Please answer all

Please answer all

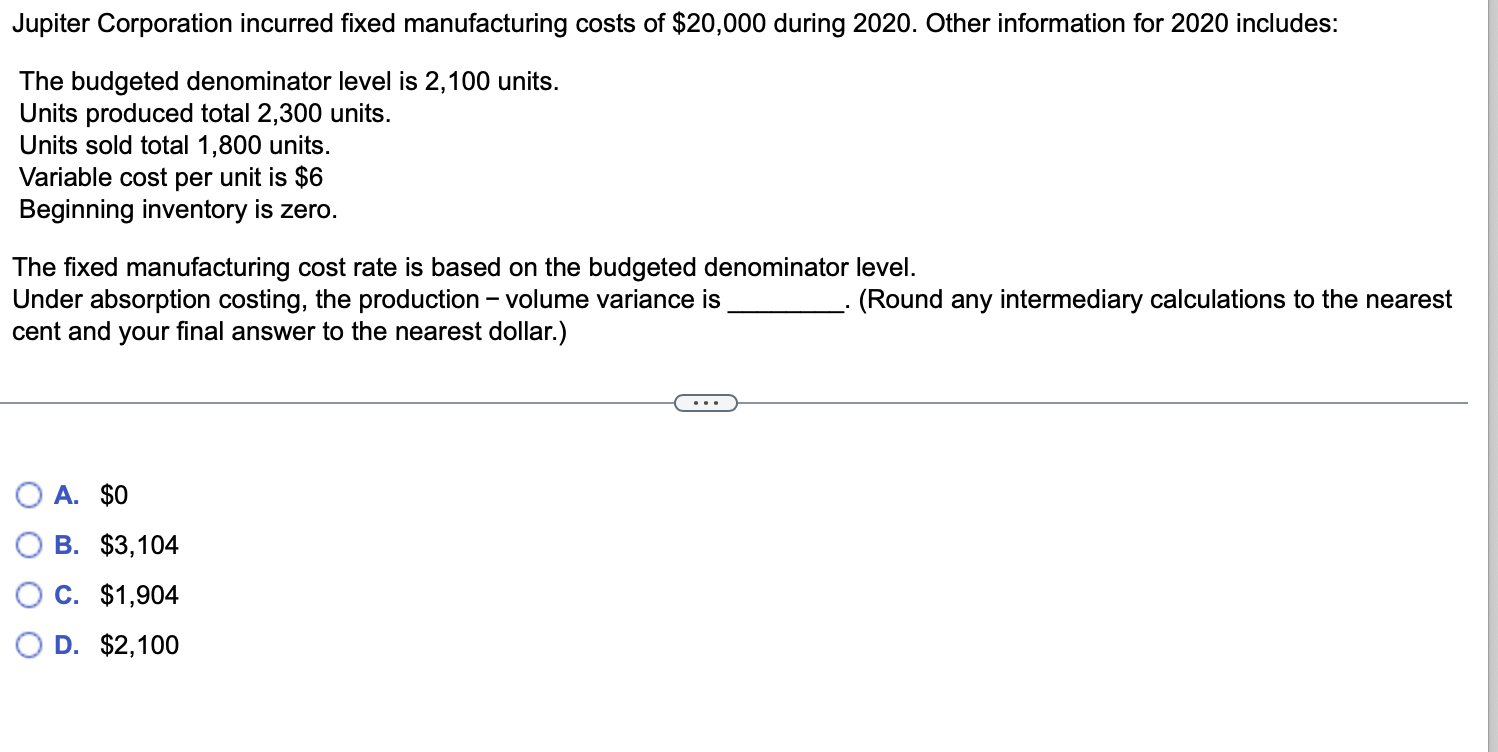

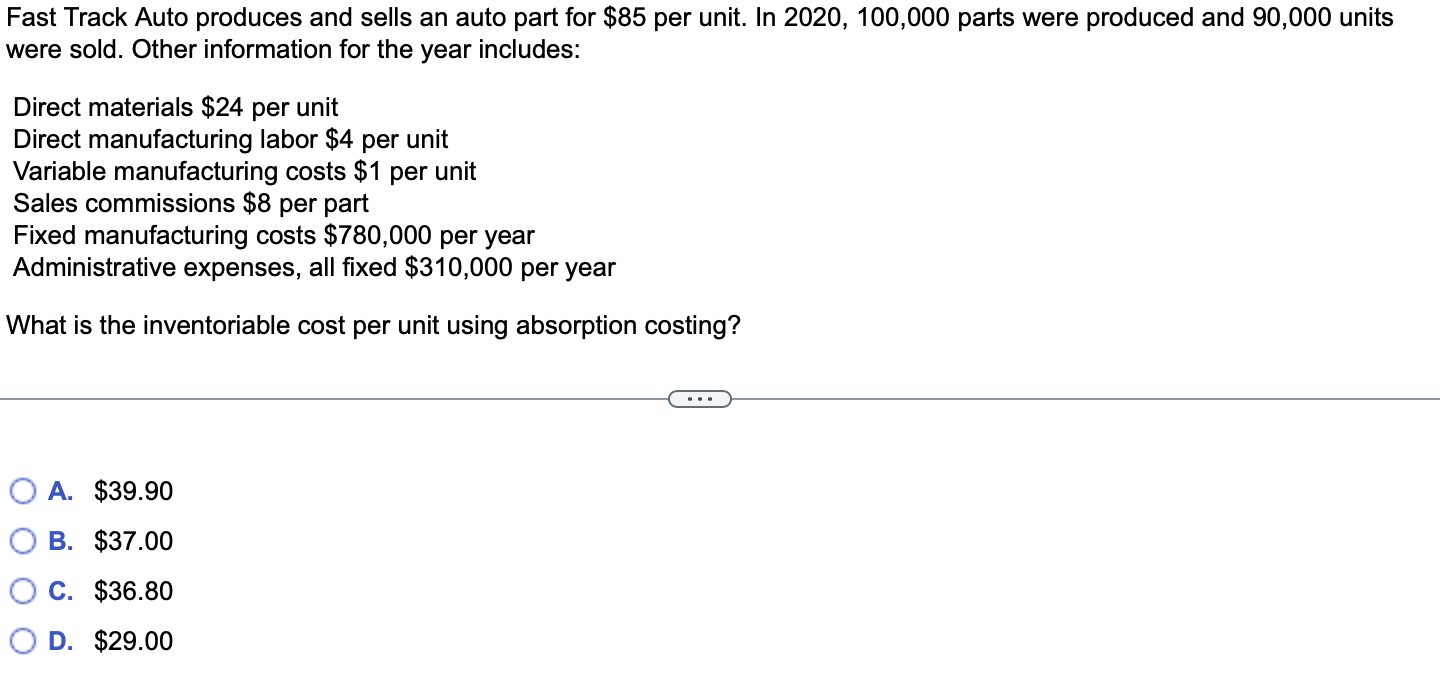

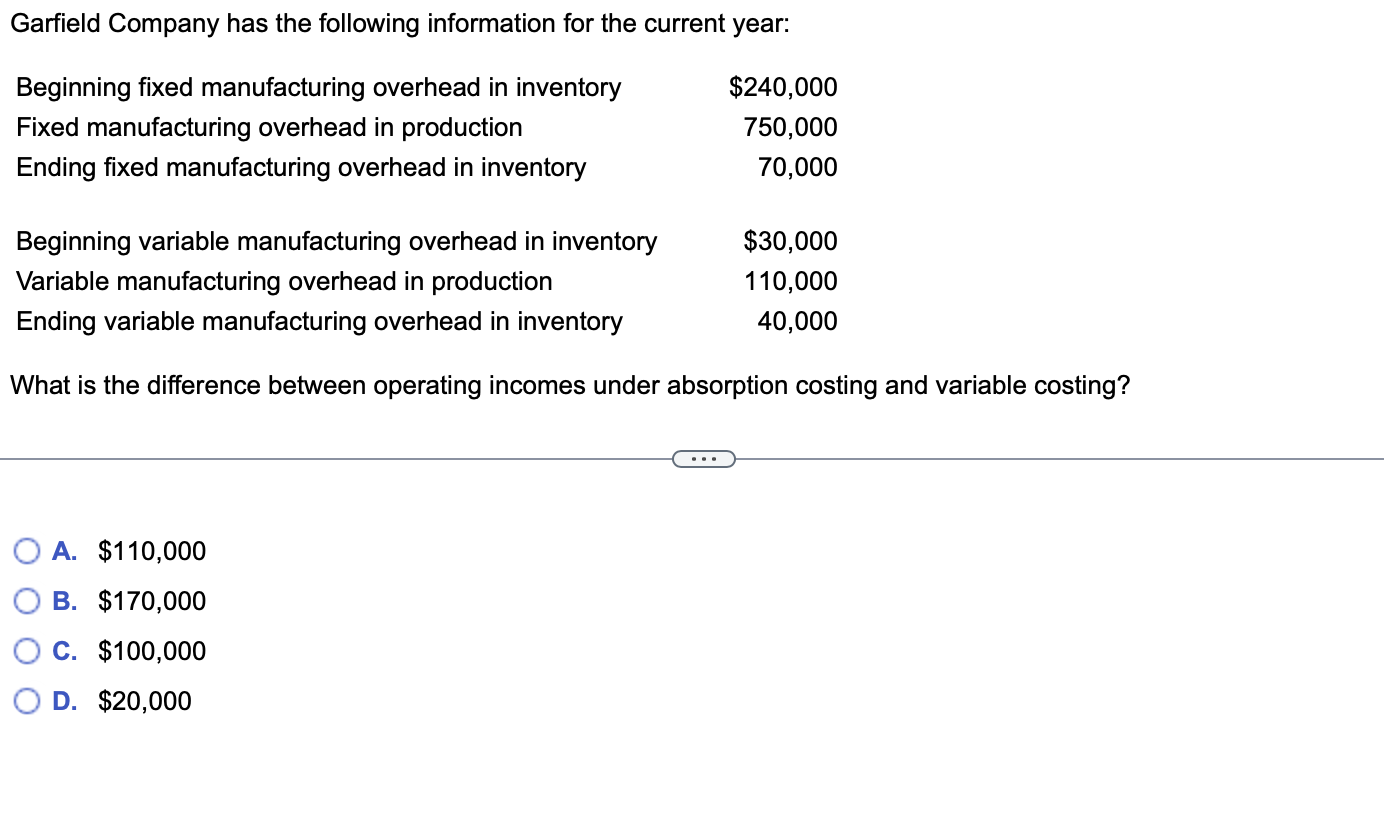

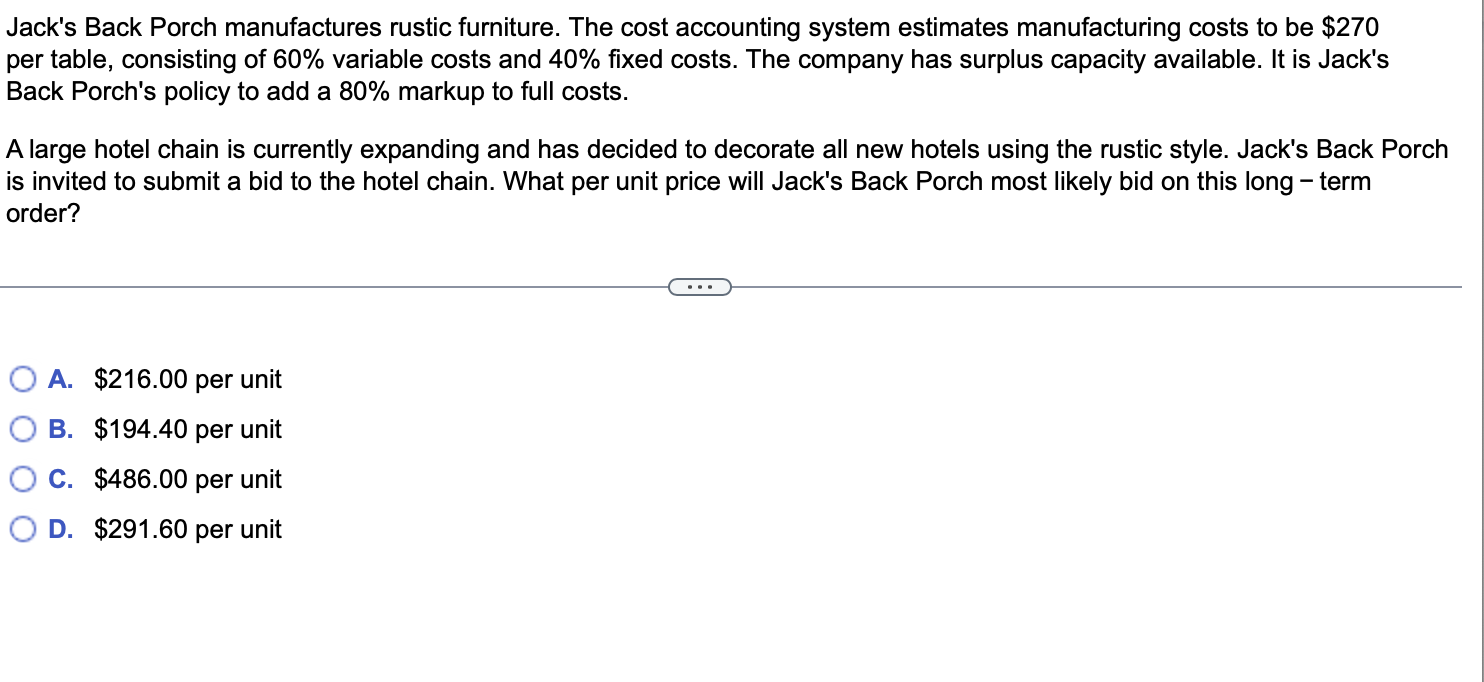

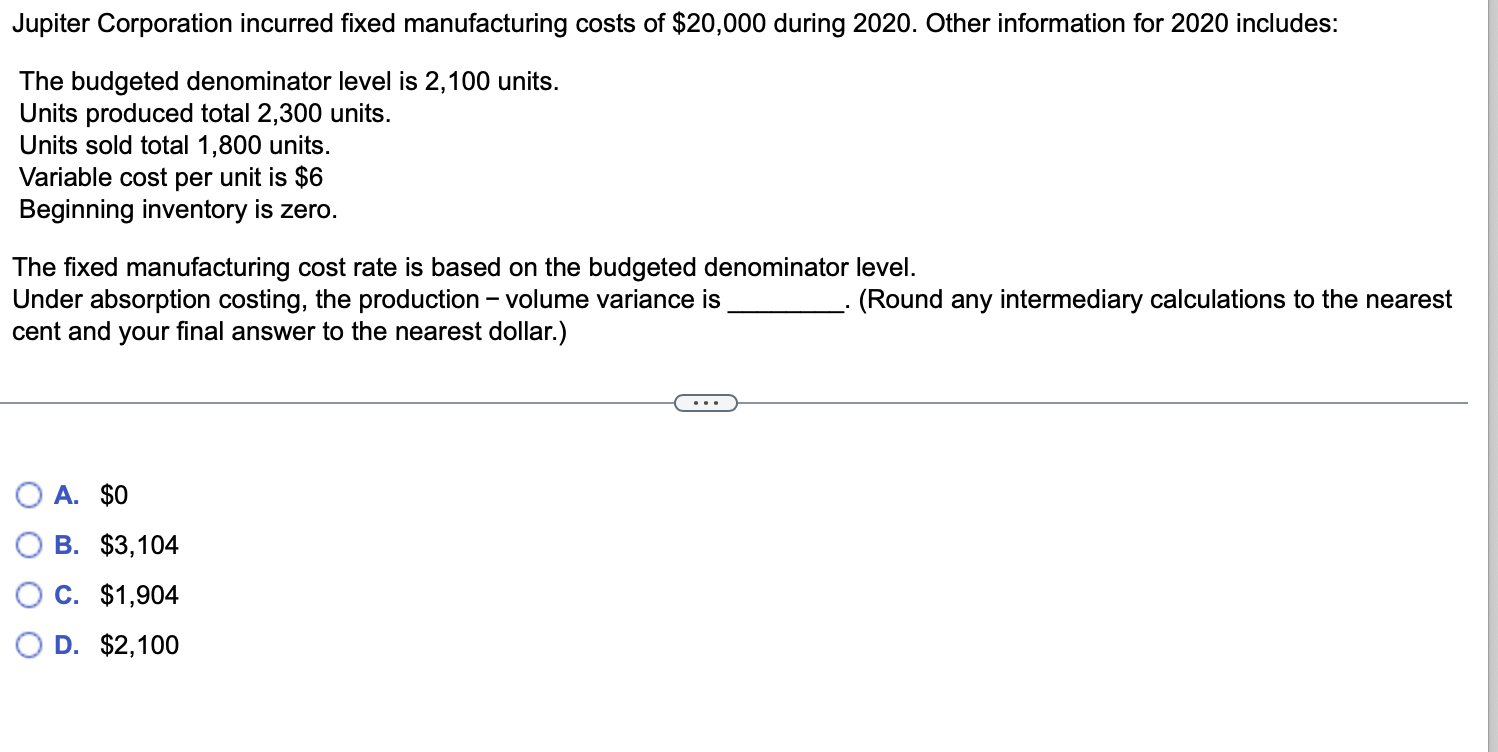

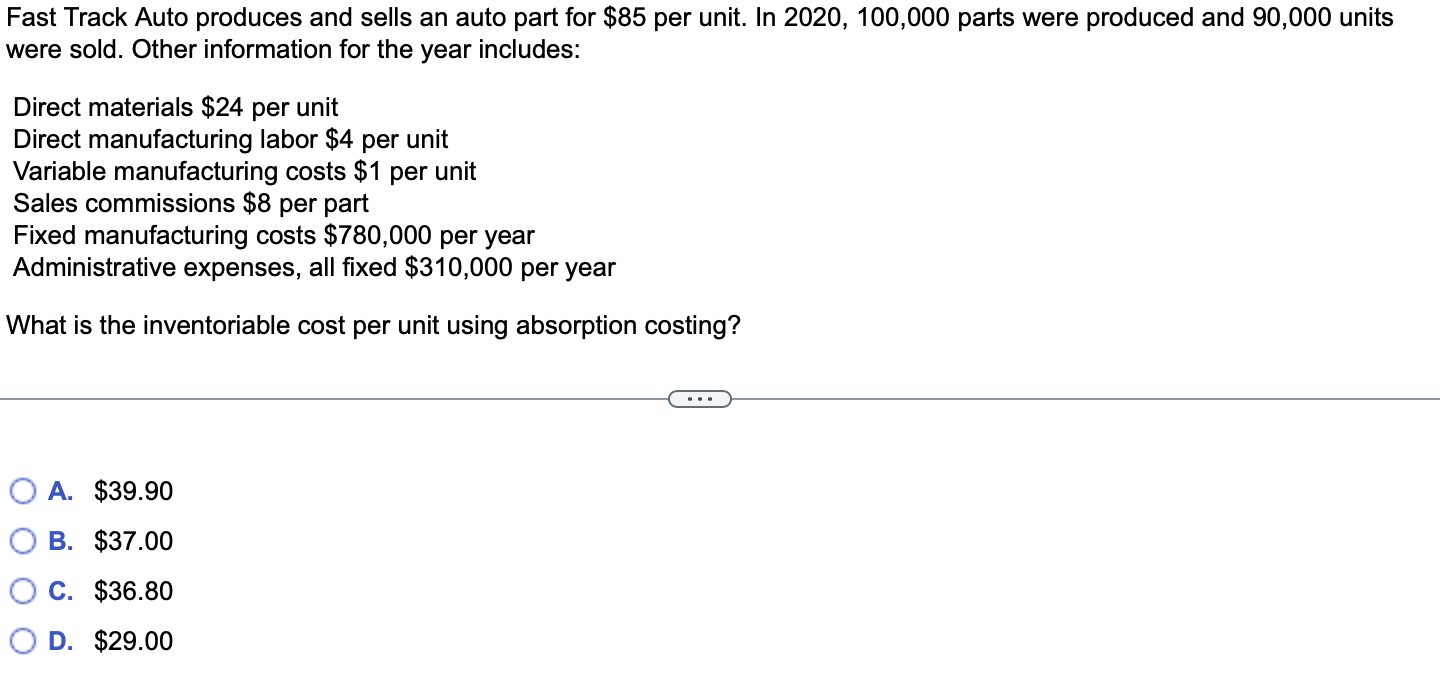

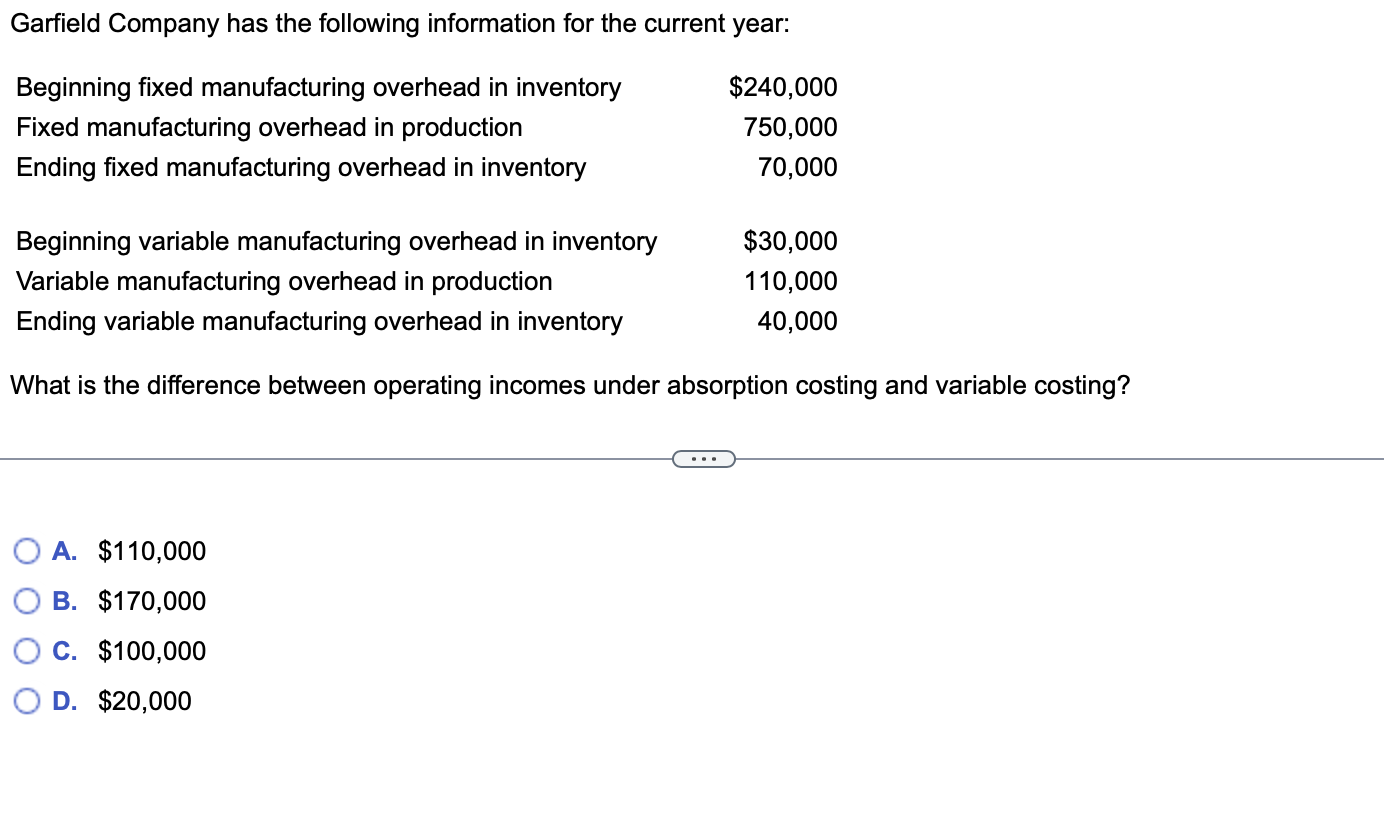

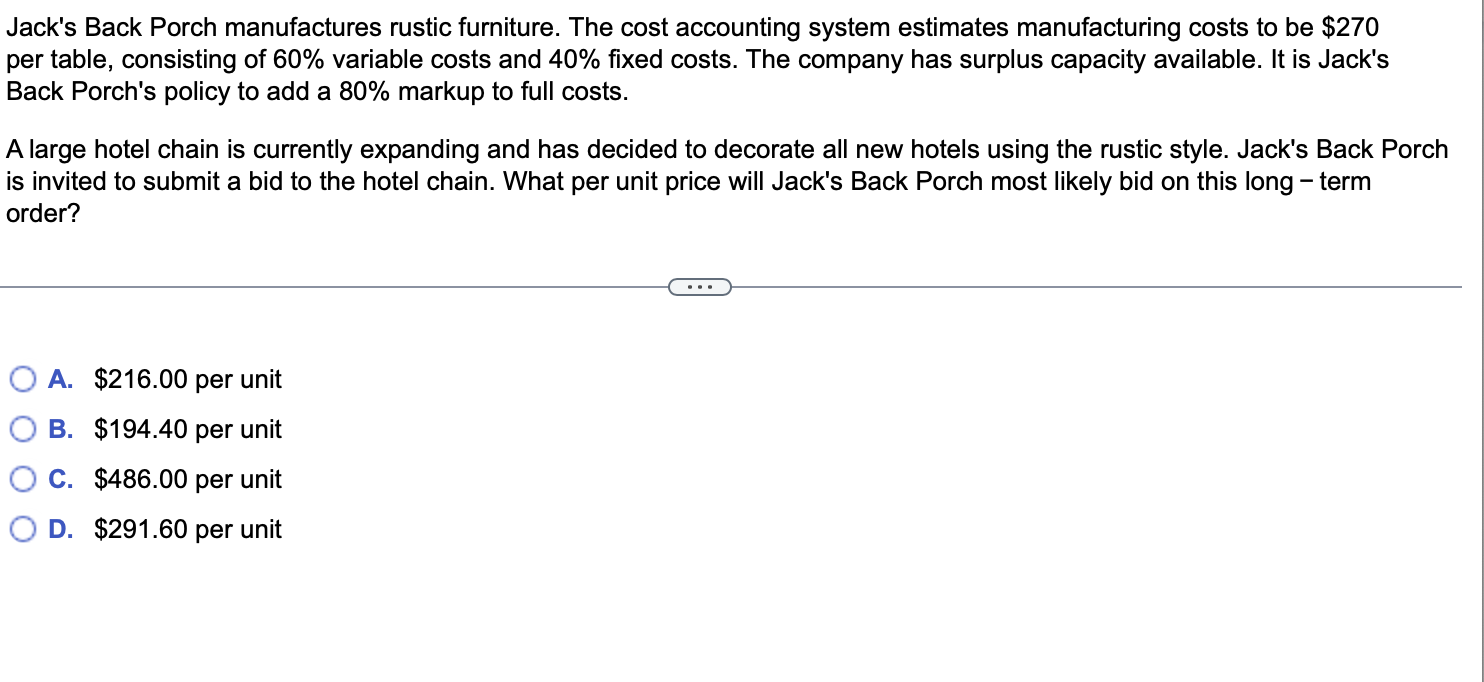

