Answered step by step

Verified Expert Solution

Question

1 Approved Answer

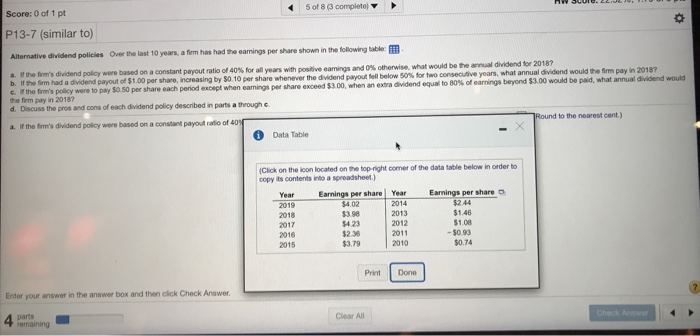

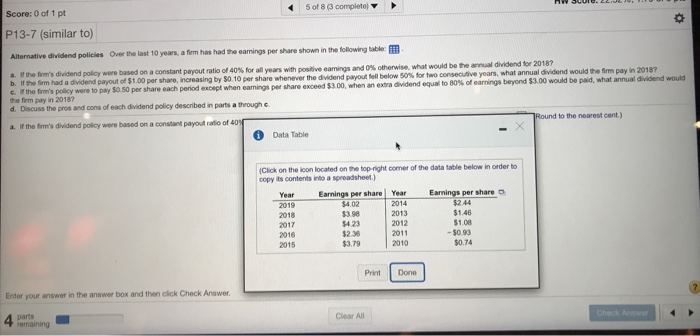

please answer all parts A-D 5 of 8 (3 complete) Score: 0 of 1 pt P13-7 (similar to) Alternative dividend policies Over the last 10

please answer all parts A-D

5 of 8 (3 complete) Score: 0 of 1 pt P13-7 (similar to) Alternative dividend policies Over the last 10 years, a firm has had the eanings per share shown in the following table: E a. the firm's dividend policy were based on a constant payout ratio of 40 % for all years with positive eamings and 0 % otherwise, what would be the annual dividend for 2018 b. If the firm had a dividend payout of $1.00 per share, increasing by $0.10 per share whenever the dividend payout fell below 50% for two consecutive years, what annual dividend would the firm pay in 20187 c if the firm's policy were to pay 50.50 per share each period except when eamings per share exceed $3.00, when an extra dividend equal to 80 % of earnings beyond $3.00 would be paid, what annual dividend would the firm pay in 20187 d. Discuss the pros and cons of each dividend policy described in parts a through e a. If the firm's dividend policy were based on a constant payout ratio of 40 % Round to the nearest cent.) Data Table (Click on the ioon located on the top-right comer of the data table below in order to copy its contents into a spreadsheet.) Earnings per share Earnings per share o Year Year 2019 $4.02 2014 2013 $2.44 $1.46 $1.08 -$0.93 $0.74 2018 $3.98 2017 $4 23 2012 2016 $2.3 2011 $3.79 2015 2010 Print Done Enter your answer in the answer box and then click Check Answer parts remaining Clear All Check Anwer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started