Answered step by step

Verified Expert Solution

Question

1 Approved Answer

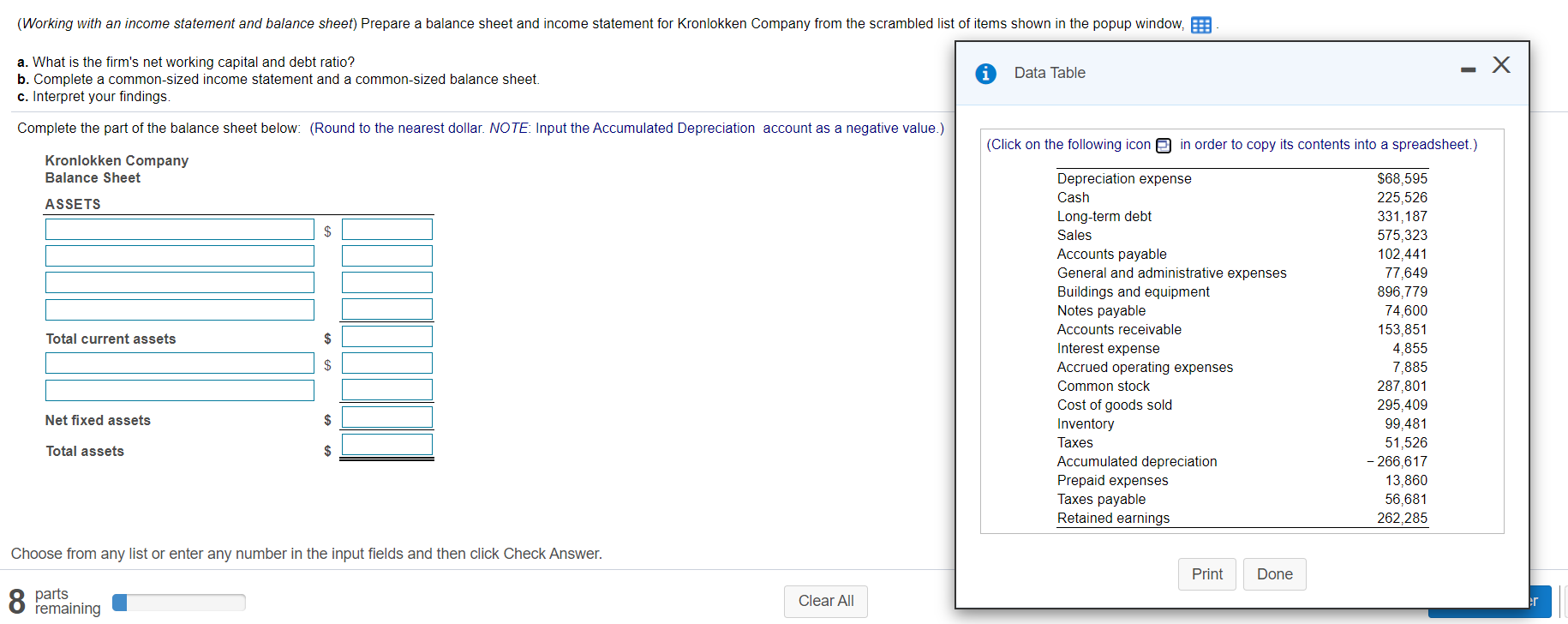

Please answer all parts completely. (Working with an income statement and balance sheet) Prepare a balance sheet and income statement for Kronlokken Company from the

Please answer all parts completely.

(Working with an income statement and balance sheet) Prepare a balance sheet and income statement for Kronlokken Company from the scrambled list of items shown in the popup window, EE a. What is the firm's net working capital and debt ratio? b. Complete a common-sized income statement and a common-sized balance sheet. c. Interpret your findings. Data Table Complete the part of the balance sheet below: (Round to the nearest dollar. NOTE: Input the Accumulated Depreciation account as a negative value.) (Click on the following icon in order to copy its contents into a spreadsheet.) Kronlokken Company Balance Sheet ASSETS $ Total current assets $ Depreciation expense Cash Long-term debt Sales Accounts payable General and administrative expenses Buildings and equipment Notes payable Accounts receivable Interest expense Accrued operating expenses Common stock Cost of goods sold Inventory Taxes Accumulated depreciation Prepaid expenses Taxes payable Retained earnings $68,595 225,526 331,187 575,323 102,441 77,649 896,779 74,600 153,851 4,855 7,885 287,801 295,409 99,481 51,526 - 266,617 13,860 56,681 262,285 $ Net fixed assets $ Total assets $ Choose from any list or enter any number in the input fields and then click Check Answer. Print Done 8 parts Clear All r remainingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started