Jupiter Corporation incurred fixed manufacturing costs of $20,000 during 2020. Other information for 2020 includes: The budgeted denominator level is 2,100 units. Units produced total 2,300 units. Units sold total 1,800 units. Variable cost per unit is $6 Beginning inventory is zero. The fixed manufacturing cost rate is based on the budgeted denominator level. Under absorption costing, the production - volume variance is (Round any intermediary calculations to the nearest cent and your final answer to the nearest dollar.) A. $0 B. $3,104 C. $1,904 D. $2,100 Fast Track Auto produces and sells an auto part for $85 per unit. In 2020, 100,000 parts were produced and 90,000 units were sold. Other information for the year includes: Direct materials $24 per unit Direct manufacturing labor $4 per unit Variable manufacturing costs $1 per unit Sales commissions $8 per part Fixed manufacturing costs $780,000 per year Administrative expenses, all fixed $310,000 per year What is the inventoriable cost per unit using absorption costing? A. $39.90 B. $37.00 C. $36.80 D. $29.00 Garfield Company has the following information for the current year: $240,000 Beginning fixed manufacturing overhead in inventory Fixed manufacturing overhead in production 750,000 Ending fixed manufacturing overhead inventory 70,000 Beginning variable manufacturing overhead in inventory $30,000 Variable manufacturing overhead in production 110,000 Ending variable manufacturing overhead in inventory 40,000 What is the difference between operating incomes under absorption costing and variable costing? A. $110,000 B. $170,000 C. $100,000 D. $20,000 Jack's Back Porch manufactures rustic furniture. The cost accounting system estimates manufacturing costs to be $270 per table, consisting of 60% variable costs and 40% fixed costs. The company has surplus capacity available. It is Jack's Back Porch's policy to add a 80% markup to full costs. A large hotel chain is currently expanding and has decided to decorate all new hotels using the rustic style. Jack's Back Porch is invited to submit a bid to the hotel chain. What per unit price will Jack's Back Porch most likely bid on this long-term order? A. $216.00 per unit B. $194.40 per unit C. $486.00 per unit D. $291.60 per unit

Please answer all

Please answer all