please answer all of the parts that include completing the trial balances, as well as financial statements, and everything that comes as a result of the adjustments.

please answer all of the parts that include completing the trial balances, as well as financial statements, and everything that comes as a result of the adjustments.

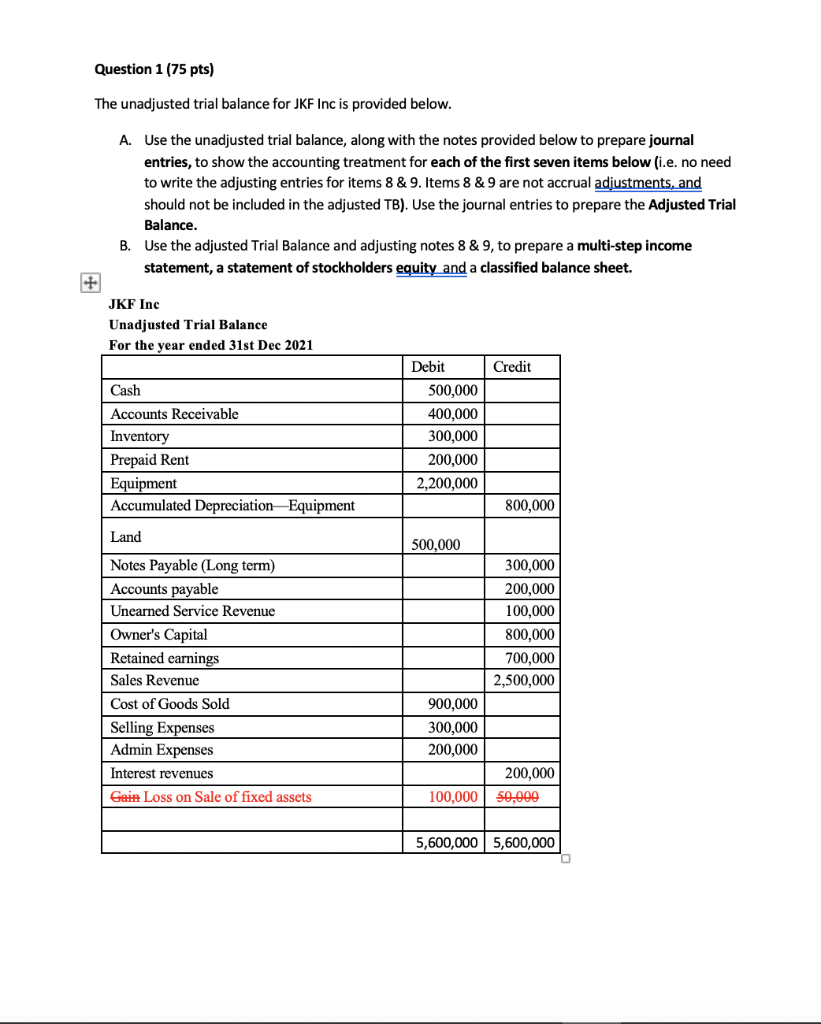

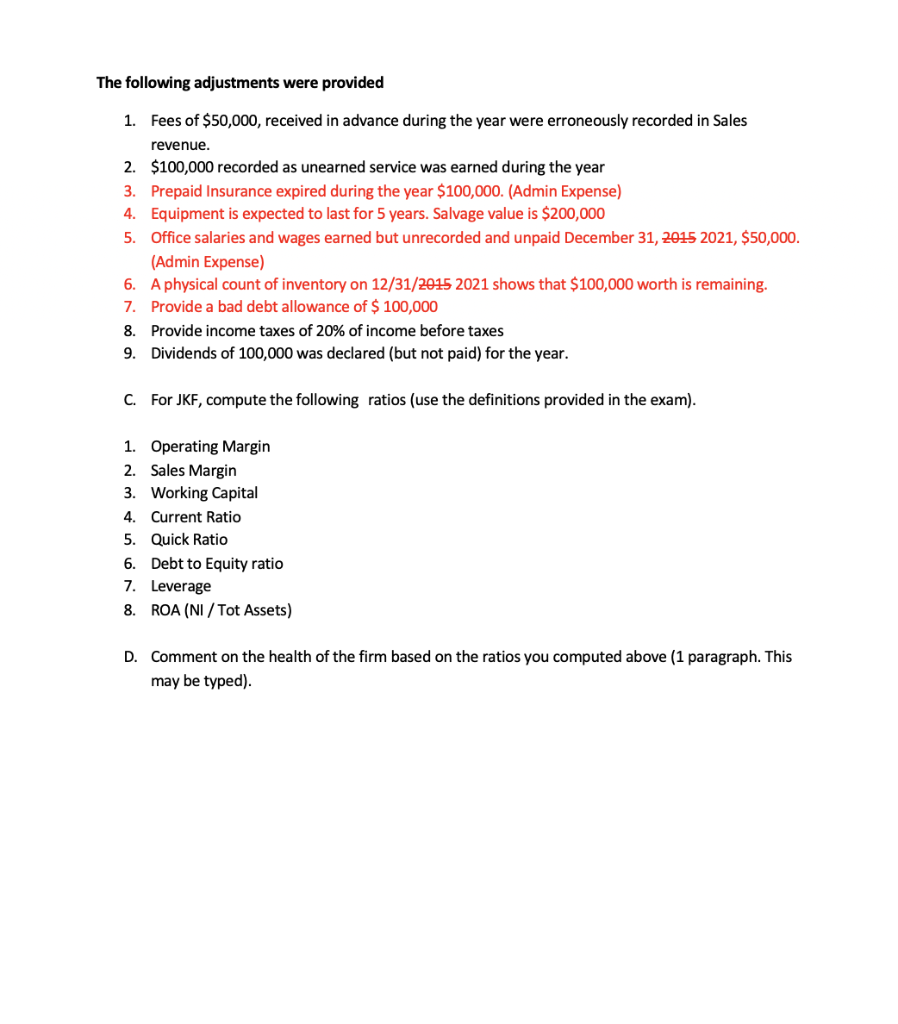

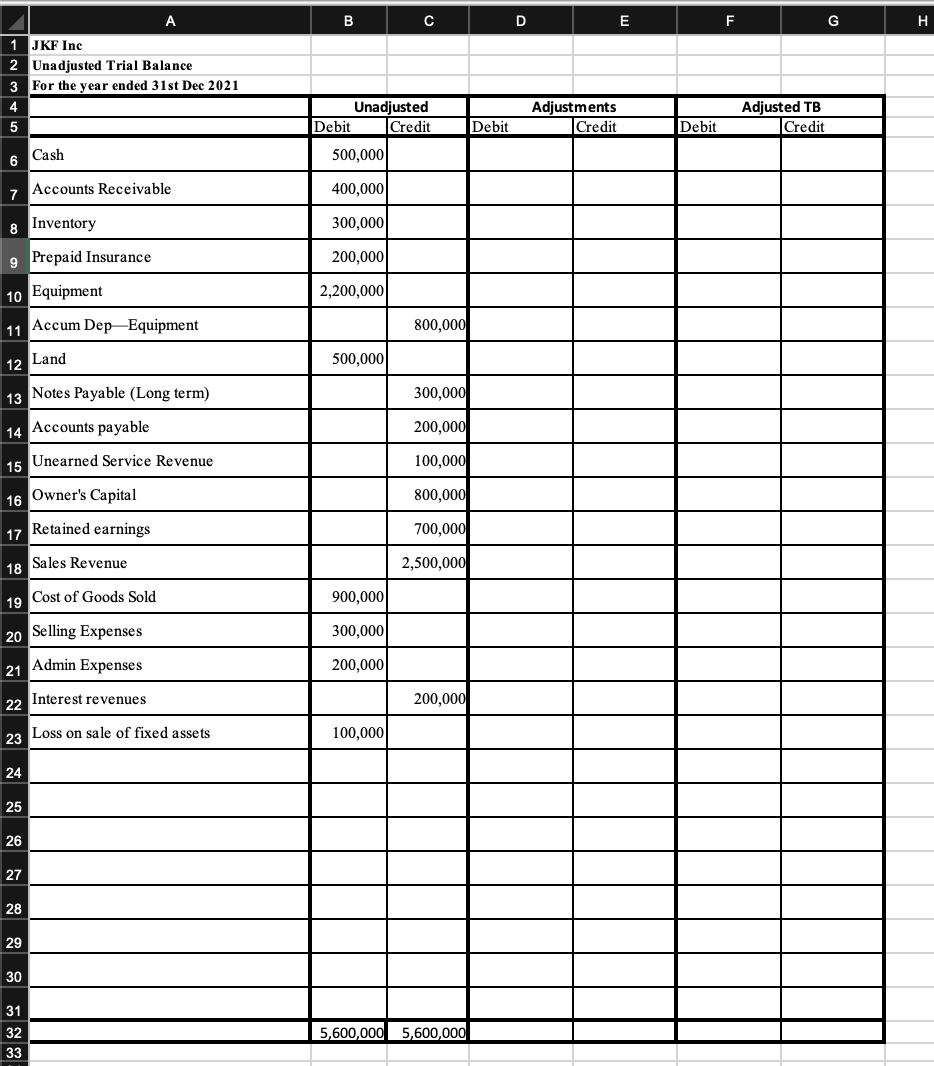

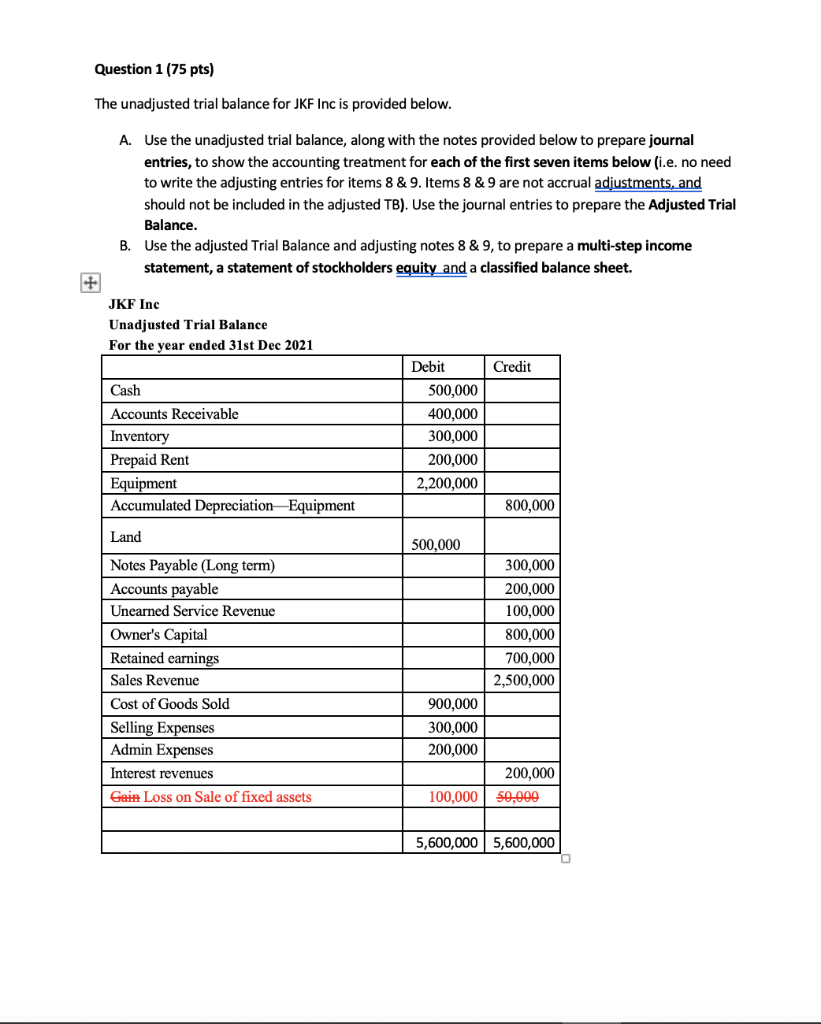

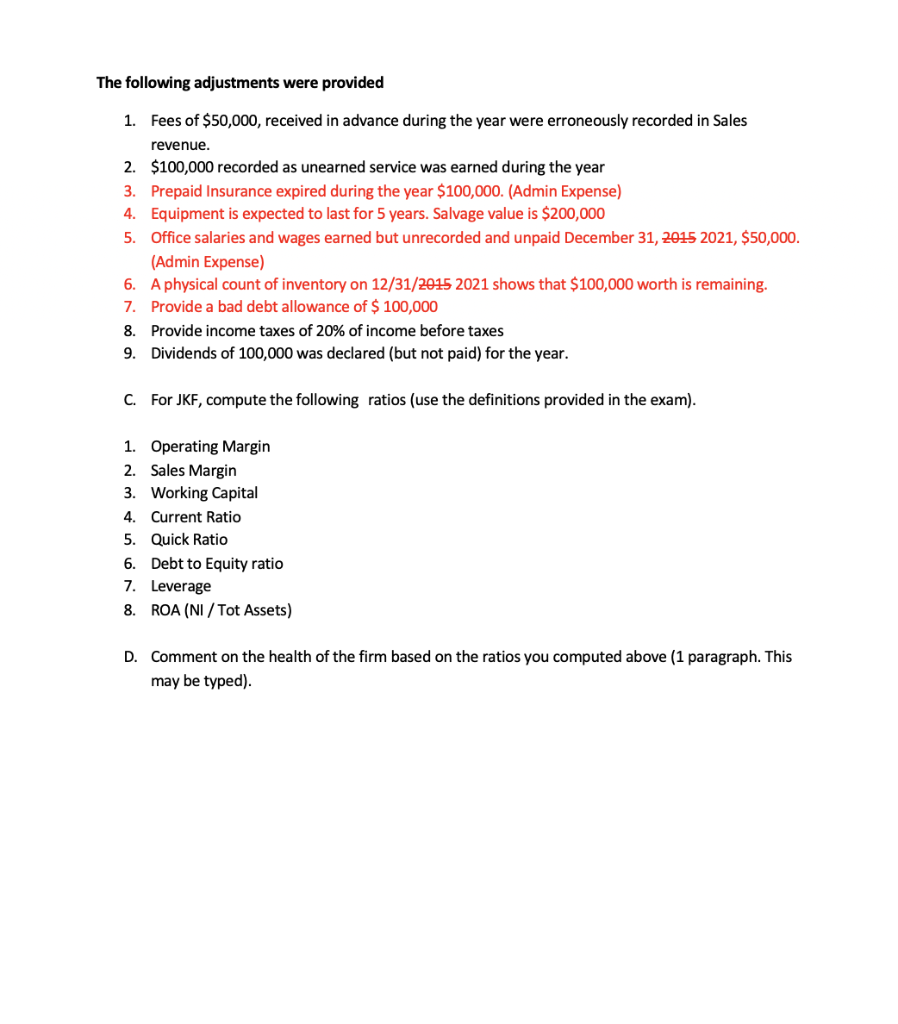

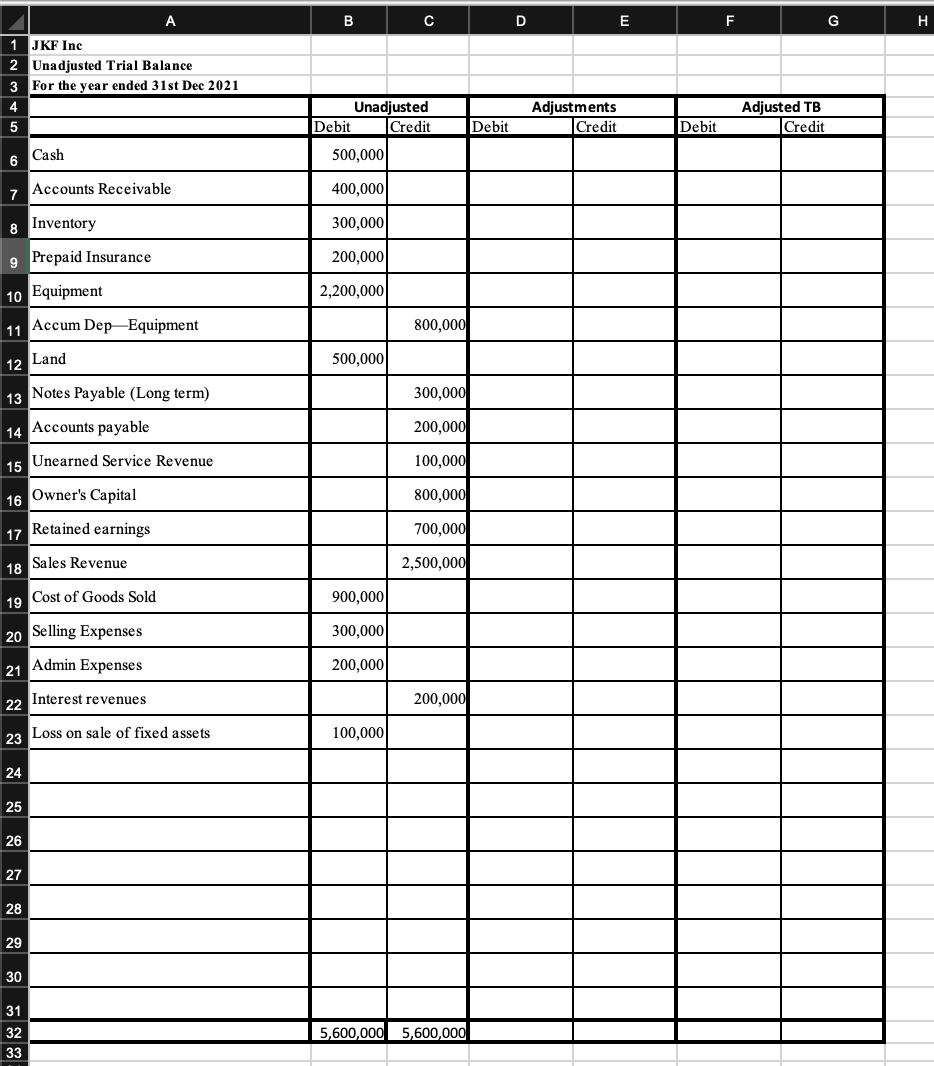

Question 1 (75 pts) The unadjusted trial balance for JKF Inc is provided below. A. Use the unadjusted trial balance, along with the notes provided below to prepare journal entries, to show the