Please answer all of 6-20 and only step #1 of 6-21

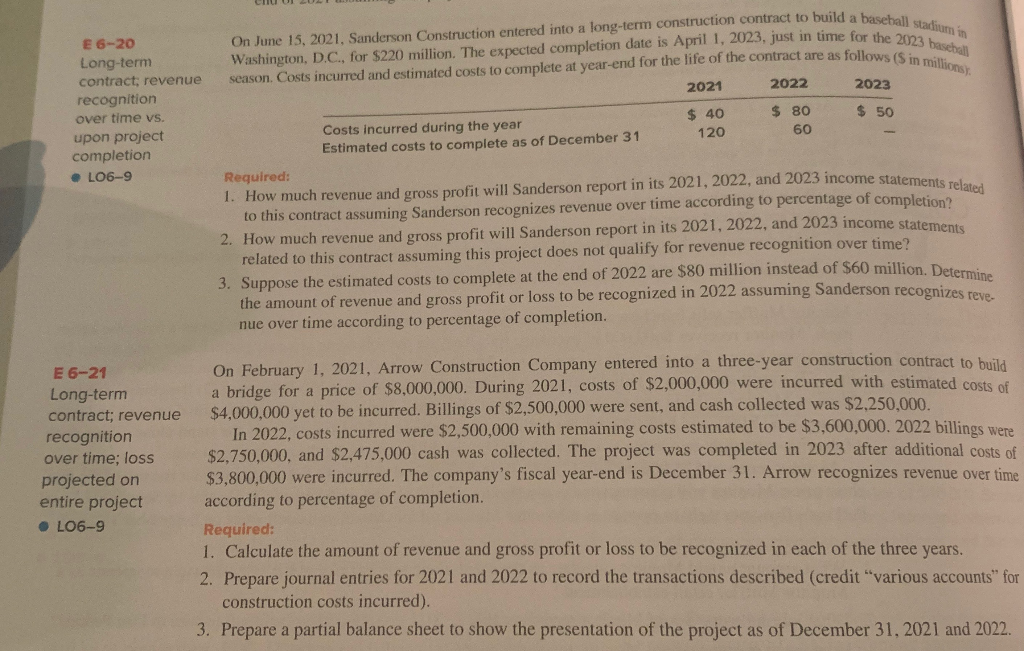

CHUUDUL baseball stadium in for the 2023 baseball alows ($ in millions 2021 E 6-20 Long-term contract, revenue recognition over time vs. upon project completion .LO6-9 On June 15, 2021. Sanderson Construction entered into a long-term construction contract to build a base Washington, DC, for $220 million. The expected completion date is April 1, 2023. just in time for the season. Costs incurred and estimated costs to complete at year-end for the le of the contract are as follows (Si 2022 2023 $ 40 $ 80 $ 50 Costs incurred during the year 120 60 Estimated costs to complete as of December 31 Required: 1. How much revenue and gross profit will Sanderson report in its 2021, 2022, and 2023 income stat to this contract assuming Sanderson recognizes revenue over time according to percentage of completion 2. How much revenue and gross profit will Sanderson report in its 2021, 2022, and 2023 income stateme related to this contract assuming this project does not qualify for revenue recognition over time? 3. Suppose the estimated costs to complete at the end of 2022 are $80 million instead of $60 million Data the amount of revenue and gross profit or loss to be recognized in 2022 assuming Sanderson recognize nue over time according to percentage of completion. d 2023 income statements related E 6-21 Long-term contract; revenue recognition over time, loss projected on entire project .LO6-9 On February 1, 2021, Arrow Construction Company entered into a three-year construction contract to build a bridge for a price of $8,000,000. During 2021, costs of $2,000,000 were incurred with estimated costs of $4,000,000 yet to be incurred. Billings of $2,500,000 were sent, and cash collected was $2,250,000. In 2022, costs incurred were $2,500,000 with remaining costs estimated to be $3,600,000.2022 billings were $2.750.000 and $2,475,000 cash was collected. The project was completed in 2023 after additional costs of $3.800.000 were incurred. The company's fiscal year-end is December 31. Arrow recognizes revenue over time according to percentage of completion. Required: 1. Calculate the amount of revenue and gross profit or loss to be recognized in each of the three years. 2. Prepare journal entries for 2021 and 2022 to record the transactions described (credit "various accounts for construction costs incurred). 3. Prepare a partial balance sheet to show the presentation of the project as of December 31, 2021 and 2022