Answered step by step

Verified Expert Solution

Question

1 Approved Answer

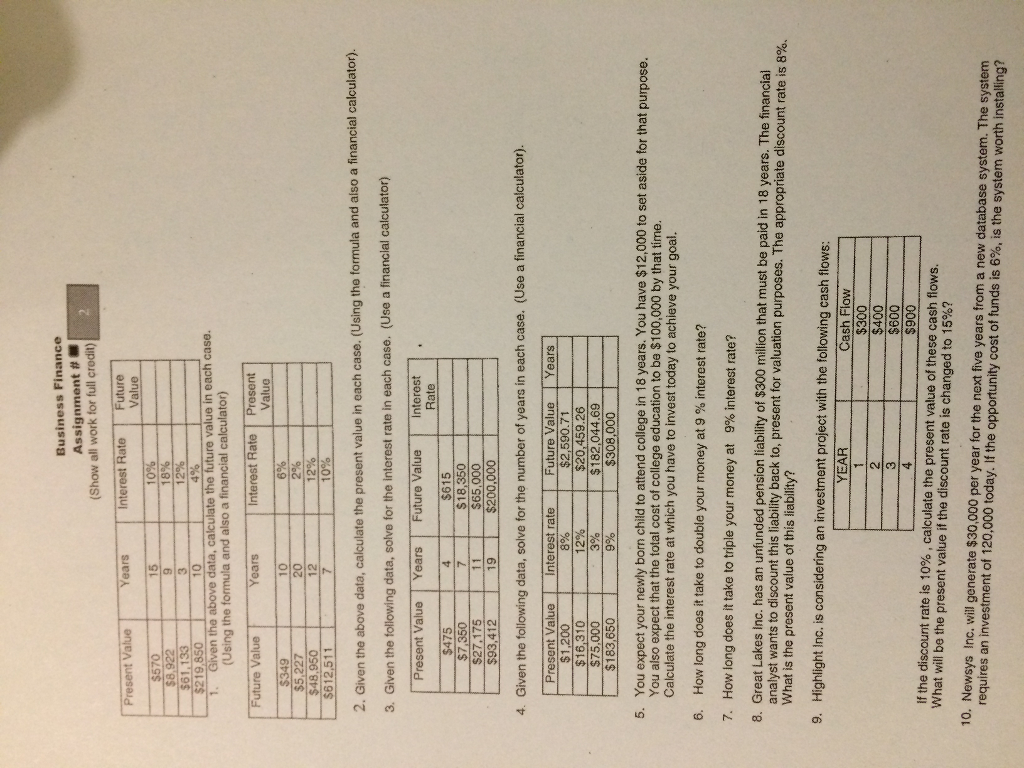

Please Answer all of the questions Given the above data, calculate the future value In each case. (Using the formula and also a financial calculator)

Please Answer all of the questions

Given the above data, calculate the future value In each case. (Using the formula and also a financial calculator) Given the above data, calculate the present value in each case. (Using the formula and also a financial calculator). Given the following data, solve for the Interest rate in each case. (Use a financial calculator) Given the following data, solve for the number of years In each case. (Use a financial calculator). You expect your newly born child to attend college in 18 years. You have $12,000 to set aside for that purpose. You also expect that the total cost of college education to be $100,000 by that time. Calculate the interest rate at which you have to invest today to achieve your goal. How long does it take to double your money at 9 % interest rate? How long does it take to triple your money at 9% interest rate? Great Lakes Inc. has an unfunded pension liability of $300 million that must be paid in 18 years. The financial analyst wants to discount this liability back to, present for valuation purposes. The appropriate discount rate is 8%. What is the present value of this liability? Highlight Inc. is considering an investment project with the following cash flows: If the discount rate is 10%, calculate the present value of these cash flows. What will be the present value if the discount rate is changed to 15%? Newsys Inc. will generate $30,000 per year for the next five years from a new database system. The system requires an investment of 120.000 today. If the opportunity cost of funds is 6%, is the system worth installingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started