Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL PARTS FOR THUMBS UP!!! Intro You have $6,000 to invest. You've done some security analysis and generated the following data for three

PLEASE ANSWER ALL PARTS FOR THUMBS UP!!!

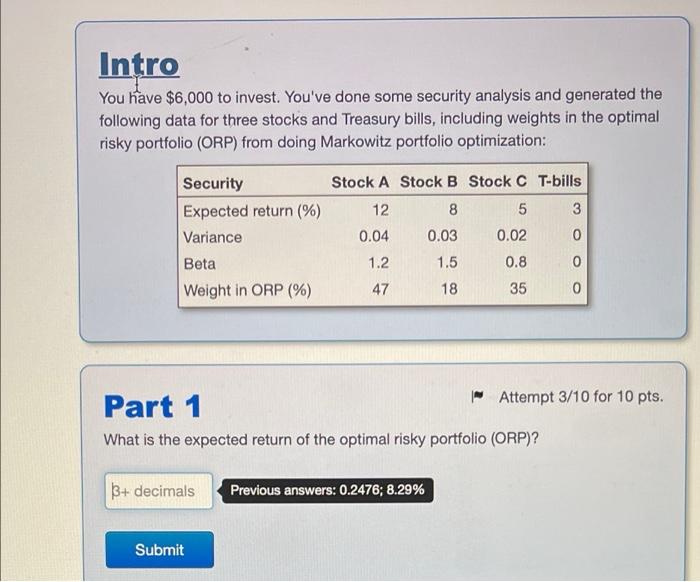

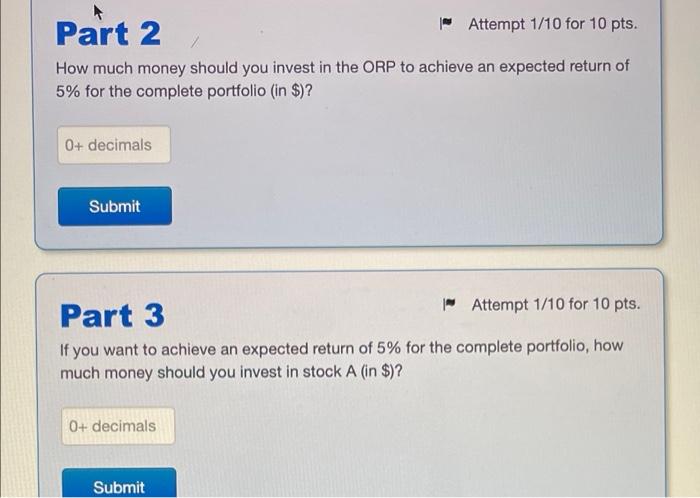

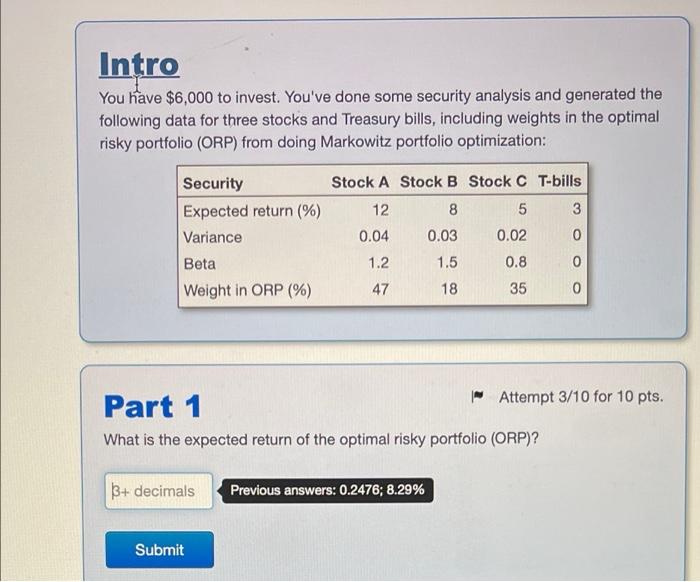

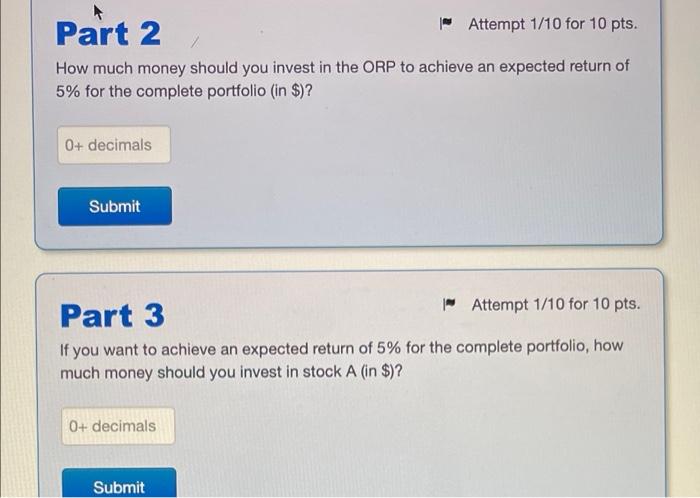

Intro You have $6,000 to invest. You've done some security analysis and generated the following data for three stocks and Treasury bills, including weights in the optimal risky portfolio (ORP) from doing Markowitz portfolio optimization: Security Stock A Stock B Stock C T-bills Expected return (%) 12 8 5 3 Variance 0.04 0.03 0.02 Beta 1.2 1.5 0.8 0 Weight in ORP (%) 47 18 35 0 Part 1 | Attempt 3/10 for 10 pts. What is the expected return of the optimal risky portfolio (ORP)? B+ decimals Previous answers: 0.2476; 8.29% Submit Part 2 - Attempt 1/10 for 10 pts. How much money should you invest in the ORP to achieve an expected return of 5% for the complete portfolio (in $)? 0+ decimals Submit Part 3 Attempt 1/10 for 10 pts. If you want to achieve an expected return of 5% for the complete portfolio, how much money should you invest in stock A (in $)? 0+ decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started