accounting treatment for each of the first seven items below (i.e. no need to write the adjusting entries for items 8 & 9. Items 8 & 9 are not accrual adjustments, and should not be included in the adjusted TB). Use the journal entries to prepare the Adjusted Trial Balance. B. Use the adjusted Trial Balance and adjusting notes 8 & 9, to prepare a multi-step income statement, a statement of stockholders equity and a classified balance sheet. JKF Inc Unadjusted Trial Balance For the year ended 31st Dec 2021 Debit Credit Cash Accounts Receivable Inventory Prepaid Rent Equipment Accumulated Depreciation Equipment 500,000 400,000 300,000 200,000 2,200,000 800,000 Land 500,000 Notes Payable (Long term) Accounts payable Unearned Service Revenue Owner's Capital Retained earnings Sales Revenue Cost of Goods Sold Selling Expenses Admin Expenses Interest revenues Gain Loss on Sale of fixed assets 300,000 200,000 100,000 800,000 700,000 2,500,000 900,000 300,000 200,000 200,000 50,000 100,000 5,600,000 5,600,000 The following adjustments were provided 1. Fees of $50,000, received in advance during the year were erroneously recorded in Sales revenue. 2. $100,000 recorded as unearned service was earned during the year 3. Prepaid Insurance expired during the year $100,000. (Admin Expense) 4. Equipment is expected to last for 5 years. Salvage value is $200,000 5. Office salaries and wages earned but unrecorded and unpaid December 31, 2015 2021, $50,000. (Admin Expense) 6. A physical count of inventory on 12/31/2015 2021 shows that $100,000 worth is remaining. 