Answered step by step

Verified Expert Solution

Question

1 Approved Answer

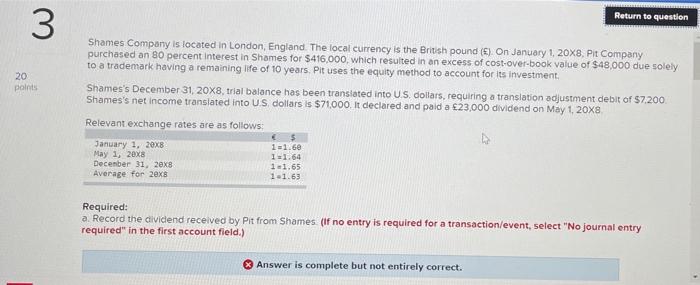

PLEASE ANSWER ALL PARTS ASAP!!!! Return to question 3 20 points Shames Company is located in London, England. The local currency is the British pound

PLEASE ANSWER ALL PARTS ASAP!!!!

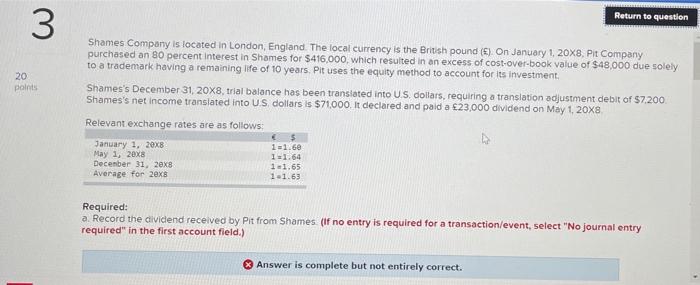

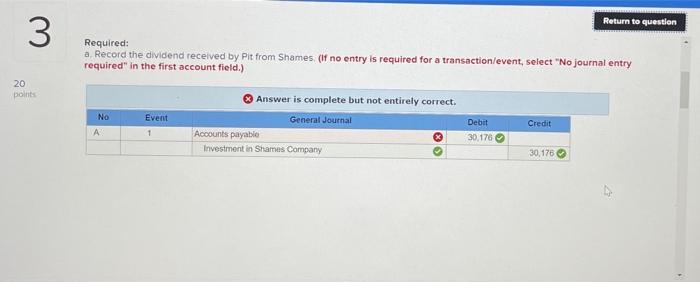

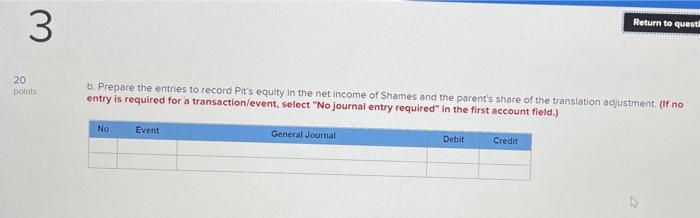

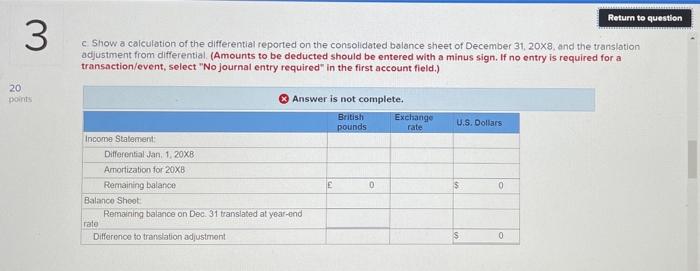

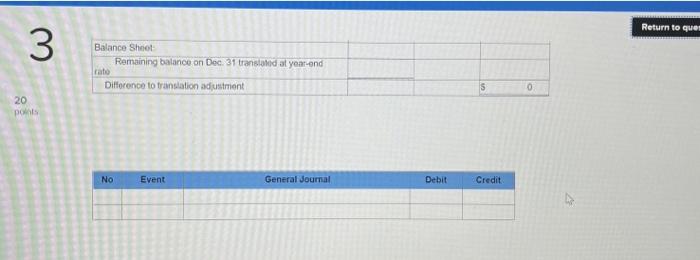

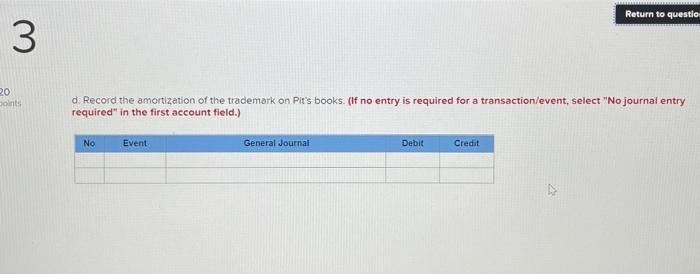

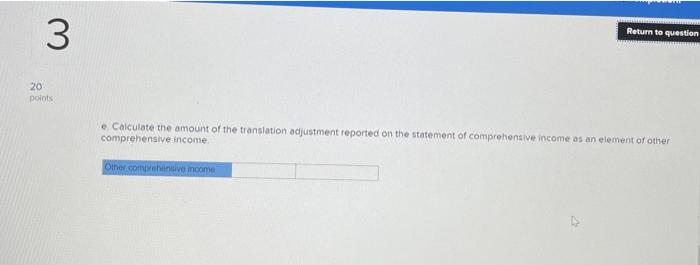

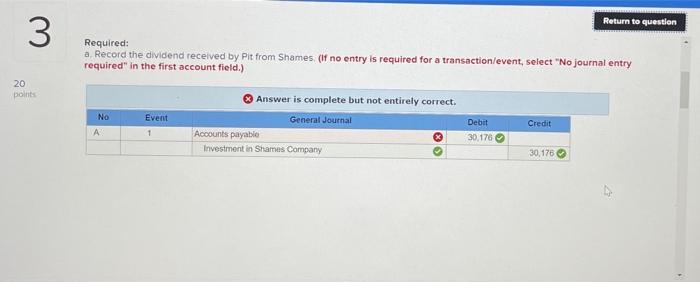

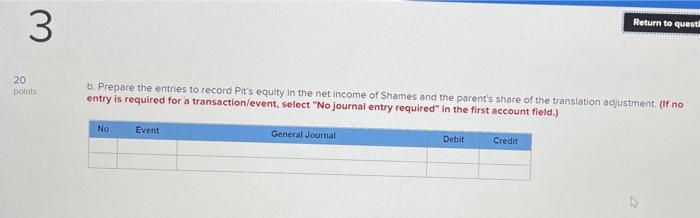

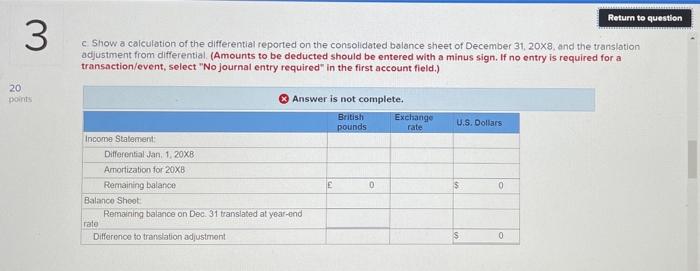

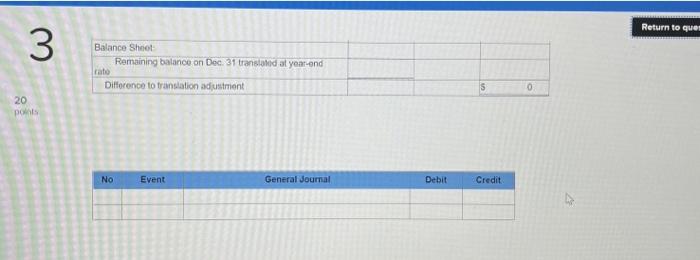

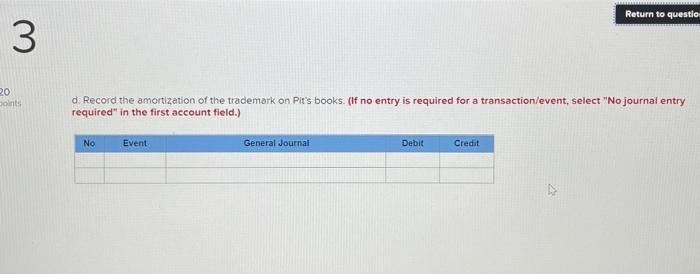

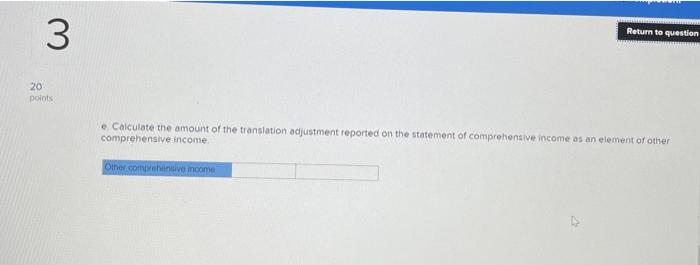

Return to question 3 20 points Shames Company is located in London, England. The local currency is the British pound (). On January 1, 20x8, Pit Company purchased an 80 percent interest in Shames for $416,000, which resulted in an excess of cost-over-book value of $48,000 due solely to a trademark having a remaining life of 10 years. Pit uses the equity method to account for its investment Shames's December 31, 20X8, trial balance has been translated into U.S. dollars, requiring a translation adjustment debit of $7.200 Shames's net income translated into US dollars is $71000. It declared and paid a 23,000 dividend on May 1, 20x8 Relevant exchange rates are as follows: $ January 1, 20x8 1=1.6e May 1, 20x8 I=1.64 December 31, 20x8 1 -1.65 Average for 20x8 1.1.63 Required: a Record the cividend received by Pit from Shames (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Answer is complete