Answered step by step

Verified Expert Solution

Question

1 Approved Answer

15) Which of the following typically applies to common stock but not to preferred stock? A) par value B) dividend yield C) legally considered

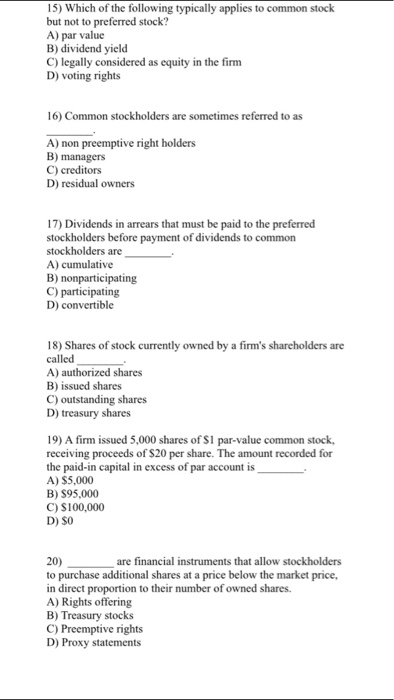

15) Which of the following typically applies to common stock but not to preferred stock? A) par value B) dividend yield C) legally considered as equity in the firm D) voting rights 16) Common stockholders are sometimes referred to as A) non preemptive right holders B) managers C) creditors D) residual owners 17) Dividends in arrears that must be paid to the preferred stockholders before payment of dividends to common stockholders are A) cumulative B) nonparticipating C) participating D) convertible 18) Shares of stock currently owned by a firm's shareholders are called A) authorized shares B) issued shares C) outstanding shares D) treasury shares 19) A firm issued 5,000 shares of $1 par-value common stock, receiving proceeds of $20 per share. The amount recorded for the paid-in capital in excess of par account is A) $5,000 B) $95,000 C) $100,000 D) $0 20) are financial instruments that allow stockholders to purchase additional shares at a price below the market price, in direct proportion to their number of owned shares. A) Rights offering B) Treasury stocks C) Preemptive rights D) Proxy statements

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below 15 D Voting rights Common stock typical...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started