Question: Please answer all parts correctly. Consider a company A with zero earnings retention ratio and a real growth rate in earnings of gamma percent. In

Please answer all parts correctly.

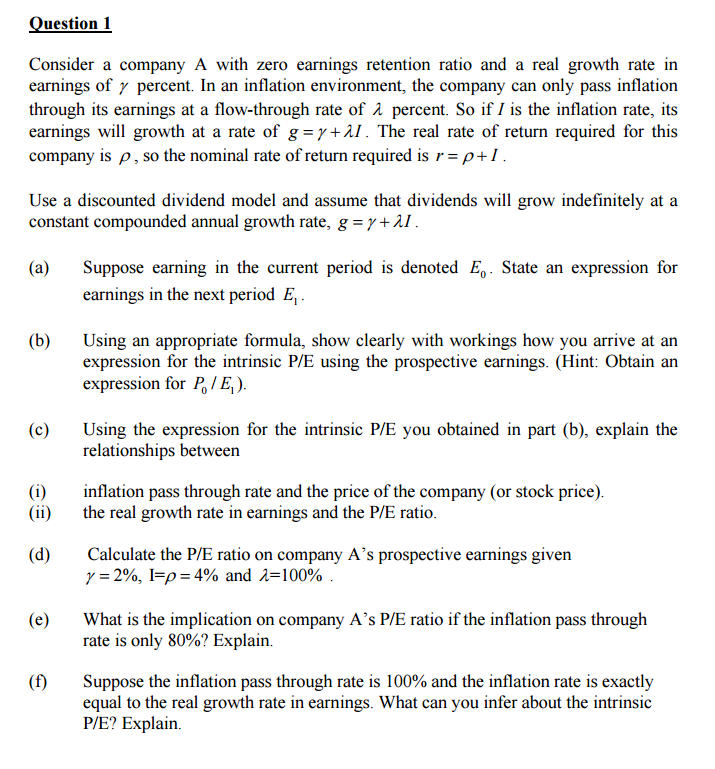

Consider a company A with zero earnings retention ratio and a real growth rate in earnings of gamma percent. In an inflation environment, the company can only pass inflation through its earnings at a flow-through rate of lambda percent. So if I is the inflation rate, its earnings will growth at a rate of g = gamma + lambda I. The real rate of return required for this company is rho, so the nominal rate of return required is r = rho +I. Use a discounted dividend model and assume that dividends will grow indefinitely at a constant compounded annual growth rate, g = gamma + lambda I. Suppose earning in the current period is denoted E_0. State an expression for earnings in the next period E_1. Using an appropriate formula, show clearly with workings how you arrive at an expression for the intrinsic P/E using the prospective earnings. (Obtain an expression for P_0/E_1). Using the expression for the intrinsic P/E you obtained in part (b), explain the relationships between inflation pass through rate and the price of the company (or stock price). the real growth rate in earnings and the P/E ratio. Calculate the P/E ratio on company A's prospective earnings given gamma = 2%, I=rho = 4% and lambda= 100%. What is the implication on company A's P/E ratio if the inflation pass through rate is only 80%? Explain. Suppose the inflation pass through rate is 100% and the inflation rate is exactly equal to the real growth rate in earnings. What can you infer about the intrinsic P/E? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts