Please Answer all incorrect answers.

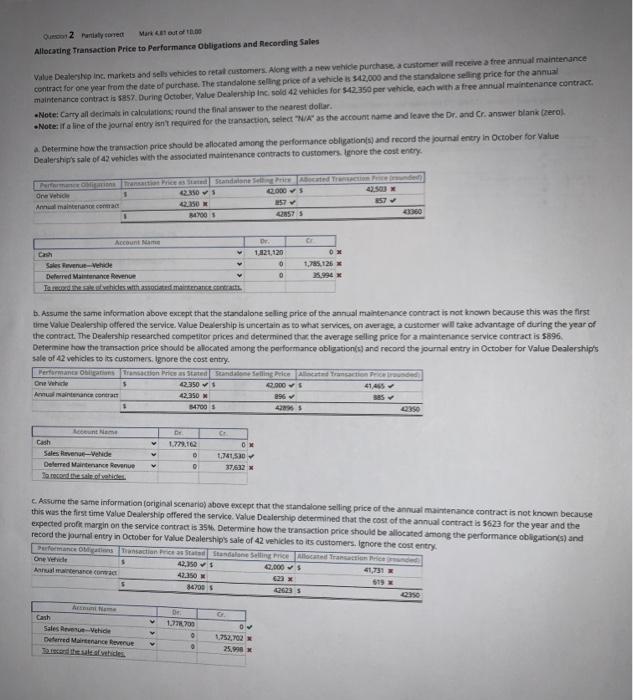

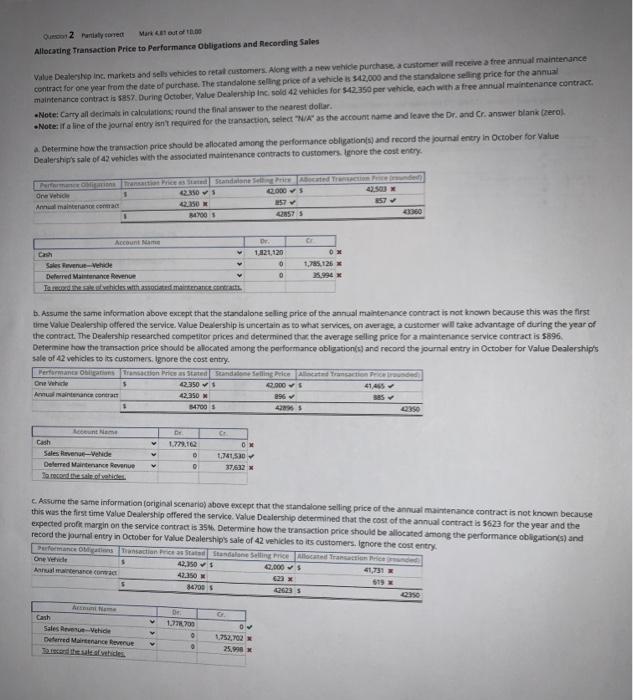

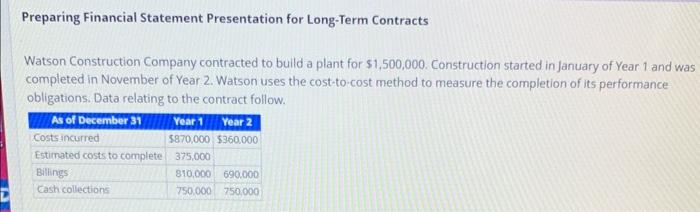

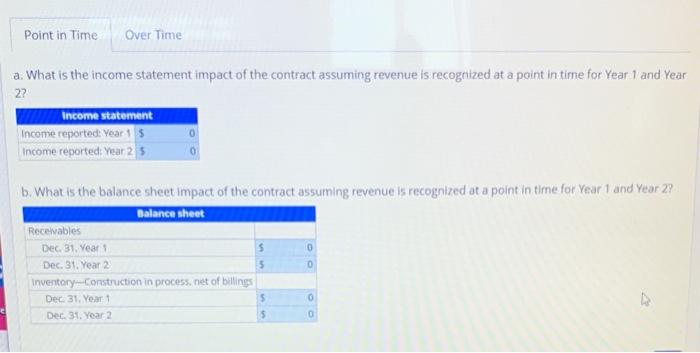

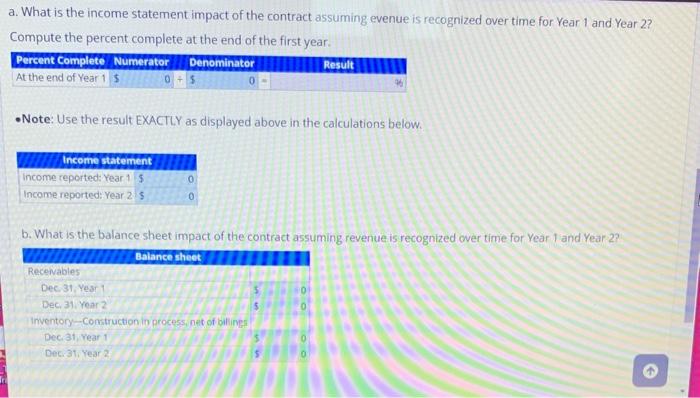

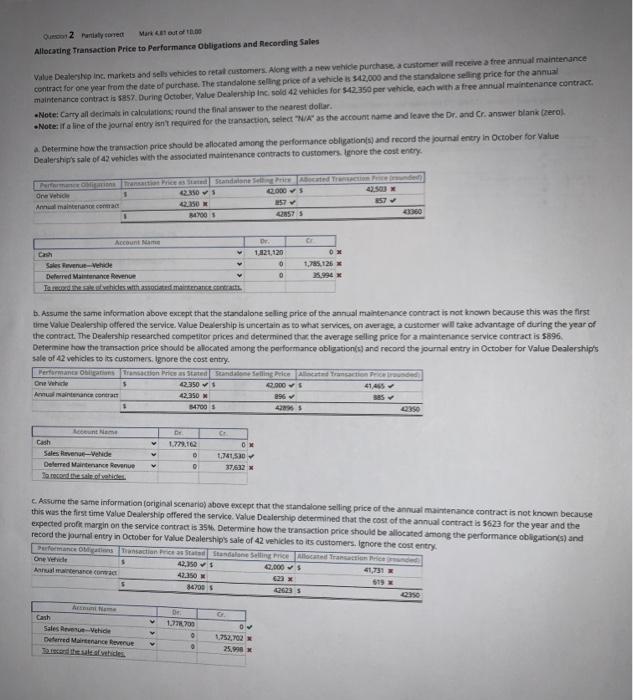

Qursos 2 Paristy tesed Mark kit ast of then Allocating Jransaction Price to Performance Obtigations and Recording Sales Value Dealesho inc. markets and selas vehiches to retal customers. Aong whith a tew vehicle purchase. a cuntomer mill receive a free annual maintenance contract for one year from she date of purchase. The standalone sefling price of a vehicle is 342,000 and the standalone seling price for the annaz maintenance contract ia 8857 . During October, Value Dealership inci sold 42 vehicles for $42.350 per vehicle, each with a free annual imaintenance cegtract. - Note: Carty alf decimalx in calculations round the final answer to the nearest dollar. 4. Determine how the transaction price should be aliscated amang the performance obligationisy and record the journai entry in October for Value Dealersh prs sale of 42 wphicles wi th the associated muintenance contracts to customerk ignore the cost entry. b. Assume the same information above except that the standalone seling price of the annual maintenance contract is not known because this was the first time Value Dealeship offered the service. Value Dealership is uncertain as to what servicen, on aver age, a custorner will tave advantage of during the year ofthe contract. The Dealership researched competitor prices and determined thar the average selling price for a maintenance service contract is Sag6. Oetermine how the transaction price should