please answer all of the following questions

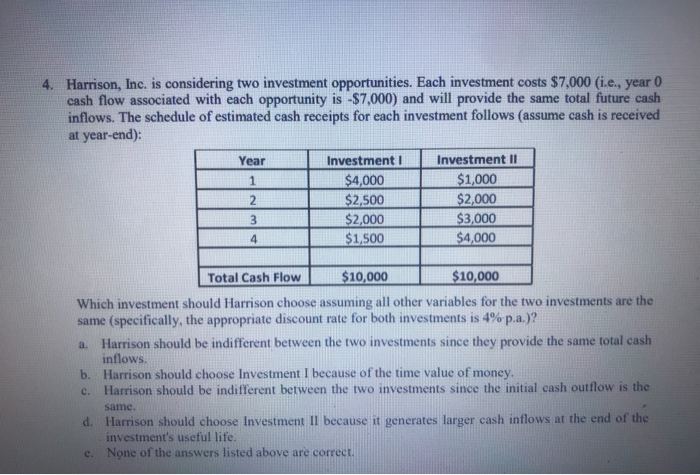

1. Which following statement is true, assuming an interest rate of greater than 0%: a. The present value of a dollar to be received one year from today is ALWAYS worth less than one dollar. b. The present value of a dollar to be received one year from today is ALWAYS worth more than one dollar. c. The present value of a dollar to be received one year from today is ALWAYS equal to one dollar. d. The present value of a dollar to be received one year from today could be worth less than, equal to, worth more than one dollar, depending on the size of the interest rate. e. All of the answers listed above are incorrect. 2. Which one of the following investments provides the highest effective annual rate of return (i.e., which of the following investments is the BEST (i.e., the largest EAR), assuming an investor wants to earn the best return over an investing horizon of 10 years)? An investment which has a 10.0 percent nominal rate with annual compounding. b. An investment which has a 9.85 percent nominal rate with semi-annual compounding. An investment which has a 9.75 percent nominal rate with quarterly compounding. d. An investment which has a 9.60 percent nominal rate with monthly compounding. An investment which has a 9.55 percent nominal rate and daily (365) compounding. a. . . 3. For a given nominal interest rate greater than 0 % , if the number of compounding periods per year decreases (for example, from quarterly to semiannually), the present value of $1000 to be received exactly 10 years from today will: increase. b. decrease. c. remain unchanged. d. either increase or decrease, depending on the nominal interest rate. a. 4. Harrison, Inc. is considering two investment opportunities. Each investment costs $7,000 (i.e., year 0 cash flow associated with each opportunity is -$7,000) and will provide the same total future cash inflows. The schedule of estimated cash receipts for each investment follows (assume cash is received at year-end): Investment I $4,000 $2,500 $2,000 $1,500 Investment II Year $1,000 $2,000 $3.000 $4,000 1 2 3 4 $10,000 $10,000 Total Cash Flow Which investment should Harrison choose assuming all other variables for the two investments are the same (specifically, the appropriate discount rate for both investments is 4% p.a.)? Harrison should be indifferent between the two investments since they provide the same total cash inflows. b. Harrison should choose Investment I because of the time value of money. Harrison should be indifferent between the two investments since the initial cash outflow is the a. C. same. Harrison should choose Investment II because it generates larger cash inflows at the end of the investment's useful life. e. None of the answers listed above are correct. d