please answer all of them

thank you so much

only need answers

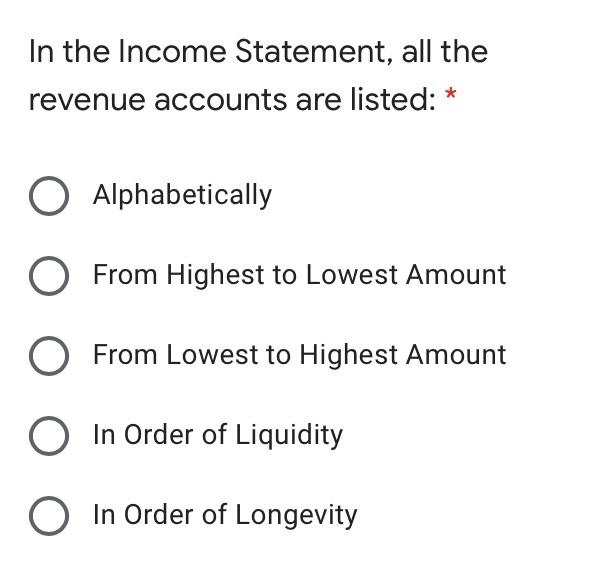

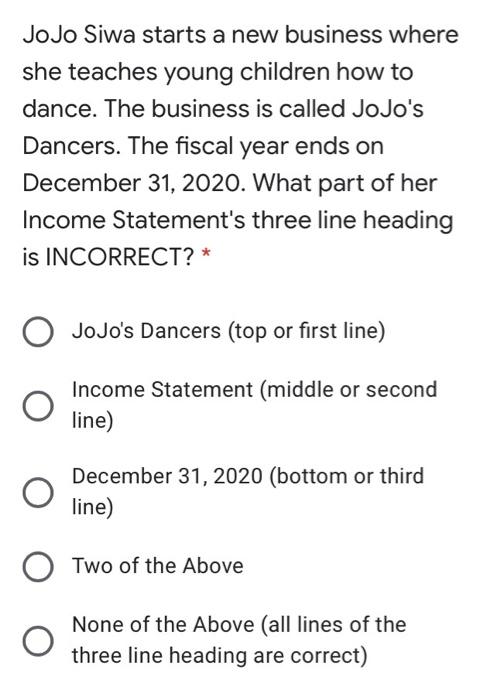

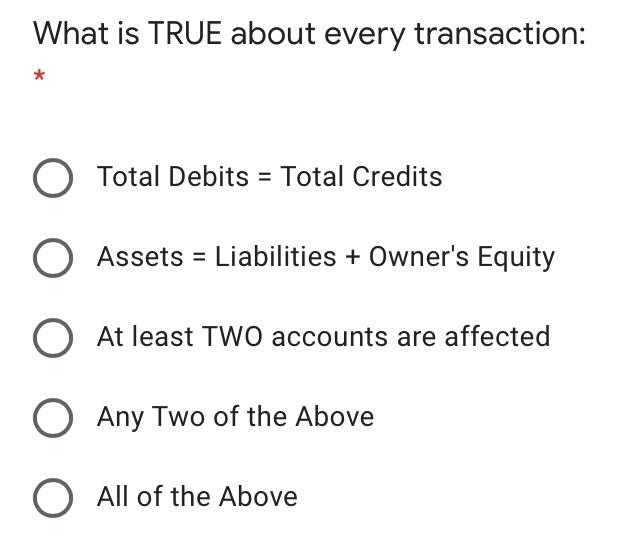

In the Income Statement, all the revenue accounts are listed: * O Alphabetically O From Highest to Lowest Amount O From Lowest to Highest Amount O In Order of Liquidity O In Order of Longevity JoJo Siwa starts a new business where she teaches young children how to dance. The business is called JoJo's Dancers. The fiscal year ends on December 31, 2020. What part of her Income Statement's three line heading is INCORRECT?* O JoJo's Dancers (top or first line) Income Statement (middle or second line) December 31, 2020 (bottom or third line) Two of the Above None of the Above (all lines of the three line heading are correct) What is TRUE about every transaction: O Total Debits = Total Credits Assets = Liabilities + Owner's Equity At least TWO accounts are affected Any Two of the Above O All of the Above According to the Accounting Cycle, which Financial Statement is created first? * O Journal O Ledger O Trial Balance O Classified Balance Sheet O Income Statement Kyle Lowry starts a basketball training camp. He teaches Fred VanVleet's children for $25,000. Fred Van Vleet promises to pay back later. What source document does VanVleet receive from Lowry? * O Cash Sales Slip O Sales Invoice O Purchase Invoice O Bank Credit Memo O None of the Above Kyle Lowry starts a basketball training camp. He teaches Fred VanVleet's children for $25,000. Fred VanVleet promises to pay back later. What source document does Lowry give Van Vleet? * Cash Sales Slip O Sales Invoice Purchase Invoice Bank Debit Memo O None of the Above A company prefers to have more: O HST Payable O HST Recoverable O The same amount of HST Payable and HST Recoverable Cash Receipts Daily Summary is: * Is a bank document informing the business of a decrease in the business bank account Is a bank document informing the O business of a increase in the business bank account Lists the money coming in from O customers for the day that were on the account Is a computer program that allows a O business to exchange funds electronically O None of the Above The Revenue Recognition Principle states that revenue must be recorded at the time: * O The transaction is occurring O The transaction is fully paid for O The transaction is completed O The transaction will most likely happen O None of the Above At the end of the fiscal period, the company has a HST Payable of $36,000 and a HST Recoverable of $39,000. As a result, the company will: * Receive a $3,000 refund from the government Pay $3,000 remittance to the government Pay $30,000 remittance to the government Receive $27,000 refund from the government O None of the Above