be alocated among the performance obligationis) and record the joumal entry in October for Value Dealership's sale of 42 vehicles to its customers: Ignore the cost entry. c. Assume the same information (original scenaria) above extept that the standalone selling price of the annual maimtenance contract is not known because this was the first time Value Dealership offered the service. Value Dealership determined that the cost of the annual contract is s623 for the year and the expected proff margin on the service contract is 35%. Determine how the transaction price should be allocated among the performance obligation(s) and retord the pournal entry in October for Value Dealerships sale of 42 vehicles to its customare. Iohnsw whe wa.m. Preparing Financial Statement Presentation for Long-Term Contracts Watson Construction Company contracted to build a plant for \$1,500,000. Construction started in January of Year 1 and was completed in November of Year 2. Watson uses the cost-to-cost method to measure the completion of its performance obligations. Data relating to the contract follow. a. What is the income statement impact of the contract assuming revenue is recognized at a point in time for Year 1 and Year 2? b. What is the balance sheet impact of the contract assuming revenue is recognized at a point in time for Year 1 and Year 2? What is the income statement impact of the contract assuming evenue is recognized over time for Year 1 and Year 2 ? Compute the percent complete at the end of the first year. - Note: Use the result EXACILY as displayed above in the calculations below. b. What is the balance sheet impact of the contract assuming revenue is recognized cver time for Year 1 and Year 2