7. Provide a bad debt allowance of $ 100,000 8. Provide income taxes of 20% of income before taxes 9. Dividends of 100,000 was declared (but not paid) for the year. C. For JKF, compute the following ratios (use the definitions provided in the exam). 1. Operating Margin 2. Sales Margin 3. Working Capital 4. Current Ratio 5. Quick Ratio 6. Debt to Equity ratio 7. Leverage 8. ROA (NI / Tot Assets) D. Comment on the health of the firm based on the ratios you computed above (1 paragraph. This may be typed). A B D E F G H 1 JKF Inc 2 Unadjusted Trial Balance 3 For the year ended 31st Dec 2021 4 Unadjusted Debit Credit Adjustments Credit Adjusted TB Credit 5 Debit Debit 6 Cash 500,000 Accounts Receivable 7 400,000 300,000 8 Inventory 9 Prepaid Insurance 200,000 10 Equipment 2,200,000 11 Accum Dep-Equipment 800,000 12 Land 500,000 13 Notes Payable (Long term) 300,000 14 Accounts payable 200,000 15 Unearned Service Revenue 100,000 16 Owner's Capital 800,000 17 Retained earnings 700,000 18 Sales Revenue 2,500,000 900,000 19 Cost of Goods Sold 20 Selling Expenses 300,000 21 Admin Expenses 200,000 22 Interest revenues 200,000 23 Loss on sale of fixed assets 100,000 24 25 26 27 28 29 30 31 32 33 5,600,000 5,600,000

please answer all of the parts that include completing the trial balances, as well as financial statements, and everything that comes as a result of the adjustments.

please answer all of the parts that include completing the trial balances, as well as financial statements, and everything that comes as a result of the adjustments.