Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all part for a good rating!! thanks Serena Monroe wants to create a fund today that will enable her to withdraw $31,300 per

please answer all part for a good rating!! thanks

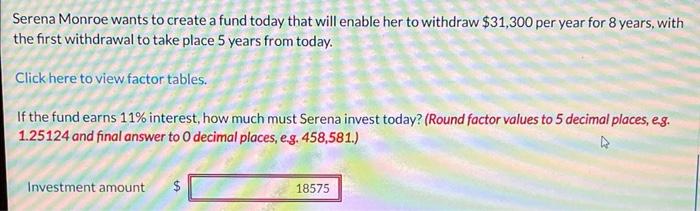

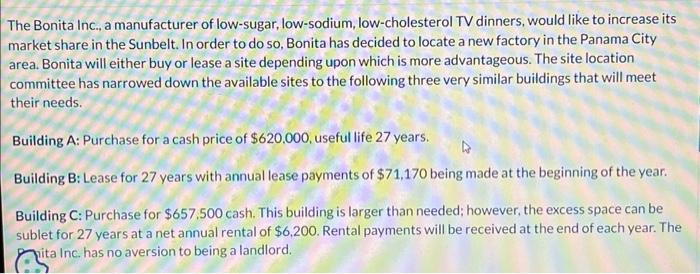

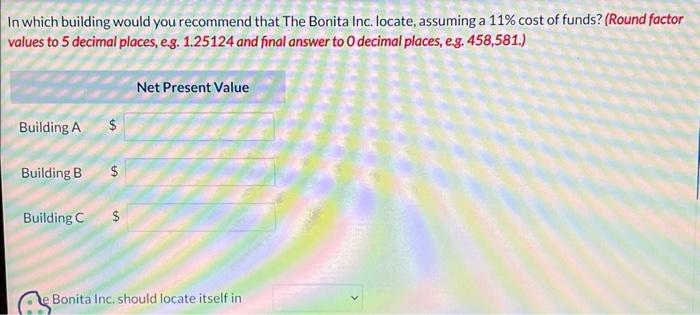

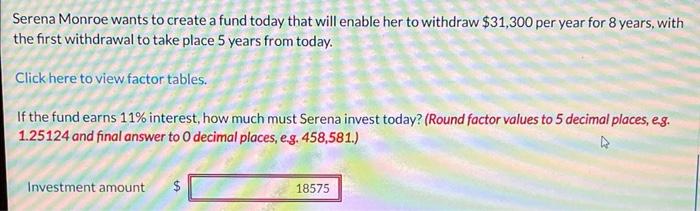

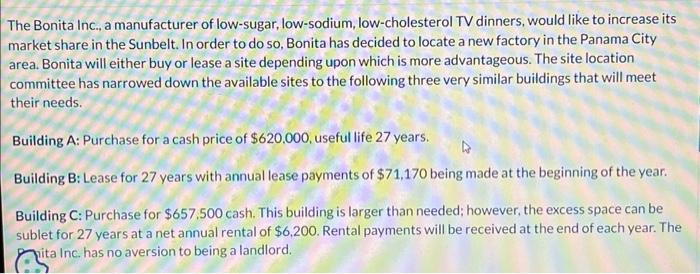

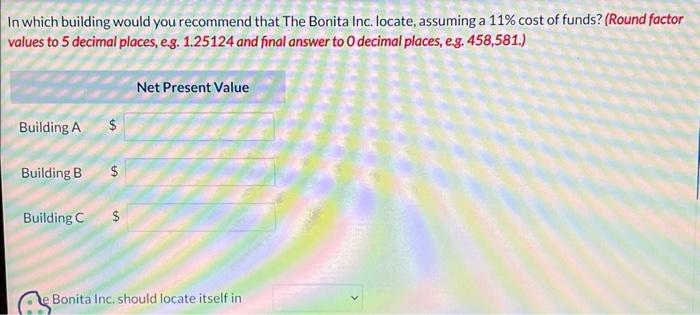

Serena Monroe wants to create a fund today that will enable her to withdraw $31,300 per year for 8 years, with the first withdrawal to take place 5 years from today. Click here to view factor tables. If the fund earns 11% interest, how much must Serena invest today? (Round factor values to 5 decimal places, e. . 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Investment amount $ market rate of interest for bonds of similar risk is 11%. Click here to view factor tables. What amount will Headland receive when it issues the bonds? (For calculation purposes, use 5 decimal places as displayed in the factor table provided and final answer to 0 decimal places, e.g. 458, 581.) Amount received by Headland when bonds were issued The Bonita Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Bonita has decided to locate a new factory in the Panama City area. Bonita will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $620,000, useful life 27 years, Building B: Lease for 27 years with annual lease payments of $71,170 being made at the beginning of the year. Building C: Purchase for $657.500 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a net annual rental of $6,200. Rental payments will be received at the end of each year. The . In which building would you recommend that The Bonita Inc. locate, assuming a 11% cost of funds? (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 0 decimal places, e.g. 458,581.) Bonita Inc. should locate itself in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started