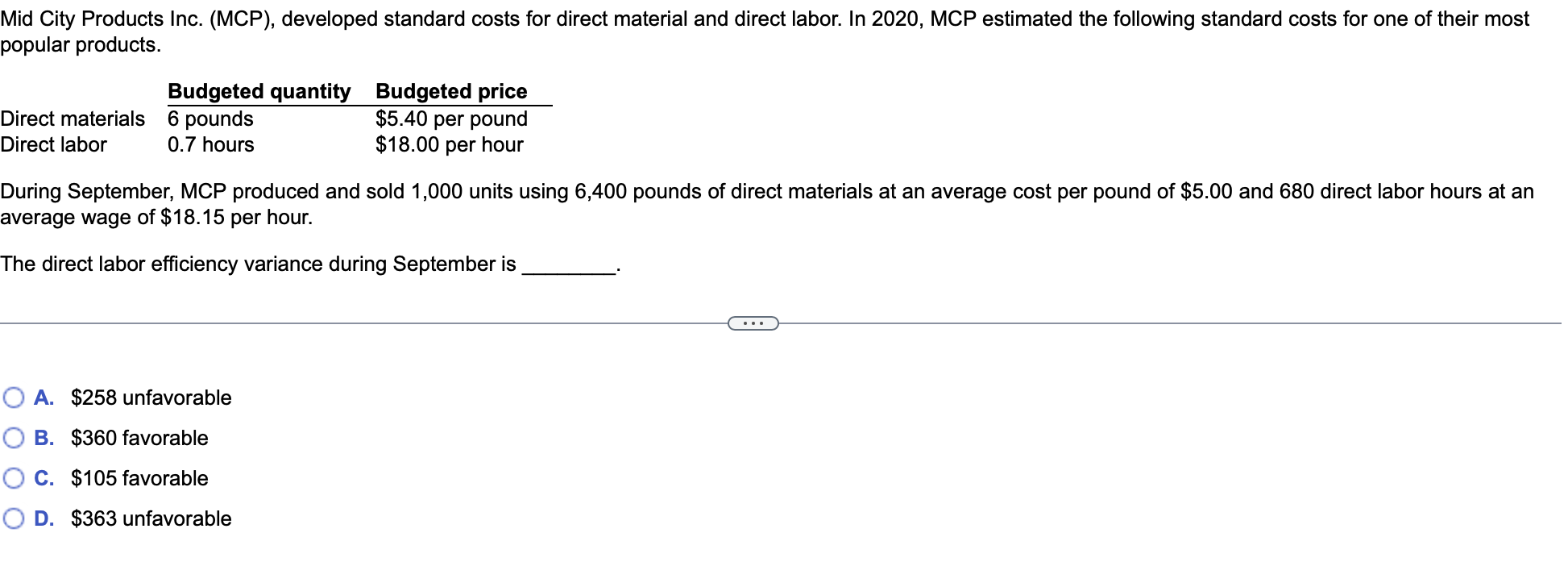

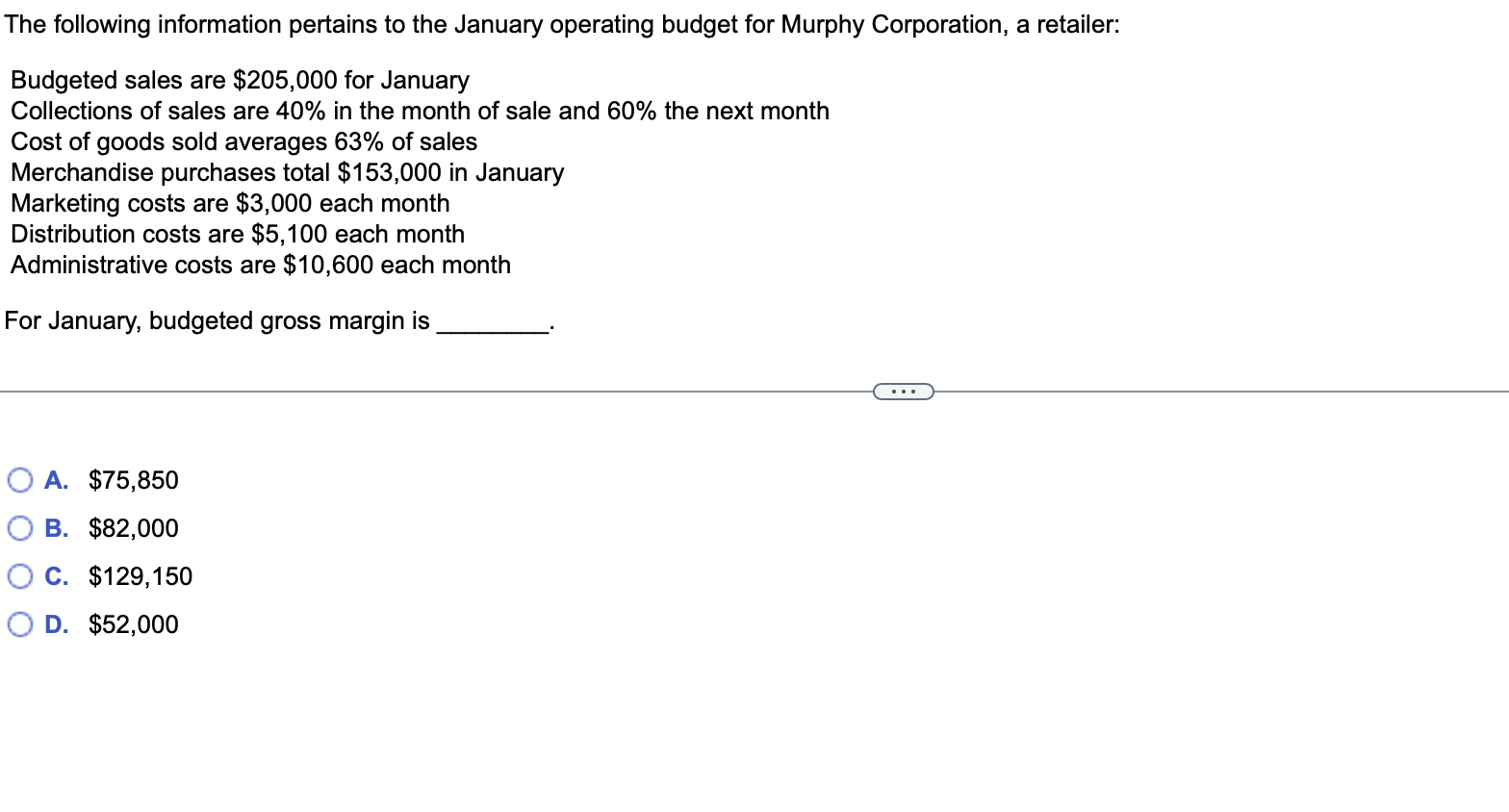

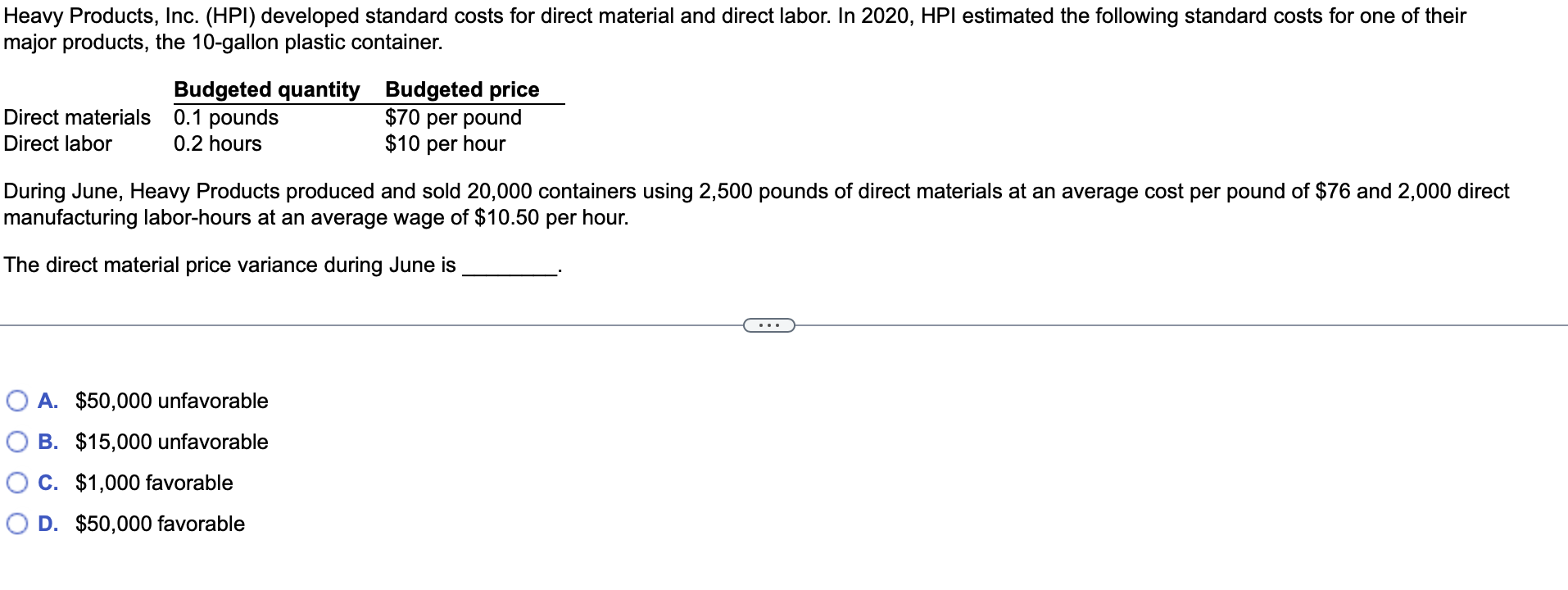

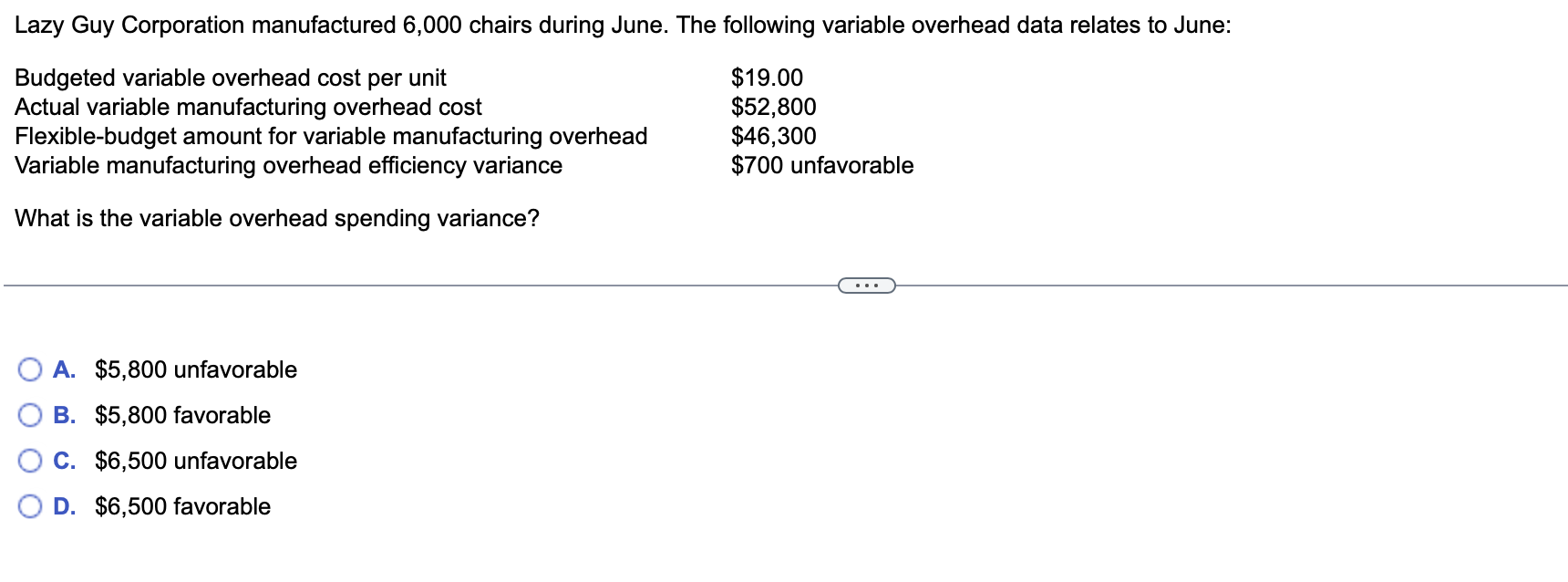

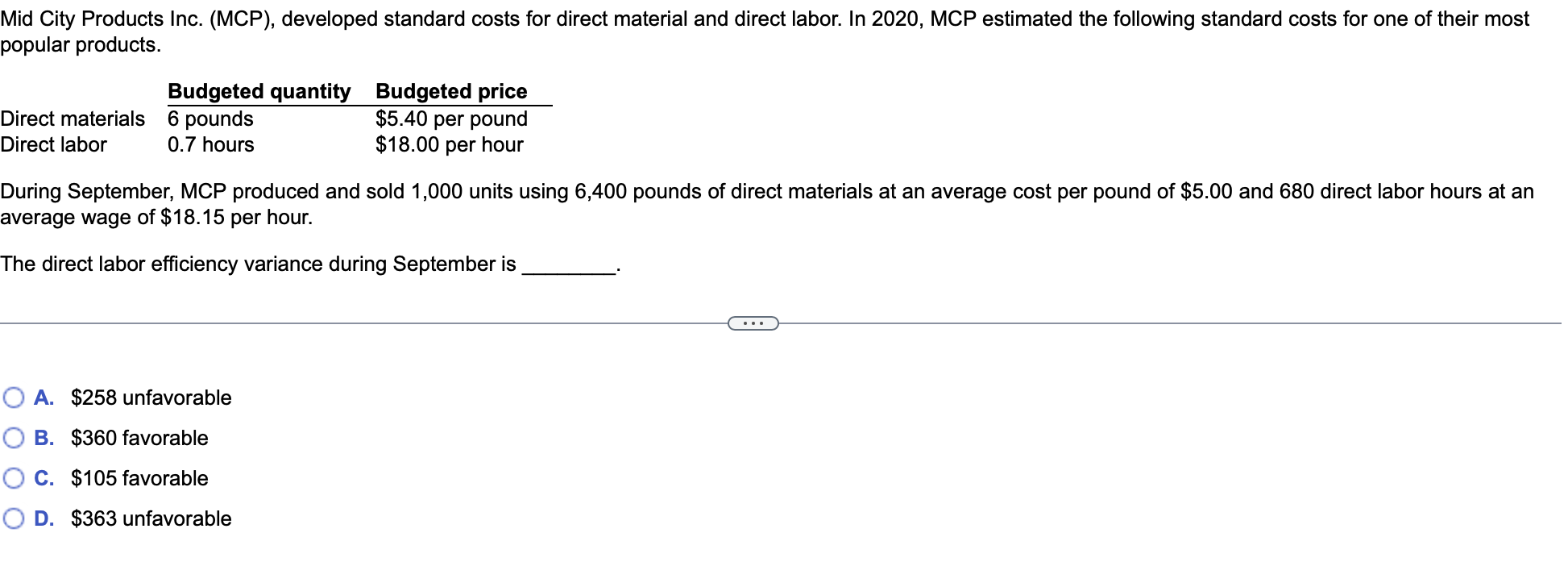

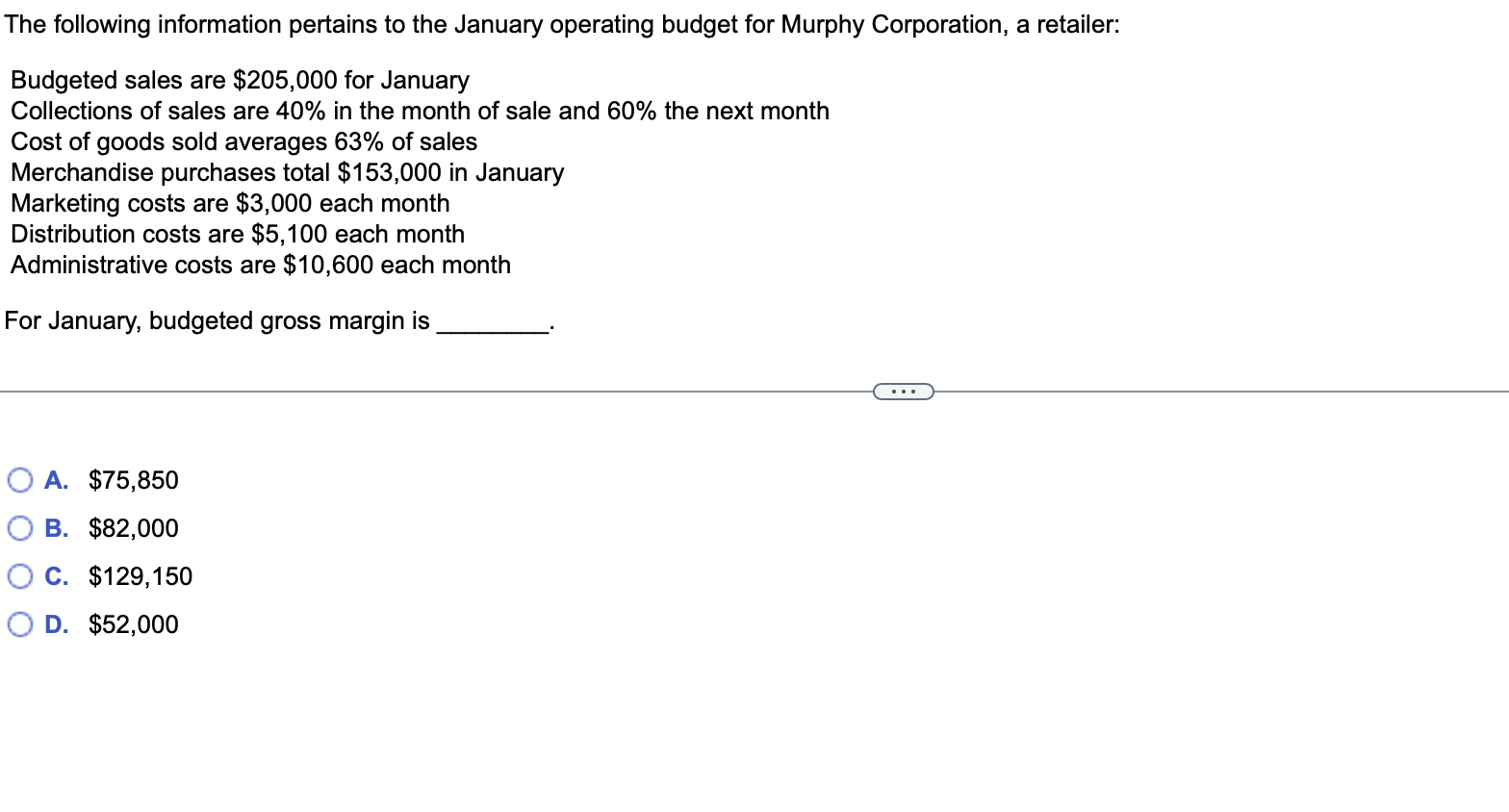

Heavy Products, Inc. (HPI) developed standard costs for direct material and direct labor. In 2020, HPI estimated the following standard costs for one of their major products, the 10-gallon plastic container. Budgeted quantity Budgeted price $70 per pound Direct