but not entirely correct. Return to question 3 Required: a Record the dividend received by Pit from Shames (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 20 point Event No Answer is complete but not entirely correct. General Journal Accounts payable Investment in Shames Company Credit 1 Debit 30,176 30,176 3 Return to questa 20 points b. Prepare the entries to record Pit's equity in the net income of Shames and the parent's share of the translation adjustment. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) No Event General Journal Debit Credit Return to question 3 c Show a calculation of the differential reported on the consolidated balance sheet of December 31, 20x8, and the translation adjustment from differential (Amounts to be deducted should be entered with a minus sign. If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 20 points U.S. Dollars Answer is not complete. British Exchange pounds rate Income Statement Differential Jan 1, 20XB Amortization for 20XB Remaining balance 0 Balance Sheet Remaining balance on Dec 31 translated at year-end $ 0 rado Difference to translation adjustment $ 0 Return to ques 3 Balance Sheet Remaining balance on Dec 31 translated at year-end rato Difference to translation adjustment S 0 20 points No Event General Journal Debit Credit Return to questio 3 20 bolnts d. Record the amortization of the trademark on Pit's books. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) No Event General Journal Debit Credit 3 Return to question 20 points e Calculate the amount of the translation adjustment reported on the statement of comprehensive income as an element of other comprehensive income Other compreinte income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started