Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all, i will thumbs up for that 6. Nantucket Corporation produces and sells a single product. Data concerning that product appear below: The

please answer all, i will thumbs up for that

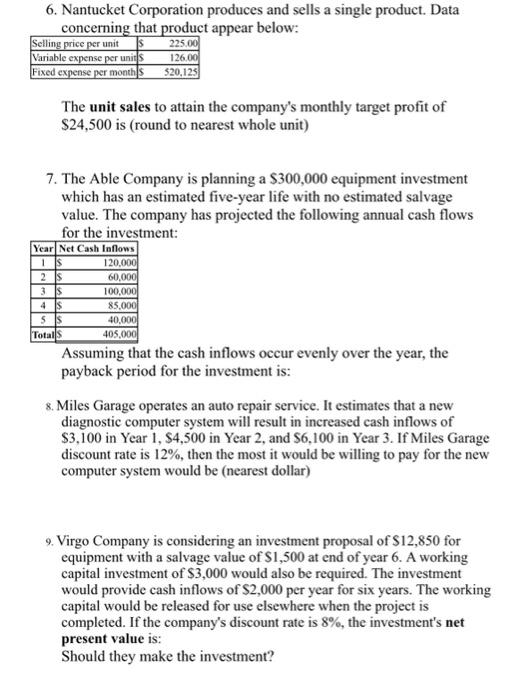

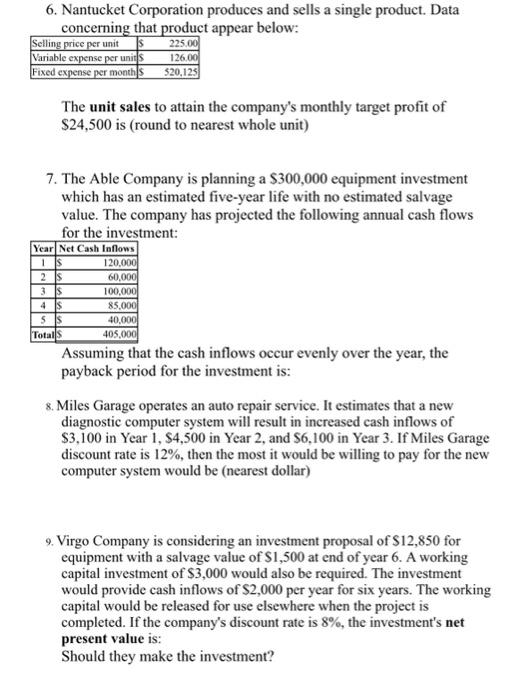

6. Nantucket Corporation produces and sells a single product. Data concerning that product appear below: The unit sales to attain the company's monthly target profit of $24,500 is (round to nearest whole unit) 7. The Able Company is planning a $300,000 equipment investment which has an estimated five-year life with no estimated salvage value. The company has projected the following annual cash flows for the investment: Assuming that the cash inflows occur evenly over the year, the payback period for the investment is: 8. Miles Garage operates an auto repair service. It estimates that a new diagnostic computer system will result in increased cash inflows of $3,100 in Year 1, \$4,500 in Year 2, and \$6,100 in Year 3. If Miles Garage discount rate is 12%, then the most it would be willing to pay for the new computer system would be (nearest dollar) 9. Virgo Company is considering an investment proposal of $12,850 for equipment with a salvage value of $1,500 at end of year 6 . A working capital investment of $3,000 would also be required. The investment would provide cash inflows of $2,000 per year for six years. The working capital would be released for use elsewhere when the project is completed. If the company's discount rate is 8%, the investment's net present value is: Should they make the investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started