please answer all parts clearly

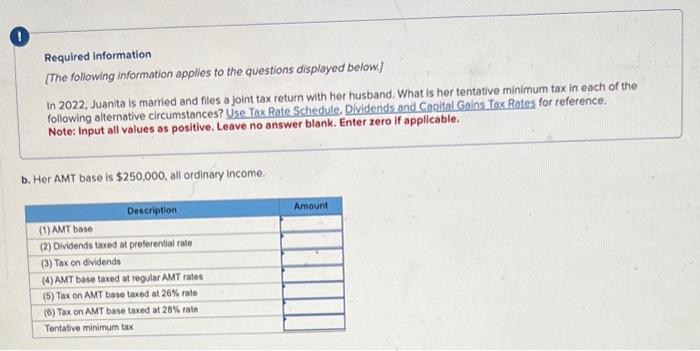

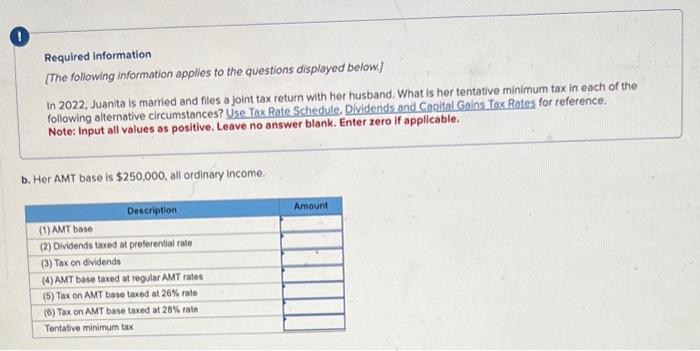

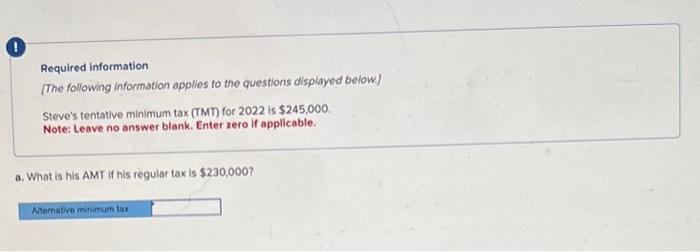

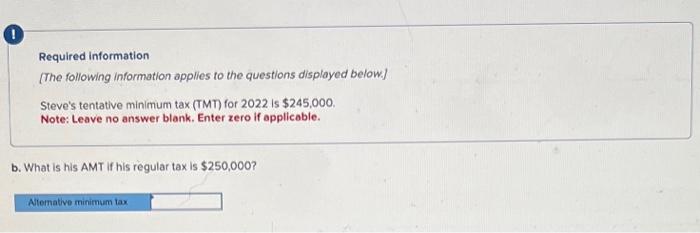

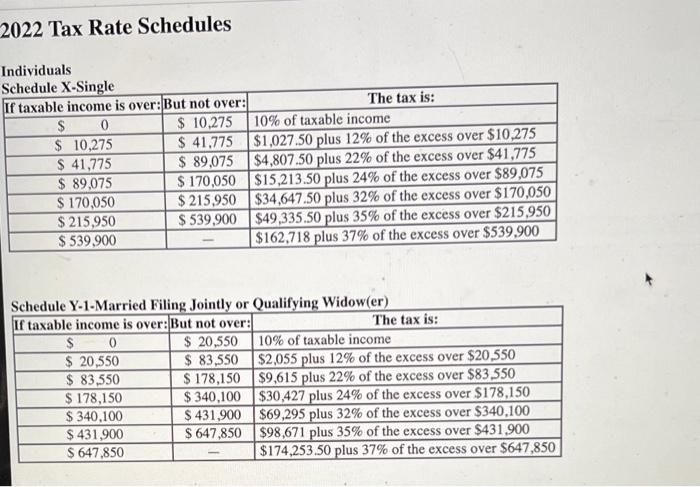

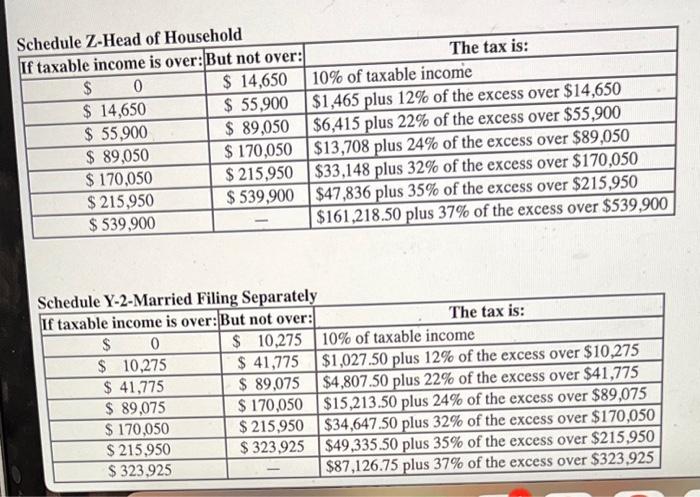

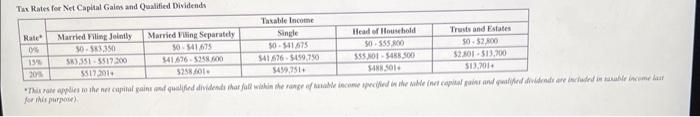

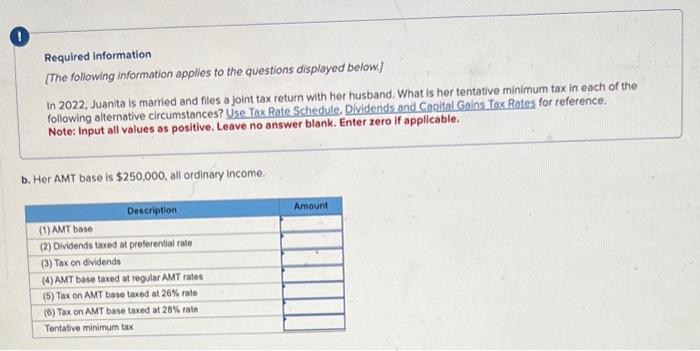

Required information [The following information applies to the questions displayed below.] In 2022. Juanita is married and files a joint tax return with her husband. What is her tentative minimum tax in each of the following alternative circumstances? Use. Tax Rate Schedule. Dividends and Capital Gains Tax Rates for reference. Note: Input all values as positive. Leave no answer blank. Enter zero if applicable. b. Her AMT base is $250,000, all ordinary income. Required information [The following information applies to the questions displayed below] Steve's tentative minimum tax (TMT) for 2022 is $245,000. Note: Leave no answer blank. Enter zero if applicable. a. What is his AMT if his regular tax is $230,000? Required information [The following information applies to the questions displayed below] Steve's tentative minimum tax (TMT) for 2022 is $245,000. Note: Leave no answer blank. Enter zero if applicable. b. What is his AMT if his regular tax is $250,000 ? 2022 Tax Rate Schedules Individuals Schedule Z-Head of Household \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$323,925 & & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Tax Rates for Net Capitat Gaies and Qualified Dividends (ar init purpose)