materials Direct labor 0.1 pounds 0.2 hours $10 per hour During June, Heavy Products produced and sold 20,000 containers using 2,500 pounds of direct materials at an average cost per pound of $76 and 2,000 direct manufacturing labor-hours at an average wage of $10.50 per hour. The direct material price variance during June is A. $50,000 unfavorable B. $15,000 unfavorable C. $1,000 favorable O D. $50,000 favorable Lazy Guy Corporation manufactured 6,000 chairs during June. The following variable overhead data relates to June: $19.00 $52,800 Budgeted variable overhead cost per unit Actual variable manufacturing overhead cost Flexible-budget amount for variable manufacturing overhead Variable manufacturing overhead efficiency variance $46,300 $700 unfavorable What is the variable overhead spending variance? A. $5,800 unfavorable B. $5,800 favorable C. $6,500 unfavorable D. $6,500 favorable Mid City Products Inc. (MCP), developed standard costs for direct material and direct labor. In 2020, MCP estimated the following standard costs for one of their most popular products. Budgeted quantity Budgeted price $5.40 per pound Direct materials 6 pounds Direct labor 0.7 hours $18.00 per hour During September, MCP produced and sold 1,000 units using 6,400 pounds of direct materials at an average cost per pound of $5.00 and 680 direct labor hours at an average wage of $18.15 per hour. The direct labor efficiency variance during September is OA. $258 unfavorable O B. $360 favorable O C. $105 favorable D. $363 unfavorable The following information pertains to the January operating budget for Murphy Corporation, a retailer: Budgeted sales are $205,000 for January Collections of sales are 40% in the month of sale and 60% the next month Cost of goods sold averages 63% of sales Merchandise purchases total $153,000 in January Marketing costs are $3,000 each month Distribution costs are $5,100 each month Administrative costs are $10,600 each month For January, budgeted gross margin is A. $75,850 B. $82,000 C. $129,150 D. $52,000

Please answer all

Please answer all