Please answer all parts - - no AI generated answers please! return and beta Personal Finance Problem Jamie Peters invested $109,000 to set up the

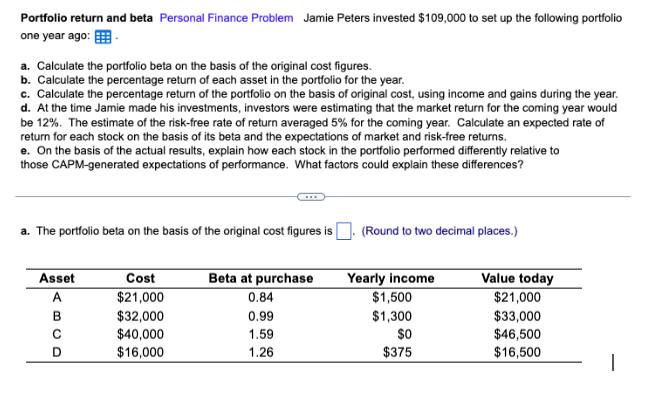

return and beta Personal Finance Problem Jamie Peters invested $109,000 to set up the folbwing portfolio me year ago: a. Calculate the portfolio beta on the basis Of original cost figures. b. Calculate the percentage return Of each asset in the portfolio Ior the year. c. Calculate the percentage return Of the portfolio on tie basis Of original cost. using incorne and gains during the d. At the tirne Jamie made his investments, investors were estimating that the market return for the coming year would 12%, The estimate ot the risk-free rate of return averaged for the coming year. Calculate an rate ot return each stock on the basis ot beta and the expectations ot market and risk-free returns. e. On the basis of the actual results, explain how each stock in the portfolio performed differently to those CAPM-generated expectatims ot pertorrnance. What tactors could explain these differences? a. The portfdio beta on the basis original cost figures is . (Round to tm decimal places.) c Cost $21,000 $32,000 $40,000 $16,000 Beta at purchase 0.84 0.99 1.59 1.26 Yearly income $1,500 $1,300 so $375 Value today $21,000 $33,000 $46,500 $16,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started